Policy

Owner-Occupiers: An Endangered Species For New Homes?

Just beneath Zillow Offers' demise roils an issue that ties Wall Street, Main Street, and Capitol Hill into a Gordian Knot. At stake, homeownership as an earned ladder-wrung to the American Dream.

The second-day lead

The great Z'misestimate has already leveled a blast to the bow of one of property data and technology's high-fliers of the past decade.

Post-mortems, take-away lessons-learned, jockeying for position among remaining iBuyer ventures have begun playing out at full-decibel volume. Thunderous reverberations and implications, dissections, predictions, I-told-you-sos, etc. will create a noisy wake, potentially existential for Zillow, and sweeping a wide, deep swath across the fledgling business model that is iBuying.

What homebuilders, their investors and lenders, their developer lot-lifelines, and their broad-and-deep ecosystem of pilot-fish partners need to know is that the dots connect ... to them.

Zillow Offers' fatal error and new homebuilding's ongoing bound into the 2020s at full-tilt may feel like six-degrees-of-separation. Peel back a few layers, though, and reframe the iBuyer channel challenge through lens that shows a spectral vortex among three roiling force-fields – Wall Street, Main Street, and Capitol Hill – and suddenly you're face-to-face with a matter for us all.

The glare of attention – wanted and unwanted – focuses first on Zillow's plan to unload 9,800 homes, and, importantly, who antes up for them.

In a housing market teeming with "alternative buyers" of housing's scarcest, and most sought-after property – homes priced below, say $320,000 – what's the true plight of the barely-qualifiable working household owner-occupier buyer?

Will that buyer – the one in the erstwhile expansive margins of housing finance's credit box, and the one who may well stand as a bulwark of the American Dream of homeownership, financial and social mobility, and merit-based prosperity – go the way of another new-housing DoDo bird, the starter home?

Want to see how quickly six-degrees-of-separation become no degrees?

What builders need to know

Zillow's business failure – smart real estate analysts conclude – reflects a contained and localized, if costly, mini implosion. The 17-thousand-property "Zillow dump" into a broader resale pool in the neighborhood of a 12-month run-rate of 5.5 million may have a negligible to minimal impact in the wider scheme of an undersupplied existing home inventory landscape. Calculated Risk's Bill McBride notes:

There will probably be around 1.6 million existing homes sold in Q4 Not Seasonally Adjusted (NSA). So 7,000 is a very small percentage, and with record low inventories (for September), this will not have an impact ... the bottom line is inventories are very low, mortgage rates are still historically low, and demographics are currently favorable for home buying."

A further case for the containment-theory on the Zillow Offers exit focuses on business and operating model flaws – including, perhaps, flawed data, executional missteps, and, the big external Black Swan factor of supply chain and skilled labor chokeholds.

Strategically, those firms that continue to invest in and grow the iBuyer model, will point to Zillow's lack of diligence with respect to a fully-baked and well-executed array of profit-generating value-add services – mortgage, title, transfer, etc. -- iBuyers capture revenue from, in addition to the buy-low-sell-high delta they achieve on the property trade.

A model that predicted Zillow's residential real estate knowledge base would print money based on flip rates and volumes alone – even in a torrid mid-2020 to mid-2021 market featuring warp-speed appreciation, multiple bids, and a highly-motivated demand stream – looks amateurish at best, with 20/20 hindsight.

In the middle of all that, a profound miscalculation on what it takes to turn many gettable, hairy, less-than-highly-desirable properties -- in fire-drill timeframes – into the kinds of homes buyers would clamor for smacked up against the mid-pandemic era's biggest risk to business period: A debilitated supply chain of building materials and products and a diminished skilled labor pool in the remodeling and renovation trades needed to pull off the flips with aplomb.

That's The Builder's Daily's take on what happened, with a view of the Zillow business failure as a parochial, micro- blunder.

What it means for homebuilders

Big.

Attach that little three-letter word Big to a business sector and what happens? Big Tech, Big Capital, Big Real Estate. The flow into and out of these terms – and believe us, the flow is a torrent – runs directly to two activated, agitated, and motivated pools of stakeholders.

A Big Tech stumble – aka Zillow Offers – attracts scrutiny, and scrutiny, whether it's from Main Street or Capitol Hill, can ultimately tighten the spigot of Big Capital. When what looked like a broad horizontal spread of safe haven investment opportunity in residential real estate, construction, and proptech suddenly winds up in the cross-hairs of Senate Banking or House Financial Services committee hearings, Big Capital's unstaunched enthusiasm for all-things real estate may start to narrow it field, or even look to other sources of yield.

In a nutshell, if what was to be a $20 billion business is actually cause for a $550 million loss and the elimination of one in four Zillow jobs and a sudden dump of $1.15 billion mortgage bonds, you can bet all that will fan the flames of agitation and activation on both Capitol Hill and Main Street.

The dots connect. Big Tech, Big Capital, Big Real Estate all flow into a single stream in the minds of attention-seeking lawmakers and affordable housing activist at the community level alike.

They see probabilities and odds stack up like this. Buyers of homes/residential property sites these days come from five "channels" of demand:

- Owner/occupiers

- mom and pop landlords

- single-family-build-to-rent developer/builders

- private equity portfolios

- iBuyers

Against a global universe backdrop of 5.5 million existing homes and 600,000 to 900,000 new construction single-family homes what may fail to come through is this fact.

All of those demand "channels" – some with enormous buying power, and some with barely-qualifiable financing credentials – share a disproportionate interest where available supply is the scarcest:

Below $320,000 properties.

This incredible crunch on properties that range from the lower middle to low pricing tiers – it's where everybody wants the inventory – and that's forcing prices up, and pricing out the owner-occupier 'affordable' buyer," says and executive on the front lines of the fray. "When you add the filters of the red hot markets, like Orlando, Tampa, Phoenix, Austin, Atlanta, Nashville, etc., you see how it works. You start with this big national funnel of inventory, and you filter it through household income-based payment power and filter it through geographical markets where people want to be and where jobs are, and you start to see where the non-traditional demand for $150,000 to $320,000 properties has been boxing out owner-occupier would-be buyers."

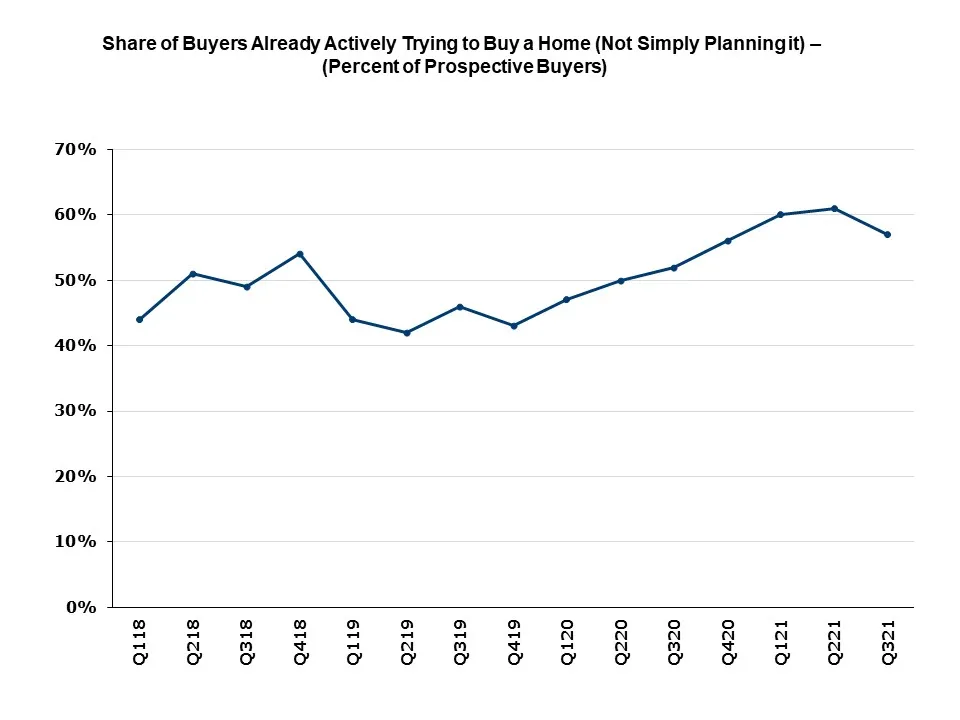

From a series of spotlight insights from its latest Housing Trends Report, the National Association of Home Builders just this week noted that soaring prices in the 3rd quarter of 2021 began discouraging a "segment of potential buyers."

Why it matters

Here's where the dots connect.

You're already starting to hear from among the real estate advisors and housing affordability advocates being called into Senate Banking hearings, that they're calling out homebuilders who are selling entry-level style new homes to private equity-backed build-to-rent portfolio companies, getting full retail prices for those homes, and driving prices higher for each new-phase release of new homes," says our real estate and construction executive source. "Retail buyers – the owner-occupier buyer – used to be at the top of the totem pole of homebuilders' best buyer group, but what's happening is that alternative, non-traditional buyer channel players have moved owner-occupier buyers down the totem pole. You start to wonder whether that 'attainable' working-household owner-occupier buyer is an endangered species."

Which is why the scrutiny, both at the Capitol Hill level and on Main Street, is likely to get more, not less, intense as prices ladder up, interest rate increases upset the monthly-payment equation, and market dynamics kick into an even higher gear.

Join the conversation

MORE IN Policy

Texas Treads A New Path Into Zoning To Battle Housing Crisis

Texas is one of the nation's most active homebuilding states, yet affordability slips out of reach for millions. Lawmakers now aim to rewire the state’s zoning laws to boost supply, speed up approvals, and limit local obstruction. We unpack three key bills and the stakes behind them.

Together On Fixing Housing: Solve Two, Start the Rest

NAHB Chief Economist Robert Dietz and Lennar Mortgage President Laura Escobar argue that the housing crisis won’t be solved by magic. It starts with a unified focus on two or three priorities—a rallying cry for builders, developers, lenders, and policy-makers.

Zone Offense: North Carolina Moves To Fast-Track By Right Housing

North Carolina legislators are pushing a bipartisan bill that could fast-track housing where people need it most: near jobs and transit. Richard Lawson breaks down what it means, how it compares to other states’ moves, and why developers are watching closely.