Capital

X-Factors Hide In Plain Sight; Builders Brace For What May Come

Here are 10 key takeaways you need to know from Builder Advisor Group’s 11th Annual Forum For Housing Executives, last week in San Francisco.

Four big riddles challenge overconfidence in the business plans of America’s leading homebuilding and residential development firms. Two of them are concerned with matters outside their control but still involve enough motivation to prepare for and invest in resiliency to withstand competitive and economic turbulence. Two of them lay at business leaders’ doorsteps, matters they need to invest in and commit to urgently if they plan to weather the mid-2020s and endure into the turn of the next decade.

- How long will the lock-in effect neutralize existing homes as an alluring alternative for prospective homebuyers, especially in lower-price tiers?

- Has employment and income’s post-pandemic growth spurt peaked, and will an employment recession declare itself in late 2024 or 2025?

- Is operational excellence where it needs to be to remain nimble on home prices and promotion enough to continue to attack affordability barriers and keep absorption paces where they need to be to pull through overheads at strong enough margins?

- Is the talent bench deep, engaged, and equipped with institutional knowledge enough to seize the reins at a moment when youthful energies, fresh approaches, and a more immediate grasp of young adults and future households are non-negotiables?

Against a backdrop of these questions – each of which could hide 2024's X factor from us now – some 70 strategic homebuilding, residential development, and investment business leaders met last week at the 2024 Forum for Housing Executives hosted by Builder Advisor Group in San Francisco. The event shed light on the nuanced and dynamic nature of the U.S. housing market against a backdrop of hard-to-read and hard-to-predict economic and consumer signals and myriad sources of volatility and uncertainty. The discussions spanned the gamut from macroeconomic forecasts to detailed industry trends, offering invaluable insights for strategic decision-making in the challenging terrain of homebuilding, residential investment, development, design, and manufacturing.

Tony Avila, CEO of Builder Advisor Group, tells us:

We had 25 builder executives on a waitlist for the Forum. Over half of new U.S. housing production was represented in the room. This was the best forum for senior leadership in housing, with an incredible networking opportunity. Our thought and practice leaders provided insight to peer around the corner and anticipate future changes in market conditions.”

Avila shared highlights, insights, and data points of the day-long conference, including 10 high-level take-aways:

- Economist consensus suggests a soft landing, but as time goes on, the risk of a recession grows

- Expect two or three 25 bps rate drops this year with the first possibly as early as June

- Strength in the single-family home market is expected to continue

- Affordability remains an issue and the cost of incentives are expensive

- Homebuilder margins remain strong but are normalizing due to increasing land prices and the high cost of incentives

- Credit remains tight and traditional lenders are not originating many new land loans: a) Less deposits means less ability to lend and bank A&D loans will be difficult to obtain and b) The rise of private lenders and higher borrowing costs

- BAG affiliates - Avila Real Estate Capital (AREC) and Encore – have originated $800 million in acquisition & development loans in the last 14 months, becoming the largest A&D lender in the nation by volume

- The public homebuilder stock index has significantly outperformed the broader market over the past 5 years

- Homebuilder balance sheets are very strong; 11 public builders generated over $17 billion in operating cash flow over the previous 12 months

- Potential acquirers are well-capitalized for M&A with lower leverage

- International capital continues to invest with builders and developers, citing higher margins and better return on capital

Economic Landscapes and Homebuilding Horizons

The forum kicked-off reflecting a consensus among economists on a potential soft landing for the economy, albeit with a growing risk of recession as time progresses. This context is critical for understanding the ongoing strength in the single-family home market, juxtaposed against the challenges of affordability and the relatively expensive nature of incentives.

Interestingly, homebuilder margins, although strong, are seeing a normalization phase influenced by escalating land prices and incentive costs.

A notable highlight was the emphasis on the tightening credit environment, with traditional lenders shying away from new land loans. This development underscores the rising significance of private lenders and the resultant higher borrowing costs. Builder Advisor Group affiliates – Avila Real Estate Capital (AREC) and Encore have stepped up – originating $800 million in acquisition and development loans, marking a pivotal shift in lending dynamics.

Investment and M&A Dynamics

The forum underscored a vigorous M&A landscape, facilitated by the well-capitalized nature of potential acquirers and the strategic influx of international capital into the U.S. homebuilding sector. With public builders generating substantial operating cash flow, the stage is set for thoughtful, strategic expansions and acquisitions, evidenced by recent transactions such as the acquisition of MDC Richmond America by Sekisui House.

Market Fundamentals and Forecasts

Central to the discussions were the projections around interest rates and the Federal Reserve's cautious stance on rate cuts. The anticipated three 25bp cuts in 2024 signal a careful yet optimistic approach toward stimulating economic activity without overheating. The demographic challenges, notably the labor shortages exacerbated by a retiring baby boomer generation, present both a challenge and an opportunity for the homebuilding industry. Developing non-traditional talent pipelines and embracing a more flexible approach to work could be key in navigating this landscape.

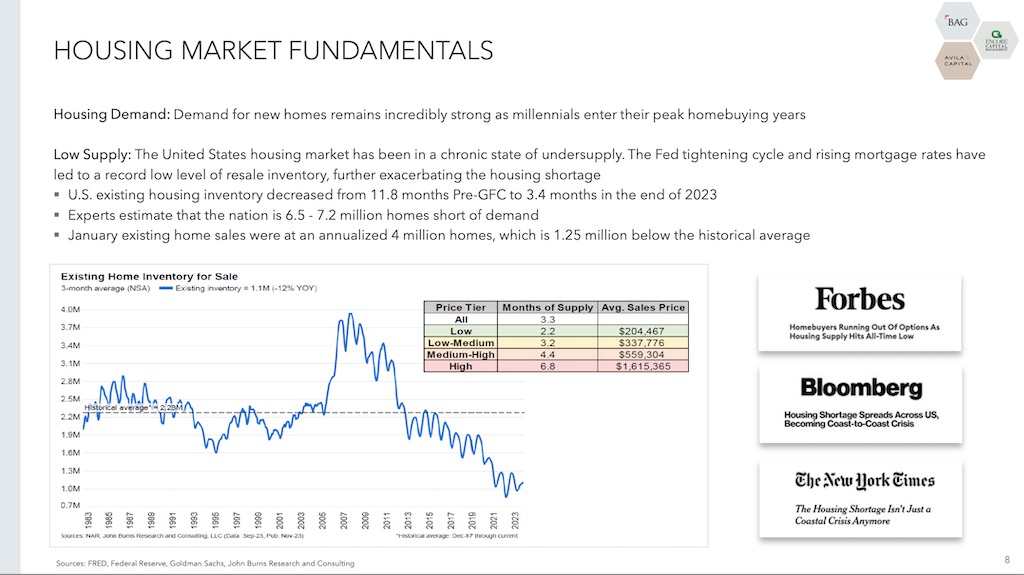

The Housing Market’s Current State

The housing market grapples with affordability and inventory challenges amid fluctuating mortgage rates and the lock-in effect. However, the resilience of the new single-family home market, buoyed by robust demand and a well-capitalized builder community, points towards sustained growth. Despite rising prices, the strategic emphasis on land acquisition – specifically in fast-growing markets that are clearly undersupplied in ground-up housing at more attainable price ranges --points clearly to a bullish outlook on the future of homebuilding.

Technological and Operational Adaptations

The conversations also ventured into the operational realms, highlighting the strategic investments in advertising, lot acquisition, and the recalibration of product offerings to enhance affordability. The growing emphasis on digitization and manufacturing automation reflects a sector poised for innovation, aiming to address labor challenges and improve efficiency.

Insights for Strategic Executives

The forum offered several critical takeaways for strategic executives and owners navigating this complex landscape. The necessity of remaining agile in a tightening credit environment, the opportunities within the M&A domain, and the strategic importance of adapting to demographic and economic shifts stand out as pivotal focus areas.

Moreover, the evolving dynamics of land acquisition and development finance and the strategic imperatives around technological adoption and operational efficiency underscore the need for a proactive and informed approach to strategy formulation and execution.

Remember, it only dawned early last year on housing and market-rate single-family for-sale business leaders and owners. An X factor. Out of nowhere, it sprang up, ever-unpredictable but invariably obvious in hindsight as the housing market turns do.

Spiraling interest rates’ blessing in disguise. A true prophet could have foreseen by the end of 2022 what would become 2023’s market-defining housing dynamic. But who else?

Rather than douse new-home buyers’ motives, means, and impulses to snap up deals and mortgage buydown accommodations on new homes, decade-plus high-interest rates worked like a kind of counter-intuitive magic wand. Things took a turn homebuilders could only have hoped for, dreamed of, ... a competitive advantage they’d never had.

The vast existing home sellers’ universe quieted. An eerie silence – like that of a huge opposing army’s unaccountable retreat in the night – set in. Dirt-cheap 30-year fixed-rate mortgages of a bygone easy-money run of years quelched ideas of trading that grand bargain for new, more punishing realities of a new mortgage on a newly purchased home.

Builders’ only-game-in-town edge got a grip and held for 2023. Now, what was once a scarcely detected X-factor has hardened into a strategy.

One of 2024’s core business assumptions, it feeds—along with a barrage of promotional tools and financial incentives that have been working reliably, an undiminished demographic demand stream, and local market upon local market of sharply underbuilt housing supplies — a familiar brand of homebuilder optimism.

It's a giddy, irrepressible sense that structural, cyclical, and sustainable forces have finally aligned. Things are going their way. A remaining mid-2020s into the 2030s of blue-sky growth and headroom lay invitingly ahead.

What reason could there be for conditions like these to lose momentum, let alone derail or collapse?

Typically, a reason might arrive stealthily if and when it does come. Cassandras will recognize it. Others will deny it. Finally, at some point well after considerable unnecessary losses, disappointments, and fall-out, a consensus will acknowledge the reality of another downturn in the cycle. Some will say it could never have been anticipated. Others will say it was inevitable.

In essence, the 2024 Forum for Housing Executives has painted a picture of a sector at the cusp of significant transformation, driven by macroeconomic shifts, demographic trends, and the restless pace of technological innovation. For strategic executives and business owners, navigating this landscape will require a blend of strategic foresight, operational agility, and a deep understanding of the nuanced drivers of demand and supply in the U.S. housing market.

Those who adopt and master that blend will be outliers, and very likely it'll be they who are first to recognize and seize on this year's still unknown X factor.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.