Land

Woodside Homes Is Finalizing Purchase Of Boise-Area's Hubble Homes

Hubble Homes has been built under the steady, service-as-a-strategy hand of E. Don Hubble, who at age 73 is said to be "choosing to take his chips off the table at the top of his game." He's created a strong business culture and a land position in what's viewed as a resurgent Boise marketplace.

Sekisui House-owned Western regional power builder Woodside Homes is said to be finalizing details of its acquisition of Meridian, ID-based Hubble Homes, a top 100 homebuilding enterprise with annual revenues upwards of $300 million.

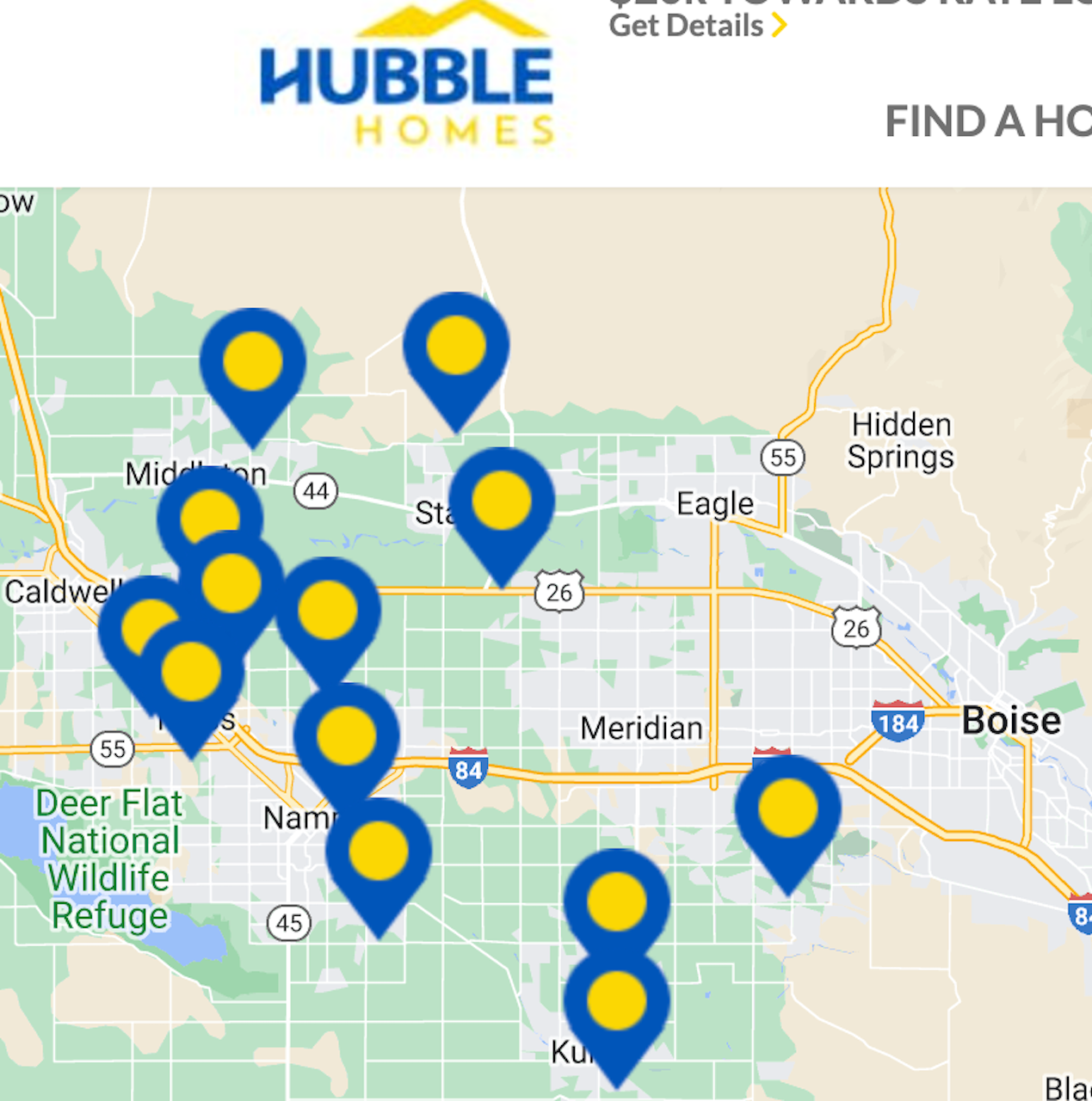

The purchase of Boise-metro area Hubble – whose 11 or 12 actively-selling communities arc the western periphery of the state capital and generate 600 to 700 new home closings annually – rounds out an increasingly imposing Western Regional footprint that Japan-based Sekisui House began assembling with its 2017 acquisition of Salt Lake City-based Woodside Homes in 2017, adding Pacific Northwest operator Holt Homes in December 2021, and anteing up $514 million for Houston-based Texas power builder Chesmar Homes a year ago – almost to the day.

The playbook driving the latest addition, a 26-year-old operation, follows a carefully and forcefully mapped and updated five-year Sekisui House SH Residential Holdings strategy, which continues to call for mergers and acquisitions in the U.S. Here's what we wrote following the Chesmar deal in June 2022.

Although Sekisui House's corporate headquarters, its deep cultural core as a business, and its capital center happen to be Osaka, Japan, a hallmark operational principle driving expansion initiatives into opportunistic overseas markets is corporate leaders' belief they need to "learn from the proven experts," not only what American regional and local homebuying customers want, need, and will buy, but other local factors that impact regulation, access to construction trades, land sellers, etc.

"The goal in the post-merger stages for all three companies is to learn what each of the local operators does best, and how that works," says SH Residential Holdings' ceo Rick Robideau. "Whether it's Roger Gannon at Woodside or Greg Kubicek at Holt Homes, or now Don Klein at Chesmar, each of them is a crucial learning and discovery point for Sekisui House as to how and when to move forward in the markets as a key to durable success."

Robideau notes that what initially caught parent Sekisui House Ltd.'s strategic attention as magnets for each operators' position where three key non-negotiables: a product position that stands for value vs. price; a strong commitment bias toward sustainable, high-performance buildings, and a corporate team capable of cultural contribution towards Sekisui House's business principles. For the would-be acquirer, this narrows the field among strong business operators in any market or region to a short list of firms Sekisui House is prepared to listen to for intelligence and insight as to its opportunities every bit as much as it offers strategic guidance, financial, and operational resources to grow.

"Our initiatives with respect to the local operators – Woodside, Holt, and Chesmar -- emphasize patience even as we explore, first of all synergies – human resources, some SG&A shared services, looking at national vendor agreements, procurement, rebate programs, and begin to get on the same page on IT across the operator group," says Robideau. "We are not going to be disruptive, but we'll look for the opportunities to support the businesses with any of those synergies that can help, particularly when supply chains are still undergoing stress and shock."

Hubble Homes, built under the steady, service-as-a-strategy hand of E. Don Hubble, who at age 73, is said to be "choosing to take his chips off the table at the top of his game," with a strong business culture and land position in what's viewed a resurgent Boise marketplace. Expectations are that the strength of the team, the local relationships and customer knowledge, and the land position will mean that Hubble will continue to draw off its own strengths in an increasingly competitive Boise area market even as the firm begins to tap into both the deep resources and broad knowledge base of portfolio siblings and parent.

Robideau says that, next in line of priorities, one might expect more of an operational approach across the three separate entities on matters of business cadencing, monthly reporting, governance, and especially customer research, customer care and marketing as the company begins ambitious support around a two-pronged product development strategy."

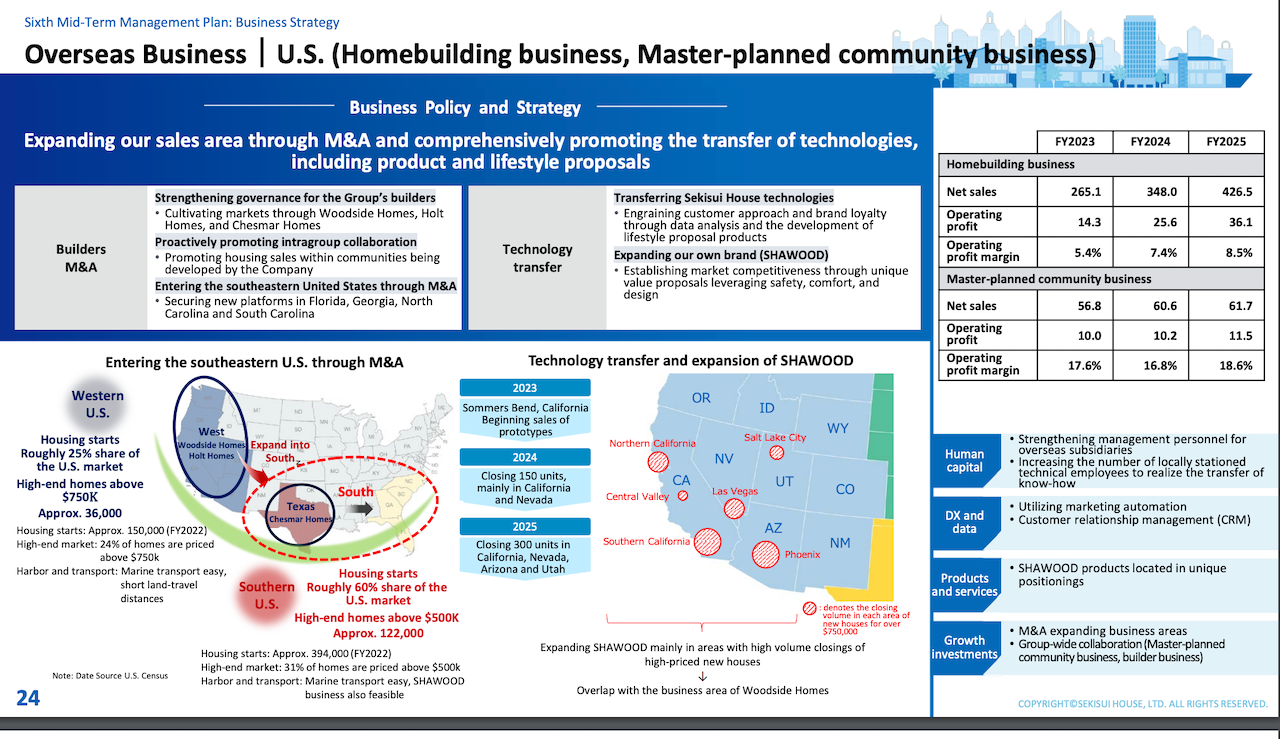

For Sekisui House and its North American operating unit SH Residential Holdings, near-term sales dynamics play almost no role in what is a long-term strategy. A slide from the organization's Sixth Mid-Term Management Plan: Business Strategy, from this past March, promises M&A growth into the Southeastern region of the U.S., a roll-out of the ShaWood product and technology platform throughout its California, Arizona, and Nevada footprint, and growth in its masterplanned communities business.

One big question in a devilishly tricky economic context is, "has the lamp for mergers and acquisitions switched on after an earlier pause" due to bank, investment, and strategic disruptions?

Word is there are a lot of deals that have been on or off in the works for some time, and a number of them are highly active right now.

MORE IN Land

D.R. Horton Bets Big On AI-powered Land Technology

America’s largest homebuilder has gone all-in on AI. D.R. Horton’s multi-year partnership with Prophetic signals a turning point for technology adoption in land acquisition—and a warning to competitors still operating in manual mode.

Land 'Heavy,' Future Ready: Stanley Martin’s $700M Pivot

In an AI-driven land rush, Stanley Martin Homes turned deep zoning and engineering expertise into one of the largest single-use, single-parcel land sales in U.S. history. President Steve Alloy explains why playing “land heavy” still pays off when skill meets timing.

Millrose Q3 Outperforms On Tech, Discipline & Land‑Light Strategy

As many builders pull back, Millrose Properties leverages data‑driven underwriting and select partnerships to bank growth despite a softening market.