Leadership

With The Jury Out, Here's What Housing's Leaders Can Dial In

As business leaders in real estate and construction up their game to adapt and improve operational performance, it's also a time to prepare to weather downstream challenges. Here's how.

No, it's not business as usual. And no, it's not a time for business leadership as usual. And, no, we at The Builder's Daily will not cover housing, its challenges and its extraordinary opportunity ahead over the next decade as if March 2, 2022 was a typical Spring Selling Season weekday.

Federal Reserve Chair Jerome Powell to Congress, per a CNBC report this morning:

The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain,” he added. “Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook.”

It's too soon to say, the Fed chairman allows, both how economic sanctions and the direct and downstream impacts of the conflict itself – not to mention effects on consumer behavior and psyche – will blowback or not on a U.S. economy that's overheated but recovering.

So, the jury's out. And the time for leaders in residential real estate and construction is neither to panic nor to under-appreciate ways the initial geopolitical shocks and their aftershocks and ripple effects can impact business processes, access to resources, partners, and customers.

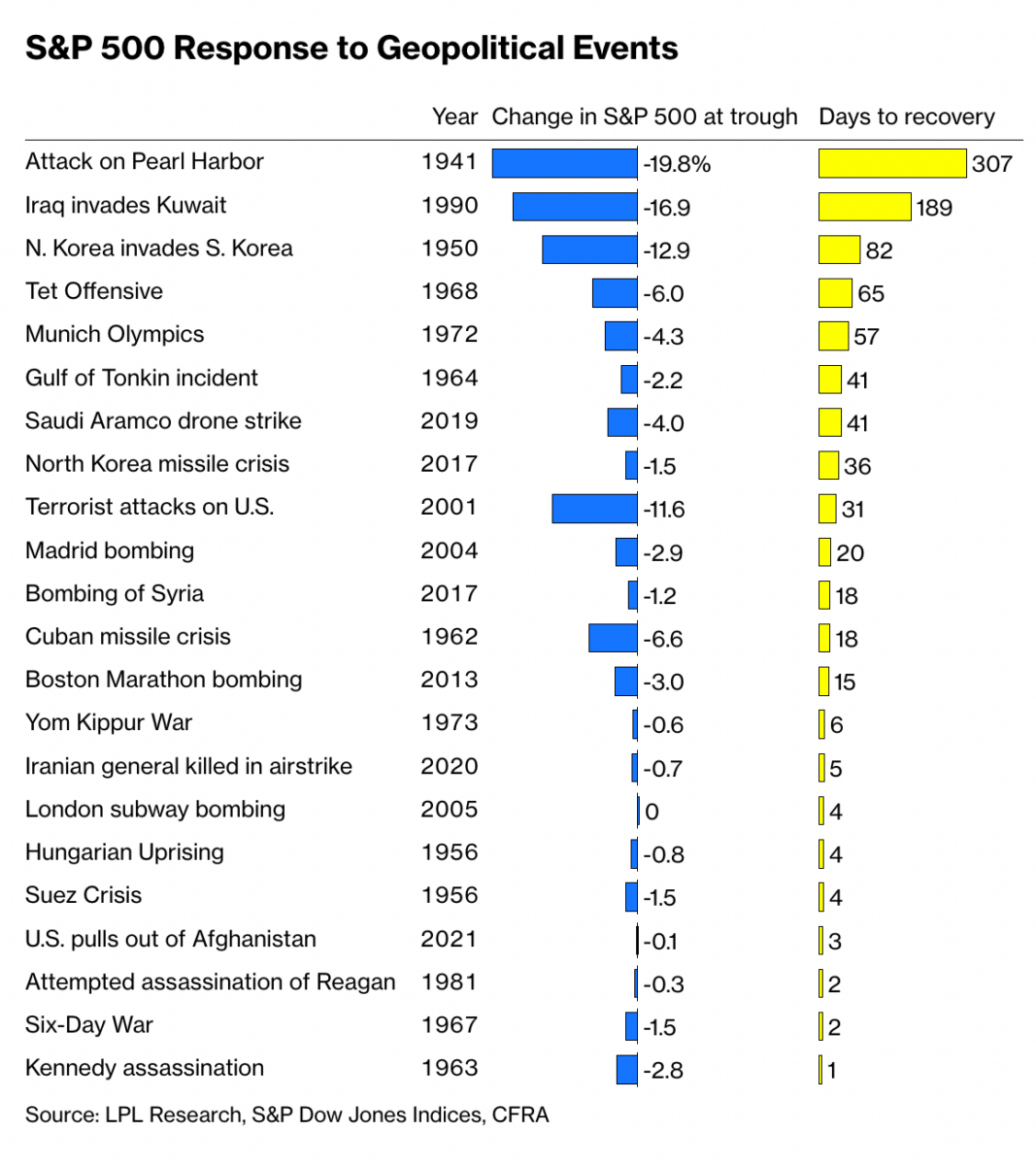

Looking back on how geopolitical events that can appear to upend everything have typically exerted only a short-term effect on stock markets and corporate value creation may come as some comfort. Smart perspective on this historical pattern comes from The Big Picture blog host and investment strategist Barry Ritholtz, who – [beneath this chart] – writes:

“The moral is not that you should be complacent about serious events or assume nothing can harm your portfolio, but that you should be cautious about drawing a straight line from the news to turns in the market. Although Wall Street has no shortage of professional commentators on geopolitics, it’s difficult to successfully trade on their forecasts. Markets often stumble on headlines, but soon after these wobbles, they tend to return to whatever the prior trends were.”

Events – even ones with historical sweep and deeply traject effects – work out to be a blip for investors and private enterprise players, not a trend. On that note, we're reminded of what leaders in housing, real estate, manufacturing, distribution, and related fields told us -- all too recently – when this time 24 months ago COVID-19 cropped up and threatened to shatter the world as we knew it.

There's no playbook for this."

What happened then, despite an onslaught of pandemic surge after surge, spreading pain, anguish, dislocation, displacement, economic uncertainty and doubt, etc. was what many began to refer to as a great acceleration of trends, themes, threads, and initiatives that pre-dated the pandemic but made all the more sense once COVID hit.

... Like owning a newly built home. A more efficient home. A safer home. A healthier home. A more durable home. A home nobody had lived in before, and one that connected to all its residents wanted to connect with, and protected them from all they wanted to be protected from. The pandemic – with a big assist from Uncle Sam and the Fed – accelerated that trend.

... And like the sudden ability to remove barriers – physical, logistical, financial, bureaucratic, time-consuming, technological, etc. – from the home shopping to the home purchase to the home move-in process by swiftly implementing ideas that had been bouncing around for years prior. The pandemic – thanks to Silicon Valley and a new breed of talent among enterprise homebuilders, their finance and lending partners, their customer management platform partners, and their own tech-savvy team members – accelerated that.

... And like the capability to include holistic smart-home technologies that inter-operated with both the structure and systems of the home and solved for home resident routines, and needs, and sources of excitement and entertainment, and health, comfort, well-being, and security. The pandemic accelerated that.

So, we've come another full circle since the novel coronavirus pandemic. Those who'd prematurely declared the "end of the world" as the virus upended lives, and wreaked havoc with public health capacity and shut down a third of the economy and exacted a heavy toll on Americans' psyche, were wrong.

Those who hit the panic button now, based on the convulsion abroad, are likely wrong to do so. So, too, are those who'd look with complacency at what's unfolding in Eastern Europe, and fail to recognize that the full-stack of impacts, on oil and commodities prices, on transport, on an array of hits to consumer spending and savings capability, on overall economic activity, on what people work for and why.

There's no playbook for this."

We wrote it here yesterday and it bears repeating once more:

I keep hearing from people 'what would be the trigger to slow the market other than big rate increases?' I'm not convinced you always need a reason. Sacramento, August '05, Northern Virginia Sept '05 went full stop. For no reason. Buyers just had had enough of rising prices. It's not something you can know - what's the breaking point."

The pull, or rather that strong tug, on developers and producers and architects and technology providers of new homes and communities may – at any given time – pull from a well of pent-up demand, current demand, or pulled-forward future demand.

It's a leader's job to know which "demand stream" is driving their business today, and to listen, learn, be present, decipher, detect, and secure his or her business to thrive, come what may. We're 100% behind leaders who are getting that job done today by doubling down on the listening, learning, and being present. Otherwise, how would one not make the same mistake nearly every business leader in residential real estate, construction, and community development made in 2006 and 2007, when "buyers just had enough of rising prices," and most leaders missed the memo.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.