Leadership

With So Much Happening At Once, Here's Where To Focus

For compass headings amidst a heavy cloud of uncertainty, consumer bellwethers and leadership presence stand as constants.

The whipsaw of headlines rips ahead of markets', pollsters', and pundits' ability to reckon with them.

This raises a question: what is headline risk? Rather than take a pontificator's path – to amplify either impending doom or to turn a deaf and denying ear to real-world challenges – here's a kind of middle ground to take stock amidst a whirl of events, circumstances, and ripple-effects that add up to a lot of "we don't know what we don't know," good or bad.

Headline risk is the possibility that a news story will adversely affect the price of an investment, such as a stock or commodity. Headline risk can also impact the performance of a specific sector or the entire stock market.

What would headline risk sound like? Well, underneath housing's simple but challenging narrative talk-track for 2022 – "high demand meets low inventory" – Motley Fool contributor/analysts Jason Hall and Matt Frankel tried to get their heads around a through-line for market rate homebuilders in 2022, taking into account squalls of volatility – inflation, supply chokeholds, interest rates, economic mixed signals – minus the latest blast into the realm of unknown unknowns, Russia's Ukraine invasion. Here's a snippet of what they sounded like on Feb. 11.

Matt Frankel: I think there's a lot of moving parts in the homebuilding space that we just haven't seen before.

Hall: Right.

Frankel: I don't think we've ever seen an environment where the price of lumber has had such a wide range over the past year or so.

Hall: Yeah.

Frankel: I don't think that's ever happened. From bottom to top, it's like a 4x in lumber costs over the past year. I don't think we've ever seen this type of labor shortage in the U.S., at least in my lifetime, and this much wage pressure. I can never remember since I started work when I was 15. I don't remember wage pressure like this. A lot of different moving parts that you spoke about as having had to deal with or at least for decades haven't had to deal with.

Hall: They're more extreme than usual. I mean, it gets back to the basics of the three Ls. Labor, lumber, and land. The variability of that is a real challenge right now.

Frankel: Having said that, I am worried about it a little bit long-term. I think of it as more of a big short-term challenge, and I'll tell you why. A lot of these home builders have massive backlogs because of what's been going on in 2021. They've already agreed on a contract price for those homes. In some cases, it's like a year's worth of building that they've already committed to at a certain price, so they are at the mercy of materials' costs. They are at the mercy of labor availability and wage pressure and things like that. Margins could definitely be under pressure in 2022 more than people are expecting because of all of those moving parts that are existing on homes that they've already committed to sell for a certain price.

Net, net, these two pretty knowledgeable, evidence based analysts are battling to get an understanding of nearer-term impact factors on market valuations, versus the enterprises' structural ability to produce value and investment returns over a longer haul.

Overplaying the noise and temporary disturbances of the present versus squaring with an overarching, defining framework, i.e. high demand meets low inventory, would distort the outlook unhelpfully. Sacramento Appraisal blogger Ryan Lundquist of Lundquist Appraisal Company concludes a briefing on real estate doom and gloomsayers with two recommendations here:

1) Know the numbers: Pay attention to actual stats and let the numbers form your perspective and narrative. Ultimately, without a good sense of seasonal trends and current stats, it’s easy to get tossed around by each new sensational headline. Moreover, a quick way to lose credibility in real estate is to habitually share articles that lack merit. I know, that sounds so judgy, but it’s the truth. If you feel like you’re not in tune with stats in your market, maybe start pulling them yourself, find a few people who are doing a good job (and devour their stuff), or even check out what a source like Redfin puts out there.

2) Read mostly everything: I recommend reading from a variety of sources and following lots of different people who talk about housing. Having a well-rounded perspective is important as a system of checks and balances too. On a related note, if someone has a positive-only or negative-only housing outlook, don’t waste your time. All that said, I appreciate hearing what Ivy Zelman has to say lately because she’s been more contrarian than most other housing analysts (which piques my curiosity). Some of my favorite housing voices include Calculated Risk, Altos Research, Odeta Kushi, Jonathan Miller, Len Kiefer, Daryl Fairweather, Steven Thomas (SoCal), Patrick Carlisle (Bay Area), etc…

So, while the jury's out on whether the huge events of the moment will meaningfully alter the "high demand meets low inventory" characterization of the business outlook, we'll stick here to what we can track and what works as bulwarks of strategic focus, good times or bad: Consumers and leadership.

Watch Consumer Moods

Yes, consumer spending's latest January 2022 reading "rose briskly." Savings rates – a factor that plays a role in down payments and closing costs -- have tailed downward, well off a pandemic era peak to the lowest savings rate recorded since 2013, and in a high-inflation consumer environment, consumer worry over finances has begun to mute exuberance.

Here's a January pulse reading, from a New York Times|Momentive consumer survey, with five key highlights:

- Consumer confidence sinks to its lowest-ever score, 41 out of 100, ticking down from the previous low of 42 at the end of last year (poll has been running since Jan. 2017)

- The pandemic weighs heavily on savings: fully half (50%) of adults report depleted savings compared with before the pandemic; that’s triple the proportion that’s boosted their savings (16%).

- The ongoing burden of Covid-19 is widespread: 40% of adults say their families are worse off financially now than prior to the pandemic.

- Pay raises struggle to beat out inflation: 55% of workers received a pay raise in the past year, yet 41% say their raise hasn’t kept up with inflation

- Inflation concerns remain nearly universal: 89% are concerned about inflation, roughly unchanged from December 2021 (88%)

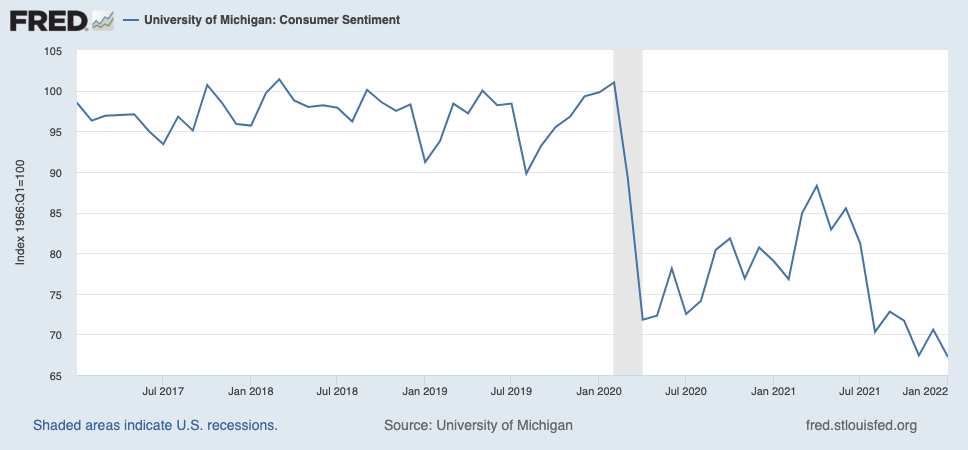

Here are the two monthly standards of consumer confidence and sentiment, The Conference Board's Consumer Confidence Index and the University of Michigan's Consumer Sentiment benchmark. Both reflect declines during the past 36 month period, not only from a decade-long upward trajectory prior to the onset of COVID-19's impacts in early 2020, but further deterioration, to levels lower than any readings since December 2011.

Whether consumer confidence lags or leads homebuying and housing activity has been subject for argument. Factors that typically impact sentiment – jobs, payment power, economic mobility – have at least a tinge of uncertainty around them in a shifting and heaving high-volatility marketplace where the single common denominator constant is a generational swelling of household-forming late 20s-through-early 40-year-olds and a growing share of 55-plus year-olds on the move to fuss-free, connected and amenitized community living.

Whether those common denominator constants get swayed by the course of turbulent events in ways that impact structural demand is a coin toss, and few strategists with deep experience expect profoundly disruptive or lasting effects.

So, leadership priorities center on consistency, and skill at unifying and aligning both team members and partners around a simple shared goal. Berkshire Hathaway ceo Warren Buffett and the company's vice chairman Charlie Munger, right up to the latest letter to shareholders, remain a font of wisdom on how leaders can remain truly present amidst the fray of external disturbances and disruptions.

Teaching, like writing, has helped me develop and clarify my own thoughts. Charlie calls this phenomenon the orangutan effect: If you sit down with an orangutan and carefully explain to it one of your cherished ideas, you may leave behind a puzzled primate, but you will exit thinking more clearly."

In another leadership gem – one whose timeliness amidst tumult and distraction offers a business true north – from this year's letter Buffett talks in the first person to the second person "you," a shareholder. Homebuilders and their residential real estate and construction partner business leaders might simply interpret the "you" in this case slightly more broadly, to include not just their shareholders, but homebuying and renting customers, localities, partner firms, and team members. Buffett writes:

I would like, however, to emphasize a further item that turns our jobs into fun and satisfaction --— working for you. There is nothing more rewarding to Charlie and I ..."

For times like these, when headline risk comes a mile a minute, leadership presence around clarity and trust – the work builders stand for – can help weather the storm.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.