Leadership

With ASGi Purchase, D.R. Horton Leans Into First-Time Home Buyers

The Builder's Daily has learned that D.R. Horton this week finalized purchase of Houston-market "affordable" homebuilder, Conroe, TX-based ASGi Homes.

D.R. Horton strategists aren't kidding around when they say they're intent on leaning into market share gains sooner to ignite both volume and returns growth later.

Added proof of that comes today, with word that the nation's No. 1 homebuilder – and No. 1 in marketshare in the U.S.'s five most-active new-home construction markets – will fortify and add to an already-dominant position in Houston effective immediately.

The Builder's Daily has learned that D.R. Horton this week finalized purchase of Houston-market "affordable" homebuilder, Conroe, TX-based ASGi Homes assets, and has established right-of-first refusal access to thousands more lots owned and controlled by ASGi co-owners, Bill and Colleen Ellison's Ellison Development Company entity. Builder Advisor Group represented the sellers.

We are honored to work with Bill and Colleen," says Tony Avila, CEO of Builder Advisor Group. "They have built a tremendous company. They embody our mantra of working to house Americans."

ASGi, founded in 2016 by Bill Ellison, has had a single strategic position:

We started building entry level affordable housing for working class people," Ellison tells The Builder's Daily, confirming the deal. "For example, the barista at Starbucks can afford a house from us or you know, the night stocker at the grocery store, or the kid that works next door that changes oil, or a school teacher or EMS worker or a firefighter. Those folks, as a single income, can't necessarily afford a $300,000 or $400,000 house here in Houston, which the average which is kind of the average sales price. Our homes average about $180,000. with homes anywhere from about $120K up to about $250K. So we're the most affordable company that's scaling and doing a lot of houses in the entire Houston surrounding market.

That being said, over time, I realized that in order for me to maintain affordability, I needed to start developing my own lot pipelines. And so I created Ellison Development, we started development arm doing the doing all the horizontal construction, putting in putting the roads, the utilities, the infrastructure and so forth, selling those lots back to ASGi Homes. And that's what kind of got us to the point we are today. We decided to go with Dr. Horton and and sell them the the assets of the company. And so they'll be taking that over from today forward."

ASGi offers a glimpse at the lengths, product types, and direction D.R. Horton will go – not just for deeper local scale in their current operating arenas – to redouble its core commitments to build affordably to entry-level and first-time buyers even as those buyers face stiffening challenges on mortgage credit and monthly costs.

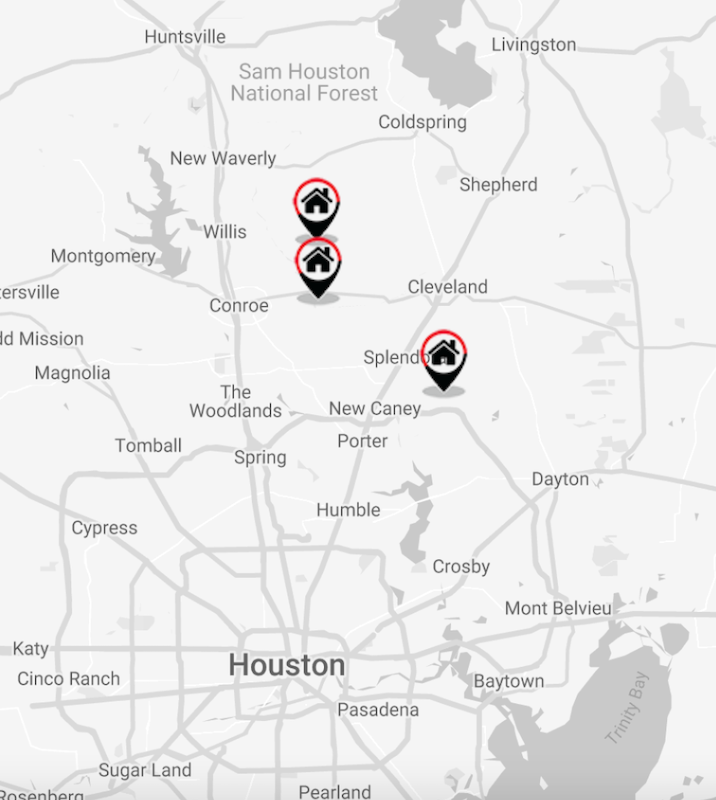

While actively selling in just three communities communities located between 12 o'clock and 2 o'clock north of Houston, some 35 to 40 miles out of downtown, Ellison Development controls enough of a growth pipeline to catapult Horton to nearly 20% market share primacy in the Greater Houston-Sugar Land metro area within a two- to three-year timeline.

These communities are situated just where where the growth is happening," Colleen Ellison tells The Builder's Daily.

Earlier this Fall, Ellison Development reached agreement with D.R. Horton to sell the majority of the lots in its Williams Reserve East project in Conroe.

.JPG/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:1280)

With product offerings ranging from the mid-$100s to mid-$200s for single-story and two-story 1,100 to 1,200-sq ft houses, ASGi's land positions, its product square footage, its rental-refugee attainability and customer satisfaction, and its operational efficiencies align precisely with buyer D.R. Horton's declared intent to keep its sights set on monthly payment attainability as a bedrock standard for its first-time buyer offerings.

The spirit of why these these two companies match so well together is that D.R. Horton has the strength and the scalability – not only in their brand, but what they bring to the table to build and sell, despite affordability and interest rates challenges where they are," Colleen Ellison says. "They're just a great builder, and this development company is able to make the dirt roll fast. These these two businesses together just fit in really well to tackle this affordability issue."

In remarks earlier this week with investment research analysts discussing D.R. Horton's Q4 and full-year fiscal 2023 performance, strategic executives repeatedly emphasized focus on first-time buyers despite obvious headwinds of price- and interest-rate sensitivity.

Here's a sampling of those comments:

Why first-time buyers?

Jessica Hansen, VP, Investor Relations

We still really like over half of our business being first-time homebuyers because despite what's happening with interest rates, those buyers need a place to live. They don't already own a home, so they're not a discretionary buyer. They're in the market looking at buy versus rent opportunities. So, if we can stay competitive with the rental market on that front, we're going to continue to capture first-time homebuyer market share."

How to price-in first-time buyers?

Michael Murray, Executive VP, Chief Operating Officer

Our buyers are focused primarily on affordability. And for us, the way we deliver that affordability is through the monthly payment process. That's obviously been a big driver for the rate buydowns, but also introducing smaller product footprints. De-amenitizing some of the homes a bit and letting people do things to improve their homes after the closing when their financial position perhaps has changed and they can afford a little more. But it's continuing to hit a price point relative to median income, so that we can find a place to work in that family's budget."

Mortgages for first-time buyers

Michael Murray, Executive VP, Chief Operating Officer

During the fourth quarter, virtually all of our mortgage company's loan originations related to homes closed by our homebuilding operations and our mortgage company handled the financing for 76% of our buyers. FHA and VA loans accounted for 51% of the mortgage company's volume.

Borrowers originating with DHI Mortgage this quarter had an average FICO score of 725 at an average loan-to-value ratio of 87%. First-time home buyers represented 55% of the closings handled by our mortgage company this quarter."

D.R. Horton: Strategy from Day One

David Auld, Vice Chairman

Everything – you go back 45-year history, the goal of the company is to be the low-cost provider of affordable housing and create opportunities for first-time homebuyers to get in a home. And everything we've done through those years has been to position the company a little bit better and a little bit stronger...

... our internal focus is going to continue to be project-by-project, driving improvements to efficiency, simplifying product, making it – even as overall individual component price increases, the availability of housing to the first-time homebuyer continues to be there."

So, what the ASGi deal does is to give D.R. Horton visibility into the land positions, product types, square footages, build cycles, selling and marketing mechanisms, absorption pace models, and return benchmarks to remain 100% activated serving those first-time buyer customers through thick and thin in a higher-for-longer interest rate environment.

This, of course, amounts not just to a stronger strategy to sustain its own operational systems, disciplines, and performance, but also rather raises pressures on homebuilders competing in its markets to follow it on pricing even if they don't have operations and processes to do so profitably.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.