Land

Will Secondary Market Magnets Redraw Big Builders' Footprints?

Engaged in a land rush to secure reliably steady supplies of lot inventory within their current network of stores, builders now face the challenge and opportunity of whether, how, when and where to expand.

We're at the trailhead of what economists call "a new geography" in the U.S., one more than likely to impact the heart of "location, location, location." Four forces factor into where we are at this trailhead.

- scarcity-fueled soaring property prices

- a not-quite-post-traumatic pandemic macro reflex

- exponential connective technologies impacting work and livelihoods

- the firehose of a digitally native piglet-in-a-python new generation of young adults reaching a critical household income threshold.

At the same time, a gush of global money has led to a land rush into every potential residential real estate channel – old or new, fad or trend. They're betting that a) the physics of sheer demand for any and all new housing will validate the investment, and they're betting b) against a larger, more ravenous fray of strategic and financial buyer rivals than has historically engaged in the game.

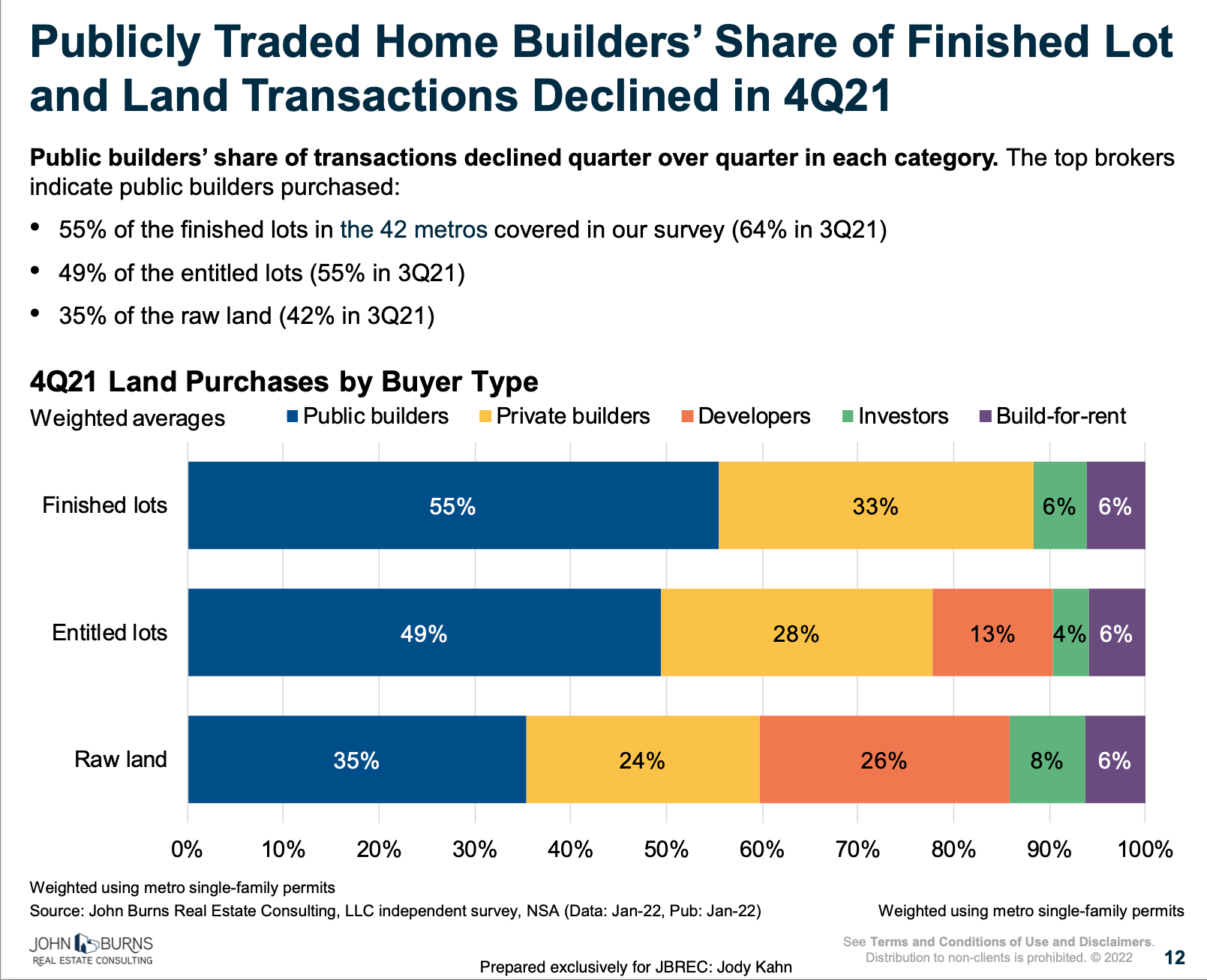

A look, from the John Burns Real Estate Consulting team's Q4 Residential Land Survey takes note of the fact that public home builders' share of the finished lot and land market has declined as a percentage of totals, thanks to the proliferation of richly capitalized investors including land bankers, developers, foreign buyers, and private home builders. Public builders share of finished lot purchases, the study notes, fell below 60% of total finished lots sold for the first time since Q1 2015. Investors' share, on the other hand, swelled across the three land purchase categories below.

The new geography – demographers say – untethers itself from post-industrial era manufacturing and distribution, and creates new technology-and-advanced-learning-centric market hubs where culture, business, tech, education, health, and policy-making thicken in comparison with other places.

Famously, Enrico Moretti, author of "The New Geography of Jobs," writes:

In the coming decades, global competition will be about attracting innovative human capital and innovative companies. The importance of geography and the forces of agglomeration in determining the location of human capital will keep growing. The number and strength of a country's brain hubs will determine whether it will prosper or decline."

Early detection of the scent of that trail – into the coordinates and timing of where and what and when and who and why of jobs, of talent, of economic value creation, of culture – is hugely material to the forward-looking investment, development, and construction in new homes and communities that ride along with those other forces and factors.

Still, the actual, present-day business of putting capital to work to line up lot supplies well beyond the current 12 to 18 month immediate term inventory turns – focused on business visibility from 24 to 60 months outward -- has taken on a life of its own, as mentioned, tapping the rocket fuel of capital and the number of agents looking to place it into specific residential project development.

What's shaping up as an area of curiosity – and potential challenge and opportunity -- is that, while there's surely an overlap between the ferocious and manic nearer-term land and lot strategies playing out now and the step-change reset of central hubs mapped into "the new geography," there are noteworthy differences. Mismatches.

While what would typically be regarded as secondary and tertiary market metros – not active or scaled enough to support operational overheads – have established themselves during the early pandemic era shuffle of people, jobs, second homes, retirement homes, and entry-level homes as viable, they tend to be operational extenders, rather than a full embrace of a "new geography."

Beyond the visible horizon line of the inventory-turn futures of homebuilders and developers – locked as they are in an arms race to secure a lots proximate to where they're already active – a gap grows between that investment and the "new geography" of economic growth in the future.

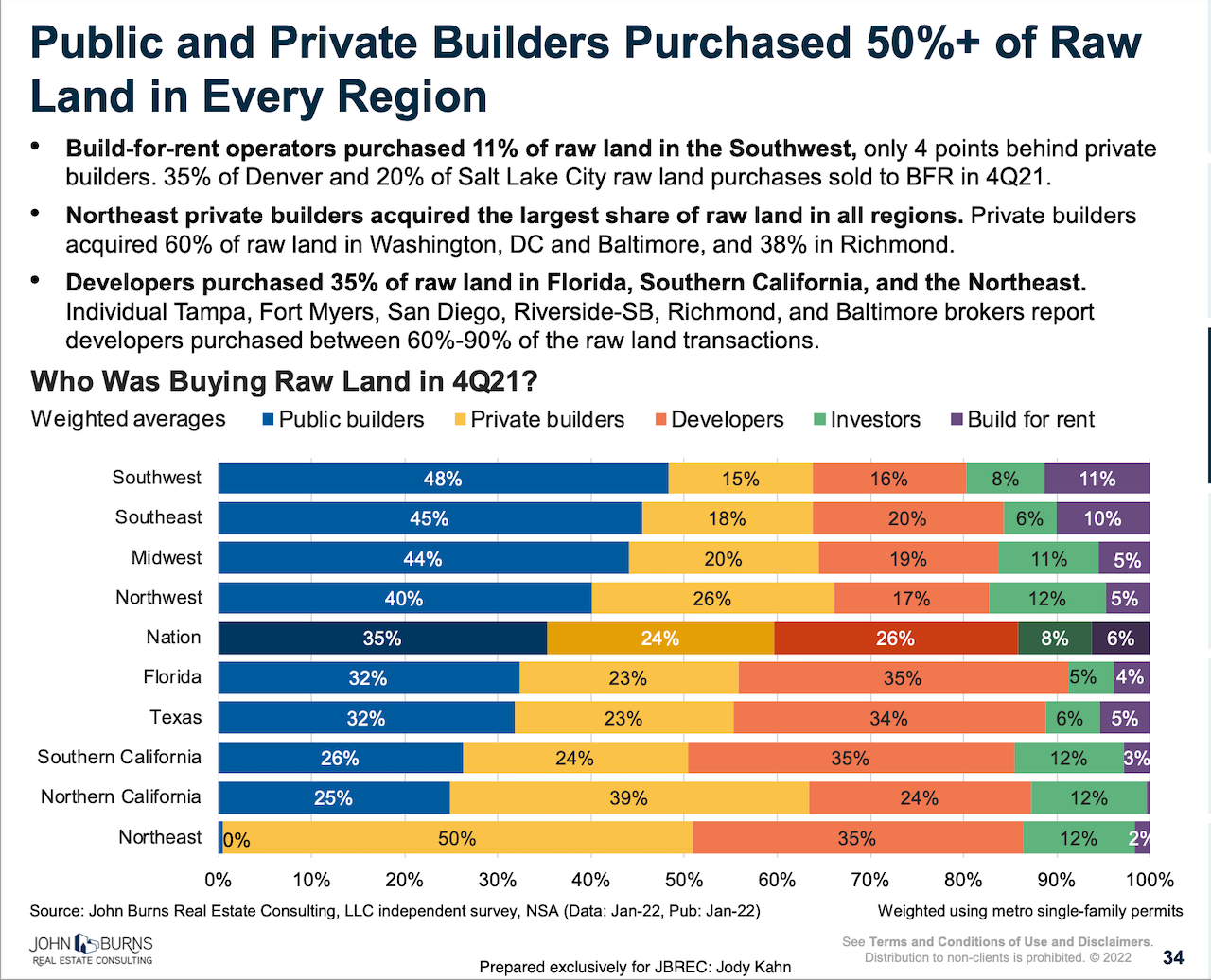

Here, from JBREC, we see a market share breakout of "raw land" purchases that shows – by region – public and private homebuilders purchase 50% or more of those available raw, unentitled, undeveloped lots.

Where the discrepancy between current land and development investments and where the economic engines of growth – talent, earning power, younger adult household concentration – seem to be revving up is worth exploring.

In research he completed for the think tank Heartland Forward, demographer/ business strategist/author Richard Florida notes:

Despite the continued dominance of a few coastal metro areas, many more affordable places have made considerable strides in attracting talent in the nation’s heartland, which according to our definition covers 20 states in the center of the country running from the Midwest to the Sun Belt.

These include larger metro areas like Austin, Nashville, Minneapolis-St. Paul, Kansas City, St. Louis, Oklahoma City, Des Moines, Omaha, Columbus and Cincinnati. Smaller college towns and cultural hubs like Ann Arbor, Michigan; Madison, Wisconsin; and Iowa City, Iowa, also rank as significant talent hubs."

Florida's "new geography" map – in contrast with the markets many of homebuilding and development's most active investors and operators have focused on – includes a significant number of "flyover" or heartland markets. Many of these are the domain of successful single or multi-market privately held homebuilders, but aren't, yet, mapped into the strategies of the larger, public builders, save for D.R. Horton, which has enjoyed secondary and tertiary market dominance for years.

Recently, Lennar added Idaho, Wisconsin, and Alabama to its operating footprint, indicating both a more nimble operating and overhead management capability and a believe its expansion investments will validate themselves as permit and economic growth arc upward.

Are homebuilders and developers – as frantic as they are to secure hard to get land positions in their long-time comfort zones – on a convergence course with the "new geography" of the future of talent, jobs, and economic growth? A pivot may be in the works, and if it is, there are lots of stand-out privately-held homebuilding operators in those fly-over state hubs that are getting a closer look as dozens of strategic, investor, foreign, and other less conventional buyer prospects map their own mid-term and longer-term futures.

A few decades ago, coastal cities attracted talent because of their thick labor markets and unique bundles of amenities — like restaurants, cafes, nightlife and museums — that knowledge workers with a choice about where to live could not find elsewhere. But over the past decade or so, as these places have become more expensive, smaller metros in the center of the nation have worked hard to improve their offerings, adding bike trails and other outdoor amenities and drawing in better restaurants, cafes and music venues, in part because of their more affordable real estate."

Join the conversation

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.