Leadership

Will M&A Heat Up As Market Gets Rougher? We Ask Our Deal Expert

It's more or less the same drivers bringing buyers and sellers to the table now as it was before, only with more motivators on both sides, says Tony Avila, ceo of Builder Advisor Group, a new addition to The Builder's Daily's Dream team.

Brace for a financial market-moving housing starts release tomorrow, coming as it will as Wall Street investors try to digest the impact of today's Federal Reserve hike of its funds rate by 75 basis points.

New bumps and bruises to homebuilders' projected 2022-23 plans, budgets, and near-term business challenges came through loud and clear in three other broadsides today, leading to greater likelihood of a consequential slowdown impacting single-family housing starts.

A business that looked as if it would tear through the first part of the 2020s without a moment to look back, is now looking forward – near-term at least – at a different business runway against an economic backdrop full of uncertainty.

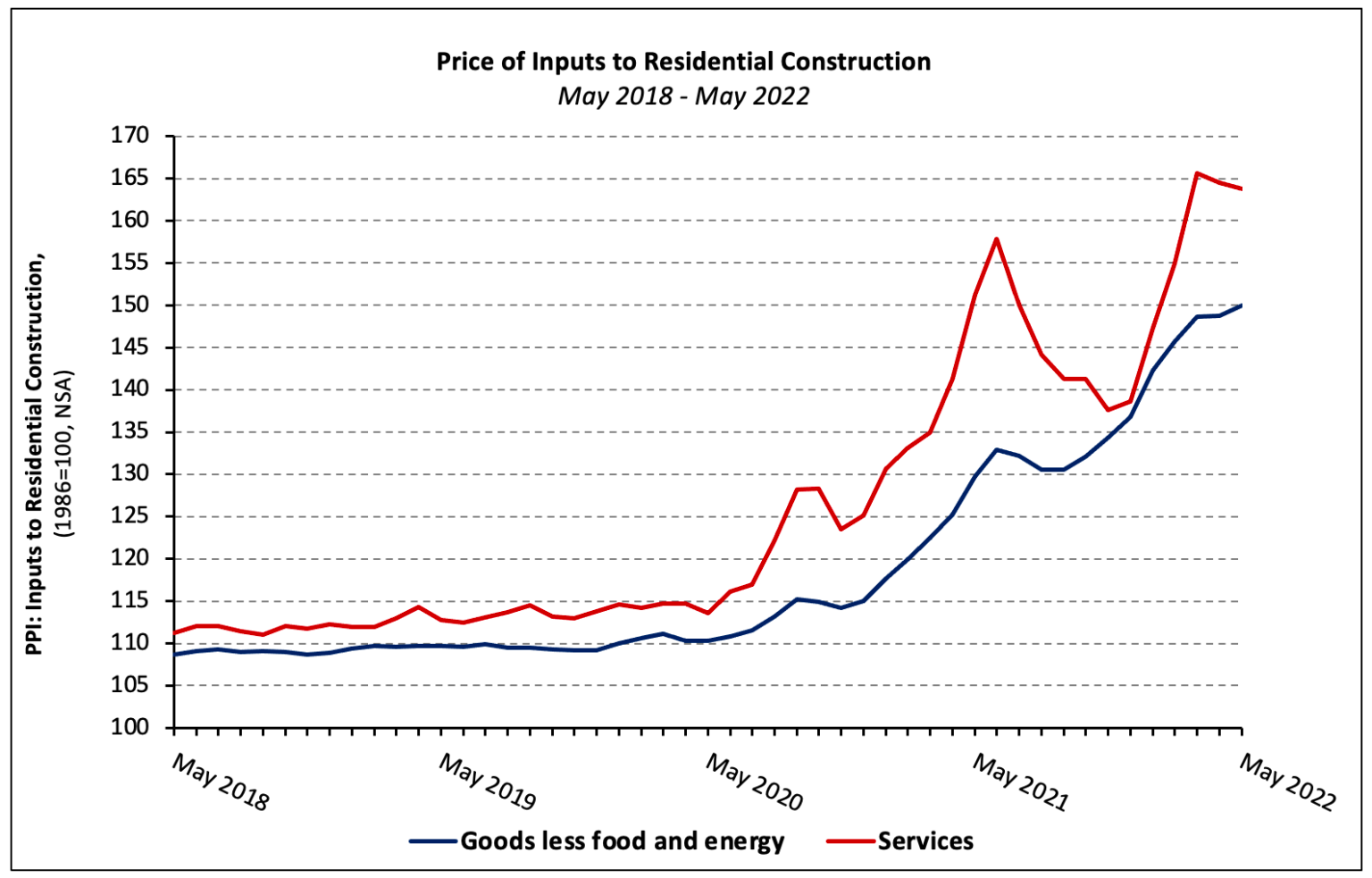

- One hit comes on the cost-of-doing-business front, where producer prices of goods used in construction are up 19.4% year-over-year.

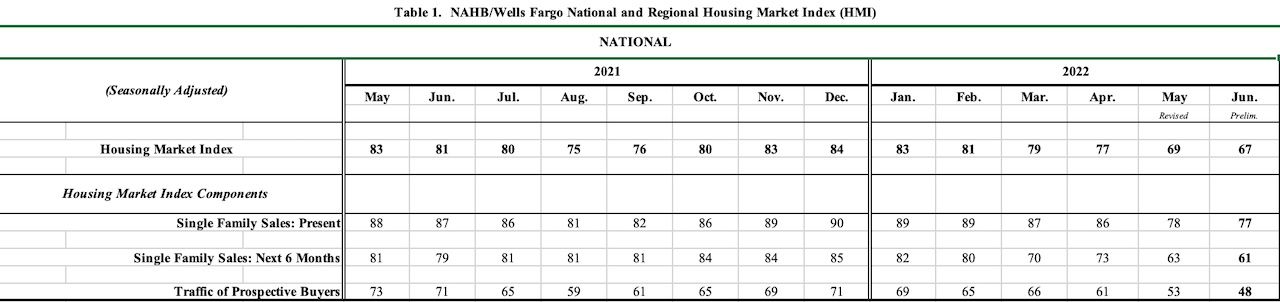

- Another focal pain point concerns a wall of worry about the very card they'd held up their sleeve in case things got rougher, a solid, undeterred new-homebuyer demand stream, where traffic among prospective homebuyers just fell to a previously unthinkable level not seen since the shocking COVID collapse in June 2020.

- That wall of worry loomed higher, thicker and more daunting yet thanks to a third hit to housing and homebuilders' shaken firmament – interest rates at 6%, slamming demand for mortgage loans by half – and that was even before the Fed's move to increase the rates it charges for loans to its best customers and sets as overnight borrowing costs among banks, expected to increase in its largest step-change in 28 years.

A cascade of effects suggests at least this much. Things for homebuilders and their partners are likely to get more adverse – or worse – before they improve. Bloomberg columnist Conor Sen, who often writes about housing notes:

It's true that inflation is too high and demands a policy response, and the housing market was unsustainably hot, with home prices and mortgage rates combining to create extreme affordability challenges. So it makes sense to raise mortgage rates to help cool off both inflation and the housing market.

The concern comes when we realize there is a wave of tens of millions of millennials who will be looking to buy homes over the next decade. The housing market needs the construction of many more homes to meet that demand. If we’re already constraining economic activity so much that it's leading to job losses, that will make it more difficult to ramp the machine back up after inflation is under control.

The hardball dynamics of a 180-degree cool-down, meanwhile, have sparked a wholly new range of intensity levels for essentially the same longer-haul driver grinding toward ever-greater consolidation and concentration in homebuilding over the past couple of decades. In the collision of sudden shocks and stresses with more structural tectonic shifts, urgencies, motivations, desperation, and opportunism find their new level in real estate's most fascinating "Game Of Thrones" – part natural selection and part Shark Tank– its mergers and acquisitions deal flow.

A $514-million deal last week that brought together privately-held Texas-focused powerhouse Chesmar Homes and a growing Japan-based global mega builder-remodeler-developer enterprise Sekisui House, stands as a bridge that spans the long- and short-term bright lines, connecting cyclical gravity with pan-cyclical opportunity.

For a whole robust raft of strategic and financial buyers – public companies, large private strongholds, roll-up companies, foreign-based strategics, Clayton Properties, and a new hybrid of Wall Street fund-backed strategics in the single-family built-for-rent space – the driver underlying a deal like the Sekisui House-Chesmar combination is about a blend of land assets, local real estate intelligence, product match, operational excellence, and an accordion-like capability expansion at the pace of the area's metropolitan economic growth.

Under these circumstances, an operator who's currently doing $60- to $80 million in a market that's gaining steam may well be looked at as a $200 million division in the next five years with access to deeper resources. An $800 million or so a year player like Chesmar can similarly be looked at as a $1.5 to $2 billion regional portfolio piece in the same time period, with the same kind of expanded resources and platform support.

The timing of the opportunity for buyers in this M&A market ratchets up in intensity," says Tony Avila, ceo of Builder Advisor Group, which served as Chesmar Homes' representative in its sale to Sekisui House. "Despite a rise mortgage rates, demand in some markets is still very strong, and those demand dynamics are fueling urgency among more potential acquirers in this market than I've ever seen before."

Avila and the Builder Advisor Group team, which recently partnered with The Builder's Daily as a sponsor, has been involved in 15 separate M&A and entity-level capital finance raise deals in the past 15 months, many of them pairing large enterprises with top 200-ranked privately-held operators in hot domestic migration hubs that have stood out for desirability and relative affordability.

The Chesmar-Sekisui House combination ran consistent to a tee with one of two driving M&A acquirer themes that fall roughly under a broad umbrella agenda of large enterprises amassing more concentrated power in the form of controlled lot pipelines and deep local operational scale. That is, a geographical "manifest destiny" – in this case expanding the Sekisui House operating footprint into the most-active new-home state by volume. We wrote here:

The Chesmar acquisition – pegged to close in two phases, one July 1, 2022 and the second by Dec. 31, 2022 – will give Sekisui House homebuilding operations and scalability in seven high-housing-and-construction-activity states, expanding the portfolio's volume by more than 60%, and revenues by upwards of 43%, based on 2021 operating benchmarks.

Chesmar, whose 75 or so actively-selling communities ring the Austin, Dallas-Fort Worth, Houston, and San Antonio markets with energy-efficient h0mes that mostly range from $200,000s to the $500,000-plus price points, now has a deep-pocketed capital partner to help it stand head-to-head with all of the nation's largest national homebuilders with operations in Texas – competing with clout and local scale for homebuying customers, trades, timely materials supply, and land.

That macro theme – a new manifest destiny portfolio management that emphasizes geographical exposure to pandemic-era economic momentum for more affordably-priced new homes – has figured prominently in all of the major and medium-sized strategic acquisitions of the post-pandemic era, and Avila sees that trend continuing to influence a number of deals he expects will cross the goal line through the end of 2022.

Even an environment of slowing absorption rates, many investors have tremendous capital to invest. That capital is earning zero in the bank. If they can put the money to work accretively, their earnings per share will increase. The driver is not just business volume. There are other drivers such as earnings per share and return on invested capital," notes Avila. "Whether it's publics needing to get that volume to stay on guidance, or some of the foreign ownerships needing the business volume, or the single-family-rental investors, ... they've all got that urgency to produce investment performance. M&A is a classic tool to do that in times like now, and then they concentrate on transforming that marketshare into better margins.

While word is that strong privately-held players are on far sounder financial footing – lower leverage, higher liquidity and operating margins, and lighter land books – they're still prone to anxiety over their exposure in times like now to personal loan guarantees. A broader economic context of headwinds ahead – and within that, a housing cool-down that could impact orders, price, and their land asset values – means that more privately held players are on the dance floor looking for partners.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.