Leadership

Will Homebuilders Backslide On Building Frontline Capability Now?

Leaders of homebuilding organizations who've strived so hard, especially over the past few years, to evolve the human capability pipeline now need a continuity and cohesiveness people plan.

This week lands us in the thick of public homebuilders' 3rd-quarter calendar year 2022 earnings season. In succession, they're likely to report terrific results based on business they booked nearly a year ago, challenged results based on what's been going on for the past four or five months, and increasingly cautious, risk-prone outlooks on 2023 and 2024 business.

It's a look-back-look-guardedly-forward moment of truth crossroads for the business. Securing a lifeline, a path of profitability, a marketshare growth platform, and explosive opportunity for a dynamic future make up the priorities short list. On that note, a word of caution about what happens to organizations' "people first" mantra, now that cost and headcount cuts become almost synonymous with "securing a lifeline" for the business.

What homebuilders – an essential center of economic activity for hundreds of thousands of business ecosystem participants and livelihoods – should work to do is avoid backsliding on the human capital front. Leaders of homebuilding organizations who've strived so hard, especially over the past few years to evolve human capability – and crucially, a pipeline to a next generation wave of talent, frontline skills, and commitment – need a continuity and cohesiveness people plan.

Importantly, unknowns still obstruct answers as to the trajectory and duration of the current downturn. It seems that the steep rates of deterioration have mostly served to encourage many strategists to believe that hitting the bottom has to be soon. That's what many colleagues are reading into a stream of record-breaking drops in housing activity, prices, valuations, and confidence.

The duration of this stress and shock period will one-day – perhaps not until 2024 or 2025 – tell whether residential construction and real estate enterprises either dig themselves a bigger hole on the people front, or set up a human capital bridge to span across the adverse stretch of time.

The housing collapse and Great Recession set homebuilding and its capability to respond to and contribute to a growing economy back thanks to the constraints caused in large part due to the mass exodus of 2 to 3 million frontline workers from the field – many of them permanently – during that downturn.

How homebuilding firm leaders make decisions, what actions they take, and the impact that has on staffers and contractors, and subs can have a decade-long drag effect, as we've seen occur in past cycles," says Thomas Carpitella, ceo of search and recruitment firm Fast Tracking Solutions. "Everyone remembers how each brand and team work, and it takes a long time to curate that trusted network to build a talent pipeline. You don't want to throw those gains out, after all this work, even if you do have to reduce headcount. You need to work to make a place people continue to still want to work and keep that brand integrity even during the rough times."

Let's look for a moment at an example. Pulte reported its Q3 22 earnings data and business analysis this morning.

- Its positives – for the quarter, PulteGroup reported net income of $628 million, or $2.69 per share. In the prior year, the Company reported net income of $476 million, or $1.82 per share.

- Its burgeoning challenges [per a note from Wolfe Research analyst Truman Patterson] – "Order Units fell -28%, a touch below our below-consensus -25% estimate, as Cancellation Rates increased 9 ppts QoQ and 14 ppts YoY to 24%. Order ASPs fell -6% QoQ."

- Its growing headwinds [per a note from Seeking Alpha news editor Liz Kiesche] – [PulteGroup] is reassessing pending transactions. As a result of the ongoing review, Pulte (PHM) terminated a number of pending land transactions and wrote off $24M of deposits and related expenses."

Pulte president and ceo Ryan Marshall put one term underneath any change of expectations that things are likely to get worse before they get better: Stability.

In the transcript [you can find a link here] from his opening comments to investment analysts on homebuilding's No. 3 ranked national enterprise, Marshall says:

Homebuyer demand clearly moved lower as the third quarter progressed, but the dramatic and ongoing rise in interest rates likely being the biggest concern for most consumers. However, there are certainly other factors at play, including inflation, fear of recession or increasing concerns about job loss.

Given all of these considerations, it is easy to understand why consumers have moved to the sidelines. Having said that, people still desire homeownership and are prepared to buy when they find a compelling offer. Operationally, we are appropriately taking a more defensive posture for at least the near-term as we work to navigate today's more turbulent conditions. We believe this approach is appropriate today, and appreciate that stability ... whether talking about mortgage rates, the stock market or inflation, maybe what people will need to move off the sidelines and become homebuyers again [emphasis added].

Importantly, stability is an externality. A homebuilder, all homebuilders, and all businesses large and small together may have no say on when stability can regain purchase in the minds, hearts, and pocketbooks of consumers.

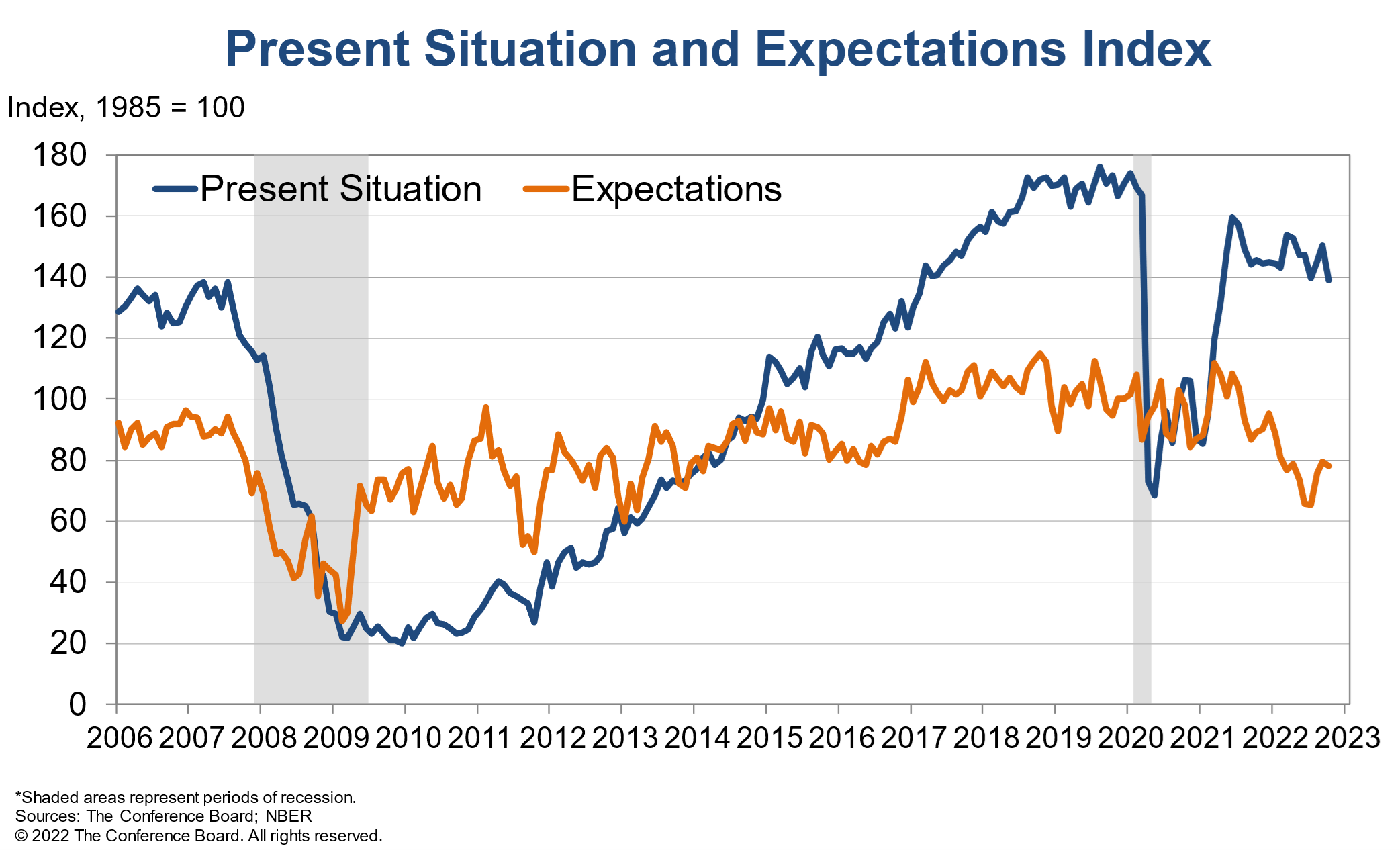

As data released today from The Conference Board shows, consumer confidence is slipping, and expectations are a nervous shrug, "who knows?"

Stability is not something the Fed or the government or the economy are going to be able to order up on a platter. And just because things feel now like the ground is shifting under our feet doesn't mean the time's coming soon for "the bottom."

Heading into this "duration" – come what may – means keeping the array of recent accomplishments on the people front resilient and ready for growth when the inevitable upturn happens, whenever that is.

We need to resolve to keep focus on the opportunity here, for the present and future's sake," says Carpitella. "If you can recruit and onboard and start to grow top performers, you literally are going to be able to do more with less in terms of total resources. And you're going to be able to come out of the gate faster and more capably when the tide eventually turns and momentum comes back."

As a sign of progress homebuilding's business culture has made on evolving its human capability, this week the Leading Builders of America's Building Talent Foundation celebrated its third year in action, an investment and commitment to achieving a sustainable workforce in residential construction.

A challenge now – one that will tell of the business cultural evolution of the residential construction and real estate sector itself – is whether its corporate players will together tap the "enlightened self-interest" to lock in those gains, rather than scrap them all and start all over again.

You're going to see some firms dig deeper to sustain that progress on the people front," says Carpitella. "There are always ones who're playing the long game."

Staffing and recruiting done right. Fast Tracking Solutions specializes in delivering top talent in accounting/finance, construction, and technology operations.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.