Land

Will 55+ Cohort Seek Future-Proof Retirement Relocation Choices?

Doubters as to how swiftly mobility and migration trends can pivot and course correct – powering new boom markets in geographies long considered backwater, tertiary markets at best – need only look at Spring 2020 through Spring 2022 as a "narrative-buster."

One of residential real estate's tried and true narratives is that people quickly, almost reflexively, predictably forget.

That truism has reliably held true, and will continue to do so. Until it doesn't.

Natural hazards, in particular. However devastating and however likely they are to recur with increasing ferocity in the future, they never prove to stifle demand nor valuations for real estate in affected areas. The narrative, every real estate and land strategy executive will tell you, is that property values and natural disasters never ultimately correlate. Amnesia inoculates properties from natural hazard risk – it's always been the case, and why wouldn't it always be so?

The past few post-Covid years may yet prove out the vulnerability of narratives and truisms of all kinds. The Big Picture host Barry Ritholtz writes:

Every now and again, we reach a moment in time when the scales fall from our eyes, and reality is revealed to us. We are now at one of those moments when the stories we tell ourselves have fallen apart. The dominant narratives are failing.

Not their irresistible appeal to our deep lizard brains, but rather, their ability to lead us by telling a compelling story.

This morning we catch this piece, by New York Times contributor Susan B. Garland may be on to the demise of yet another. Garland writes:

A small but growing number of older people like the Hoaglands are taking climate change into account when choosing a retirement destination, real estate agents and other experts say. Armed with climate studies, many retirees are looking for communities that are less likely to experience extreme weather events, such as wildfires, drought and flooding.

David Dew, a real estate broker who sells homes near the Rappahannock River in and around W*hite Stone, Va., said a larger number of retired clients were voicing concerns about weather patterns. With many waterfront properties in minimal danger of flooding there, the area is attracting retirees from the flood-ravaged Outer Banks of North Carolina as well as other Atlantic Ocean communities, he said.

“At first, they will say they want big views and deep water, but then they ask whether a hurricane or a nor’easter will wipe out the dock,” Mr. Dew said. “They want to be on the water but more protected.”

Garland's NYT piece draws on data from University of Pennsylvania analysis of climate impacts to property values in coastal Florida, and from insights extracted from online property brokerage Redfin's meta data on residential searches.

The data appears to be changing the behavior of many home buyers. According to a Redfin analysis released in September, the company’s users who had viewed listings that scored at severe or extreme flood risk instead bid on homes with 54 percent less risk. The website’s users who did not have access to the data were more likely to bid on high-risk homes.

“This is the best evidence that people do respond to climate change risks when they are presented with the information,” said Daryl Fairweather, Redfin’s chief economist.

Now, one more factor to add to the consideration set here – especially as organizations do some hard rethinks on land positioning and investment strategies that can both bridge near-term disruption trends in homebuyer demand and set up the best opportunity for growth once the cycle regains its footing again.

Doubters as to how swiftly mobility and migration trends can pivot and course correct – powering new boom markets in geographies long considered backwater, tertiary markets at best – need only look at Spring 2020 through Spring 2022 as a "narrative-buster."

Brookings Institution senior fellow and demographer William H. Frey writes:

Recently released U.S. Census Bureau population estimates emphasize that it was domestic out-migration that exerted an outsized demographic impact on large metropolitan areas during the prime 12 months of the COVID-19 pandemic. These estimates—for the period July 1, 2020 to July 1, 2021—reveal an absolute decline in the aggregate size of the nation’s 56 major metropolitan areas (those with populations exceeding 1 million). At the same time, smaller metro areas, as a group, experienced higher population growth than in each of the previous two years, while non-metropolitan America showed the greatest annual population gain in more than a decade.

Even with work-from-anywhere in question, what the Covid shock showed definitively is that people will move to protect their families and themselves as a primal instinct, and at scale, in ways that can rewrite valuations on land and community development on an accelerated basis.

Now, we see two phenomenal forces coming into clarity in ways we're only beginning to grasp – an unprecedentedly enormous aging American cohort and an ever-sharper sense of climate risk.

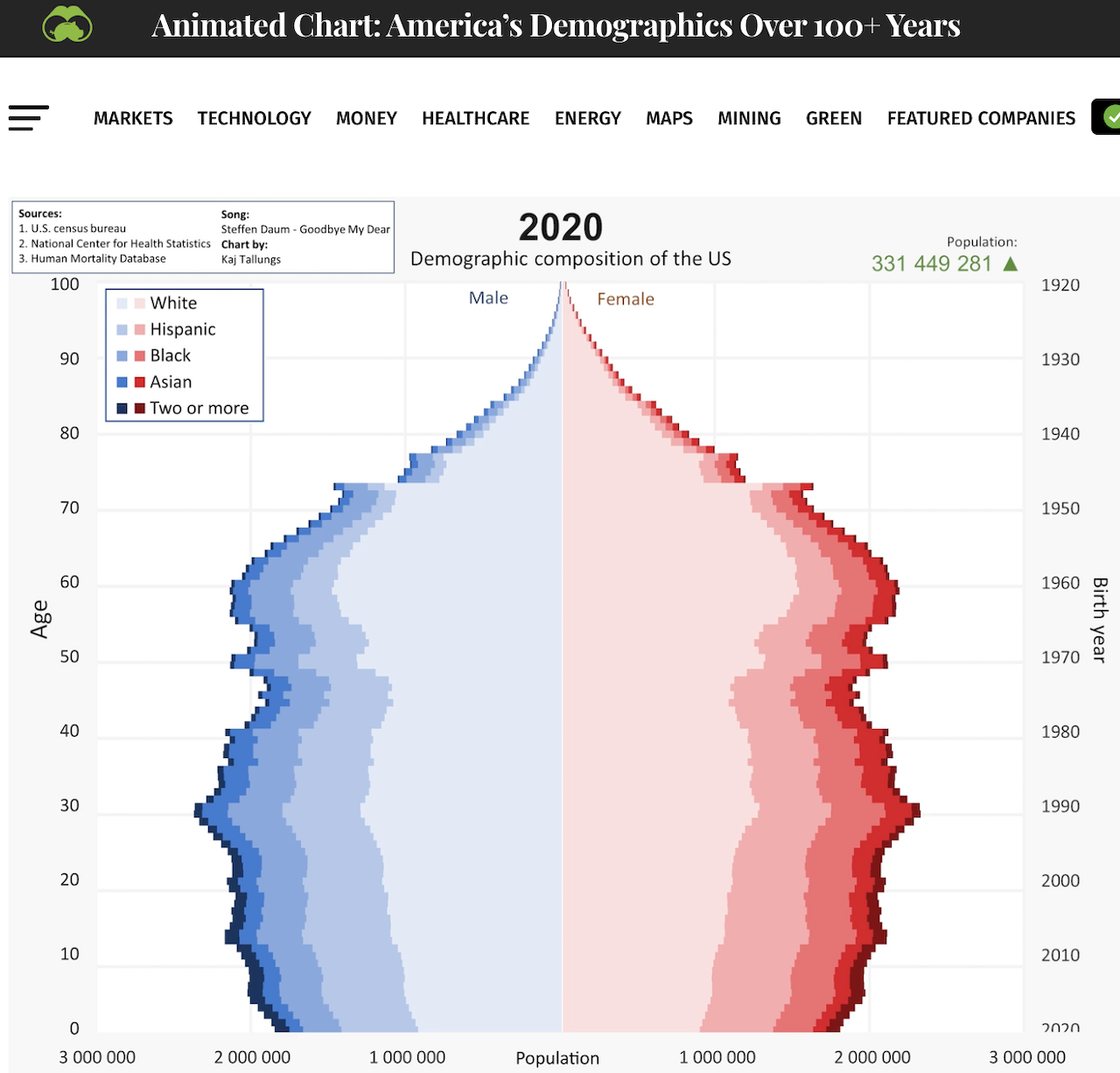

A reminder. Let's look at how fast things can change – in spite of a narrative that nobody holds a longer-term memory of natural hazard risks – by looking at how the demographics of households are changing every moment of every day:

Like many countries, a “graying” of the population will become a concern in the United States.

By 2060, it is expected that 95 million Americans will be over 65. But the share of those 18 and under will also continue to grow (albeit at a much slower pace) from 74 million people in 2020 to 80 million in 2060. – Visual Capitalist

So, will the time-tested narrative that people forget, and that demand for properties considered in harm's way of Mother Nature's wrath will continue to spool upward as if nothing bad will ever happen again?

Or has the future arrived, perhaps ahead of schedule for at least the residential land strategy stakeholders who'd like everything to continue as they always have?

Early in life, the future could never come too soon. Two older siblings had privileges and were "in the loop" in a way I could only envy. Validation, full regard, impact ... these were tightly-guarded experiences only an agonizingly slow-unfolding future would someday release.

Now, of course, it's the opposite. More and more, it feels as though the future arrives ahead of schedule, and nearly always with the effect of chipping or ripping away at any sense of having things figured out and well-oriented for what's still to come.

Actually, however it feels, we learn that the future arrives when it does. Precisely never late nor early. That may make for a more boring headline, and in many cases, the plain facts, evidence, and data don't lend themselves to catchy catch-phrases, or as New York Times columnist David Brooks refers to as "performative" "cotton candy media concoction" attention-grabbers.

MORE IN Land

Land 'Heavy,' Future Ready: Stanley Martin’s $700M Pivot

In an AI-driven land rush, Stanley Martin Homes turned deep zoning and engineering expertise into one of the largest single-use, single-parcel land sales in U.S. history. President Steve Alloy explains why playing “land heavy” still pays off when skill meets timing.

Millrose Q3 Outperforms On Tech, Discipline & Land‑Light Strategy

As many builders pull back, Millrose Properties leverages data‑driven underwriting and select partnerships to bank growth despite a softening market.

Jody Kahn: What Builders Say Now About New Home Demand

Amid slumping buyer urgency and looming policy uncertainty, John Burns Research & Consulting research guru Kahn summarizes builder sentiment trends and pain points from fresh field data.