Leadership

Why The Next 150 Days Matter So Much As Builders Seek Equilibrium

Here's three ways the markets will give clear answers to questions about where price and pace ratios may settle. The caveat is, solving for clarity won't solve for the market's contraditions.

Rather than do backflips of joy that these United States clinched two astonishing feats of economics wonder to report this morning – one, that the jobs economy has now more than fully recovered from the COVID-19 shock in 2Q 2020, and two, that the U.S. unemployment rate matched head-to-head with a five-decade low point, at 3.5% – many market-rate homebuilders feel a spasm of anticipated pain and struggle in the months ahead, directly as a result of this morning's news.

Wolfe Research senior housing analyst Truman Patterson writes this morning:

Unfortunately, stronger job gains and hotter wage inflation have taken the 10-year yield 12 bps higher this morning, which we expect will be a headwind for the housing equities today. While we are not rooting against increased employment, we have mixed thoughts about the strong job gains this morning. The optimist will point out that employers are still willing to hire into recessionary fears and employment remains robust. The pessimist will point out that the +0.5% MoM wage gain likely continues driving sticky core inflation, and consequently tighter Fed actions, while elevated inflation is driving consumers back into the workforce. The unemployment rate edged down to 3.5% from 3.6% and is back to pre-pandemic levels. The +50 bps MoM increase in hourly earnings suggests the workforce is demanding compensation for elevated inflation.

Double-edge swords slice both ways.

The 153 days left in 2022 will make a few things clear for homebuilders and their myriad residential real estate cycle-centric partners, which is why we're hearing repeatedly that countdown between now and Jan. 1, 2023 will out-box its weight-class.

- One is about clarity itself, which may feel like a goal to strive for, but which won't rid housing market dynamics of one of its bigger challenges of the moment, the fact that they're a bevy of contradictions.

- Another dimension of clarity – for people and organizations whose livelihood springs from market-rate home and community investment, planning, development, design, construction, manufacturing, and materials distribution – will come from answers regarding a thin and narrowing blue line of navigation between the rock of remaining supply chain disruption and the hard place of math- and psychology-related cancellation rates. Call it homebuilding's "market clearing event," in itself a daisy-chain of moves, counter-moves, actions, and reactions on new-home pricing that almost-programmatically kick into high-gear once multiple builders competing in each submarket start racing to secure bigger slices of a shrinking pie.

- Thirdly – but certainly not least in order of importance – is the light bulb of clarity that will flash around new-homebuyer confidence and trust, particularly as the cohort of buyers in builders' backlogs criss-crosses in time with buyers who jump for opportunities during builders' drive to clear their spec inventories while the getting's good.

Solving for clarity and solving for contradictory conditions don't necessarily match up.

Coping with supply chain impacts on construction schedules, many homebuilders did the smart thing as a response to try to give homebuyers greater visibility and a sense of security regarding the moment they'd get to take hold of their set of keys and move into their new home. To give buyers that comfort, many builders amped up their spec home activity, and – with full expectation that buyers would queue up the moment any home was released for sale – builders would progress their spec homes several stages through the start-to-completion cycle, to, say, sheet-rock ready, and then release the spec for sale. Then, with a firmer sense of the remaining finishing trades, appliances, lighting, etc., buyers could take encouragement from a 60- to 90-day period from that point as their move-in date.

All smart ideas at the time, and the right thing to do for customers. That is, until the late-June Federal Reserve hike threw a mathematical and psychological wrench into the works – further slowing orders and jacking up cancellations.

When that rate hike took its initial effect on 30-year-mortgage interest rates, monthly payments homebuyers were looking at were suddenly 32% higher due to the effect of the rates and selling prices, suddenly exposing risk both to builders' backlogs (for cancellations) and forward-selling of all of those homes builders started as spec, thinking orders would match up to them the moment they hit sheet-rock and got released.

Instead, where in the long-run single-family market rate supply is "underbuilt" by some order of magnitude that may one-day again be relevant, for 2022 and 2023, the amount of new homes under construction may way overshoot in terms of matching every one of them to a buyer prospect with the wherewithal to settle.

Here's where a "market clearing event" may be needed to restore months' supply and pace-price modeling to its new equilibrium. Calculated Risk's Bill McBride writes:

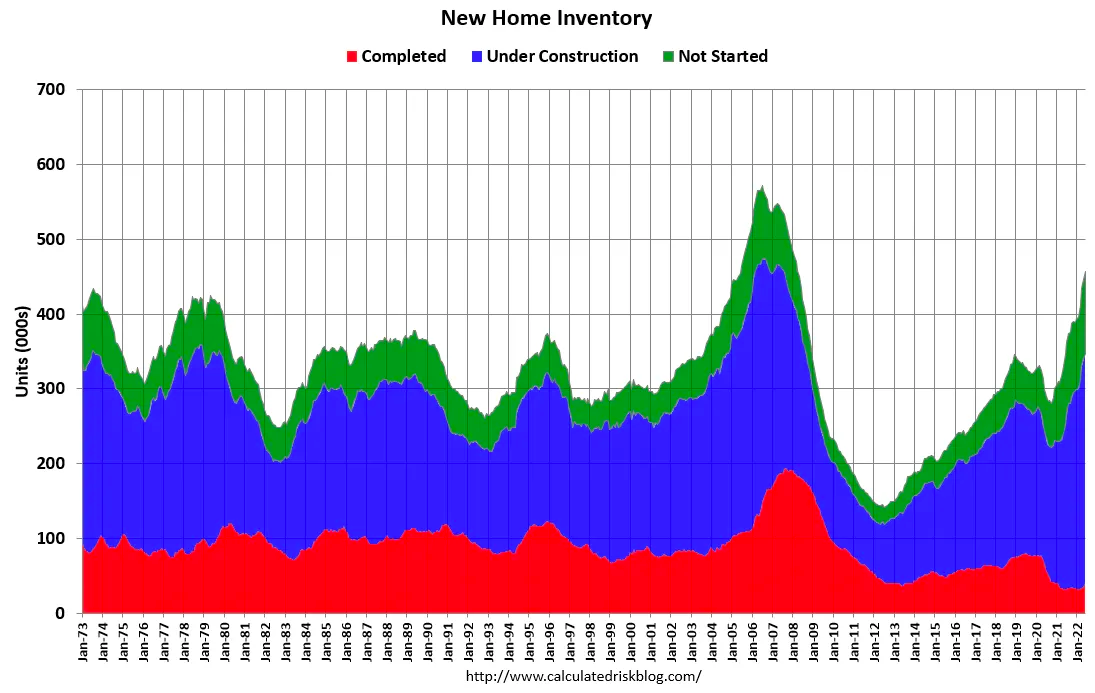

The inventory of completed homes for sale - at 41 thousand - is up from the record low of 32 thousand in 2021 and early 2022. This is about half the normal level of completed homes for sale but starting to increase.

The inventory of homes under construction at 306 thousand is very high, and about 9% below the record set in 2006. The inventory of homes not started is at a record 110 thousand.

So, here's where we get clarity in the next 150 days. Atypically – given the adversely moving targets of Fed funds rate increases, inflation, and volatility's impact on consumer confidence – they have to work with equal focus on both securing their backlog sales, which is hard, and moving a higher-than-normal spec pipeline to clear the market sufficiently to establish a new-normal mark to market.

One of our trusted senior level strategic building and development sources lays out the predicament – which will see clarity in the next 150 days – this way:

Cycle-times are still longer, so it will take longer to protect the backlog. Again, with this level of specs, how long can you do this? You can't allow standing inventory to pile up. Horton and Lennar won't. It's not in their nature, they know 'he who cuts first cuts less' and since Wall Street has already priced the builders for trouble, it won't hurt the stock price. If those guys move, everyone else will have to.

So if sales drift down, and we can absorb the specs without major discounts, it won't be a soft landing, but the plane will land and not catch on fire. If we hit an air pocket on sales, as seems to be happening in a few places, and it grows across the country, then very serious discounts will start, and we may need foam on the runway.

That's why builders are desperately calling every scattered lot BFR company to try and off-load units.

None of this will change the long run trend in this country of undersupply. But that does not protect you from short term oversupply due to buyers loss of confidence.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.