Land

Where The Future Of Home And The Future Of Work Meet Up

'This time is different' may be the most dangerous words in the investment business. However, residential real estate investors ignore them at their peril.

Location, location, location.

The same words as ever. What changes, from normal, to new normal, to the next new normal, and so forth, is what real estate's mantra means in the context of three critical force factors: what people value, timing, and money.

This matters now for The Builder's Daily audience because certain amounts of risk tend to mean greater investment rewards, but too much risk is often only recognized in hindsight.

Red flags fly when we see or hear the words, "this time is different." Still, we're of the belief that nothing new under the sun and uncharted waters can and do co-exist.

For instance, the lead of today's story was buried at the bottom of yesterday's.

The limbo of the future of work and the future of home may define who's long on land right now and who's not.

Let's unpack this this way.

Long on land tracks as one of the residential real estate and construction business' cardinal rules of engagement. The term applies to those who face or experienced ruination because of money misplaced or mistimed or miscalculated – errors of location, timing, or amount – to secure home sites, residential community development's table stakes.

Mismatches are real estate's devil in the details. They make for winners and losers in a game where for fleeting stretches it appears that everybody's a winner. Mismatches in residential real estate mostly occur in three dimensions: place, timing, and financial valuation. Remove the urgency to be correct in any of the three dimensions and anybody can be a winner 100% of the time. That's not how it works.

Now, back to the lead.

The limbo of the future of work and the future of home

Mismatches in invested capital in residential real estate – again – will come as some players misplace, mistime, and miscalculate the dollar value of property.

The economic, financial, and operational models aimed at predicting, and measuring returns to solve for those mismatches are – we must remember – constructs. Those constructs may be in play.

Consider:

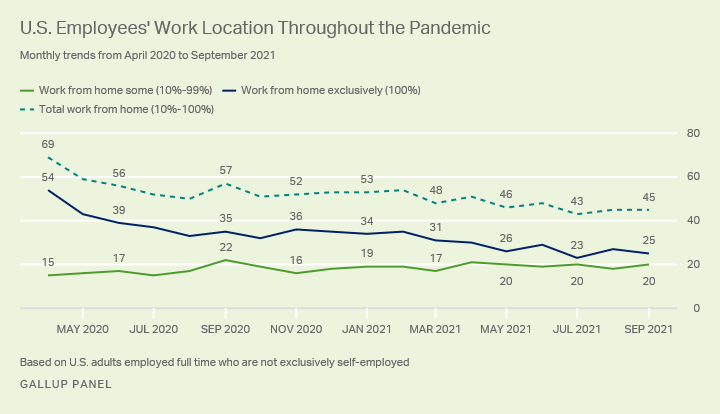

- Amazon to allow employees to work remotely indefinitely

- Still, companies "can't agree on remote working"

- In workers' minds, "Remote Work Persisting and Trending Permanent."

Here's what that looks like:

As regards the calculus of residential investment, development, and construction's most mercurial, if not most expensive raw, direct input cost – land – 2021 is a step-change threshold of occasion for mismatches.

As we noted yesterday, models for housing demand boil down to population growth, job and income growth, household formation growth, and family formation growth.

Since Covid, assumptions, trends, and predictions for all four of those leading indicators have checked up, sent mixed signals, and promised shifts ahead.

Essential assumptions like, "everybody needs shelter," and "everybody needs a job" are working through a pandemic era reframing. The Great Resignation is part of it. Writes Nobel Prize winning economist Paul Krugman:

It seems quite possible that the pandemic, by upending many Americans’ lives, also caused some of them to reconsider their life choices. Not everyone can afford to quit a hated job, but a significant number of workers seem ready to accept the risk of trying something different — retiring earlier despite the monetary cost, looking for a less unpleasant job in a different industry, and so on.

And while this new choosiness by workers who feel empowered is making consumers’ and business owners’ lives more difficult, let’s be clear: Overall, it’s a good thing. American workers are insisting on a better deal, and it’s in the nation’s interest that they get it.

If you happen not to like Krugman, here's another take, this one from Roger W. Ferguson, Jr., former president and CEO of TIAA, with one that speaks directly to the issue of financial bets on the path of residential growth's future.

While many employees are moving on to better opportunities or better wages, others are simply dropping out of the workforce entirely or retiring early. In fact, based on some projections, 2 million more workers than expected have retired in the pandemic. Some individuals are reluctant to return to work due to fears of exposure to COVID-19 or difficulty in finding affordable childcare.

The thing about the future of work and the future of home is that it's not what, nor where, nor how much, nor when, nor how the present and the past of work and home have defined themselves. We can't know the future of work or the future of home from wisdom, brilliance, nor experience passed along to us.

We need to learn it. That's why they're both called the future. And that's where we land on this assertion:

The limbo of the future of work and the future of home may define who's long on land right now and who's not.

Join the conversation

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.