Leadership

Where Do Homeownership Rates — and The Dream — Go Next?

As would-be owner-occupiers of homes meet greater challenges and deeper-pocketed competition in some of housing's more attainably-priced markets, it's worth looking at homeownership, by definition and its varied meanings.

Some stories – for a housing business community that has not quite yet been able to see itself as that – come in the form of a question.

The question ideally would not provoke a reflexive reply.

Rather, it might best awaken a curious openness to learning not how you or I would answer it, but how history might.

The story is of a question about homeownership and its helical relationship with the American Dream of merit-based upward mobility and standing. The reason to ask it, now – one may propose – is a growing mismatch between where people can and want to live and the current properties available in those places.

If we accept that livelihood and location – for a household – are tied, even in a post-pandemic less tethered future of work, then this mismatch's endgame comes sooner or later to a something's-got-to-give moment.

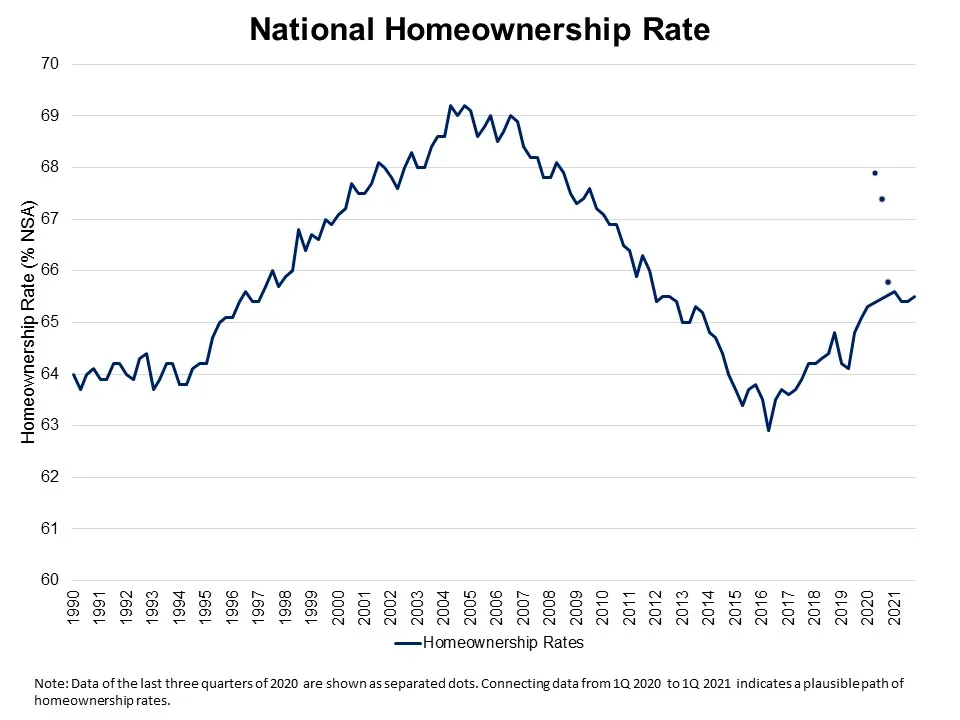

So, homeownership rates are flat. Let's ask the question – before we see them either remain flat, go up, or go down – where our interests lie.

Two caveats come with the latest Census Bureau data about our nation's homeownership trends.

One big grain of salt concerns the reliability of the data itself. Even on a good day – i.e. when there's no upheaval from a highly contagious, massively severe health pandemic that has undermined access to housing at a yet-undetermined level – this Census survey's validity is contested.

The other caveat, of course, centers on the face-value of the benchmark, which indicates that 65.5% of the nation's 127.4 million non-vacant housing units are owner-occupied.

Net, net, the key passage in the pandemic-impacted Census report notes:

The homeownership rate of 65.5 percent was not statistically different from the rate in the fourth quarter 2020 (65.8 percent) and not statistically different from the rate in the third quarter 2021 (65.4 percent)."

Most of the analysis of late focuses on the wobbly nature of the survey sample thanks to the pandemic upheaval, and its anticipated return to a normal level of unreliability as the health crisis disruption eases data collection.

Worth keeping an eye on, according to National Association of Home Builders senior economist Na Zhao, is the survey's snapshot of homeownership rates for America's varied age and generational cohorts, as a bellwether of demand – particularly as America's largest population group – a Millennials subset – turns 29 to 33 in 2022.

The homeownership rates for households under 35 was 38.3% in the fourth quarter of 2021, and 61.4% for households led by 35-44 years old, 70.0% for 45-54 age groups, 75.3% for 55-64 age groups and 79.4% for households ages 65 years and over."

A meaningful narrative – one whose context is the rocket fuel of global investment capital flooding into the U.S. housing market that the pandemic powered with even greater urgency – is brewing around the question of the future of the owner occupier.

Like so many other measures of our society's capability, homeownership is now a term that has a single, common-denominator definition, but an array of at least six entirely different meanings, depending on which lens you're looking through.

- The owner-occupier

- The builder-developer

- The municipal or community stakeholder

- The capital investor or lender

- The elected representative on Capitol Hill

- The macro economist

There may be no debate from any of these five discrete view points as to the definition of homeownership in legal and financial terms.

That's where agreement ends, however.

The term's meaning, for instance, at a macro economic level versus the lens one of those young-adult potential household formation units are likely night and day different from one another.

For that young-adult household, homeownership's value comes in a multitude of ways, from forced savings, to growing equity, to a sense of belonging, to a level of arrival, to a state of well-being – with many financial, logistical, practical layers of value in between. For those for whom homeownership can work, it is a superior plan for living, and one truly worth aspiring to and working to earn, not just in the past but for foreseeable time to come.

And the builder's perspective may give homeownership – because it's part of an essential value proposition the firm brings to its market – an entirely different meaning, because the downward tilt of the entire playing field in the direction of its products, and locations, and prices, and communities means homeownership translates into inventory turns, revenue, margins, and value creation to stakeholders.

COVID-19, the Federal Reserve's monetary stimulus strategy, an adult cohort overdue to launch, and homebuilders and developers' skill at making homes and communities people gravitate to converged to ignite the current avalanche in homeownership demand.

What today's rush into homes and property ownership, and the business of homes and property ownership, and the strategic capital investment in homes, and the politics of homes, and the economics and the fact that a materially disproportionate amount of this rush concentrates itself in quite a finite subset of housing markets ... what that rush has done is to reveal some things about this bedrock of homeownership that suggest we look at its purpose, where it can and should go from here, and its role as a measure of equity.

People at the household level felt the tug. They had the means. They saw the moment come, and they knew it couldn't last forever. What many of them did not expect was how everybody else – including big institutional investment players – moved with the same impulse.

Definitionally, homeownership may be the source of no misinterpretation. How the term is used and what it's intended to convey – on the trading floor, or in the lobbyists' Zoom gallery, or on Main Street, or in the developer's conference room, or at the Zoning Board of Appeals or City Planning Commission, or during a quarterly earnings stream with analysis – is worth a level set.

It's how homeownership and the American Dream interrelate. Do they equate? Do they interrelate? Can people achieve one without the other? And what is that more expansive market of equity creation and regeneration that can change – for all of us – the meaning of homeownership?

Join the conversation

MORE IN Leadership

United Homes Group’s Board Crisis In Compliance Countdown

United Homes Group is running out of time to rebuild a functioning board and avoid a Nasdaq compliance breach. CEO Jack Micenko says day-to-day operations continue, but governance uncertainty and market headwinds now threaten the company’s stability.

Smith Douglas Homes Doubles Down On Pace And Growth

Smith Douglas Homes Corp. (SDHC) remains defiant amid a slowdown by prioritizing pace over price. The builder's rapid cycle time and focused expansion strategy could serve as a blueprint for competitors that serve the strained entry-level segment.

After An Involuntary Pause, Orders Matter Again For LGI

In a market where affordability is collapsing, LGI’s disciplined, spec-first model is proving its worth. A year after seizing ground from private builders, the company’s focus on land control, cost precision, and first-time buyers is paying off.