What's A Homebuilding Leader To Do About A 'Deferral Mindset' Market?

Limbo is no fun.

But it's part of what homebuilding's business leadership signed up for, ever-testing their and their teams' ability to adapt.

A slew of fresh data and insights reveal a market marked by a blend of cautious optimism and enduring challenges.

As leaders in the homebuilding and residential development sector, it's crucial that we grasp the intricacies of the current builder sentiment. This understanding will enable us to devise actionable strategies in sync with the broader economic context. The challenge leaders face amidst the growing 'deferral mindset' boils down to a classic business stress test: articulating a straightforward and adaptable vision.

Homebuilder Sentiment and Outlook Benchmarks

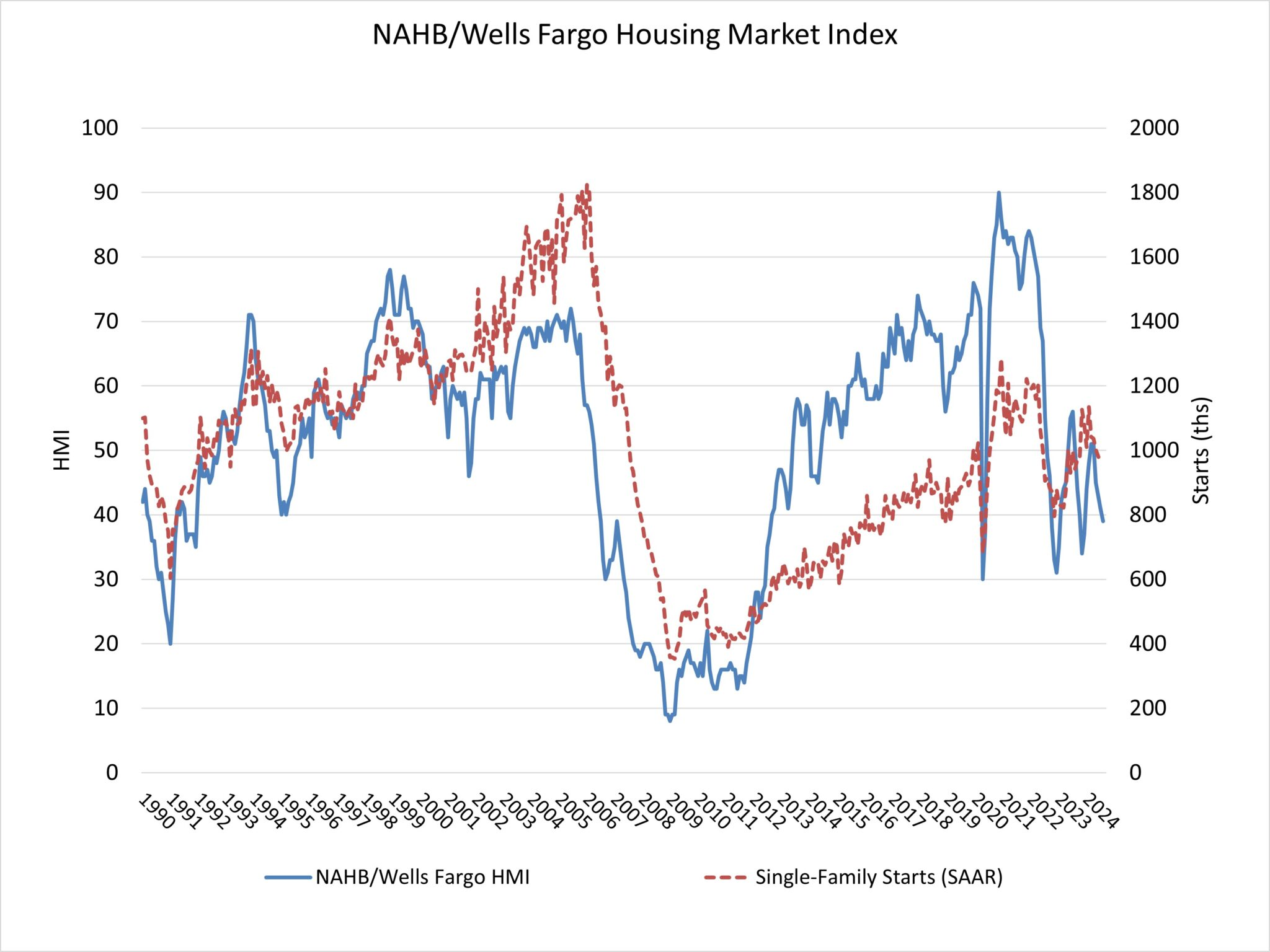

The August 2024 homebuilder sentiment surveys—from NAHB/Wells Fargo, BTIG/HomeSphere, Wolfe Research, and the Fannie Mae Home Purchase Sentiment Index (HPSI) — collectively point to a market under pressure, yet not devoid of opportunities.

Builder confidence continues to wane, with the NAHB/Wells Fargo Housing Market Index (HMI) dropping to 39, its lowest level of the year. Similarly, the BTIG/HomeSphere survey reflects weaker sales and traffic across most regions. In contrast, the Wolfe Research survey shows a modest -3% month-over-month (MoM) decline in orders, slightly better than the historical average but still reflective of a market in retreat. Fannie Mae’s HPSI underscores the broader consumer sentiment, with only 17% of consumers believing it’s a good time to buy a home, further indicating the challenges facing both builders and buyers.

Understanding the Shifting Buyer Landscape

One of the primary reasons behind the slowdown in sales pace, as highlighted by the BTIG/HomeSphere survey, is the growing disparity between expectations and reality in buyer traffic and sales. In July, 38% of builders reported sales as worse than expected, a sharp increase from 23% in June, leading to a significant shift in sentiment. The gap between expected and actual traffic also widened, with only 26% of builders seeing traffic exceed expectations, compared to 34% reporting traffic below expectations. This divergence highlights a key challenge: the traditional drivers of homebuyer traffic and conversion—such as seasonal trends and minor rate fluctuations—are no longer as effective in the current high-rate environment.

Deferral Mindset in the Marketplace

The Fannie Mae HPSI adds another layer of complexity to the current market dynamics, reflecting a widespread "deferral mindset" among potential homebuyers. With 82% of consumers stating that it’s a bad time to buy a home and 31% expecting mortgage rates to increase further, there’s a palpable sense of hesitancy. This sentiment is driven by high home prices, elevated mortgage rates, and economic uncertainty, contributing to consumers’ reluctance to engage in the housing market. For builders, this deferral mindset means that the pool of active buyers is smaller, more cautious, and more selective.

Targeting Less Price-Sensitive Segments: As interest rates stabilize around 6.5% — down from last year’s peaks but still significantly higher than pre-pandemic levels — builders are increasingly focusing on segments less sensitive to these fluctuations. The 55-plus discretionary buyer, who often has the financial flexibility and motivation to purchase despite higher rates, is one such demographic. Additionally, households experiencing life events—such as a new child, divorce, or other significant changes—are likely to prioritize purchasing a home regardless of broader market conditions. Identifying and catering to these segments could mitigate the impact of reduced overall demand.

Strategic Pricing and Incentives Management

With sales slowing, builders are resorting to a range of tactics to stimulate demand, though with mixed success. According to the Wolfe Research survey, July saw a slight reduction in the use of incentives, dropping to 3.7% of orders from 4.2% in June. This retrenchment suggests that builders are cautiously optimistic that lower rates might boost demand without the need for aggressive discounting. However, 62% of survey respondents indicated they plan to maintain or increase incentives in the latter half of 2024, reflecting the uncertainty surrounding demand.

Meanwhile, the BTIG/HomeSphere survey noted that fewer builders raised base prices in July (20%) compared to earlier in the year, while 28% increased sales incentives — the highest level of 2024. This reflects a strategic shift: builders are increasingly relying on incentives rather than price cuts to drive sales to preserve margins. Yet, with 36% of builders reporting a year-over-year decline in sales, it’s clear that these measures are only partially effective in countering the broader market slowdown.

Balancing Volume with Margins: With 33% of builders cutting prices in August — the highest rate this year — and sales incentives at their highest since 2019, leaders must balance the need to drive volume with the imperative to protect margins. While price cuts and incentives are necessary tools in a market where affordability is a significant barrier, they should be deployed strategically to target specific buyer segments and regions with the most impact. The Wolfe Research survey’s indication that many builders are opting to maintain pace over price further emphasizes the need for a nuanced approach.

Builders’ Outlook: Waiting for Change

The outlook among builders remains cautious, with many pinning hopes on a market rebound driven by expected mortgage rate cuts in late 2024 or early 2025. According to Wolfe Research, 62% of builders reported that if demand improves in the fourth quarter of 2024, they would focus on maintaining sales pace rather than pushing for price increases. This suggests that many builders are preparing for a prolonged period of tight margins, with the primary goal being to keep sales moving and avoid inventory build-up.

However, the BTIG/HomeSphere survey reveals that ongoing challenges temper the optimism for a near-term recovery. Builders know that while a decrease in mortgage rates could help stimulate demand, the broader economic context —including fears of a potential recession and the persistent affordability issues highlighted in the Wall Street Journal and Fannie Mae’s HPSI — means that any recovery may be slow and uneven.

Many builders do not expect a significant improvement until 2025, when they anticipate that both economic conditions and consumer confidence might be more favorable.

Localized Strategies for Diverse Markets: The regional disparities highlighted in the BTIG/HomeSphere and NAHB surveys suggest that a one-size-fits-all approach will not suffice. For instance, while Florida shows significant softness, regions like South Carolina and Indiana exhibit relative strength. Leaders should focus on tailoring strategies to regional conditions, leveraging local market knowledge and relationships to navigate challenges and capitalize on opportunities where they exist.

Preparing for Economic Uncertainty

The broader economic context, as detailed in reports from Bloomberg, the Wall Street Journal, and Fannie Mae, underscores the fragility of the housing market recovery. While there is cautious optimism that lower mortgage rates could stimulate demand, fears of a potential recession loom large. Builders like those surveyed by Wolfe Research are preparing for various scenarios, with 38% expecting competitor incentives to increase as they navigate the latter half of the year. Leaders must prepare for a range of outcomes, from a gradual market recovery driven by easing rates to a more prolonged downturn if recession fears materialize.

Clear communication with investors, team members, and business partner stakeholders is a no-brainer for homebuilding business leaders navigating this uncertain, unforgiving environment. They should articulate a well-defined strategy that acknowledges current challenges while highlighting the adaptive, proactive steps to navigate them. This includes transparent discussions about the potential for margin compression due to pricing pressures and the steps being taken to mitigate these impacts.