Policy

What Does Elon Musk Have To Do With The Price Of Land In Richmond?

As America's bad-boy, genius, business mogul, innovator makes headlines, other matters -- like land -- are worth exploring too.

The game-show Jeopardy correct answer to nearly every major business challenge question out there – including the global supply chain disruption – seems to be this.

Who is Elon Musk?

Equal parts namesake Nikola Tesla, P.T. Barnum, James Dean, Howard Hughes, the Pied Piper, and Forrest Gump, Elon Musk appears to work a day job that includes space, time, the grid, motion, power in several of its forms, energy, light, and at least two of the planets he believes humans can inhabit.

And this has what to do with the rest of us mortals who make investing in, designing, engineering, building, and marketing homes and communities our livelihoods?

Well, bear with us momentarily, and we'll get there.

Musk makes news at every utterance, and society, business, and culture seemingly set themselves up as a behavioral reward system for his steps, missteps, and walk-backs. In this larger-than-life genius, us would-be geniuses get to vicariously choose money-is-no-object, you-only-live-once choices in Elon Musk style, just to see if they play. If they don't, no worries.

Yesterday, a 180-degree turn on Tesla's buying and accepting Bitcoin fit the pattern of a naif boldly opting for a "save humankind through technology," only to discover – later – a darker unintended consequence.

Bloomberg Green correspondent Lionel Laurent has caught on to a Muskian world of feint and dodge vision, strategy, and mission mixed with an aim to make money. Laurent writes here:

While it’s an encouraging development to see Musk’s latest tweet acknowledging Bitcoin’s inconvenient truth, namely that energy-inefficient mining algorithms by some measures consume more power than entire countries, the speed of his overnight conversion is a little discombobulating. Not least for the crypto fans hanging on Musk’s every word, who were stung by the $365 billion or so wiped off the market’s value following Musk’s decision to halt support for Bitcoin payments.

Now, why this matters to the residential construction and real estate firmament – and why the substance of this matter has urgency – comes through a look across the content aisle to work from Brookings Institution Metropolitan Policy Program fellows Adie Tomer, Joseph W. Kane, Jenny Schuetz, and Caroline George.

This is, mind you, stuff for which the Jeopardy answer is not "Who is Elon Musk?" but is definitely focused squarely on where investors in real estate and the fate of humankind intersect.

Their assertion – sharing at least some common ground with the reasoning behind Elon Musk's vaunted walk-back on Bitcoin – is a simple, powerful, elegant one that real estate investment is struggling with, whether or not its players care to admit it:

We can’t beat the climate crisis without rethinking land use.

The framework the Brookings Institute fellows layout here is of a no-going-back choice whose business, investment, and cultural sweep leaves nothing open to question nor confusion.

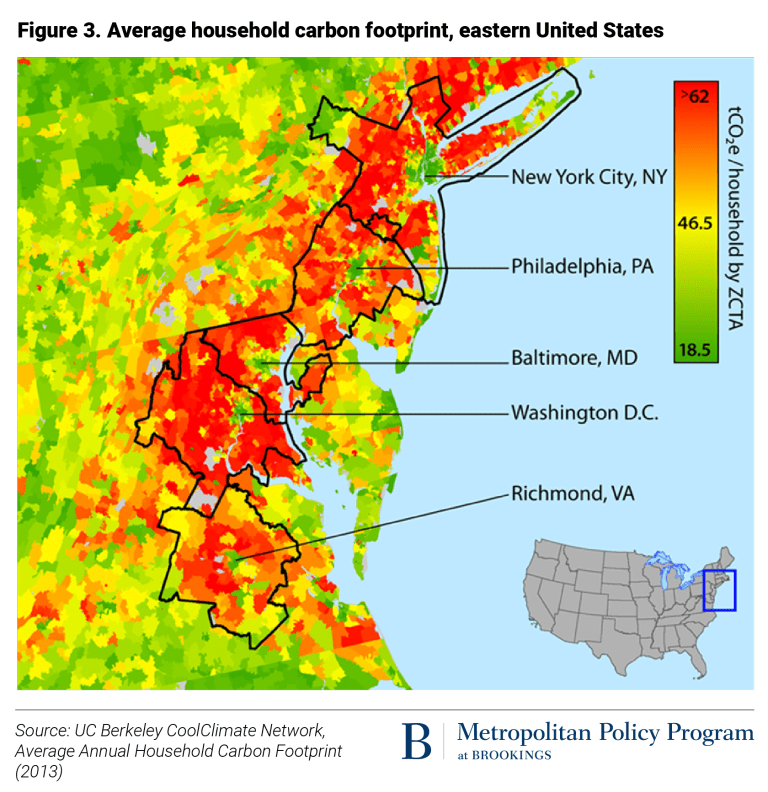

Simply put, the United States cannot reach its GHG reduction targets if our urban areas continue to grow as they have in the past. After decades of sprawl, the U.S. has the dubious honor of being a world leader in both building-related energy consumption and vehicle miles traveled per capita. Making matters worse, lower-density development also pollutes our water and requires higher relative emissions during the initial construction.

That leaves the country with no choice: We must prioritize development in the kinds of neighborhoods that permanently reduce total driving and consume less energy. Such human-centered neighborhoods have the added benefit of helping us adapt to climate impacts, improve public health, and promote access to activities. Encouraging their development should be a central part of any national climate resilience strategy.

This won’t be an easy task. Fundamentally changing where and what we build requires new ways of planning and investing in our communities. Since the federal government doesn’t directly control local land use, changing where we live and how we get around will require buy-in from states and local governments that manage zoning and other regulations, real estate developers who lead construction, and the finance industry that underwrites it all. With little time to waste, the U.S. must begin testing and scaling policy levers than enable a more resilient approach to regional development.

Three paragraphs above here frame a residential investment future beyond that which even Elon Musk has thoroughly and rigorously imagined. Transportation, the energy complex, community, and even the idea of home – identity, safety and security, well-being and prospering – all hang in the balance of forces of dynamism and urgency none of us quite grasp as we look toward and work on what's ahead.

Humbling.

And at a moment when all business memes seem to point to Elon Musk, we're reminded of another point of reference.

What makes a muskrat guard his musk?

Courage.