Capital

What D.R. Horton's Bang-Up Q3 Results Mean For Other Builders

A minimum of eight times in this morning's earnings call with Wall Street investment research analysts D.R. Horton c-suite executives used the word "market share," ... as in coming for more of yours.

You could read into D.R. Horton's consensus- and guidance-beating 3rd quarter financial and operational results – and its outlook for "quarter by quarter by quarter" growth in the months ahead as a harbinger, a signal of a rising tide that will lift all ships.

But you would be mistaken to do so.

Team Horton's bang-up quarter and its raised guidance bode well, all right, but not so much for any homebuilding operator not named D.R. Horton, with an exception or two or three.

A minimum of eight times in this morning's earnings call with Wall Street investment research analysts D.R. Horton c-suite executives used the word "market share," as in more of it.

D.R. Horton president and CEO David Auld used the term multiple times as a bedrock strategic imperative and organizational catalyst, as a transcript of the call with analysts attest:

We are focused on consolidating market share by supplying more homes to meet homebuyer demand, while maximizing the returns and capital efficiency each of -- in each of our communities. With improvements in both labor capacity and availability of materials, our cycle times are decreasing, positioning us to release homes for sale earlier in the construction cycle. We are pleased that we were able to increase our homebuilding starts to 22,900 homes this quarter, which was supported by a 6% sequential increase in our active selling communities."

Our results and position reflect our experienced teams, industry-leading market share, broad geographic footprint and diverse product offerings. All of these are key components of our operating platform to sustain our ability to produce consistent returns, growth and cash flow, while continuing to aggregate market share."

With labor and material consolidation, our ability to program out our starts and then continue to build the houses and gain efficiency in that process, it's just an ongoing effort. So, do we have a target out there of we've got to get to this number? No. Our target is market by market, flag by flag, how do we consolidate these markets and increase our market share. And just by the nature of doing that, we're going to get bigger and bigger and bigger."

Aggregating market share involves aggregating trade base and materials within those communities. And we've been talking about a consistent start pace when we've been talking about simplifying the process and making it easier for our trades to get to and from the job with the right materials, with a complete understanding of what they're doing. That is allowing us to aggregate these trades."

Another term Auld used? Consolidate, as in power, clout, control of a manifest destiny to live true to and realize a tagline its team members regard as a mission: "America's Builder."

In CEO Auld's own words:

We believe that as we continue this process, we will consolidate the labor availability capacity. And with labor and material consolidation, our ability to program out our starts and then continue to build the houses and gain efficiency in that process, it's just an ongoing effort."

Our target is market by market, flag by flag, how do we consolidate these markets and increase our market share. And just by the nature of doing that, we're going to get bigger and bigger and bigger."

And Auld's final punchline:

We've been focused for years now on simplifying this business and creating a level of consistency that didn't exist in the '80s, '90s, or early 2000s. And jokingly I call it building a real business, and I believe we have and are doing that. And coming out of the downturn, there was tremendous opportunity to consolidate market. But we didn't have the liquidity or balance sheet to do it.

So, as we have grown through this last 15 years, our goal has been to create a company with a balance sheet and the liquidity to take advantage of any disruptions in the market. And since 2019, it just seems like, at least quarterly, you either coming out of it or going into it another disruption. So, it's the power of the platform and we talk a lot about it. I think you're seeing it play out. It's people, it's location, product, it's just trying to simplify the business and create affordability to a level nobody else can achieve. And that's going to consolidate these markets."

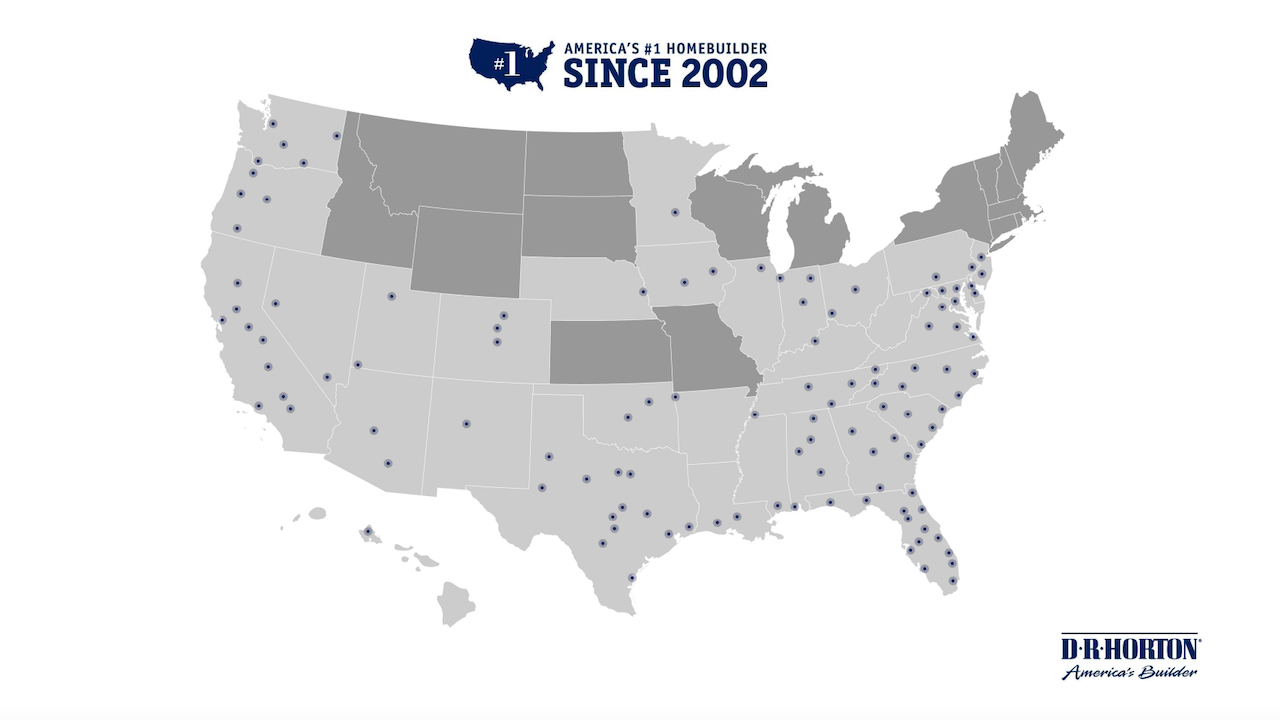

This take-away here for builders who are not so endowed with capital right now is this. Quarter by quarter by quarter, as David Auld says, D.R. Horton is bound and determined to hit or eclipse its growth targets, and right now that means they're "coming for you," if you happen to compete in any one of these geographical areas:

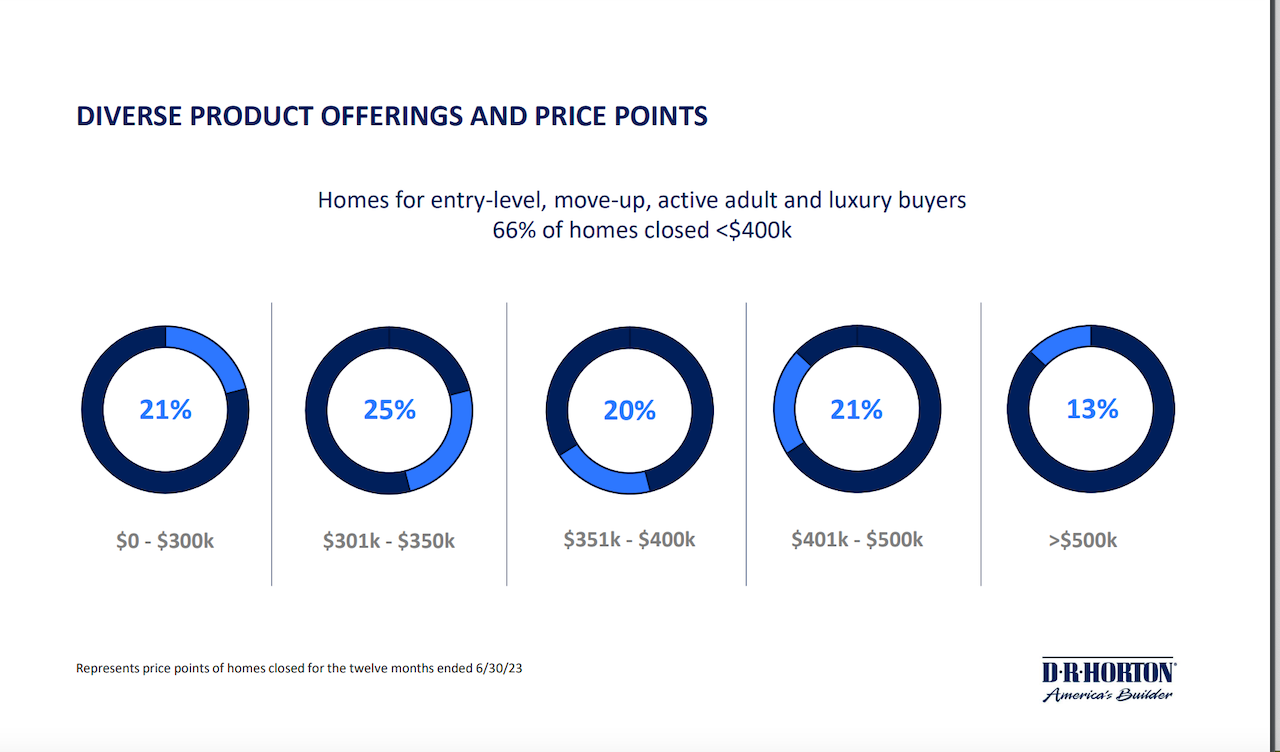

Never mind that bank financing is getting tricky. Never mind that affordability – with higher-for-longer interest rates and high asking prices – may be challenges for private builders. Here's a homebuilder, 66% of whose new homes price in at under $400,000.

That's how to take market share in today's market; and it's coming out of others' hides.

Add D.R. Horton to the list of either big challenges right now, or alternatively, as an opportunity. As CEO David Auld says:

It is really hard to put a lot on the ground. It is really hard to build houses. And these private guys, now, they've got to struggle with capital from either private or banks increasing in cost. So, do we have the opportunity to talk to a lot of these guys? Yes, we do. But it's going to take unique opportunities for us to invite them into the family, because we do have a special culture here and we're not going to screw it up trying to force a square peg in a round hole."

Now here's the other key dimension, compliments of D.R. Horton executive VP and CFO Bill Wheat:

During the first nine months of the year, our cash provided by homebuilding operations was $2.1 billion and our consolidated cash provided by operations was $2.3 billion.

At June 30, we had $4.6 billion of homebuilding liquidity, consisting of $2.6 billion of unrestricted homebuilding cash and $2 billion of available capacity on our homebuilding revolving credit facility."

The tide may indeed be rising, but not for all ships. So, heading into Fall 2023, where seasonal downward drifts in demand and questions of the ongoing impacts of higher rates and tighter mortgage availability on 2024 sales, a private homebuilding operator may want to consider getting in on some of that cash while the getting's better than it will eventually be.

MORE IN Capital

United Homes Group’s Board Crisis In Compliance Countdown

United Homes Group is running out of time to rebuild a functioning board and avoid a Nasdaq compliance breach. CEO Jack Micenko says day-to-day operations continue, but governance uncertainty and market headwinds now threaten the company’s stability.

As Builders Face Bank Fatigue, New Financing Paths Emerge

Lending conditions have tightened for 14 straight quarters. A new era of private construction finance is taking shape — faster, leaner, more relationship-driven.

Hunt Companies Buys View Homes Amid M&A Wave

The early-October deal signals a growing M&A presence of patient capital platforms -- some of them global asset managers --backing operators as capital pressure mounts on private builders in a long-term bright-future backdrop for U.S. residential development.