Marketing & Sales

Watch The Gap Risk Between Forecast And Actual Demand

Headroom — for both price increases, as well interest rates and household inflation shocks — still buffers homebuilders from consequential hits to demand. However, here's where leaders can focus if they have less headroom than they'd like to think.

At issue now is a risk of a gap between what residential real estate construction stakeholders are interpreting in consumer behavior, and actual, structural, sustainable behavior.

Limbo and its duration require leaders in the business community to make choices that will keep their organizations resilient, whether or not such a gap exists and how wide or deep or narrow it may be.

Times of limbo – like now, when so many moving external parts are moving so erratically – are times for leaders to double-down on presence, people, customer-facing purpose.

To take and keep a pulse on that delta between sales and revenue forecasts and what actually is out there – a seldom static value, tending either to narrow by some ratio across time, or to widen at a specific rate – sentiment and confidence surveys and polls and other forms of consumer demand tracking research abounds.

In the best of times, this research is prone to lags and false flags that send forward-looking signals that ultimately conflict with actual behavioral trends.

Gallup surveyed 3,035 adults, a sample age 18 and older in all 50 U.S. states and D.C., over a five-day period this past mid-January. The purpose of this poll was to ask the classic "what keeps you up at night" question, to try to get at a proxy reading on America's well-being.

DemoMemo steward and demography guru Cheryl Russell recaps top line findings of the survey this way:

One-third of American adults (32 percent) reported 'very good/excellent' sleep last night, another third (35 percent) reported 'good' sleep, and the final third (33 percent) say their sleep was only 'fair/poor.'"

Behind the headline data points, however, Russell notes a statistical wrinkle – which may not be a surprise, given the circumstances and timing of the survey, still in the firm grasp of the pandemic, plus uncertainties around the economy, and – then – rising awareness of inflation's toll on household budget items. She writes:

The 54 percent majority of adults reported some kind of trouble sleeping last night, according to the survey. The largest share (28 percent) had trouble staying asleep. Another 15 percent had trouble falling asleep, and an unlucky 11 percent had trouble both falling and staying asleep.

Casper-Gallup analysts took some far-reaching inferences from the data, especially as the findings suggest a strong reciprocal – two-way – relationship between well-being and sleep, and sleep and well-being. Maybe short of causation, Gallup analysts point to at least very strong correlation between positive mental, physical, emotional, and financial well-being and sleeping well. And the opposite as well.

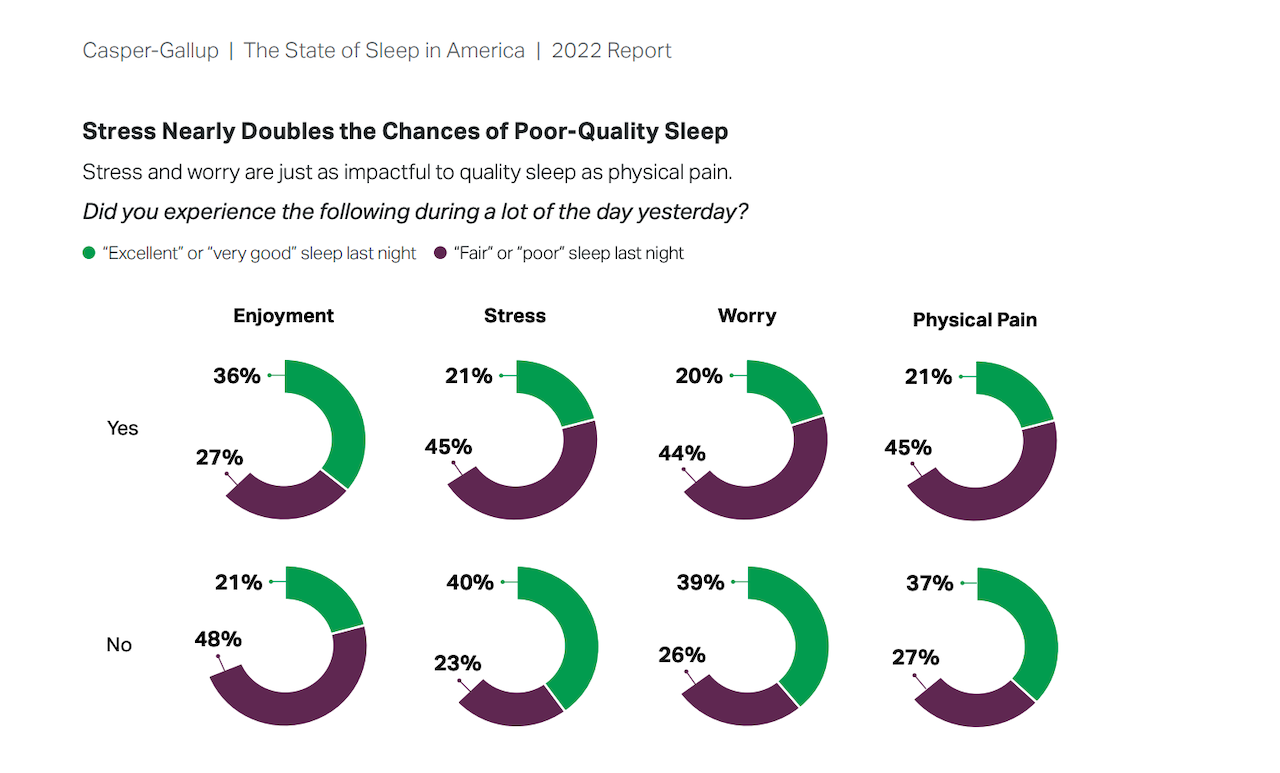

Here's one chart from the Casper-Gallup data gather that illustrates that bi-directional relationship between people feeling pretty good about things and reporting good sleeping experiences, whereas those who don't don't.

The math in these charts is clear. Positive feelings go with better sleep; negative experiences sync with worse sleep.

The survey's series of secondary breakouts – by demographics, financial means, age, gender, and race, etc. – further enlighten differences and distinctions among those saying they slept well last night and those who didn't, that particular week in mid-January, on the eve of the Beijing Olympics and about six weeks before Russia's invasion of Ukraine.

Of course, it would be enlightening to see the same 3,035 adults' responses to the same questions over a five-day period this past week or so, one month after the Feb 24th invasion that has so upended well-being in most of Europe and sent a powerful new series of fissures of strain and shock into worldwide supply chains of resources, products, and productivity.

The duration of limbo – this stretch of volatility, uncertainty, and sweeping surges or risk and reward – is not known, but can not be expected to be brief.

So, presence, people, and customer-facing purpose stand out as pillars where business leaders retain agency despite the hard grip of externalities to contend with no say in how they pan out or impact business.

We'll take another liberty with a focus Seth Godin offers in his constant flow of applied brilliance. His view is that customer-facing purpose is not only your best real-time barometer of forward-looking consumer demand, but a morale and team-building – people – booster at a moment your associates most need your leadership presence to pronounce itself. It's about a "hospitality mindset" in your business and operational culture, and there's a practical, method to get to it:

Is cheaper better?

Is profit the only thing to be maximized?

For its first decade, Federal Express embraced customer service as a marketing tool. They were competing with the postal service, but more than that, they were trying hard to create a habit that turned 25 cent deliveries into $20 deliveries, particularly among businesses.

They answered the phone on the first ring.

They hired people who cared about the customer experience and gave them tools to keep their promises.

They sacrificed short-term profits in order to build a brand promise that people could trust.

Some organizations end up ingraining this ethos deeply into what they do, and stick with it for the long haul. They have a hospitality mindset. Service isn’t simply the tool to make profits–it’s a key part of why you’re here in the first place.

Godin concludes:

It’s possible to build an organization that does work you’re proud of, surrounded by people who feel the same way. People who care, solving problems and creating connection.

While you're in limbo – whatever the duration – of not knowing whether there's a gap between your read on customer demand and what's actually out there, this is a way to assure you'll be around and thriving when we come out of that in-between period.

Join the conversation

MORE IN Marketing & Sales

How Homebuilders Can Fix Broken Buyer Conversion Now

New Home Star’s Chris Laskowski breaks down what’s stalling new home conversions in today’s market—and what to do about it. From weak webpages to ignored AI search, he lays out a builder’s to-do list for turning traffic into buyers.

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.