Architecture

Value Engineering Is Only Partly About Design And Price ... It's A Strategy

Tactics and tailwinds – necessary and successful as they've been in stemming what could have been a rout from the start of 2023 – amount to this: They've bought builders time.

Only with the benefit of hindsight will clarity sharpen enough to explain precisely who, how, and why the first-half 2023 new home sales market cleared its low bar of expectations by a mile.

Certainly, matters homebuilders can control and some they can not played a strong helping hand in a timeframe executive strategists and owners will be glad to record for the books.

- Effective backlog scrubbing and management to neutralize the impact of order cancelations and get cancel rates back towards normal.

- Effective, real-time, community-level pricing, incentives, and mortgage rate buydown tools worked both to secure backlog settlements, and price-in new orders at higher-than-seasonally typical absorption rates.

- Scarcity of existing home options, in part due to current owners' anchored to historically low mortgage interest rates they'd secured on the purchase or refi loan they're currently paying.

- The stealth-effect "non-contingency" buyer – first-time homebuyers, rental refugees, and such – homebuilders have been able to "meet halfway," to price them in on a monthly payments-math basis.

With more hindsight, too, we'll understand which ones moving forward over the last four to five months fall into a "pent-up" demand pool of those buyers who'd waited for prices and lending rates to come down off their peaks, and which might rather fit a "pulled-forward" group, motivated to move now before conditions get worse.

If you back out both the pent-up demand and the pulled-forward demand, where does that leave normal, household-formations driven, stable-employment driven demand in the near-, mid-term, and 24-to-36 month future?

Where you'd expect: Facing an affordability cliff.

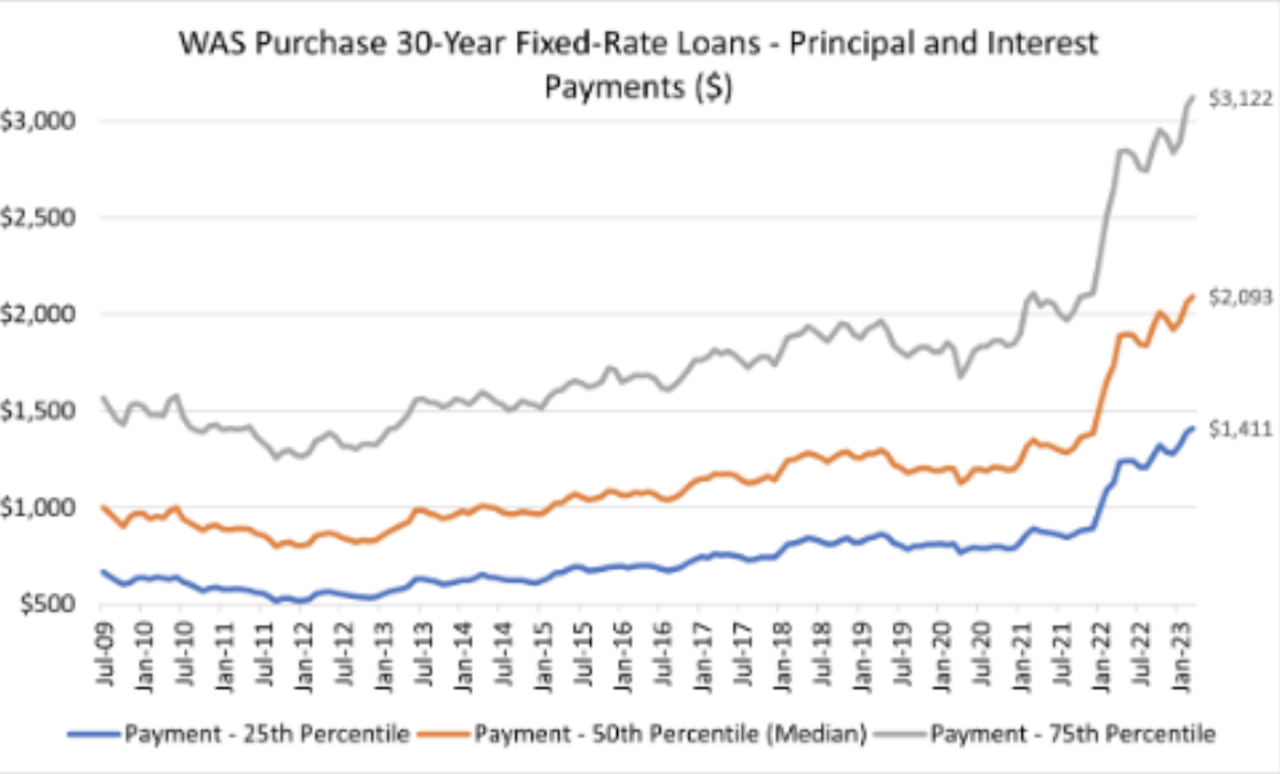

A note from the Mortgage Bankers Association last week helps quantify the fragile, conditional, and very likely temporary nature of the demand stream currently pumping through the Spring Selling system.

Homebuyer affordability declined in March, with the national median payment applied for by purchase applicants increasing 1.6 percent to $2,093 from $2,061 in February... The national median mortgage payment was $2,093 in March, up from $2,061 in February and from $1,964 in January. It is up $357 from one year ago, equal to a 20.6% increase."

Tactics and tailwinds – necessary and successful as they've been in stemming what could have been a rout from the start of 2023 – amount to this: They've bought builders time. Beyond pent-up and pull-forward financial incentive catalysts, a progressively less patient matter of recoupling household wherewithal to new homeownership attainability keeps coming back to time-tested solutions for the same syndrome in other eras:

- Smaller square footages

- Attached vs. detached options

- Greater density

An April 2023 "Insights from the Drawing Boards" report on the Future of Production Home Design, from John Burns Real Estate Consulting's New Home Trends Institute contextualizes the standing challenge like this:

The report opens invaluable insight into the forward investment homebuilders and their design and architecture partners have committed to as essential to their efforts to value engineer product offerings that will narrow the obstinate affordability gap that poses the biggest risk to their businesses beyond the present-day gust of good numbers on the demand front.

One of every five architects and designers the company surveyed says that value engineering was a core challenge of 100% of their projects, while seven in 10 new floorplan and elevation projects were fast-tracked into redesigns that would reduce construction and materials inputs by at least 7% to 10%.

What comes through loud and clear in this year's April analysis is a "devil-in-the-details" array of insights that bore into where square footage trade-offs add meaningful value as they subtract net square-footages and reduce input costs. "Size reductions will not be uniform across all areas of the home," the report notes, adding that while primary bedrooms, master baths, and main-level hubs like kitchens, great-rooms, and garages will get bigger – they'll "cannibalize" space from rooms residents place less value in.

Value engineering new floorplans and elevations, of course, are only a dimension of a multi-pronged operational blitz the best organizations put into place to ready themselves for a plot-line mix-shift pivot toward more affordable offerings that can accelerate pace and drive market share and net margin opportunity.

The sync up of value engineering to these separate-but-related disciplines – not something most enterprises can effect with a flip of a switch, but rather a cutover that comes with months of planning, investment, and practice – has to hit on all cylinders to work:

- vacant developed lot and raw lots that bring down the land basis cost, with as little entitlement risk and time-delay in permitting and development

- policy, land, architecture, and local relationships teams that can cut through approval impediments and fast-track bringing more affordably-priced neighborhoods online.

- construction cycle processes and trade crew resources that can achieve high velocity rates in start-to-completion build-cycles for new value engineered floor-plans, elevations, material and product SKUs, etc.

- Marketing and selling systems and talent that keep an evenflow pull of pace and push of new starts on a disciplined cadence to optimize cost-of-sales resources and sustain momentum from community opening to sell-out.

It's exciting to recognize that many cycle-tested organizations are at it, using the time an above-expectations level of demand they've been able to buy to bear down and do that thing homebuilders – some of them anyway – prove they can do when the affordability cliff becomes so menacing. They leverage agile variable-cost filled balance sheets to roll back their own hard expenses as far as their business can tolerate and create an entirely new plot-line homebuyers find it tough to resist.

- Price

- Product

- Property location

When the moment calls for it, best of breed players will break out of hiberation with fully formed and operationalized strategies that both cut their input costs and strike buyers as the best home offering money can buy for a household of their price sensitive wherewithal.

In 12 months or less, we'll be recognizing and saluting those who set the new pace.

MORE IN Architecture

AI Crushes Missing-Middle Time And Cost Curves Toward Affordability

Developing multifamily rental and for-sale properties takes time — sometimes years -- depending on a labyrinth of zoning rules and the whims of local jurisdictions.

Beyond Blueprints: AI Alters Home Design, Development Calculus

In an exclusive one-on-one, Higharc co-founder and Special Projects leader Michael Bergin reveals how AI is eliminating homebuilding bottlenecks, cutting soft-cycle time, and transforming home design from an unpredictable process into a precise, real-time system.

Building Back L.A.: Fast-Track Permits That Build In Resiliency

Demand to build homes with materials that can withstand the increasingly frequent and intense wildfires is growing. However, whether the permitting process can keep pace with the demand has become an increasingly-contested, and urgent issue.