Leadership

Value-Adds For New Home Tech: Loss Reduction, Lower Premium, Peace Of Mind

New homes tend now to include as a non-negotiable standard a smart-home suite of services. Fact is, as they evolve, those smart home devices have emerged as more than “nice-to-have” convenience solutions.

High prices, they say, cure high prices. Whether that maxim proves plausible in an American housing market so short on available for-sale and rental supply continues to be a point for hot debate. Yet, given where home purchase and rental prices rose to in 2021 and early ‘22, what’s clear is that a whole lot of curing needs to go on.

What’s more, nobody expects that any cure could or would be pretty, quick, nor pain free.

For some Americans, however -- as the past few months prove -- there’s no better time than now to purchase a home. They may have family needs to do so. Or, for them, it’s the smart thing in light of their own personal financial position. They’re moving ahead, despite the reality that housing’s historically least-affordable moment in memory might seem to make a decision to go ahead at this time a tough pill to swallow. [The Atlanta Federal Reserve looks at affordability trends below].

How and why can that be?

Demand Drivers

That stream of demand is happening when – thanks to demographic and economic patterns -- a household’s human life-stage urgencies to move combine with a household’s ability to get across two big honking barriers – one mathematical, and one psychological. To hurdle the mathematical barrier, a buyer needs to be “priced in” to a homeownership opportunity based on their monthly take-home pay. For the mental barrier, buyers must be confident the decision will provide them long-term peace-of-mind even if home prices continue on a softer, volatile pathway.

For context, remember that if a household either needs to or wants to buy a home in 2023, options at some price ranges are practically out of the question on the resale side, and historically limited across nearly every price tier. This makes new homebuilders’ ready-to-own spec homes the “new” existing home market, especially among first-time and entry-level buyers.

Moreover, some people feel that early 2023 continues to be an opportune moment to buy new because new homebuilders and developers have raised the bar on the value buyers feel they’re now getting for their money. Along with that, those same homebuilders – to catalyze a pace of demand they can count on -- have lowered one barrier after another to bring a buyer’s monthly payment to a manageable level.

Many senior homebuilding executives we have been listening to say that asking prices have come down off their peak levels by 10% or more in many communities in many markets, upping the dollar value proposition for buyers who otherwise may have waited on the sidelines. Further, to “price-in” more buyers whose income levels may be in the margins of loan qualification criteria, builders now typically source their own mortgage finance arms or work with other lenders to buy down mortgage rates so that a principal and interest payment can fit within buyers’ monthly take-home income.

Reducing Friction

So, we’re back to talking about those two barriers that block either the wherewithal or willingness to commit to buying right now, and homebuilders’ all-points push to rid sources of friction – financial or psychological – from buyers on their path to homeownership, especially since mortgage rate pressure continues to push upwards.

It’s very important, especially for the majority of our customers having an impounded account, also known as the escrow account where it's part of what they'll call their mortgage payment,” says Gabriel Salazar, VP, Agency Support Services at Westwood Insurance Agency. “It's all rolled into one payment. The one way to reduce that – given most borrowers have a fixed-rate mortgage, is to recognize the insurance and the taxes will always go up. So, one way to review the finances is to take a look at your insurance policy [for opportunity to save].”

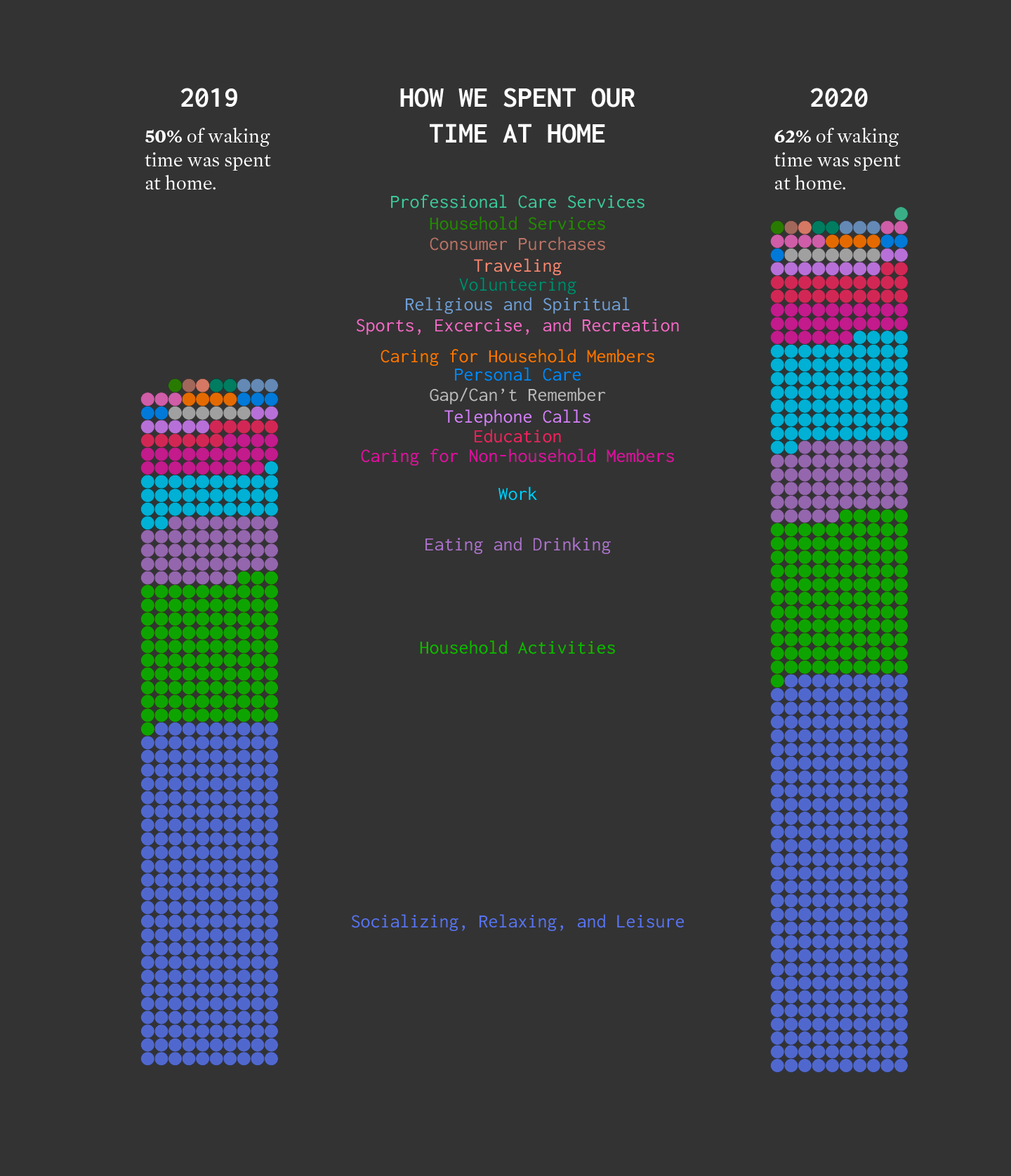

Partnerships with solutions providers like Westwood Insurance Agency serve a critical role to instill both confidence going forward and an opportunity to save a few important dollars of the monthly budget give homebuilders an edge as they work to remove friction from the buyer’s journey. Since that journey’s goal means – whether or not work-from-home winds up sticking as a pervasive future-of-work trend – more time at home for more people.

New homes, as a rule, tend now to include as a non-negotiable standard a smart-home suite of services. Fact is, as they evolve, those smart home devices have emerged as more than “nice-to-have” convenience solutions. More and more, home security, leak detection, energy management, fire loss protection, and indoor air quality management technologies figure into monthly budget calculations every bit as much as they mean adding to a baseline of peace-of-mind and well-being.

Double-Barreled Benefit

Here's where we begin to recognize the friction-removing impacts of technologies that can save a homeowner money on the monthly outlay side, and on the other hand assure residents of a greater sense of well-being and protection from loss when it comes to their most-expensive financial asset acquisition in their lives.

Insurance companies, per smart-home technology analytics and insight firm Parks Associates, are ramping up premium benefits to those who’ve got security, water-shut-off, energy shut-off, etc. devices, recognizing the levels of loss-control and damage-reduction that may one-day become commonplace:

An increasing number of smart home and residential security brands are partnering with insurance companies. Insurance providers want to offer their policyholders more comprehensive solutions while smart home brands need additional customers.” Parks Associates

Whether it’s home security, protection from water leak damage, fire loss protection, inside power shut-off in emergency, etc. smart home devices – in their early-learning curve of design, engineering, data capture, and functionality – may one-day play an important role in the monthly budget management process. For now, they can offer a valued benefit to a would-be homebuyer seeking a dependably sound source of confidence in his, her, or their largest investment.

The discounts were seeing so far are pretty small, but they're meaningful,” says Christi Burkhardt, CPCU, VP, National Sales and Growth, Westwood Insurance Agency. “And there are things insurance companies are really waiting to see, like the long-term data of how it affects claims. So, we recommend having those smart tech solutions, and of course, the best are the ones that do automatic shut-offs. Still, the motivation for doing it is really peace of mind and protecting your belongings. The insurance discount is just a bonus on the side.”

MORE IN Leadership

Eastwood Homes, Napolitano Unite In Culture-First M&A Deal

In a rare private-to-private M&A deal, Eastwood Homes acquires Virginia’s Napolitano Homes—uniting two family-founded builders in a move that blends culture, strategic market expansion, product synergy, and generational transition.

Fire-Ready Future Forward: KB Home Builds Hardened Homes At Scale

Escondido, CA-area’s Dixon Trail becomes the nation’s first IBHS-certified Wildfire Prepared Neighborhood—fusing resilience, affordability, and innovation into a new model for community design.

KB Home Guidance Cut Bodes Sharper Sector Challenges Ahead

In a reflection of broader market tensions, KB Home — following on an earlier lowered guidance from Lennar — drastically revises its 2025 outlook downward amid weakening consumer confidence and escalating costs.