Land

Undersupplied And Over-Built: How Could Both Be True At Once?

The paradoxical riddle – undersupply and overbuilding – has moving-target market-rate for-sale new-construction demand disruptors many market appraisers neglect as well.

One of market rate ground-up residential development and construction's riddles right now speaks to an atypical market "instability that increases risk levels."

Scott Cox, a Dream Team advisor of The Builder's Daily, who contributes here often, bullets out the sources of instability and the character of risk bedeviling asset portfolio management, new investments, and baseline resource allocation planning at least for the near- and mid-term future. Here's Scott's bullet points (a sneak snippet of a presentation he'll give this week in Toronto):

- Long-term undersupply plants the seeds of price volatility.

- Long processing times create temporary oversupplies within the overall undersupply.

- Volatile pricing and slow demand response function creates “bad math.”

- Erratic project delivery times complicate managing overhead efficiently.

The crux of the riddle is the line "temporary oversupplies within the overall undersupply."

Scott shines a lens on protracted investment-entitlement-planning-permitting-developing-construction-inspection-and-delivery processes that mess with predictably timed and priced delivery of completed homes. Add to those abnormally drawn out – and growing more so – value stream delays with materials supply chain snags, skilled labor chokepoints, climate-related disruptions, etc., and the "bad math" of supply calculations starts to come clear.

The paradoxical riddle – undersupply and overbuilding – has moving-target market-rate for-sale new-construction demand disruptors many market appraisers neglect as well.

(1) A sudden inflection among professional employees

A Wall Street Journal story today headlines "The Disappearing White Collar Job," noting that for the 12-months ended in March, the number of unemployed white collar workers had ballooned by 150,000.

The jobs lost in a monthslong cascade of white-collar layoffs triggered by overhiring and rising interest rates might never return, corporate executives and economists say. Companies are rethinking the value of many white-collar roles, in what some experts anticipate will be a permanent shift in labor demand that will disrupt the work life of millions of Americans whose jobs will be lost, diminished or revamped partly through the use of artificial intelligence.

“We may be at the peak of the need for knowledge workers,” said Atif Rafiq, a former chief digital officer at McDonald’s and Volvo. “We just need fewer people to do the same thing.” – Wall Street Journal

(2) A winnowed cohort will inherit huge "wealth transfer"

A New York Times deep-dive yesterday on generational wealth transfers past and present calls attention to a profound narrowing of the lion's share of the benefit of Baby Boom pass-along wealth to 10% of less of their children and grandchildren.

Born in midcentury as U.S. birthrates surged in tandem with an enormous leap in prosperity after the Depression and World War II, boomers are now beginning to die in larger numbers, along with Americans over 80.

Most will leave behind thousands of dollars, a home or not much at all. Others are leaving their heirs hundreds of thousands, or millions, or billions of dollars in various assets.

In 1989, total family wealth in the United States was about $38 trillion, adjusted for inflation. By 2022, that wealth had more than tripled, reaching $140 trillion. Of the $84 trillion projected to be passed down from older Americans to millennial and Gen X heirs through 2045, $16 trillion will be transferred within the next decade.

... The wealthiest 10 percent of households will be giving and receiving a majority of the riches. Within that range, the top 1 percent — which holds about as much wealth as the bottom 90 percent, and is predominantly white — will dictate the broadest share of the money flow. The more diverse bottom 50 percent of households will account for only 8 percent of the transfers." – New York Times

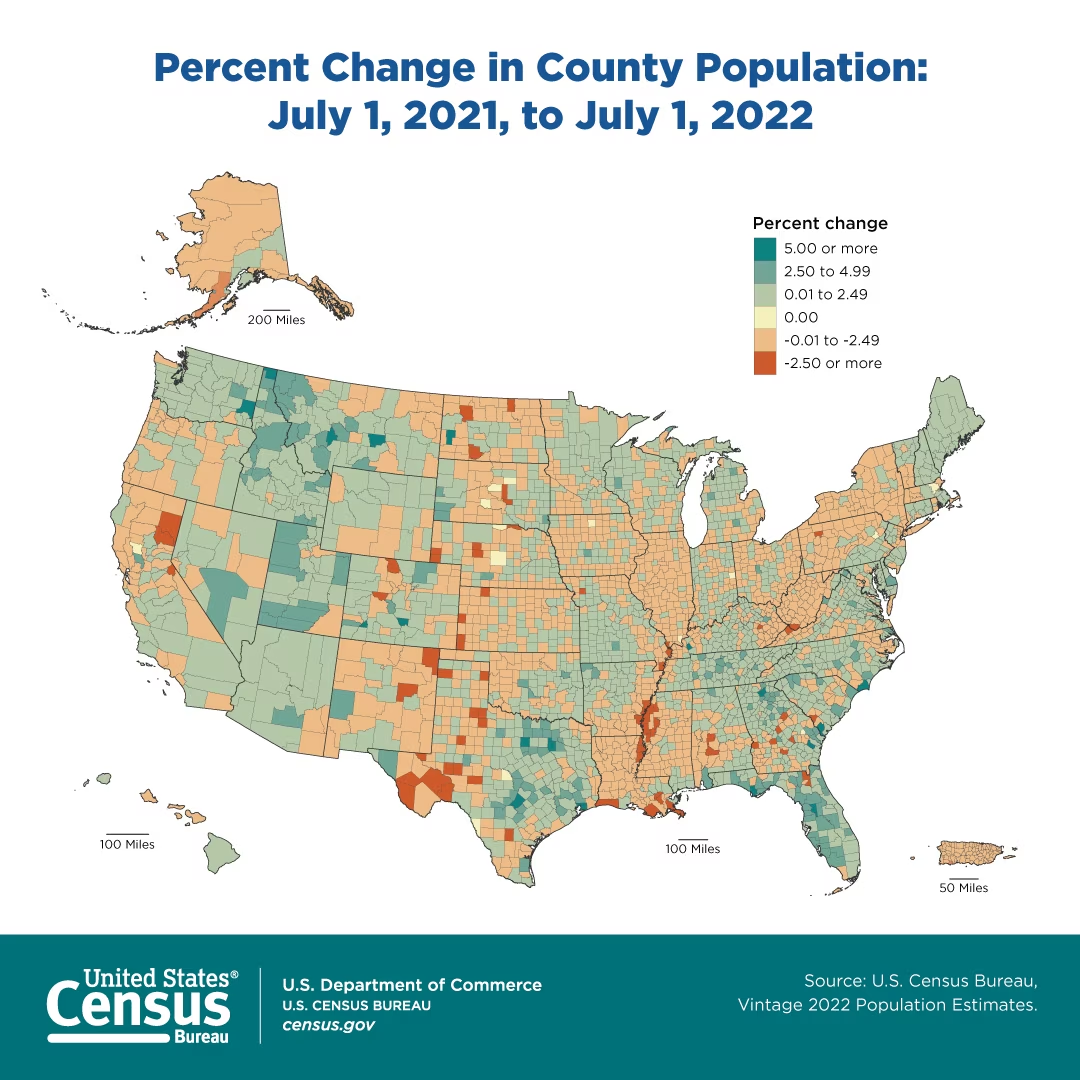

(3) Shrinking population in 47% of U.S. counties

Note, population declines almost always go hand-in-hand with weakening economic conditions.

SlowBoring, an analysis and commentary site hosted by Matthew Yglesias, looks at a range of implications specific to housing demand, of a nation of slow to negatively-growing places:

In a scenario of population decline, though, the market value of a house falls below the replacement value of the structures. You can see this by looking at statistics, but it’s pretty easy to eyeball where it’s taking place because the signature is a neighborhood with more vacant lots or vacant buildings than ongoing construction projects. Huge swathes of Detroit are, infamously, like this. But it’s also true of Cleveland and St. Louis and Milwaukee and Baltimore and other cities. Abandoned or vacant buildings are a source of blight — negative amenity value to the neighborhood." – SlowBoring.com

Just as housing supply capacity is susceptible to an array of "moving-target" forces that undermine business planning and investment in a broad, long-haul, chronic context of undersupply, demand – particularly among ground-up market-rate homebuyers and renters – can run through distortions and disruptions as well.

In such a tricky, volatile, and complex environment, recognizing and navigating the differences between housing need and housing demand are critical. The first is a function of population and headship rates. The second has present and future wherewithal built into it. The future of work, the future of wealth transfer, and the future of population growth in a place can all impact wherewithal.

Solving the riddle will mean being ready for the "bad math" tricky demand estimates can create, as well as its impact on supply modeling and deliveries.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.