Technology

Two Nemeses Stalk 2024 Budget Planning: Here's How To Slay Them

Operators' best weapon to offset the risk of the two nemeses is running a business that's as light and agile on borrowed capital as possible, and as efficient and competent at deploying that upfront capital in the right places at the right moment.

Two nemeses shadow the path of private homebuilding company principal owners and strategists as they dead-reckon into 2024 budget planning in the next few weeks.

- One is a very likely prospect of a long run of higher debt service costs, tighter reins on credit, strictly monitored and enforced loan covenants, and the intensified pressure of personal guaranties that go with all that.

- Another is upward pressure on the dollars involved in that financing, given that more, bigger, and hungrier organizations are fixating in more concentrated circles, domino-ing into higher land prices, higher carrying costs, and intensified pressure on margins.

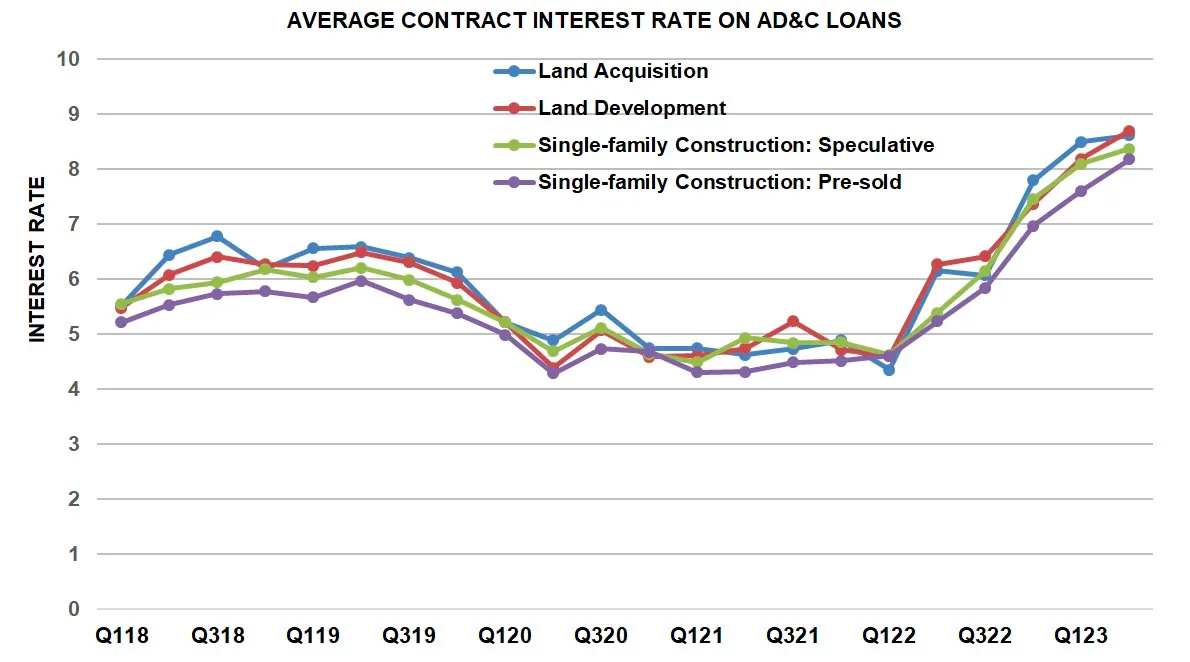

Evidence of the first nemesis comes through clearly in the latest second-quarter update on acquisition, development, and construction lending trends as part of the National Association of Home Builders Survey on AD&C Financing. Paul Emrath, NAHB VP for Survey and Housing Policy Research writes this week:

Quarter-over-quarter, the contract interest rate increased on all four categories of loans tracked in the AD&C Survey: from 8.50% to 8.62% on loans for land acquisition, from 8.19% to 8.70% on loans for land development, from 8.10% to 8.37% on loans for speculative single-family construction, and from 7.61% to 8.18% on loans for pre-sold single-family construction. In all four cases, the contract interest rate was higher in 2023 Q2 than it had been at any time since NAHB began collecting the data in 2018. The rates have been climbing steadily every quarter since the start of 2022 with one minor exception (for land acquisition loans in the third quarter of 2022). – Eye On Housing

Emrath further notes that measures of credit tightening – while slightly less negative than at their worst – continue to be "solidly in negative territory" for a sixth consecutive quarter. These measures signal that "both borrowers and lenders have been reporting tightening credit conditions," Emrath writes.

Here are the ways builders quantitatively express their pain-points about borrowing, impacting both their access to needed operating capital, and in the cost of financing.

Builders reporting tightening credit from Q1 2023 to Q2 2023 reported the most common ways in which lenders tightened credit were to increase the interest rate on the loans (cited by 85% of the survey respondents who reported tighter credit conditions), reduce the amount they were willing to lend (73%) and lower allowable Loan-to-Value or Loan-to-Cost ratio and requiring personal guarantees or collateral not related to the project (63% each)." NAHB

The second nemesis – to a great extent, a by-product of a doubly-better-than-expected first-half of 2023 – are land costs. A year ago this time, bets were that land prices would fall as business slowed, builders walked from land deals, and new production ground to an expected low-ebb place-holder level, awaiting a strike-price verdict from homebuyers.

Despite the high likelihood those bets would squeeze high costs out of the building lifecycle, they didn't pan out in real lift. Homebuyers took a brief pause, then demand kicked back in by the end of the year, exerting upward pressure on the entire food-chain of cost inputs. Replenishing land pipelines has not been a front-burner issue for most builders this year, as most had sufficient lots and communities out in front of them to keep feeding the machines of both spec and build-to-order new absorptions.

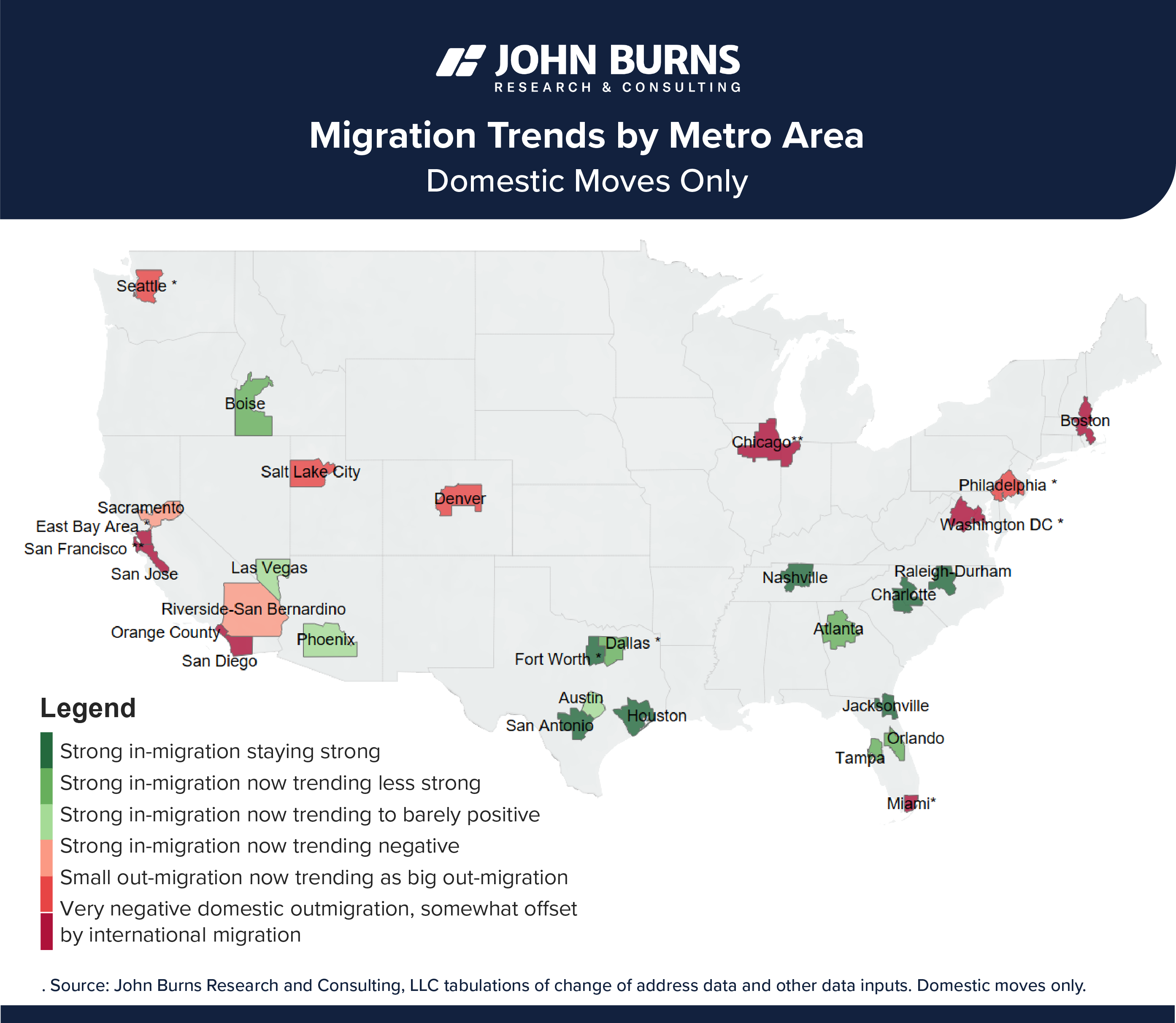

Now, a hazard of faster absorption paces and communities that sell out is that it's forcing builders into a land acquisition mode with higher motivation and greater urgency than they've been accustomed to, or are comfortable with. Furthermore, not only are national and regional credit conditions tougher, there's a new wrinkle of risk in the land buying and development landscape: a spotty, lumpy quilt work of virtuous cycles and vicious circles playing out in the form of domestic in- and out-migration and local economic dynamism.

In other words, where markets are hot – luring movers in pursuit of attainable home pricing, higher quality of life, and infrastructure that's supportive of hybridized work-of-the-future balances – they're likely to remain hot. That means a feedback loop of strong land pricing, a greater concentration of motivated bidders for the same parcels, and, therefore steeper pricing.

And, of course, it's the inverse for markets that are undergoing more out- than in-migration.

The team at John Burns Real Estate Consulting looks at how these trends are tracking in the late-pandemic, early-post-pandemic timeframe, as remote work patterns have begun to solidify and family formation and late-career household preferences have coursed through the early 2020s. JBREC maps "30 domestic migration winners and losers" here, suggesting narrower areas of concentrated opportunity for growth, while most other markets pass through a limbo of softened demand.

Builders best weapon to offset the risk of the two nemeses is running a business that's as light and agile on borrowed capital as possible, and as efficient and competent at deploying that upfront capital in the right places at the right moment.

With intensifying pressure on pricing due to “higher-for-longer” interest rates, the tools homebuilders have to continue to build affordably involve stepping up operational excellence to source lots on a land-light fast-turn basis, design and produce product that stands out among would-be buyers, give them the buyer experience they demand, and – increasingly – value-engineer their offerings to meet buyers’ budget limitations.

Especially at a time, large national public homebuilders have doubled-down on market share gains as a business strategy, smaller local and regional operators need both balance-sheet agility and operational and executional excellence to offset competitive disadvantages in local markets.

Core competencies – trusted relationships with land sellers and developers, exceptional product design, a nimble asset-light balance sheet, high velocity, right-the-first-time construction cycles, and high-touch customer focus can set privately-owned homebuilders – become a smaller private firm’s super power and growth engine.

How?

- They build closer, sustainable win-win relationships with land seller and development partners

- They stay closer to the needs, wants, and pocketbooks of potential homebuyers and renters

- They can recruit and retain more purpose-driven, loyal, and entrepreneurial talent

- They can thrive in times of slimmer margins by keeping builder-of-preference status with trade, manufacturing, and materials distribution channel partners

- They can keep debt costs to a minimum by driving revenue back into funding continued growth options

We are having calls every day with new clients that are seeing their access to traditional financing dry-up, says Brad David, Executive VP of development and construction at Snap.Build, a partner of The Builder's Daily. "Our opinion is that this will only continue. The private lending space is rapidly growing and we feel extremely well positioned with our platform to capitalize on that growth."

David says that the Snap.Build team is seeing private builders begin to evolve in use of technologies to improve the build-cycle process, increase inventory turns through velocity, and optimize use of project and operational finance to pivot for growth as they prepare and harden themselves for a "higher-for-longer and tighter" credit and interest rate regime.

We have discussions around tech with all of our builder and developer clients," says David. "Builders that have technology implemented in their businesses are drawn to our platform for the obvious reasons. Where we really see the light go on is when we talk with builders that have been reluctant to implement technology around their payables and overall capital management. We give them the opportunity to have access to best-in-class technology and software without increasing their overhead and capital outlay."

Once operators integrate those technologies on the finance life-cycle part of operations, what David and the Snap.Build team observe is that the operators gain time back to double-down on their focus where they tend to drive the most value into the end-to-end build-cycle.

By combining our technology platform with construction funding and managing those processes on behalf of builders, our builders are able to focus on their core competences," says David. "In Snap.Build, they have a lender that can match their ability to build more efficiently and quickly turn more product. Our builders are also able to negotiate better pricing and credit terms based on how quickly and efficiently we pay on their behalf."

As the two nemeses rear their heads in the upcoming months, smaller, entrepreneurial operators need every tool they can lay their hands on to navigate a trickier, narrower, gauntlet in 2024 and beyond. The opportunity to put best-of-breed financial and construction management technologies together with access to on-demand capital gives some operators a leg-up in agility.

The challenges smaller builders face with the Big Publics will always be there," says David. "The publics are well funded and well managed, so smaller builders have to find any opportunity to level the playing field. Technology is certainly one of the key ways that they can do that. That speaks to the power of our platform and what we offer builders. We are giving them access to capital markets they would not have otherwise and a technology solution that is truly powerful."

Join the conversation

Snap.Build provides builders with funding for residential construction projects. Snap.Build offers a non-recourse loan structure, competitive rates, and efficient loan closing.

MORE IN Technology

Lennar Taps Into Geothermal To Power New Colorado Homes

A major homebuilder's bet on geothermal heating and cooling for over 1,500 new Colorado homes could pave the way for mainstream adoption as buyers increasingly seek sustainable, energy-saving features.

AI Crushes Missing-Middle Time And Cost Curves Toward Affordability

Developing multifamily rental and for-sale properties takes time — sometimes years -- depending on a labyrinth of zoning rules and the whims of local jurisdictions.

Brandon Elliott’s Next Big Thing: An Uber-Style Building Trades Platform

After selling Elliott Homes to Meritage, the Gulfport, Miss.-based entrepreneur sets his sights on transforming trades with a logistics-tech startup that aims to make construction faster, smarter, and more affordable—starting with siding.