Leadership

Trust: Homebuilding’s Secret Metric For A Competitive Edge

In 2025, trust will separate winners from laggards as homebuilders navigate complex ecosystems of buyers, partners, and investors.

Make no mistake:

Hard numbers – business, financial, and operational performance metrics – will separate U.S. homebuilding operators, one from another, and some above all, in a year-plus of anticipated double-edged dynamism, turbulence, and peer-vs.-peer competition.

Being better — smarter, faster, and of higher value than a half-dozen or more local competitors in each and every one of America's most active new home and residential development markets — in ways that true up to a timeless imperative coined by Peter Drucker, "The purpose of business is to create and keep a customer," will tell the story of homebuilding business fates and fortunes for at least the next 36 months.

As every strategic and operational leader in the business knows only too well, the catch with homebuilding is that the term itself is practically a misnomer. More accurately, homebuilding operations and enterprises, as we recognize them, typically describe an alliance of as many as 10 to 15 business operations under a single brand or corporate banner. Retail, manufacturing, consumer insight, logistics, real estate development, data and technology, sourcing, sales and marketing, product design and architecture, local policy, investment and financial management, to name some but not all.

Typically, each of these respective operating groups tracks along to its own set of supply and demand, headwind and tailwind, and opportunity and risk criteria. It's this complexity both the largest enterprises in homebuilding, the medium-sized regional players, and the single- or multi-local market production builders are trying furiously to pivot into asset-light homebuilding "systems" that carry the end-to-end homebuilding lifecycle through an integrated value stream, from first-investment to a homebuyer's mental picture of the home they want.

The leaders of these enterprises must always recognize that these operating groups compete in the same pool of resources. In fact, they often actually conflict head-on with their internal department teammates on priorities, practices, timing, incentives, and departmental results.

For all intents and purposes, a homebuilder operates as a unified business in name only. In reality, homebuilders operate a confederation of concurrently aligned project teams that, in the best case, coalesce to produce new homes and communities for people who need, want, and aspire to own them.

This inherent complexity can make a hot mess of hard-number metrics for company performance without a kind of glue that binds one to another.

That glue also binds the whole enterprise to an ecosystem of "customers" that includes homebuyers and renters, for starters. However, it also gives equal priority, commitment, and investment to internal team members, investor owners and lenders, trade partners, land sellers, local planning and building officials, commissions, and even potential acquisition partners.

The glue, immeasurable in conventional resource allocation, financial, and operational performance metrics, is trust: Leaders and team members say what they're going to do, and do what they say they will do.

The annual America’s Most Trusted Study reminds us that while metrics and profitability drive decisions, trust is the invisible currency that sustains long-term growth and resilience. In an industry where every detail, from land acquisition to customer handover, must align, trustworthiness becomes a decisive factor in success.

The 2025 America’s Most Trusted Home Builders

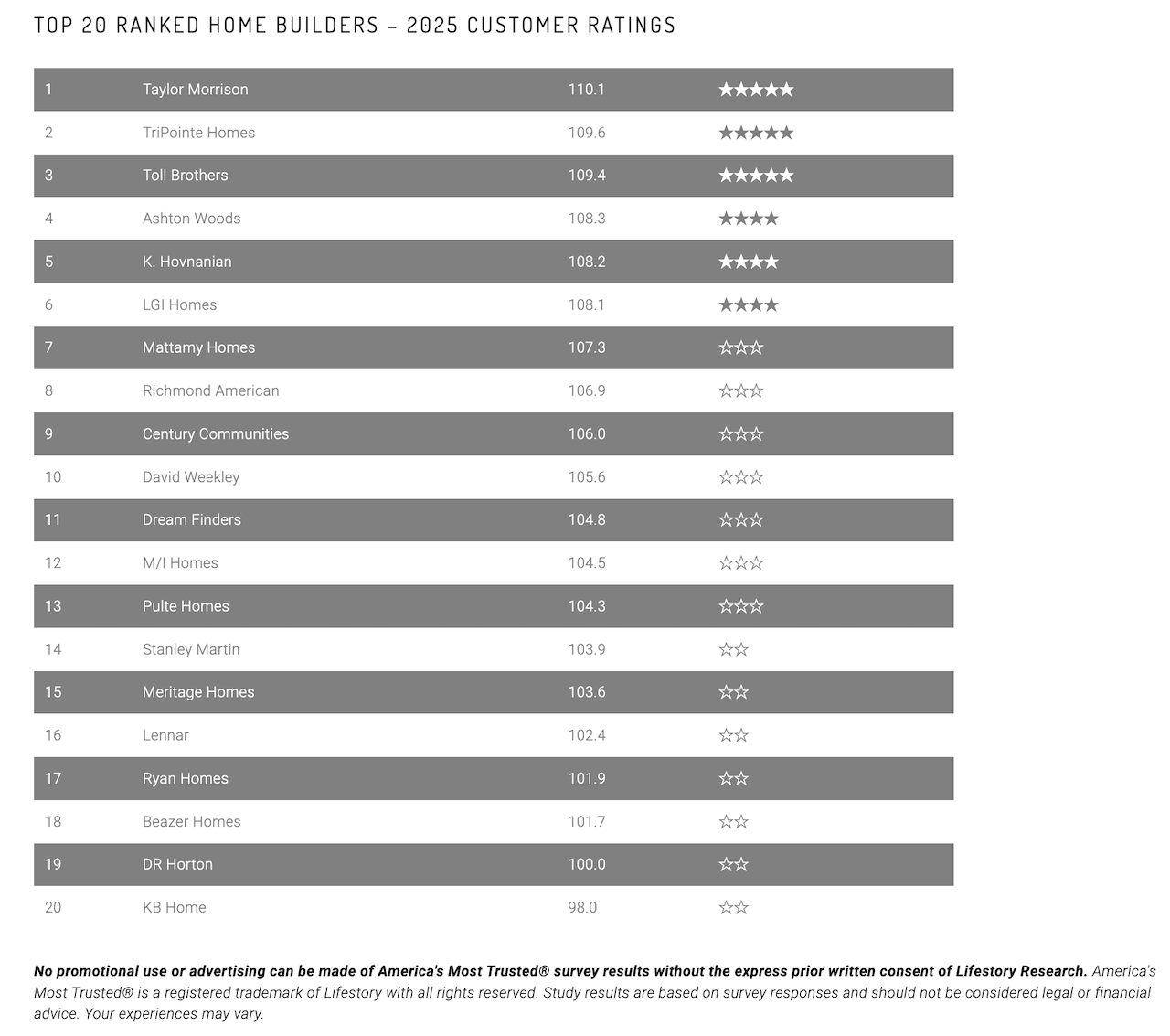

The annual America’s Most Trusted Study, conducted by Lifestory Research, isn’t just a yardstick for consumer sentiment; it’s a mirror held up to the soul of the homebuilding enterprise. This year, Taylor Morrison once again claimed the title of America’s Most Trusted Home Builder, extending its unbroken streak to ten consecutive years. The study, which aggregates feedback from nearly 67,000 consumers, reinforces the understanding that trust isn’t a side benefit of operational excellence; it is a mainstay.

Taylor Morrison’s Net Trust Quotient of 110.1 stands as both an accolade and a call to action for competitors. Among the Top 20, names like Tri Pointe Homes, Toll Brothers, Ashton Woods, and K. Hovnanian demonstrate that, in a hyper-competitive arena, trust translates directly to influence, market position, and financial success.

But what exactly does it mean to be "trusted" in the homebuilding space?

It’s more than delivering a quality home. It encompasses the entire ecosystem —every stakeholder, every department, and every project thread that weaves into the homebuyer’s journey. The Lifestory Research study identifies key metrics of trustworthiness: consistency in quality, positive word of mouth, transparency in communication, and post-sale support. These are not just hallmarks of good marketing but of operational and cultural alignment at every level

Why It Matters Beyond Buyers

Trust isn’t just critical to winning over homebuyers; it influences the entire operational spectrum. Investors gravitate towards companies that inspire confidence in their ability to deliver predictable returns. Trade partners choose to prioritize projects led by firms known for fairness and timely payments. Municipal officials favor working with builders who honor commitments, facilitating faster permitting and zoning.

The interconnected nature of these relationships forms the foundation of what Harvard Business Review refers to as the “Ecosystem of Shared Value.” Companies that embrace shared value understand that trust expands beyond transactional relationships. They embed it into how they manage land acquisition, collaborate with construction partners, and engage their workforce.

In the homebuilding sector, where margins are narrow and volatility is a constant, embedding trust at every operational intersection can insulate a company from disruptions. This approach not only improves efficiency but generates tangible financial returns. Studies have shown that high-trust organizations report 50% higher productivity, 74% less stress, and 40% lower turnover rates.

Avoiding the ROI Trap

A temptation many leaders fall into is attempting to quantify trust through conventional ROI calculations. The Medium article, “The ROI of Trust,” highlights that while trust influences revenue, its true value often lies in reducing friction and enhancing resilience — factors not easily captured in spreadsheets.

As homebuilding enterprises strategize for 2025 and beyond, the smartest move might be to invest in trust not because it promises an immediate financial return, but because it underpins sustainable, long-term performance.

In an era of double-edged dynamism, where market conditions pivot rapidly, trust might just be the competitive advantage that ensures homebuilders don’t merely survive — they thrive.

And they win.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.