Land

Trumark's Wathen Castanos Buy Puts It On An M&A Fast-Track

With an "imperative" to grow, according to Trumark co-founder and co-CEO Michael Maples, and a green light to tap the deep, highly-motivated capital resources of Daiwa House, he says, "stay tuned."

Trumark Homes – majority-owned by Osaka, Japan-based Daiwa House Industry Co., Ltd. – has acquired Clovis, CA-based Wathen Castanos, which is currently building in San Luis Obispo, Monterey Bay, Clovis, Fresno and Madera.

In an accelerating homebuilding M&A backdrop, the deal boosts Trumark's growth, expands and fills in its North to South California footprint, and adds more attainable products, price points, and property locations.

Under an "imperative" to grow, according to Trumark co-founder and co-CEO Michael Maples, and a green light to tap the deep, highly-motivated capital resources of Daiwa House – one of three Japan-based real estate development and construction giants who've built dynamic, top-25 ranked, U.S. homebuilding portfolios in the past decade – Maples' highest priority in getting the Wathen Castanos deal done focused on people.

What struck [Trumark co-founder and co-CEO Gregg Nelson] and me about Wathen was their company culture," Michael Maples tells The Builder's Daily. "Even though the deal came together fairly quickly from the time we went into a LOI (letter of intent), our conversations span over a year. Obviously, without culture, things just deteriorate. If that box doesn't get checked, we don't go any further. They operate a business that we really admire. Their product is special, and they look at the consumer experience and try to delight customers with their design, just like we do. We thought – especially for some of the markets they operate in, they did a very good job of that – the buyer experience is solid, so there's just a lot of ways we connected with them."

While access to strategic opportunistically-priced land positions and a strong line in to complementary – more interest-rate and price-sensitive – customer segments, as well as a strong reputation among trades and land sellers in an operating arena all stand as factors that make the Trumark-Wathen deal make sense, the story overflows with ramifications:

- to Trumark Homes, which just like that has become a $1 billion in revenue homebuilder

- to Daiwa House, which has leveraged strategic strongholds on the East Coast, California, and Texas as regional launch pads for a nearly-national Manifest Destiny operating footprint

- to homebuilding at large, which is pitching into what advisors and participants infer may be one of the more active wheeling and dealing M&A market windows in at least the post-Covid era

We'll take each piece in that order.

The Trumark-Wathen Castanos Deal

First, what builders need to know about the Trumark acquisition of Wathen. Per today's press statement:

Originally founded in 1983 and currently led by President and partial owner Josh Peterson since 2014, Wathen Castanos Homes is a leading private homebuilder in California’s Central Valley and Central Coast with a long-established legacy of homebuilding success. ... Wathen Castanos Homes is known for its award-winning design and energy efficiency.

“We are very excited and honored to join the Trumark Homes family,” said Peterson [who'll serve as Trumark's Central Division president]. “Over the decades that we have been in the homebuilding industry, we have always been guided by a foundation of quality and values, a tradition of craftsmanship, and dedication to high quality customer care. Trumark Homes shares these same guiding principles as well as the resources to accelerate our growth, which makes them the perfect match for us.”

Nelson, Maples, and Peterson emphasized the quality of employees and dedication both Trumark and Wathen Castanos have to their highly skilled teams as integral to the value of joining the two companies.

Apart from the fact that two cultures share "principles and values" and seem likely to fit, Trumark's Mike Maples notes that Wathen adds both new market, land strategy, and pricing exposure as opportunity areas for the whole entity.

63% of their future pipeline is in the Clovis Fresno area," says Maples. "We like that because it's a lower price point than we typically have in our other California markets. We'd like to blend it. They do a lot of first-time buyers where we aren't doing as much of that given some of the areas we operate in. Then they also have the Monterey and the SLO (San Luis Obispo) markets. About 24% of their deliveries will come out of the SLO market and about 13% out of the Monterey area so they have a nice little diverse portfolio and we think we can add to those pipeline positions in future years as well."

Already, Trumark has created a "logo lock-up" with the highly-regarded and trusted Wathen brand, according to Linnea Chapman, corporate VP of marketing at Trumark.

We are introducing the Trumark Homes Company alongside with Wathen Castanos," says Chapman. As new projects come online, we will be evaluating the market and looking at timing but we will roll that up to Trumark Homes eventually. Right now with all of their live communities and with their coming-soon community that's going on sale in Q1 in Copper River, that will go out as Wathen Castanos, a Trumark Homes Company."

This branding approach is noteworthy, especially because there's a strong "stay tuned" for more M&A activity to come in the Trumark Homes Company hopper:

We are targeting significant growth throughout the western states," Gregg Nelson, co-founder and co-CEO of Trumark says. "Colorado was our first expand geographic expansion outside the state. This one is obviously within California, it does help fill in sort of the middle between our Northern California and Southern California operations. It will push us to well over a billion dollars in revenue next year, we anticipate which is a is a nice step forward for us.

We have been looking at opportunities throughout the Western states, both from a strategic perspective and an opportunistic perspective. One of the things that we really pride ourselves on and really try hard to represent and experience as a company is that this is a great place to work. It's a great company to be part of. Michael and I are so grateful to be part of such a high-caliber team. When we when we were introduced to the Wathen folks, we saw that these guys would fit right in, both from a skill standpoint, the way they approach their product, and what they value in their own culture. So that's really important to us. But we do see it as as a step. Stay tuned. There'll be more releases to come we feel as we continue down this path of growth."

Daiwa House North America Expansion

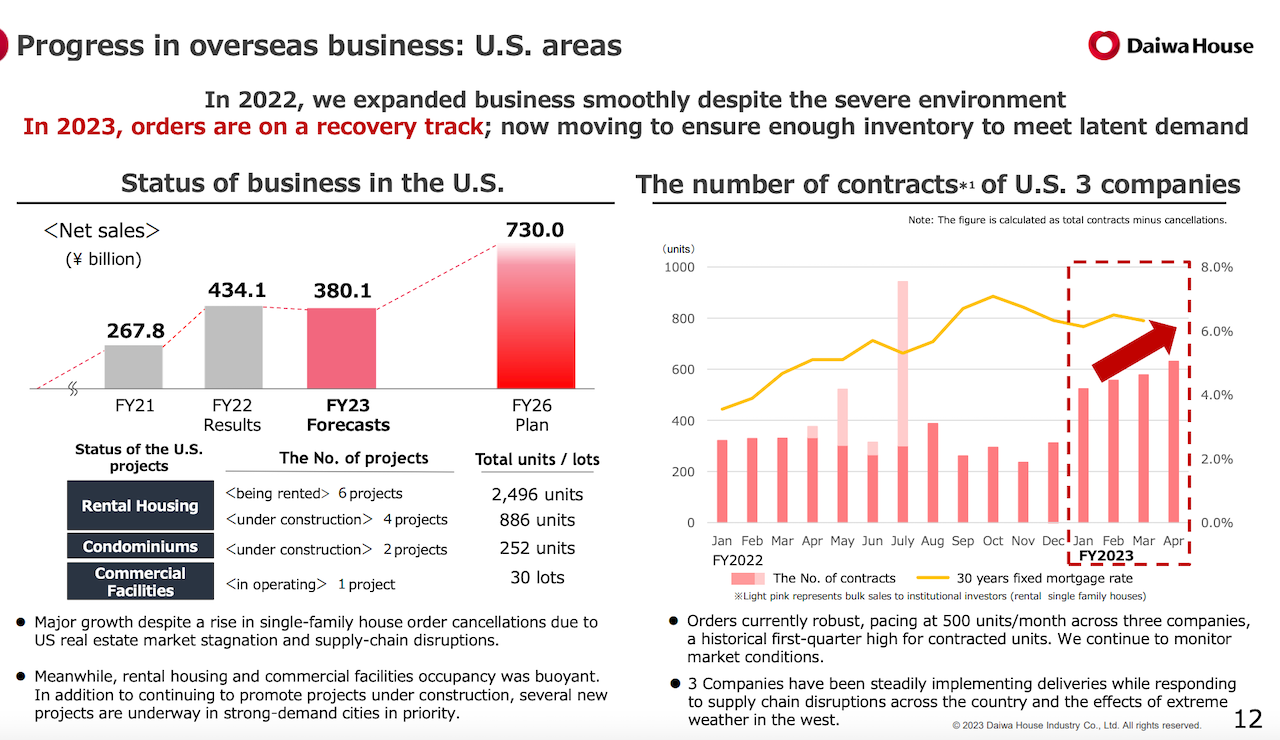

Trumark is just one leg of Daiwa House's three-legged stool when it comes to its growth imperatives.

As we wrote in August 2021, in the wake of Daiwa House's $500-million acquisition of 80% of Texas-based Castlerock Communities, Daiwa House's mission to become a dominant U.S. residential construction and real estate player is only partway done:

Together with its new Daiwa House siblings, Stanley Martin Homes and Trumark Companies, CastleRock immediately becomes part of an empire whose collective firepower as an operating portfolio exceeds $2.14 billion in home sales revenue on deliveries of 5,700 homes, ranking the group well within the U.S.'s top 20 homebuilding enterprises.

As a final acquisition target, we were searching for an opportunity in the State of Texas as the link between both coasts," Daiwa House chief financial officer Takeshi Kosokabe explained to investment analysts August 10th. "Excluding indirect subsidiaries, this acquisition represents a provisional conclusion to M&A plans for the Single-Family Houses Business in the United States."

Mr. Kosokabe further noted that Daiwa House's three-year plan budgeted for upwards of $900 million for M&A , "which we have now nearly reached with this acquisition."

So, the question becomes, what's next?

- Daiwa House growth spurt: Daiwa House's three-year plan, ending March 2022, calls for a goal of $3.6 billion [400 billion yen] revenues from its overseas real estate business group – which now includes CastleRock, Stanley Martin, Trumark, and Australia-based Rawson Homes. This still leaves a "go-get" between current revenue levels of the respective operators and the March '22 goal.

- Nesting instincts: Stanley Martin, acquired by Daiwa House in 2017, since acquired FD Communities [Atlanta] and Essex Homes [the Carolinas], expanding the Stanley Martin footprint up and down the Middle Atlantic-Southeastern states corridor. This suggests that Daiwa House might well consider further bolstering its operating scale and clout by nesting further acquisitions under CastleRock, Stanley Martin, or Trumark.

- Talent show: CastleRock, Stanley Martin, and Trumark each boast strong, housing cycle-proven, entrepreneurial, tenured strategic leadership groups, each of whom has cultivated deep management and next-generation talent in the wings.

While the master footprint has taken on greater clarity through Trumark's expansion into Colorado, and its now filled-out geographical coverage of California, there's more to go both to the north and into Arizona, Utah, and Nevada, which is where both Trumark and CastleRock may push their brands and systems.

To that end, Trumark has engaged an advisor, who had a hand in the Wathen process, and who'll stay on for the "stay tuned" part of Trumark's trajectory. The press statement notes:

JTW Advisors LLC served as the exclusive financial advisor to Trumark Homes for this transaction. As a boutique investment bank focused exclusively on the real estate industry, JTW is a valued partner to Trumark Homes and will continue to counsel the company on future growth opportunities.

The Wider M&A Backdrop

Deal flow is likely to pick up over the next three to 12 months, but here's a characterization of how the current environment may work to a select few privately-held homebuilders' advantage, while others may undergo downward pressure on their valuations and eventual pay-outs:

There is a bifurcation in the supply of homebuilders," says Chris Jasinski CEO and Managing Partner of JTW Advisors, Trumark's consultant. "There are not a lot of great-quality builders being brought to the market, whereas there is real, healthy demand. Still, there are a lot of builders that operate at sub-average performance, that are not seeing the level of interest that the sellers would probably like.

Here's what buyers want: a quality company that makes above-average margins. What's more, they're in a challenging entitlement environment and they've created a lot of value through the entitlement process. That's the type of seller everybody's after."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.