Leadership

Trough Coming Or Going, Expect The Unexpected In The 2023 Plan

Here are data points that tend to run counter to narratives that shape our plans. Assumptions support our planning; what happens if our assumptions – even ones based on the consensus of expert thinking – don't prove correct, or go sideways?

Another Monday, another dunk into the glass-half-full-glass-half-empty pool of humility.

How do you feel about and characterize this past Friday's jobs report from the U.S. Bureau of Labor Statistics?

What's highly likely – whether you're in the half-full or half-empty camp – is that you're at least partly right. Maybe partly right's good enough for you and your business interests, and we hope that's the case. The important issue is that what you take to be evidence persuasive enough to guide your anticipation and preparation proves reliable, and that barring that, you've got room for error.

Statistical trends, more often than not, serve to confirm our biases or to frame reality and time so that we'll view what has happened and what will happen as others would have us do.

Here's something that boggles the mind about our tiny speck of reality. amounting to an explanation for why we need new prefixes to bolt onto our numeric constructs of quantity.

More data is recorded on digital media every day than all the information stored since the beginning of mankind through 1970. According to a Science research article, if all the bytes (a unit of digital information that consists of eight binary bits) were stored on compact discs and stacked up, the tower of discs would extend beyond the Moon (more than 238,900 miles or 384,400 kilometers). And this is only the data stored between 1986 and 2007. The Covid-19 pandemic increased the use of digital technology by 400%, and by the end of 2030, the stack of discs would extend all the way to Mars with the data generated in just one year: 1024 bytes. This data explosion is not just a physical storage problem, but also a scientific one. In 1964, standards bodies began adding prefixes to units of measurement to accommodate these unimaginably huge and tiny numbers. In November, four new prefixes were added to the International System of Units (SI): ronna (1027, symbol R), ronto (10-27, r), quetta (1030, Q) and quecto (10-30, q)." – El Pais

If nothing else, the need for the invention of these four new prefixes to describe numbers of units of anything is humbling.

Here are a few new data points, related only insofar as they impart information that either fits or doesn't fit within your plans for survival – a singly important and consistent requirement for sustained success.

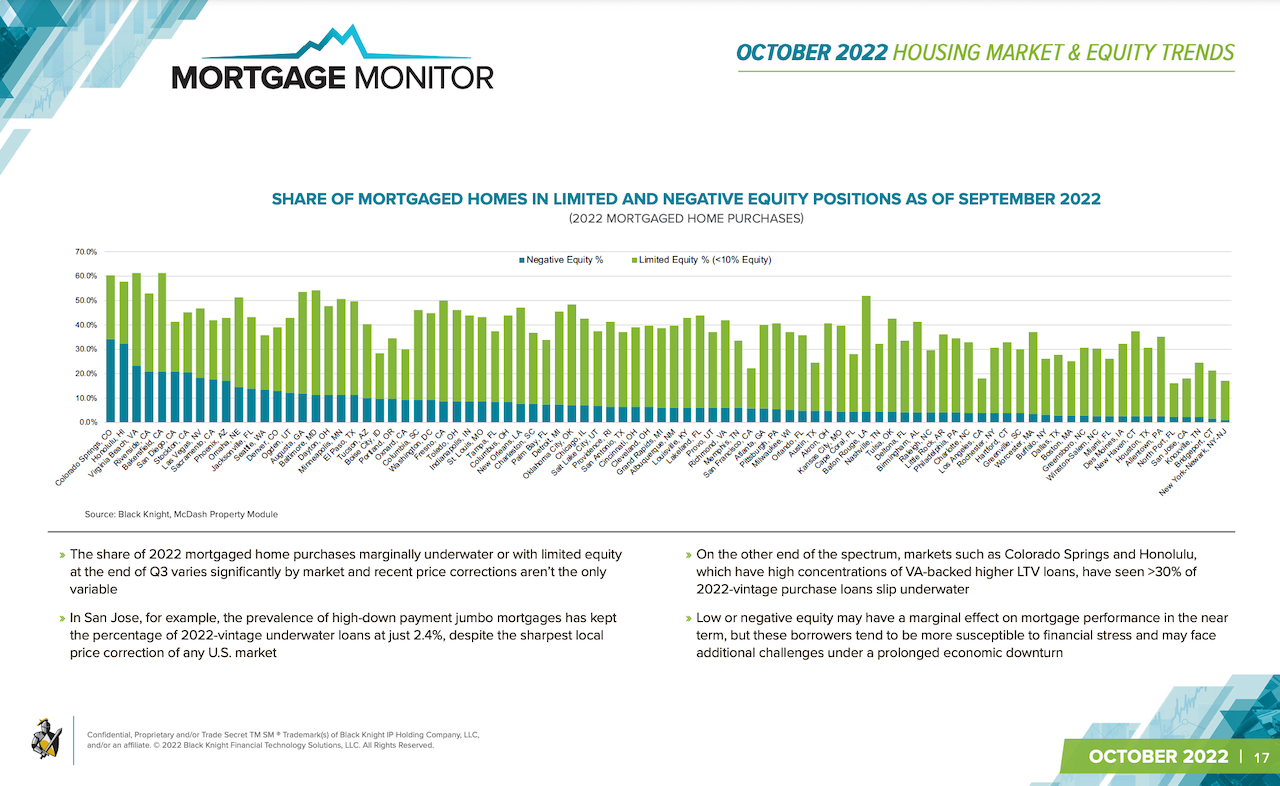

- Did you know that 8% of 2022 home purchase mortgages – and their homebuying borrowers – are in negative equity, underwater, due to house price drops in their markets? Further, four out of 10 purchasers with a loan in 2022 – most of them FHA/VA borrowers, 20% of whom are "under water" – have less than 10% equity in their homes. – Black Knight

- Did you know that the share of young employees – ages 18 to 34 – who have stayed with a current employer three years or more has changed little in 40 years, right up to the present time? – Pew Research

- Did you know that the U.S. economy – and homebuilders and remodeling firms – added 105,000 to payrolls in the past 12 months, and that in the decade since a low-point during the Great Recession, 1.2 million people have joined or rejoined payrolls of residential construction firms? – Eye On Housing

The common denominator of these data points is that they tend to run counter to narratives that shape our plans. Assumptions support our planning; what happens if our assumptions – even ones based on the consensus of expert thinking – don't prove correct, or go sideways?

Up to this moment, Dec. 2022, we've seen strong evidence that homebuilders and their partners have done well at solving for many of the specific challenges of the past traumatic downturn during the GFC. Will those lessons learned shield everybody from the stresses and shocks of what's working its way through the world, national, and local economic backdrop?

Here's a perspective that focuses on financial and investment wisdom, but one builders and their investor and manufacturer ecosystem would find equally helpful. It's an excerpt from Morgan Housel's Psychology Of Money, and the point here is that to succeed, you've got to survive.

More than I want big returns, I want to be financially unbreakable. And if I’m unbreakable I actually think I’ll get the biggest returns, because I’ll be able to stick around long enough for compounding to work wonders.

Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.

A barbelled personality – optimistic about the future, but paranoid about what will prevent you from getting to the future – is vital.

What matters little in the waning days of 2022 is who's correct or not about the next Fed policy rate move upward. Nor does the one after that make all that big a difference, but – overall – what the ultimate rate caps out at and for how long, and most importantly, what that does to consumers' mindsets, buying behaviors, and, finally, house prices.

Here's Fed chair Jerome Powell's latest thinking on the "destination" and duration of a Fed rate peak:

He outlined two possible strategies for proceeding. One would be to quickly raise the fed-funds rate well above the 5% level broadly anticipated in financial markets and then lower it right away if it turns out they have gone too far. Another would be to “go slower and feel your way a little bit to what we think is the right level” and then “to hold on longer at a high level and not loosen policy too early.”

It's anyone's guess as to what consumers' appetite, tolerances, break-points, etc. will be when Fed policy rates start to stabilize and markets reset a new floor under mortgage interest rate expectations.

Still. root outcomes for user-audiences of The Builder's Daily are what we're getting at here: that as many of you as possible survive the tough going in the months ahead, and come out of that period stronger for it – whether it's midway through 2023 or a year later or even longer than that.

As we see, there's data evidence enough everywhere to either confirm your comfort zone of confidence or to keep you up tossing and turning at night in panic. Choose whichever filter you want to process the information, but remember, when it comes to planning:

the most important part of every plan is to plan on the plan not going according to plan.

The power of healthy skepticism and humility in business shines through in those who've been around through cycles of varied cause and nature. And we'll see a lot of them on the other side of this one as well.

MORE IN Leadership

Homebuilding Strategists Talk Candidly About Getting To 2030

At Denver’s Focus on Excellence summit, five builder leaders strip away spin. They reveal real pressures—capital, costs, people—and how they’re fighting back.

D.R. Horton’s Greenville Play Signals Private Builder Squeeze

The nation’s largest builder isn’t slowing tuck-in acquisitions. SK Builders’ exit reveals why privates face thinner "lower-for-longer" margins — or, perhaps, the exit door.

Insurance Costs Now Define Housing’s Affordability Equation

Insurance premiums have soared nearly 70% in five years, now consuming almost one in ten housing dollars. Homebuilders who plan for insurability early protect both margins and buyer trust.