Land

Tri Pointe Plants Its Flag In Utah, Ken Krivanec To Lead Expansion

In a bid for a competitive share of the higher-end of the Salt Lake City, Provo-Orem, Ogden, Draper, and Saint George new residential explosion, Tri Pointe taps a Utah native son to lead the charge.

In late-July, Q2 earnings discussions with Wall Street investment research analysts, Tri Pointe Homes chairman and CEO Doug Bauer got quizzed like just about every one of his C-suite peers in that period's earnings cycle.

Roughly, the question – after reporting a gang-busters second quarter performance, and announcing a "dry powder" treasure-trove of $1.7 billion in liquidity, with $982 million in ready cash and $695 million in a unsecured revolver – was this: What will you do with the chest of cash to ignite future earnings growth?

Bauer's response was a cordially-guarded non-answer.

We're still seeing some strategic opportunities for growth. At the same time, I would say that our primary focus is looking at organic in a couple of markets that we're currently in the process of establishing. So more to come on that. Obviously, the organic model is something we know very well. We're pursuing, let's call it 'M&A and B.' I look at the credit markets and talking to the bankers, and it's going to take a little bit longer for more opportunities to kind of flush out of the system. There are definitely capital constraints. As you know, all the banks, big money center banks and others are under a lot of pressure, raising capital. Credit markets are very tight for the less-capitalized builders and land developers. That's another area that we're looking at. But there's a little bit of a longer process as you go through and see where the opportunities could land. I think it will be towards the end of the year going into next year as the credit markets probably continue to slow, and continue to slow down credit opportunities for the small to medium-sized builders and land developers."

That was about six weeks and a blue moon ago in today's whipsaw of volatility and uncertainty. Suddenly the time is right to strike on "strategic opportunities for growth," and a more definitive answer of the question of how all that cash might go into driving growth in 2024 and beyond.

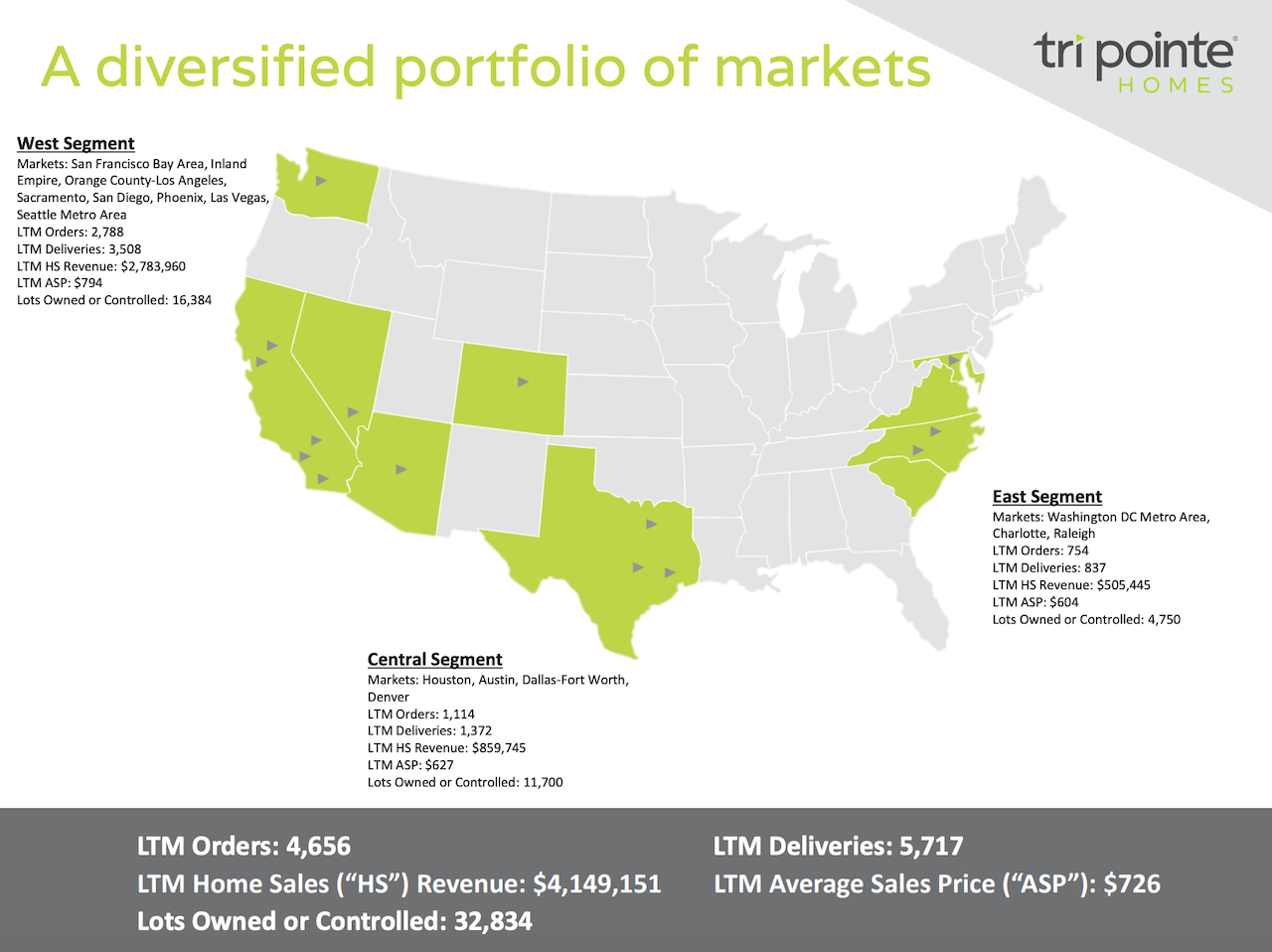

Tri Pointe Homes unveiled plans today that it will expand its 10-state operating footprint to include an 11th, one of the pandemic era's fastest-growing residential markets, Utah, with a de novo new division to be headquartered in the greater Salt Lake City region.

Tri Pointe's choice to start the new Utah division from scratch rather than to take the quicker-hit of an M&A deal follows a tried-and-true strategic playbook (i.e. Charlotte/Raleigh, N.C. in 2019) and taps into a cycle-proven strategist, Washington state division president Ken Krivanec, to lead the expansion.

In a press statement, Krivanec says:

Utah’s consistently strong housing market is fueled by its diverse economy, which provides a runway for long-term growth,” said Ken Krivanec, who has been named as president of the new division. Krivanec, who has served as division president for Tri Pointe Homes’ Washington division for 12 years, will serve in a dual president role. “The state is home to a large number of different industries, including tech, life-sciences, aerospace, financial services and energy/natural resources. This diversity has led to one of the strongest job growth markets in the country which coincides with an ever-increasing demand for housing.

“Utah, like the rest of the country, has a severe housing shortage, which has been exacerbated by existing homeowners who are unwilling to sell and give up their low interest rate mortgages,” said Krivanec. “At the same time, new home builders have pulled back on housing starts, which has created an even greater shortage. We believe that this presents Tri Pointe with an ideal opportunity to apply our Best of Big and Small pillar when expanding into Utah and to successfully leverage the unbalanced supply and demand conditions in the market.”

In entering the Utah market, Tri Pointe's product line and community positioning and pricing – mostly a notch-or-two-above the fiercely competitive fray of highly interest-rate sensitive entry-level and first-time buyer-focused builders – check several important boxes for a state growing leaps and bounds due to both natural and in-migration population growth, as well as economic development.

Per a recent Axios overview:

Utah's population is still expanding — but not as fast as it was a year ago.

Driving the news: Newly released census estimates show Utah grew by about 41,700 people from July 2021 to 2022 — the ninth biggest net population growth and 10th highest growth rate of any state.

With its "premium lifestyle" product and pricing positioning, Tri Pointe strategists are likely betting a new divisional start-up can get a jump-start at least in part because it's not competing head-to-head for lots, homebuying customers, and, to some extent, construction trades with entrenched major nationals like D.R. Horton, M.D.C., and Lennar nor trusted Utah private builder operators like Edge Homes, Ivory Homes, Woodside Homes, and Clayton's Oakwood Homes group.

Still, establishing traction, gaining momentum, and grabbing sufficient market share to achieve local scalability for a new division often stems from local relationships and experience to get the product just right and draw on trust capital among land sellers, construction crews, and the distribution channel there.

In Q2 earnings comments chairman and CEO Bauer nodded to extra challenges of a de novo division:

Whenever you start up a division – for example, Raleigh, where our scale is still growing – you're going to have a few more challenges to attract and retain the right trade partners. But labor has always been tight before the pandemic. Our labor force was aging well before the pandemic started. But we're still able to scale up with our trade partners, especially in our 15 divisions, we've got tremendous growth that we're experiencing in the Texas and the Carolinas market, especially the Charlotte market. So, as you do scale up, as you said, you do get more trade partners and become more efficient on both costs and cycle times."

The good news as well is that Krivanec – although he's spent 13 years as Tri Pointe's division leader in Seattle and another seven before that as head of sales and marketing at Quadrant Homes (which became part of Tri Pointe in 2010) is native to the Utah market and has built trusted relationships on the ground there through the years.

From the press statement:

Ken is the ideal leader to launch our new Utah division,” said [Tom] Mitchell [president and chief operating officer of Tri Pointe Homes]. “Having been raised in Utah, working in the industry there previously, and regularly travelling over the last decade between the Washington and Utah markets, Ken has deep ties and a profound understanding of the market."

As for further use that $1.7 billion in liquidity Tri Pointe may deploy when the time, place, and number are right, it may be just a little bit early to say what or when.

As Doug Bauer says:

More to come on that."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.