Land

Buyers Now Can Swap An Old Home For A New One On The Same Site

"People would look at the homes we're already building in their neighborhoods, the sites with the TJH branding on the fence wrap around the job site, and they asked us, 'how do I get what you're doing here where I am on my site?'" -- Tommy Beadel, founder, CEO, Thomas James Homes

I'm still in love with where we live. Don't think we'd be as happy anywhere else for a lot of reasons. It's just this house we've fallen out of love with."

Many would hear that as an unsolvable lament. The type of complaint that would force the speaker-owner into one of two choices. Either move out and buy new somewhere else, or put up with the current home, unhappy or not.

Others see a business. A big one with legs.

Those others tend to operate and flourish in the "don'ts zone" of U.S. production homebuilding's widely observed "do's and don'ts" of how to make money sustainably, a requirement of which is scalability. In a macro backdrop of not-enough-housing no matter where you turn, a consumer who's sold all-in on a current location, location, location but who's thoroughly tired of the house itself can only scale if you look at them through a different lens.

Call that lens a 20-20 vision of an "unmet need," the bedrock of business opportunity. They hear someone express frustration or wistfulness, and their eyes light up. Those are customers! And, suddenly, post-Covid, it's like the world is crawling with them.

In this case, that particular plight – ever more common in a post-pandemic world where parents, grandparents, non-married couples, multi-gen households, one person households of every description and configuration think differently than they did two years ago about live-work-play-sleep-eat-and-connect balances – nests into a larger $190 billion market opportunity of older homes in denser, inner-ring residential enclaves.

Our customers came to us and asked for this," says Aliso Viejo, CA-based Thomas James Homes founder and ceo Tommy Beadel in an interview with The Builder's Daily. Beadel and the TJH team – due to complete and settle on upwards of 300 homes in five operating market zones in 2023 – are rolling out replacement design, construction, and financing solutions targeted rifle-shot to this active and growing sub-stream of "homebuyer" demand . They're the ones who want and will pay for a new home exactly where their existing home stands. "People would look at the homes we're already building in their neighborhoods, the sites with the TJH branding on the fence wrap around the job site, and they asked us, 'how do I get what you're doing here where I am on my site?' We see this as a huge opportunity."

TJH's press statement announcing its new platform states:

Private Client Group: a new sales team to support the company’s BUILD by TJH solution. With a commitment to 'unlock access to the coolest neighborhoods, one new home at a time,' the well-established company is putting a stronger emphasis on their BUILD offering, which enables homeowners to unlock the value and potential of their existing home by rebuilding a new, larger one in its place—all with the confidence of TJH’s pricing and on-time delivery guarantees."

The release continues:

BUILD offers TJH clients an opportunity to maximize the square footage and value of their existing home through a turnkey design-build solution that drastically simplifies the traditional custom-building model. Two key differentiators are TJH’s ability to guarantee price upon contract execution and on-time delivery within 12 months of starting construction achieved through an integrated, end-to-end process that includes architecture, design, permitting, and construction management, while eliminating costly overages and delays."

Now, most of the nation's higher-volume homebuilders focus on driving value into the new ground-up subdivision and masterplan community operational model. They open a "store," which is a brand new community under a neighborhood flag and get their scalability by bringing construction and logistics efficiencies in design, marketing, sales, building, etc. to an iterative process across an array of floor plans and elevations, each unit of which they pull through their overheads.

We wrote almost six years ago about how Thomas James Homes works almost 180-degrees differently than most greenfield, suburban homebuilders, except insofar as it depends on repeatability, operational excellence in the start-to-completion phases, and off-the-charts customer care.

From in 2021, its analysis noted that the market potential for the replacement homebuilder market is huge:

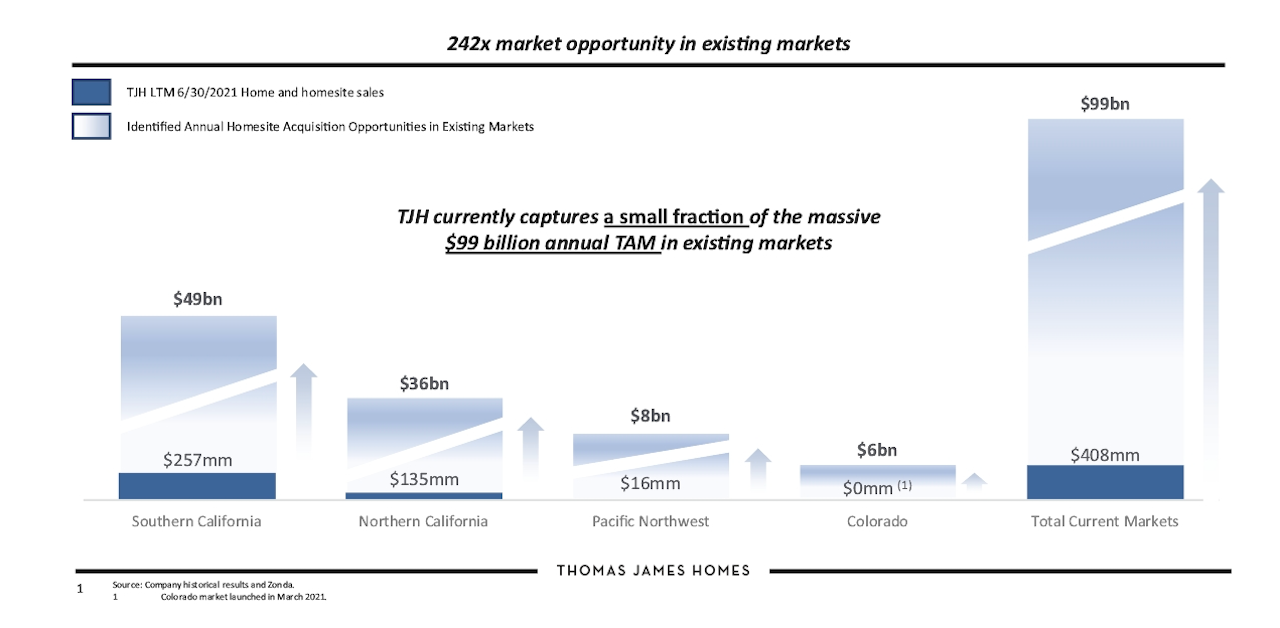

Based on our bottom-up market analysis, we estimate that across our current and target expansion markets in the United States we have a TAM value of approximately $190 billion annually, $99 billion of which is in our existing markets.

Our article focused on the TJH zag where others zig, and where it nails critical operational processes to arrive at its own dimension of scalability. Our article then noted:

What role--if any--can highly efficient home building operators have in markets and submarkets whose land and lots are just about maxed out, fully-developed, except for a few well-known big tracts and a smattering of infill sites?

Think of Los Angeles and its near environs, the Bay Area's Silicon Valley, and downtown and closer-in Seattle's King County, where severe land constraint and an aging-home stock go with the turf, and new tracts of any size are fewer and farther between than any high volume builder has any business trying to buy land to build.

Now, consider a business and operating model suited to a T for those markets, one that competes with custom builders, remodelers, and buy-tear-down-and-spec builders, and yet achieves production builder-like efficiencies and outlying per-unit net-profitablity to boot.

You'd be thinking then of Thomas James Capital Homes, who like to think of themselves as "the biggest builder you've never heard of," and one that solves its challenge of access to new dirt by buying up existing homes, tearing them down, and building new ones on those scattered, already-developed lots. All with a big builder's mentality on efficiency, scale, and steady access to building trade subcontractors, as well as a steady stream of new properties coming on line, thanks to a unique win-win relationship with real estate brokers in their markets."

What the TJH team is responding to with the launch of the Private Client Group has a lot to do with the distributed power of one-to-one marketing. Each one of its current build sites – and it currently has 500 of them in its Northern California, Southern California, Pacific Northwest, Colorado, and Arizona – becomes a design, operations, and customer care marketing channel, sometimes awakening a desire for a new home among people with the wherewithal to pay for it.

What we found out as we needed to scale was that we had predictability around the product," says Beadel, who notes that TJH's baseline library of about 50 floorplans, three to four elevations, and four-to-five structural options customers can choose from. "Each one of our floorplans has an array of curated design packages in the good-, better-, best spectrum, so you can personalize in a whole lot of ways to make it what you want."

While on-your-lot homebuilding has been a fixture of the higher volume production builder market for years, the particular urban infill business model that focuses on upgrading properties with homes already on them has been served by narrower custom- and semi-custom homebuilders and remodelers, which do not come with the "differentiators" of the TJH model: a guaranteed price at contract for the construction, and a firm delivery date within a 12-month start-to-completion cycle.

What we've learned in a decade of building and delivering 300 or 400 homes a year is the capability of delivering that certainty many many of these customers are looking for,"Beadel says. "And many of them have a first-hand opportunity to see it play out in their own neighborhood or one near them as a proof of value."

Sometimes swimming against the current, opposite from most or all of the other fish, is swimming toward more sustaining waters.

MORE IN Land

Why Smart Homebuilders Bet On Texas Single-Family Futures

The Builder's Daily contributor and land sage Scott Finfer makes the bullish case for Texas in 2025 — where fundamentals, patience, and long-term discipline still matter, and the housing market is hitting reset, not collapse.

Spring Land Slowdown Signals Deeper Strain For Homebuilders

A rare April dip in new home sales and starts — coupled with buyer hesitancy, incentives fatigue, and rising insurance costs — suggests deeper recalibration ahead for residential land strategy and valuation.

New Home–Landsea Deal Redraws Builder Power Map

A $1.2 billion private equity-backed merger creates a Top-25 national homebuilder — and signals four pivotal shifts redefining U.S. homebuilding's M&A battleground.