Land

The Prime Time For M&A In Today's Market Is A Deal That Works Anytime In Any Market

Principals in 2023's largest mergers and acquisition deal to date -- Gehan Homes' purchase of 80% of build to rent up-and-comer Southern Impression Homes -- speak with The Builder's Daily.

The housing economy backdrop never for a moment stands still. So, in homebuilding mergers and acquisitions – like in life itself – timing is everything.

In that light, 2023's first major M&A deal – the $85 million purchase of 80% ownership of Florida-based, under-the-radar build-to-rent juggernaut Southern Impression Homes by Dallas-based Gehan Homes announced last month – stands apart.

Understanding how different this combination is, particularly in its timing, sheds insight into what the deal means for Gehan and Southern Impression Homes as part of an ever-strengthening Sumitomo Forestry North America portfolio. Further, grasping that contrast is crucial to see why it matters in the context of broader homebuilding enterprise M&A activity over the next 10 or 11 months.

"Home sales are increasing, and M&A activity is heating up," notes a memo to clients and contacts from Tony Avila, ceo of Corte Madera, CA-based Builder Advisor Group. Tony spent some time with us a couple of weeks ago during the International Builders Show in Las Vegas and confirmed that the deal pipeline taking shape is active and growing.

Buyers are on the lookout for opportunistic moves to bolster financial and operational performance near- and longer term," Avila tells us. "For sellers, motivation splits between a chance for growth with an added capital infusion, or the right moment to exit with a valuation strengthened by a multi bidder pool of potential acquirers. There'll be the right deals for both, providing they can feel assured they can trust the process where both parties come out on the winning end."

So, we were fortunate to have gotten to spend some time a few days ago, speaking with principals involved in the Gehan Homes-Southern Impression Homes, John Winniford, president and CEO of Gehan Homes, and Chris Funk, president of Southern Impression Homes. Avila's colleague, Ron Yelland, VP at Builder Advisor Group, made the match.

Atsushi Iwasaki [president of Sumitomo Forestry America], Chris, Ron [Yelland, Builder Advisor Group VP], and I drove around together, touring Southern Impression’s projects, talking about our vision and respective company cultures, treating people right and focus on the customer experience," says Winniford. "Our initial interest was expanding into the build to rent space. It was evident early on that we could replicate Chris’ business model in other markets. Chris leads by example."

What comes through most clearly when they speak of the what, why, and when of their combination comes down more to proactive action than reactive behavior. That an important distinction in today's homebuilding M&A dynamics, where urgency – to buy or to sell – serves as an accelerant, if not the prime cause driving a transaction. Most homebuilding buyers and sellers, in other words, are more or less in a hurry to make something happen now ... or even better, yesterday.

Ron and the Builder Advisor Group were referred to me by a friend of mine, Wade Jurney," says Chris Funk. "They did a thorough vetting of our business – we'd been operating pretty far under the radar – before he introduced us to the Gehan team. I became comfortable with all of their experience in bringing these deals through the process, and especially their experience in prior deals with the Sumitomo Forestry team."

You see mostly, would-be buyers – and there are literally dozens of them ... strategic, financial, hybrid, public, private, domestic, foreign – race to strike first. They do this in order to a) outflank one another, b) gain leverage on acquisition costs, c) add incremental sales volume at a price point or in a geographical market, d) deepen their operational scale among local vendors, trades, land sellers, etc., or a combination of some or all of these motives. Ultimately, a would-be buyer wants to box out rivals – including local area existing sales – gain marketshare, and improve operating margins with efficiencies of scale.

For many sellers, too, the clock is ticking in one way or another. Personally guaranteed AD&C loans weigh heavier in times of slower sales volumes and pressure on prices and start-to-completion delays. Or age demographics – founders or principal owners who've reached their 60s or so – may call for a passing of the torch and an earn-out at an optimal valuation. Or, because active new-home markets have become ever more competitive – not just among homebuyer customers, but also among trade crews, distribution partners, and land sellers – pressures spool up for smaller, less well-heeled operators.

For those buyers and sellers, time is of the essence.

For a player like Gehan Homes, and particularly its Japan-based parent, Sumitomo Forestry, any time can be the perfect moment for a combination – whether the housing market is spinning up or spooling down – provided it's with the perfect partner.

Gehan Homes wanted "in" to new markets, namely Florida. Southern Impression wanted a partner to help grow its exceptional platform into a regional powerhouse. Sumitomo saw them as different, but wholly complementary and sustainably powerful.

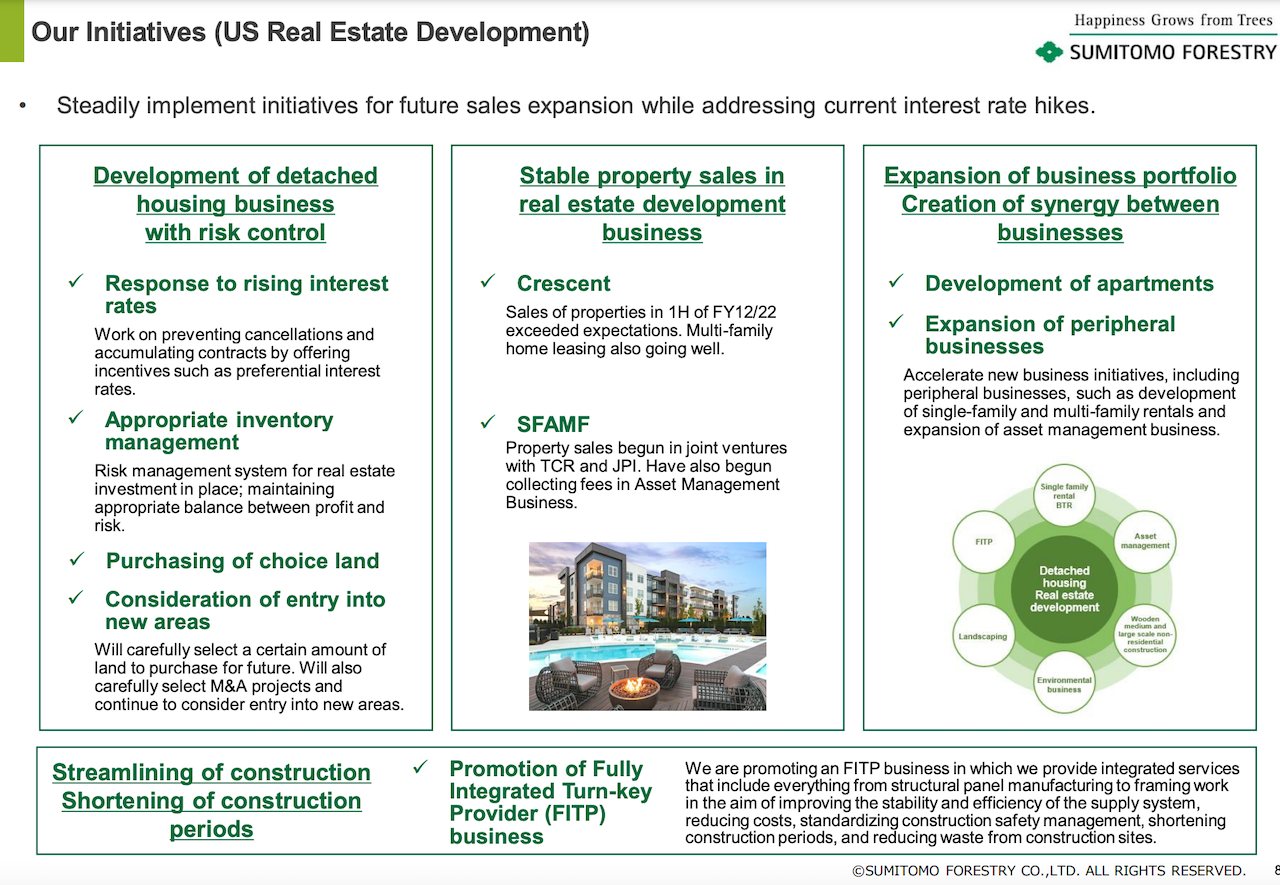

Others may be in a rush. Sumitomo is patient, deliberate, strategic. That strategy, for the company's growing base of single-family homebuilding enterprises and a portfolio of residential and commercial development players looks like this (from company presentation materials dating back to mid-2022):

From Sumitomo and Gehan's strategic perspective, the move accomplished two strategic intentions. One, expansion into a Florida market that proved resilient – so far – to the worst of a housing correction that slowed activity more dramatically almost everywhere else. The other was a strong, sound entry into the build to rent space on the back of a market-tested, operator – Southern Impression -- that had fared well in a suddenly highly competitive arena.

They have created a succinct platform in the BTR space, a space that has really become its own asset class, where the future is bright," says Winniford. "The combination gives us entry into Florida to launch a retail platform with an outstanding team in place, after we complete the integration of our two companies we will look to expand the for rent opportunity into new projects, and other markets, including Texas and Arizona."

Because Southern Impression Homes – and its team – trues up to Gehan's and Sumitomo Forestry's long-term future template, the combination evolved more into a value generation discussion versus merely a transactional negotiation. The acquisition provides Southern Impression Homes access to Gehan’s capital, while eliminating the owner’s personal loan guarantees. These attributes, combined with their regional expertise, investor relationships, and distinct product offerings, will help accelerate growth and expansion. Net, net, it amounts to a bigger win for the principals and stakeholders in Southern Impression than if it were to remain 100% self-owned.

Through the transaction and transition, the opportunity to learn from the Gehan Homes team's years of experience and operational excellence, and we're already seeing the benefits," Southern Impresssion Homes president Chris Funk says. "We're seeing it in national pricing on building materials and rebates for products and distribution. What's more, we've seen in the past 24 months, as build for rent has gained momentum is that the stigma around having renters in a master planned community with for-sale homebuilders has all but disappeared. With that evolution, this combination of retail and for-rent can be a winner, and we've been able to go in and work with MPCs to re-zone in multiple phases to integrate the two. This synergy will propel us into new markets, and accelerate our growth."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.