Leadership

The Price, Pace, Profit Plot Thickens In A Murky Outlook

Here's why builders are hoping existing home inventory trends continue upward -- for at least the rest of 2021.

An uptick in for-sale existing home inventory comes as an answer to new-construction homebuilders' prayers.

This might sound counterintuitive.

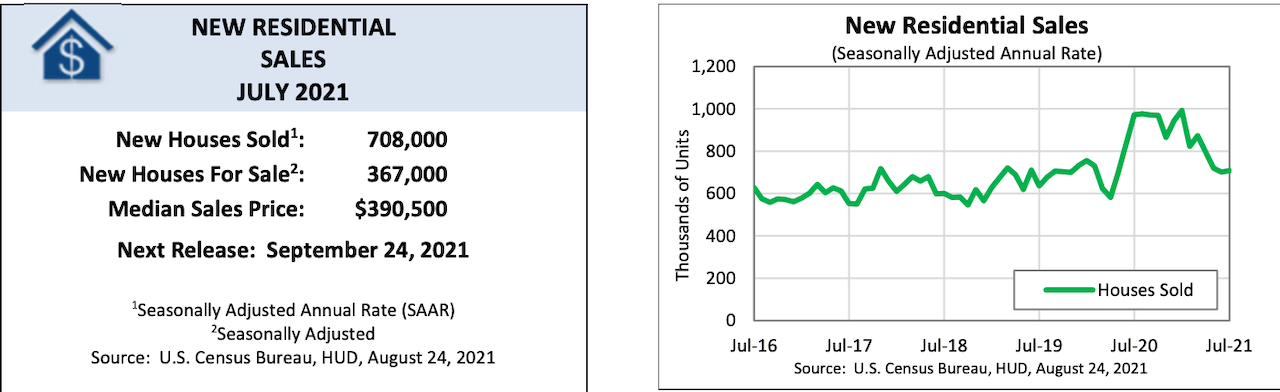

New home sales – builders' key performance indicator – are sending mixed signals on price, pace, and profit prospects: they're down in July, 27.2% year-over-year in volume, and pricing-in at a median of $390,000, with a slightly-above normal 6.2 months' supply of new homes for sale.

Typically, tight resale supply would be good news for builders. But not when they can't sell, because they're challenged to build what they've already sold.

Besieged by materials price spikes and surges, disrupted deliveries to job sites, and elongated construction cycles, many builders look at added supply of resales as a source of relief from having to put off potential customer prospects, or worse, to reprice already-contracted homes to pass along unforeseen input price increases.

Builders set out to delight buyers. Instead, of late, they've been faced frequently with having to manage disappointment, frustration, bad-faith. If inventory were to grow to more normal levels, and if price rate increases were to soften slightly, then builders might be able to better care for the customers who've already ordered, and schedule new prospects based on a backlog they could manage more predictably.

That's why they pray for more resale inventory today.

The increase in inventory is far from fully-baked as a trend, and is sending both signal and noise. Calculated Risk's Bill McBride boils down what to watch and what it means here. At a high-level, McBride notes that current level for-sale inventory, based on Altos Research data, is down 27.3% y-o-y, and down 55% from the same week in August 2019. McBride writes:

A couple of interesting points from 2019: In 2019, inventory bottomed at 814 thousand in February (so inventory is still very low compared to normal levels). And, in 2019, inventory peaked at 972 thousand in early August (an increase of about 19% from the low). So inventory is less than half of what we'd normally expect, however inventory has increased (as a percentage) more than normal.

Key question: Usually inventory peaks in the Summer, and then declines into the Fall. Will inventory follow the normal seasonal pattern, or will inventory continue to increase over the coming months? This will be important to watch for house prices and housing activity.

Altos Research founder Mike Simonsen, one of the industry's closest watchers of for-sale inventory metrics and what they indicate, senses the beginnings of a rotation from a sellers' market toward those looking to buy. He writes:

A return to the new normal in real estate? This week we're seeing real estate inventory continue to climb and demand pull back a bit, with more homes taking price reductions, and fewer immediate sales.

Available inventory of unsold single family homes rose 2.5% this week to 422,000 homes. If you watch the Altos data every week, you might recall that just three weeks ago I said I expected us to top out at 400,000. Inventory has blown past that prediction and continues to climb. Every week, conditions are improving for home buyers.

A few other insights that may support a sense of relief of the mounting pressure of demand – fueled by a Millennial tsunami into single-family living, record-low interest rates, a bull Wall Street boom, and an ongoing health crisis catalyst – against an underbuilt backdrop and a series of demotivators among potential sellers. Until recently, that is.

- One in 20 homesellers is now dropping asking prices, per Redfin's data tracking of a metric that normally runs flat at this time of year. Redfin notes, "this measure has now passed 5%—its highest level since the four-week period ending October 10, 2019."

- The July inventory level increased from 1.23 to 1.32 million units.

Caveats here include an array of "compared to what" considerations:

- Higher inventory levels, are higher than historically low numbers. As National Association of Home Builders economist Fan-Yu Kuo notes, months' supply of resales is 2.6. That's up sequentially, but still massively lower than 3.1 months' supply in 2020, and that number was itself muted by COVID-19-related issues.

- The moving-target of asking-price cuts, albeit up from where it was, comes in a broader context where prices are still tracking upward, and time-on-the-market is still low. "Home prices are still rising and homes are selling very quickly, just slightly slower than before."

The tricky navigation for homebuilders comes as summer pivots to Fall, when 2022 budgeting, forecasts, resource allocations take a stab at matching price, pace, and profit data to land-basis costs, materials and labor inputs, and overheads.

Their fixation right now is on a couple of external factors they have no control of, and a host of operational tactics and tools they can leverage should they need to calibrate their sales-per-community-per-month absorption rates in the face of economic or interest rate headwinds.

Buyers gaining some level of traction in what up to now has been a sellers' rout on the existing home sales front give builders just that little bit of breathing room they might have hoped for to try to bring start-to-completion construction cycles back closer to normal. But COVID-19's delta variant surge has toyed with some plans for a normalization of schedules, and the elongation of building times will likely carry into and past the fourth quarter of 2021.

Again, from a 40,000-foot perspective, these conditions are ripe for mergers and acquisitions, spot business failures, and the high likelihood that consolidation among homebuilding companies – fewer, larger, more geographically dispersed, and deeper scaled players – will grind on through the mid-2020s.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.