Leadership

The Kitchen Table Lens: Builders' Pricing Strategies For 2022

Headline risks of price inflation and longer-haul supply chokeholds notwithstanding, here's how you might frame your pricing strategy for an extended stretch of limbo.

A poem Joy Harjo wrote begins:

The world begins at a kitchen table. No matter what, we must eat to live.

As producer and consumer price benchmark releases suck up oxygen, dominate headlines, and fuel rhetoric, read and think about Harjo's lines, what they mean, and why they matter so much.

You too may be astonished at what these lines tell you about ourselves, our partners, our clients and customers.

Our dreams drink coffee with us as they put their arms around our children. They laugh with us at our poor falling-down selves and as we put ourselves back together once again at the table.

This table has been a house in the rain, an umbrella in the sun.

Today, in earlyish November 2021, which matters more to you?

- That in your finance and budget planning meetings you understand that prices you pay for construction inputs are upwards of 17% higher than they were in earlyish November 2019?

- Or, that at kitchen tables around the nation, families today are bearing the brunt of "core prices" that in October climbed 4.6% from a year earlier, the largest increase since 1991.

Yes, as businesses that need to make money to prosper, neither is less important, and both are equally important.

In March 2009, then Fed Chair Ben Bernanke saw "green shoots" of improvement ahead. In early November 2021, a Fed Chair successor and current U.S. Treasury Secretary Janet Yellen sees a "level off" of inflation in 2022.

That they were, or are, both right is inarguable, no? It's just this matter of timing – when, really, would the green shoots actually become full-grown vegetation? And when, in fact, will what's gathered steam as a full-blown inflationary funnel cloud level off? – that's the rub.

The endgame may be correct. The imprecision – or outright error – of the timing can wreak existential havoc on those monthly bill-paying, budget-planning, financially-disciplined mortals among us trying to manage households or run businesses.

For months running now, the mantra on job sites, among project-level supervisors, and divisional offices, and regional command centers, has been along the lines of "I don't care what it takes, just get it done."

Now, sliding toward year-end, committing to performance deliverables in Q1 and Q2 and beyond for 2022, and fully engaged in the crazy tug-of-war process that is budget planning, resource requirements, and, ultimately, allocations, volatile, upward-trending, and wildly unpredictable price markers could hardly come at a more challenging time.

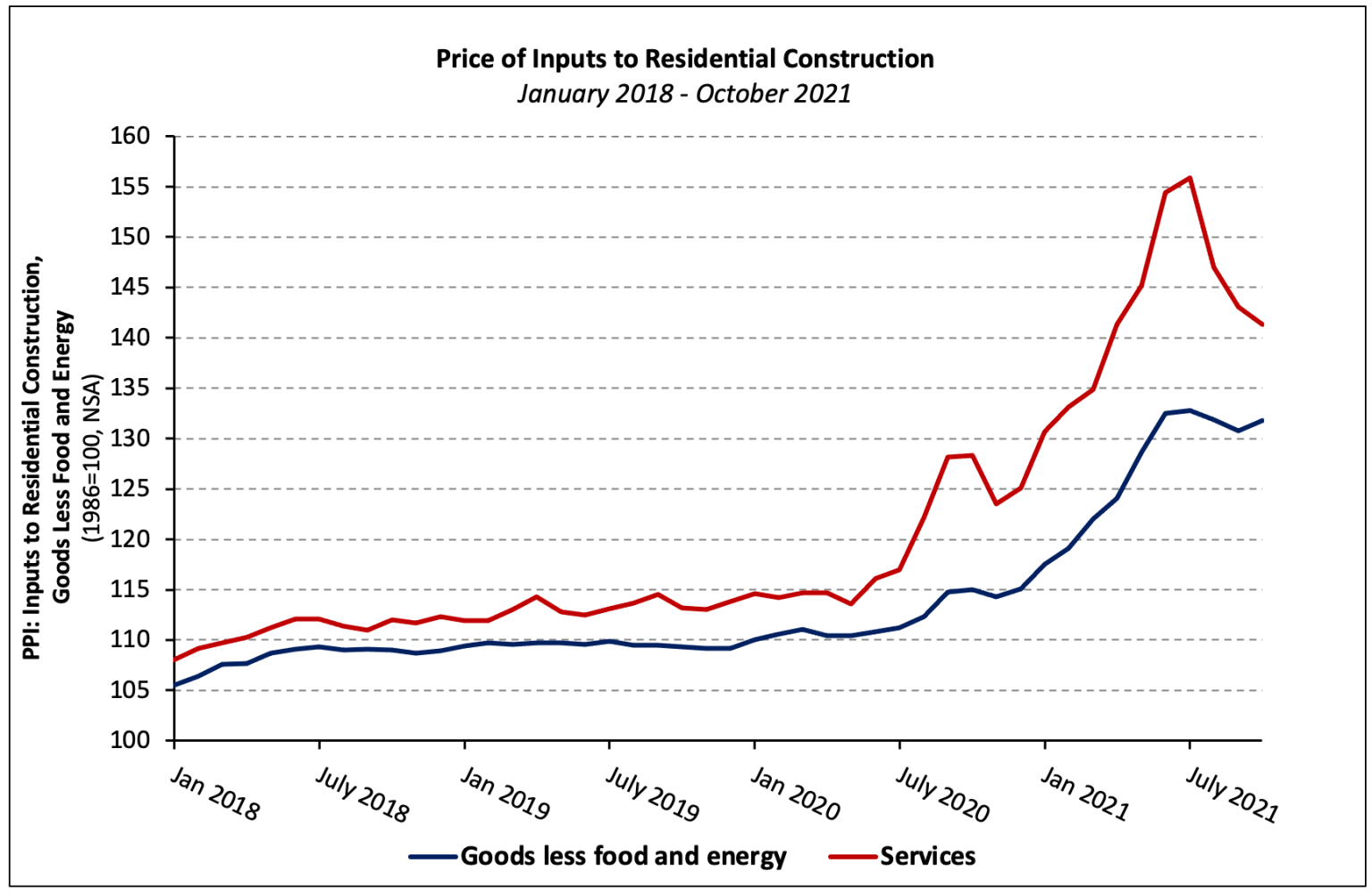

Per National Association of Home Builders director of Tax and Trade Policy analysis Paul Logan, October producer price moving-target ratios for homebuilding direct costs paint a picture of prices gone hog wild.

The price of all goods inputs to residential construction (including energy) has risen 14.5% thus far in 2021, climbing more than eight times faster than over the first 10 months of 2020. The year-to-date increase is double that of the previous year-to-date October increase (+7.1% in 2008).

Hope and logic characterize both the direction and steepness of the price curves as anchored in time to the late-stage imbalances of demand pulling and supply struggling with inertial constraint.

Here's how the Federal Reserve Bank of New York chunks out at least part of the issue builders, product manufacturers, distributors, and their ecosystem of partners have grappled with and will continue to need to navigate.

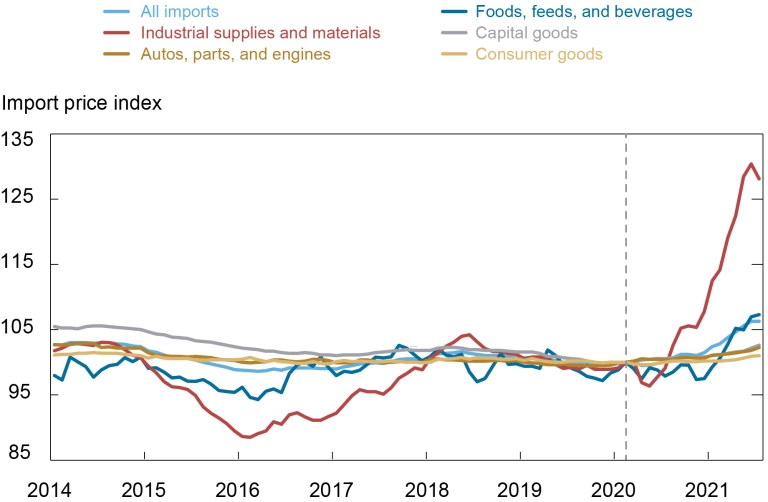

[Here] we highlight how rising prices of imported intermediate inputs, like industrial supplies, can have amplified effects through the U.S. economy by increasing the production cost of goods that rely heavily on these inputs.

Breaking Down Import Prices by Industry

Import prices of industrial supplies and materials have been highly volatile in the recent period, as shown in the chart below, where we divide imported products by their end-use categories. The import price of industrial supplies (red) fell 4 percent with the COVID-19 shutdowns, and was 28 percent higher in July 2021 than its pre-COVID level.

The industrial supplies and materials category comprises intermediate inputs used along the supply chain: paper and paper base stocks; agricultural products and textile supplies; building materials; and unfinished metals, finished metals, and nonmetals for durable goods. The largest price increases within this category have been in unfinished metals for durable goods. Import prices of other end-use categories were far less volatile, with consumer goods prices just 1 percent higher.

These impacts, in this framing, sound abstract. But in each of these commodities, and sectors, and economic chains of raw material, labor, capital, and time there are real people's livelihoods, their workmates, their hours of effort, their anxieties and joy.

In depersonalized constructs, price inflation can act as a cudgel, a pencil sharpener, a reduction in force, a missed guidance, and rant on who's at fault and who should be doing more to stop it.

Whether it's resins or semiconductors or container ships or semi-trailers, or whether it's truck-drivers, loading-dock workers, installers, retail-counter clerks, or drywallers, the consequence of the delta between "just get it done" and "how do we pay for this" is playing out on the business equivalent of the kitchen table.

And it's playing out on households' kitchen tables as well.

How far off, in timing, was Fed Chairman Bernanke's assertion of "green shoots?" How far off is Treasury Secretary Yellen in the expected "level-off" in inflationary pressure and volatility and their impacts?

That matters, but it matters less than what's being resolved, and worried about, and imagined, and dreamed at and around America's actual street-address level kitchen tables.

The single-most significant mitigating business factor in one of the wildest two-year rides for modern homebuilding and development has been the capacity, choice, and determination of people at kitchen tables to invest their financial present and future in the unique utility value of new homes, and absorb the monthly payment increases to do that.

As builders build their 2022 budgets, rising producer prices and land prices and regulatory costs, and other fees will figure into their forecasts.

One can only hope they can also stay in touch with people at their kitchen tables.

Poet Joy Harjo writes:

At this table we sing with joy, with sorrow. We pray of suffering and remorse. We give thanks.

Perhaps the world will end at the kitchen table, while we are laughing and crying, eating of the last sweet bite.

Never lose touch with that.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.