Capital

The Incredible Shrinking Spec Inventory of New Homes

Markers of buying power short-circuiting include a sudden scarcity of below $300k new homes, and a drying up of ready-to-occupy spec inventory. Interest rates had better damned well not go up.

Some things in life happen just like that.

For instance, just like that, new homes selling for less than $300,000 are scarce.

National Association of Home Builders chief economist Rob Dietz points out here that in May, per new home sales estimates from the Census Bureau and HUD that the median price of a new home – $374,400!!!! – gained 18% in value in one year's time.

Just like that.

And just like that, jaw-droppingly high prices are what people continue to pay for a new home just about anywhere if they can get one. What's more, a mere one in four homes carries a price tag of less than $300k, whereas a year ago, 44% of new homes priced in below the $300,0o0 mark.

Rob Dietz writes:

Higher costs have priced out buyers, particularly at the lower end of the market.

There's a strong correlation – if not quite cause-and-effect – relationship between homebuilders' capacity to build spec homes, ready to move-into, and new-home affordability at the lower price levels. When demand and capacity synchronize – which is rare – builders are taking down lots on a cost-efficient, real-time as-needed cadence, and working start-to-completion construction cycles in the same way, keeping the same number of homes finishing construction and ready for sale as their are new orders, new permits being pulled, and new starts.

That's called evenflow, and it's proven across cycles to increase overall velocity, reduce costly variability, and keep production of finished ready-to-own homes with a pre-set package of design finishes and options just ahead of the demand curve.

Of course, with vacant developed land already in short supply before the pandemic, and massive supply chain disruptions gumming up the works during the end of 2020 and now into 2021, designs and hopes for that kind of synchrony went out the window.

Dietz notes this change, just like that, in spec inventory:

Completed ready-to-occupy homes continue to fall as a share of new home inventory. Such homes were just under 24% of inventory a year ago. They are only a little more than 11% of the total in May 2021.

Moreover, to see how sales patterns have changed in a high demand, low supply market — the count of new homes sold that had not started construction is up 76 percent over the last year. The count of new homes sold that are completed and ready to occupy is down 33 percent.

So, just like that – with no immediate relief in sight in the way of eased demand for building materials and products nor massive new tracts of vacant developed lots, zoned and permitted for construction – a decoupling is happening, between at least some measure of what made up homebuyer demand a year ago, and now.

No one can say, just yet what that decoupling means. Only that it's happening, just like that.

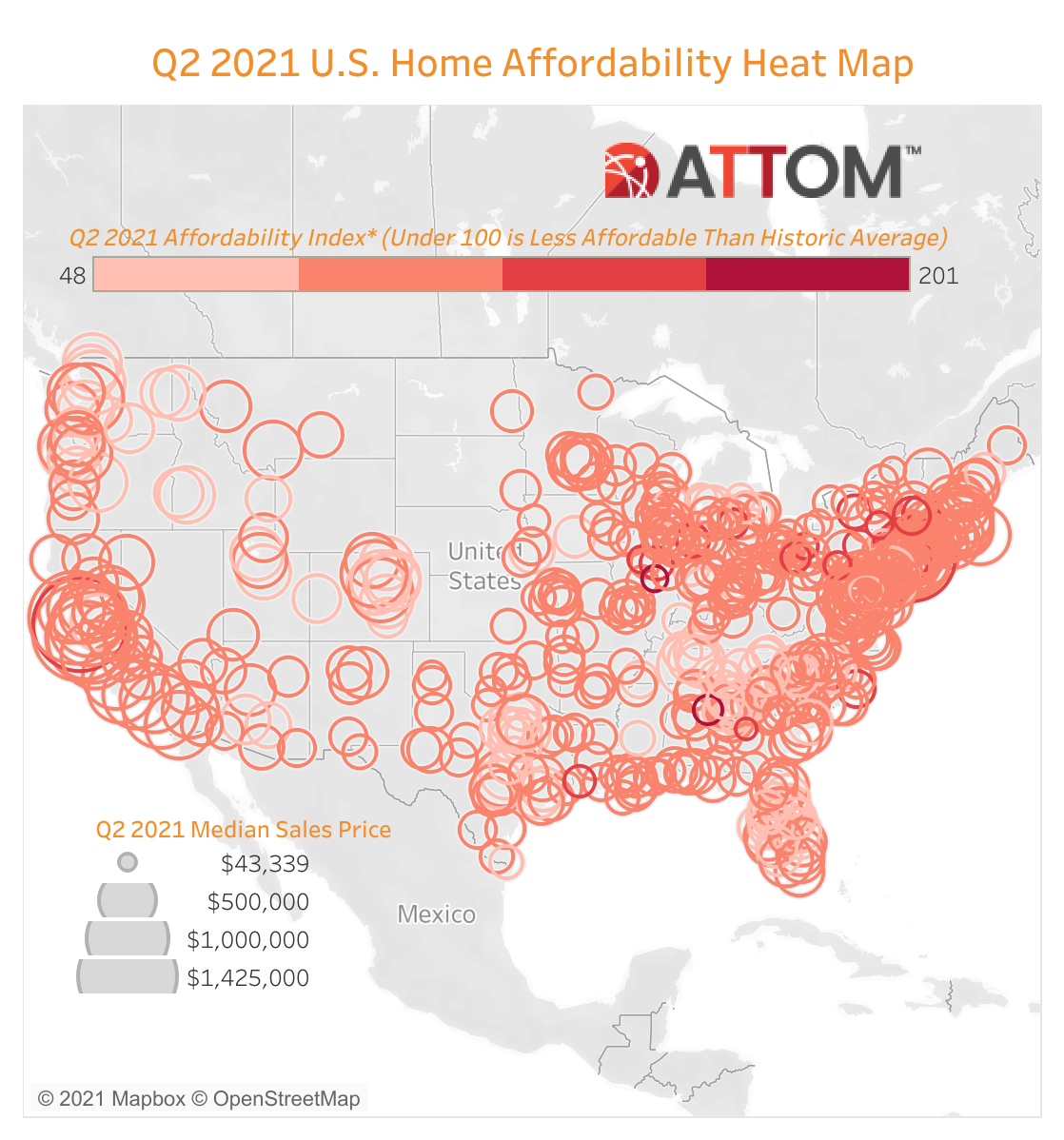

Housing and real estate analytics source ATTOM adds this color to its recent release of the 2nd quarter Home Affordability Report, showing that median home prices of single-family homes and condos ... are less affordable than historical averages in three out of five U.S. counties, as home prices outpace wages.

The latest pattern – home prices still manageable but getting less affordable – has resulted in major ownership costs on the typical home consuming 25.2 percent of the average national wage of $63,986 in the second quarter of this year. That is up from 22.7 percent in the first quarter of 2021 and 22.2 percent in the second quarter of last year, to the highest point since the third quarter of 2008. Still, the latest level is within the 28 percent standard lenders prefer for how much homeowners should spend on mortgage payments, home insurance and property taxes.

Calculated Risk blog meister Bill McBride – not one to over-dramatize data, nor read anomalies as indicative of trends – expresses a premonition of something off in what should be structurally a sound, strong, constructive new-home development and construction market with plenty of headroom.

He writes:

I'd argue house prices are too high based on historical fundamentals. I wouldn't call this a "bubble" because of the lack of both speculation and loose lending (see: Is there a New Housing Bubble?). But I am concerned about house prices.

And there doesn't appear to be any end in sight to the sharp increases in house prices. Goldman Sachs economists' model is projecting double digit price gain in 2021 and 2022... The recent price increases make sense from a supply and demand perspective, but prices do seem too high. And I suppose the frenzy is bothering me.

McBride calls the premonition a "spidey sense tingling." The conundrum comes of the feeling that typical measures and models indicating balances and disequilibria can be read as either assuring or not.

McBride writes of new home inventory levels:

The inventory of completed homes for sale was at 36 thousand in May, just above the record low of 33 thousand in April 2021. That is about 0.6 months of completed supply (just above the record low).

Sixteen or 17 days of spec inventory. Wow.

Just like that, what looked like deep, demographically-driven, capable and motivated demand could look sketchy if the income and earnings outlooks keep losing ground on the price spiral.

Want to know how hard it is to get house prices to come down?

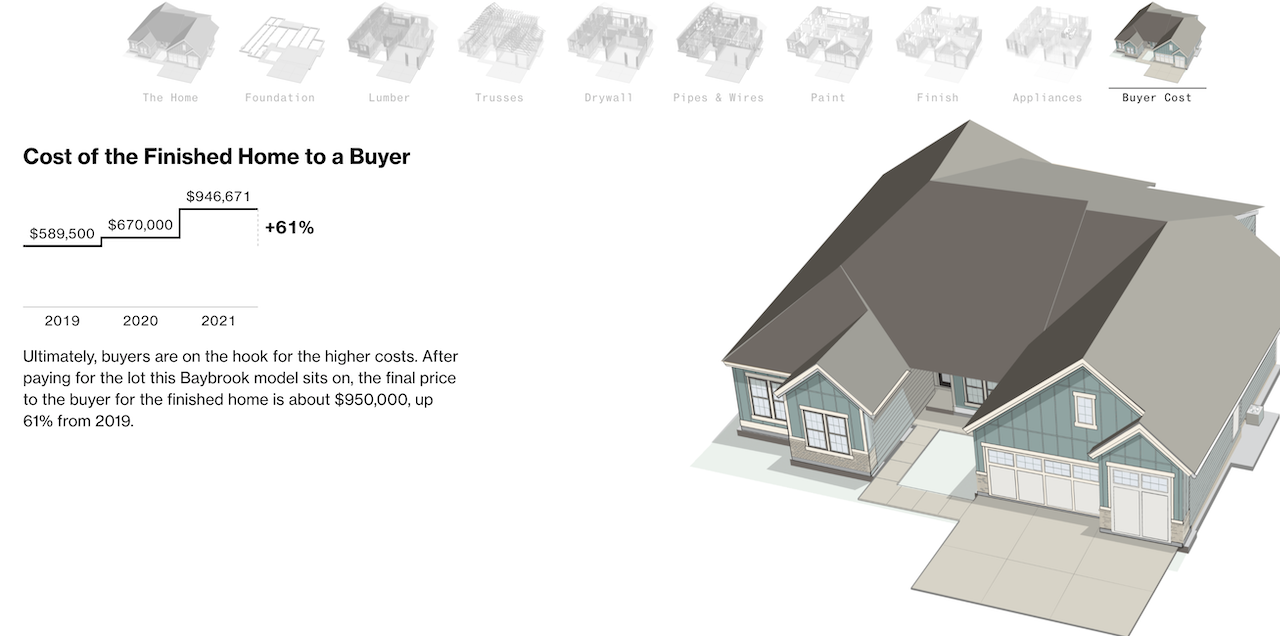

Have a look at a fascinating breakdown of the trainwreck that is real-time input cost havoc playing out as builders drive completions through disrupted supply chains.

Bloomberg correspondents Marcy Nicholson, Dave Merrill, and Cedric Sam were able to get Boise, ID-based Tradewinds General Contracting in the Avimor Community to open the kimono on direct costs in real-time flux.

Just like that, we're in an apples and oranges housing economy. Comparisons to past cycles, dynamics, determining forces, who wins, who loses, who goes away, start to feel like comparing apples to oranges.

Just like that, the decoupling of what can be offered and those whose dreams were barely in reach a year ago, but are now priced out of the market, could mean cause for concern is well-warranted.