Marketing & Sales

Confident? Depends Whether You're A Seller Or Buyer In A Frothy Market

Sellers -- whether it's a new home or a resale -- are confident they're in the driver's seat. Buyer sentiment, however, shows signs of wear, tear, and fear of not having what it takes. Mind the gap.

Builders may have a helluva time building these days, but that's not stopping more than four out of five of them from believing things are improving these days when it comes to selling what they can build.

Sellers of any place one could call home are, by and large, giddy. Partly because they're so few and far between; partly because of millennial biological clock-ticking, personal-identity-statement, fear-of-missing-out demographic absolute numbers; partly because of the Uncle Sam punchbowl; and partly because, now, inflation risk – piggy-backing pandemic panic -- makes real estate owner a safe, sound bet in a world of price-wackiness.

And, importantly, partly because "buyers" of homes includes scores of capital flush investment giants who're betting on burgeoning build-to-rent empires as silver bullets in a need-for-yield investment environment.

Essentially, what builders, sellers, even build-to-rent gold-rushers are wagering is a massively tilted playing field, a landslide of consumers with money in their pockets and just a few options open on getting to the destination – sanctuary, peace-of-mind, safety, privacy, space – they want to be in as a dicey world outside sputters and pops toward balance.

The data makes these bets – including a wager the tilted-playing field effect will continue – evident.

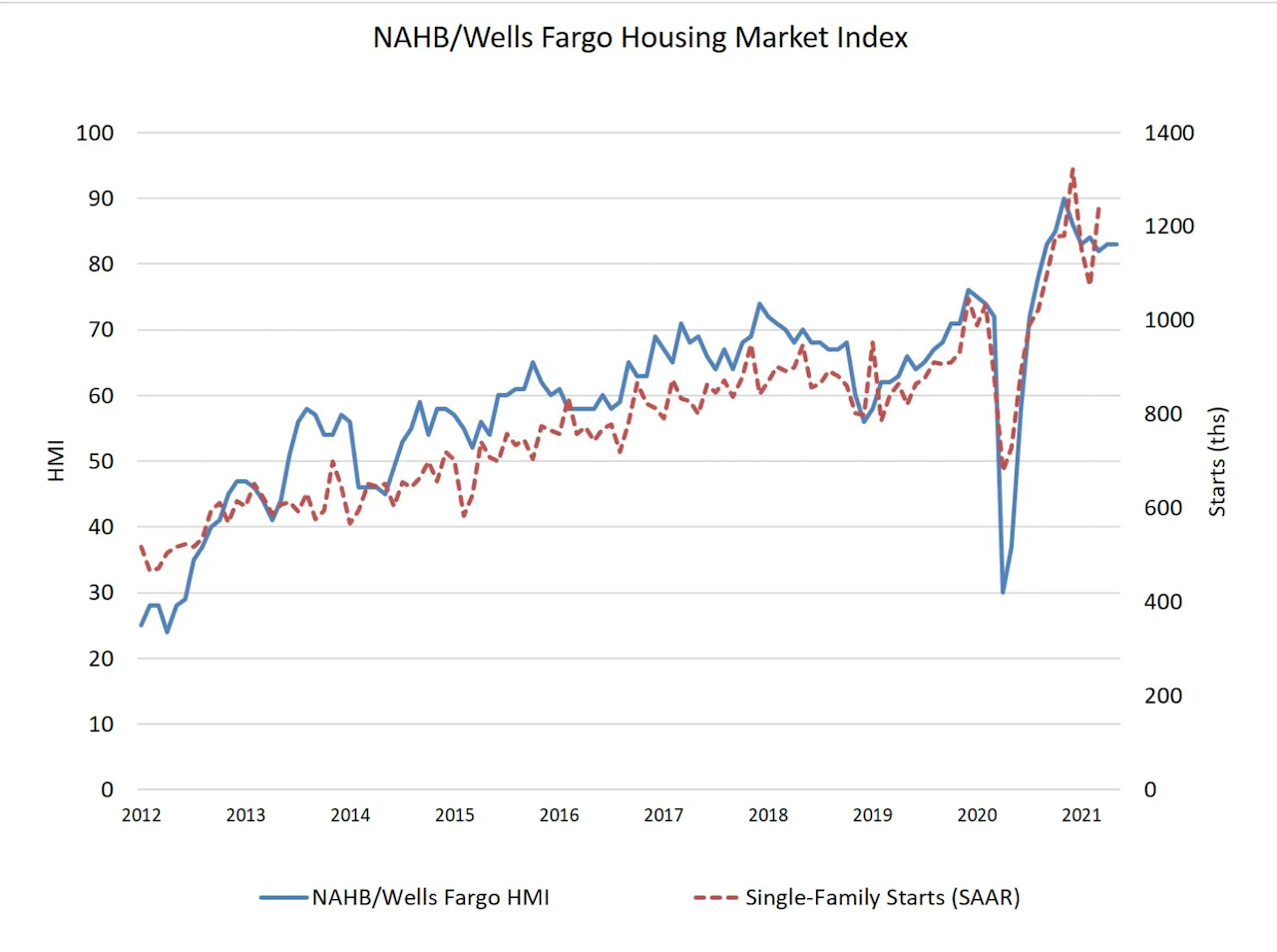

Builder confidence held stable in May, despite growing concerns over the price and availability of most building materials, including lumber. The latest National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) shows that builder confidence in the market for newly built single-family homes is 83 in May, unchanged from April.

Simply, an overwhelming majority of homebuilding company executives responding to the NAHB's monthly questionnaire believe that both current conditions and those within a horizon of 6 months are strongly positive. A blip of an increase, moreover, occurred in expectations through almost the end of 2021.

Gallup data – from a sweeping national household sample base – would seem to back up builder sentiment, with a rousing seven-out-of-10 respondents signalling belief that sellers remain in the driver's seat.

Seventy-one percent of U.S. adults predict the average price of houses in their area will increase over the next year. The current results stand in sharp contrast to attitudes in April 2020, amid mounting economic uncertainty at the start of the coronavirus pandemic, when just 40% predicted a rise in home values.

Until last year, majorities had expected home prices to rise each year since 2013. The current 71% is technically the highest in Gallup's trend, though not statistically different from the 70% measured in 2005.

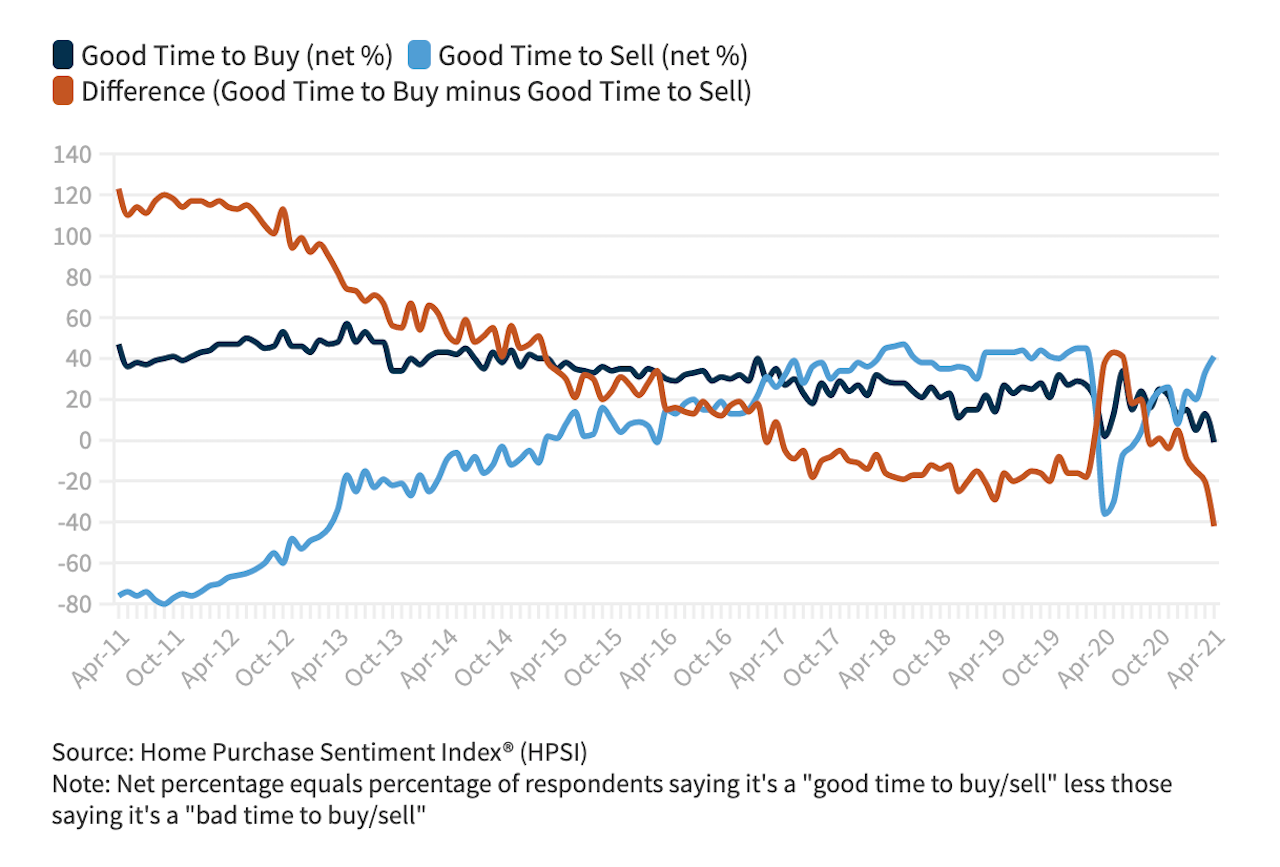

Meanwhile, Fannie Mae's April Sentiment Index also punctuates a heady sense of optimism among sellers that the moment is theirs, but here's where the caveats and notes of worry start to declare themselves.

Seller confidence notwithstanding, Fannie Mae chief economist Doug Duncan notes:

“Consumer sentiment toward buying homes reached the lowest level in our survey’s ten-year history; unsurprisingly, respondents overwhelmingly cited the lack of supply and high home prices as primary reasons for their pessimism. The decrease in homebuying sentiment likely indicates that some consumers, potentially flush with savings – perhaps boosted in part by stimulus payments – may be attempting, but failing, to buy a home due to heightened competition for relatively few listed homes. Notably, consumers in the household income range of $50,000 to $100,000, a range inclusive of the Census Bureau’s reported median household income level, showed a particularly large decrease in overall housing sentiment, and we know that the housing market serving the affordable segment has been particularly competitive.”

Structural demand – both among financial enterprises looking to corner single-family-for-rent properties for their portfolios and among individual buyers playing out their life-stage household preferences – can go so far on the fuel of fundamentals, job and income growth.

Then, the question of the Uncle Sam largesse figures into the calculus. What happens when and if that enormous tailwind shifts direction?

Already, signals of wobbliness on payment power are clear. "Affordability," in the NAHB Housing Opportunity Index sense of the term, weakened.

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI), 63.1 percent of new and existing homes sold between the beginning of January and end of March were affordable to families earning the U.S. median income of $79,900. This is slightly down from the 63.3 percent of homes sold in the fourth quarter of 2020 that were affordable to households earning the median income of $78,500.

Every interest rate increment, every materials price spike, every land-basis point pass-through becomes a stress test to tolerances still unknown. Builders would rather those tolerances remain untested, unknown. But, that's not sustainable.

That's when strategic and management rigor – among investors, homebuilding enterprises, and their array of business partners – play a role. Not when it happens to shift, mind you, but now.

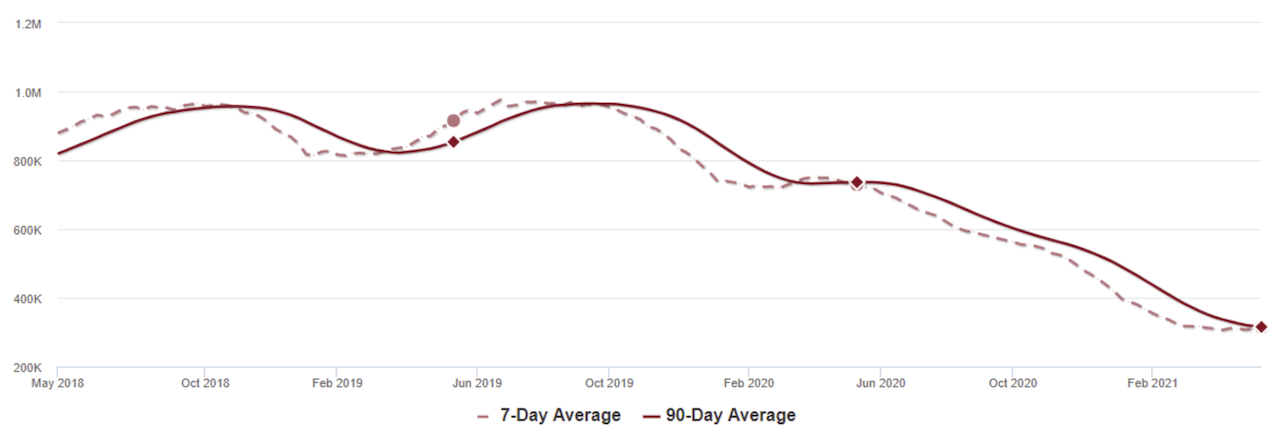

Calculated Risk's Bill McBride calls for vigilance on inventory, and notes that an inflection on listed-for-sale inventory may have occurred in the past few months, a potential tipping point in the sellers' market.

Mathematically, if standing inventory has bottomed it means that directionally more inventory in the market is expected. This can impact pricing, time on the market, and margins for builders.

The strategic and management issue for homebuilding enterprises is recognizing and solving for prospective buyers' means and behaviors in a homesales environment whose dynamics and complexion evolves in the months ahead.

Listening for signals, not noise, will be a critical differentiator for winners versus losers in a timeframe where builders don't want to blow their once-in-a-generation opportunity to turn a rising tide of would-be homebuyers into residents in their new-home communities for a decade to come.

Here's timely sage advice from "Thinking Fast And Slow" author Daniel Kahneman on consumer market signals versus all the noise.

Once you become aware of noise, you can look for ways to reduce it. For instance, independent judgments from a number of people can be averaged (a frequent practice in forecasting). Guidelines, such as those often used in medicine, can help professionals reach better and more uniform decisions. As studies of hiring practices have consistently shown, imposing structure and discipline in interviews and other forms of assessment tends to improve judgments of job candidates.

No noise-reduction techniques will be deployed, however, if we do not first recognize the existence of noise. Noise is too often neglected. But it is a serious issue that results in frequent error and rampant injustice. Organizations and institutions, public and private, will make better decisions if they take noise seriously.