Technology

The Builders' Cliff: Risk, Capability, And Culture

We reframe real estate, construction, and distribution's labor crisis as a call to action for a community pivot to a culture of care, equity, constant improvement, and dynamism.

In all its raw, nakedness, here is the matter.

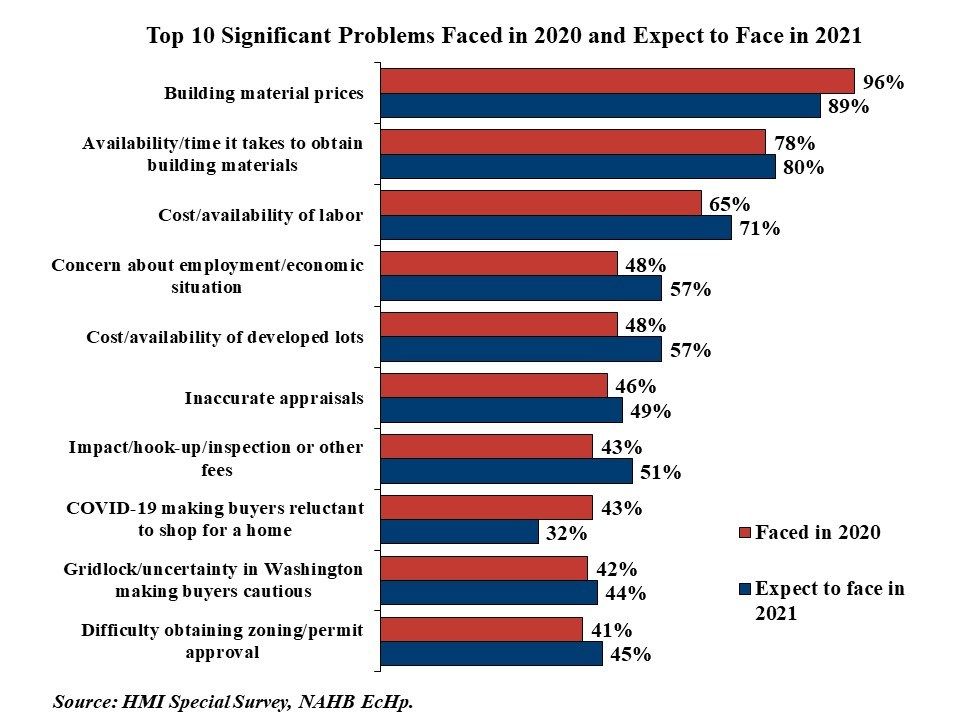

Builders responding to an annual National Association of Home Builders survey of challenges cite building materials prices and the stress on securing materials and products flow to sites as their No. 1 and No. 2 worries for 2021. And well they might. Reliable access to critical path structural materials, systems, and finished product supplies is an all-out rout.

As risks to business go, the multivariate shock to the channel is a serious, potentially crippling issue – for a finite, if indefinite duration, probably through the summer and into the Fall of 2021.

Then, as ever, the throes of new challenges will rise to take the place of this current, pervasive, budget-buster phenomenon. The crisis of the moment will be lot supply; or it will be interest rate increases squeezing out would-be customers by pushing monthly payments out of their reach; or it will be the economy and sentiment showing signs of wear and tear, or the like.

Still, all of these issues nest – in The Builder's Daily's humble view – in one granddaddy of all builders' pain-points: Capability.

Fact is, no single one of this litany of pain-points – lots, lending, materials, stress to operations, consumer care, even financial fitness through thick and thin – is unsolvable, as long as the right people are energized, engaged, and activated to chase down solutions. That calls for a cultural transformation.

This is a journey, and we resolve that The Builder's Daily is cut out for it. Work that Building Talent Foundation CEO Branka Minic and her team started about 14 months ago began the most critically important leg of the journey: Less talk, more action.

Earlier we wrote of Minic:

Her focus is on the mechanical moving parts and tedious details of construction labor’s supply and demand curve. Minic, after 16 years at Manpower Inc. and her own human resources and placement consultancies, stood as a revered expert in creating linkages where there had been none between employers in technology and IT and elusive talent pools. In industries where mismatches defined a wedge between need and opportunity, she designed the ecosystem of influencers, trainers, recruiters, placement specialists, on-the-job mentors, and—all important—untapped universes, often hiding in plain sight, of capable, hungry individuals.

A barrier to builders' initiatives to improve access to skilled and talented people across the building life-cycle is the workaday relationship with such people as "labor." None too nuanced in this term is an economic means-of-production quantity that matches task completion to cost.

Minic and her team at BTF get that, and this month introduced Jobs To Build, a careers platform designed to connect job seekers and employers across the building trades in order to better align supply and demand for talent in the US residential construction industry.

Here's where a cultural opportunity lies. A pivot to a culture of capability, away from a business environment that regards its workforce to a large extent as a nameless, faceless, roving horde of eminently replaceable commodified cost-units, is not just an opportunity. It's an imperative.

Building's Or-Else Moment

Here are two helically-intertwined realities that challenge housing’s present and future.

They’re astonishing, especially insofar as the U.S. economy and the market-rate housing economy have been on a historically stable growth trajectory. This past year’s disruption due to the pandemic only makes these two realities matter more.

- The US is currently producing three-quarters more households “priced-out” of new construction and development than those able to access and attain new homes.

- The US is also currently producing 5 times more retirees and industry-changers from construction careers than new entrants into the fields related to residential construction.

In the coming weeks, our data storytelling construct will addresses a chronically leading risk factor to builders’ plans, labor cost predictability (especially since they have little visibility into materials unit costs).

Our storytelling leads to a conclusion: the cycle-proof construction trade career, and a community-as-solution blitz to engage and activate 500,000 new associates into construction’s human skills pool by 2025, and to launch “re-skilling” of America’s current construction workforce, for both small business skills and an increasingly industrialized construction future.

What is the Builders Cliff?

Building’s skilled-labor capacity constraint, without doubt, confronts nearly every person in every enterprise, nook, and cranny of the complex of residential construction and real estate, a multi-trillion-dollar economic bulwark that, alone, accounts for about 6% of the nation’s GDP.

Shortages, walk-offs, scheduling break-downs and delays, quality problems, job-cost spikes and unpredictability, and a spooling sense that things are only going to get worse have made building’s ever-shrinking skilled workforce a top-3 pain-point in the minds of people whose livelihoods stem from making new homes and communities.

The crisis is a bane, not just as a business risk to firms and their ability to deliver finished homes to customers at a promised price and completion date, but as a secular wet-blanket, impacting housing affordability, economic and job growth, and societal solutions.

And that’s just the present. But, what about what’s coming?

What’s coming — if housing’s community of business, financial, educational, and local and national policy stakeholders don’t band together for solutions — is a certain mid-term-future calamity-in-the-making.

A builders’ cliff.

A capability collapse.

It will happen as construction’s skills and capability system fail, and it will come accompanied by ever more violent spikes in price volatility, cost inflation, or even structural paralysis, laying siege to housing’s complex system of building lifecycle mechanisms. This occurs in construction when the scarce resources — human, capital, materials and land — to build homes exceeds and then overwhelms the pocketbooks and means that all-but-a-tiny few people able to pay to purchase or rent new homes and apartments.

It will happen when, in a more and more foreseeable future, America’s construction workforce, and/or its capability to produce new homes, shrinks — due to outflows due to age demographics and, at the same time, a lack of occupational appeal to a next generation of workers.

It’s not a question now if a builders’ cliff will happen.

The question is how soon the gap will collapse into an abyss if homebuilding leaders and their partners in the private and public sector fail to act.

And what steps can — or must – be taken now to ward it off, steps that leverage new cultural commitment to rebuild construction’s capability.

These steps are practical, effective, and sustaining. However, they cannot be taken in isolation. They require connections, co-commitment, concerted care and tending. In other words, construction’s capability solution is not simply about engaging a healthy stream of new human associates into the field. Rather, it’s about a culture of capability — where humans, machines, data, and human purpose weave together as a whole solution.

There's no "them vs. us" in such a scenario. It's all about us, and them is us.

We've tapped the deep well of wisdom, experience, and urge to do more among our TBD Dream Team, and you can see from our accompanying piece here, the beginnings of a discovery, requirements, development, engineering, and solutions process we've begun at TBD today.

How It Works

It’s said that for every newcomer to one of homebuilding’s key skilled construction trades, five experienced, highly qualified, site-trained tradesmen and women retire out of the field.

The squeeze – such as we are experiencing in the imbalance of skilled construction workforce members, compared with increasing demand — today causes cost-inflation, inefficiency, and a loss of predictability in timing the delivery of new homes.

But, when that same trend accelerates, logarithmically, and you, further add other shocks and stresses to the trend — (immigration outflows impact to workforce, and impact of re-flow into other fields, and reduced flow into building).

The scenario gets darker, faster.

Risk becomes an almost certain threat. A systemic freefall in capacity breaks not only an individual firm’s ability to take-on and complete construction work. It can cripple the entire building sector’s capability at developing, producing, and benefiting from new homes and communities. That affects everybody.

That’s the builders’ cliff.

Our work on The Builder's Daily Capability and Culture project in the coming months is about what every builder, investor, manufacturer, developer, planning official, distributor, and community needs to know about the builders’ cliff.

We’ll explore what it means — not just for the big, multi-regional players, but for every builder and every partner everywhere. Why it matters, urgently.

And what each stakeholder, large and small, must do—now—to work to design solutions, at a structural, concerted, intentional level. To wait and hope it works itself out, as it has in housing and economic cycles past, will invite catastrophe.

Signs of the erosion of building’s human capability infrastructure are already evident. Schedules are delayed; prices are spooling upward; unit volumes are muted — even as fundamental demand grows.

Three Key Forces

Demographics is destiny. People patterns — in this case, occupational and career choices — make, shape, and can break marketplaces.

In this case, three concurrent occupational demographic trends have collided.

- Aging out and job-flows to other industries of current workforce

- A prolonged and increasingly anemic stream of incoming entrants into the construction fields.

- A disproportionately impactful loss of capability in the form of the retirement of construction’s most skilled, most experienced, most valued source of mentorship and best practice.

Their confluence turbocharges forces that are driving construction capability toward a point of no return: the builders’ cliff.

To understand the three separate forces that have merged now, it’s important to grasp that, for more than nine out of 10 new homes, it takes about 20 to 25 separate skilled and semi-skilled construction trade crews about 210 days — 467 hours in subcontractors’ labor – from start to completion to prepare the site, pour the foundation, frame the house and complete other rough-trade work such as electrical, plumbing, and mechanicals, and, finally, interior finishes, etc., for a median-sized, 2,300-square-foot new home.

Note that those day counts and hours-of-labor measures reflect not simply the number of people on each of the job sites, but the many varying levels of skills, experience, capability in each of the 25 or so trade crews, from foundation prep to fit-and-finish. Assemblies for each 2,260 square foot home — the national median— involve 20,000 separate parts and pieces, upwards of 600 separate SKUs, and 800-plus rows of detail in bills of materials per house.

A 45-year-old framer, for instance, whose training involved construction education, a multi-year site-based apprenticeship, and a gradual upskilling over the subsequent years, represents far greater capability — 4x-to-10x in performance yardsticks – than a 22-year-old trainee.

To fully grasp the builders’ cliff, it’s essential to look at this hidden key, often buried in the raw occupational data trends: Experienced, site-proven, better-skilled crew members are critical for two reasons.

- One, is that they get more work done per hour, dealing nimbly with conditions, variations, and circumstances that can impact the duration of each set of tasks.

- The other is the work they do is done right, the first time, a necessary factor to achieve velocity in the start-to-completion construction cycle.

So, let’s step back and look at the three occupational demographic forces at work, and why we have entered an inflection point where the three have accelerated toward a point of no return.

The Situation

The first red flag to explore here is the broad brush of the absolute number of construction workforce members, and how that has diminished in the past 15 years. A big shock occurred, of course, with The Great Recession, which plunged home construction into a nuclear winter period, from 2008 to about 2011, and forced more than a third of the industry’s workers and companies into involuntary idleness.

The 2017 American Community Survey shows that 10.3 million workers were employed in the construction industry in 2017. This is still 0.9 million fewer jobs than in 2006, at the peak of the housing boom.

- What happened to that almost 1 million workers (streams of workers flowed from US, across the border, and flowed from small entrepreneurial companies to Home Depot & Lowes, etc.)?

- Why, after a decade of cyclical recovery, momentum in housing activity, and apparently growing demand, has construction’s workforce failed to replenish and activate as opportunities have so obviously expanded in the U.S. homebuilding marketplace?

- And critically, why is that 900,000 “deficit” in skilled workers—as crippling a constraint it is in today’s highly active housing construction market—likely to pitch headlong to a point of no return in construction’s human capital pool?

In the weeks ahead we'll look at a timeline of residential construction’s workforce pool, dating back to key stresses to housing’s capability stream, and model it into the near-, mid-term, and 2030 future. Well before that year, construction’s capability will be showing signs of systemic failure.

- Starting in the second quarter of 2007, and ending in the first quarter of 2011—roughly the duration of housing’s Great Recession — the construction workforce experienced a shattering loss of 2.33 million jobs for its workers.

- In all of the calendar quarters since — 2nd quarter 2011 through 1st quarter 2020 — housings steady recovery has fallen short in terms of sparking headcount expansion among construction crews. Just 1.92 million people have been added to payrolls in construction during that 9-year period of rebound. What happened to the other 400,000?

- Job-to-job flow data from the Census

- Immigration statistics that show both construction’s reliance on immigrant workers, and at the same time, policy gridlock on “guest worker” visas for construction laborers.

- Data on career and occupational opportunities and openings, vs committed choices… (cite examples of other industry sectors—transportation & trucking, retail, food service, and other fields enduring labor constraint).

- Data on women in building—a hidden-in-plain-sight necessary part of any holistic solution, and the fact that just 1.5% of today’s construction human capital pool is women, currently representing a trickle of new entrants into the field.

The net effect of these events and trends is not only a hollowing out of the absolute number of people available to work on crews to produce housing, but creating a hemorrhage in people skills where building can least afford it—among the ones able to do the most, do the best work, and, potentially, guide more junior workers on both efficiency and quality.

This creates a double-jeopardy effect of the aging-out process. So, a 60-something year-old head-count attrition has effect not only on productivity, but on warranty-call-backs and lost work due to errors, on task completion, on quality assurance, and on overall accountability.

How do we look, across a relatively accelerated time period at the rapid diminishment of experienced/skilled workers, vs the few new people coming in with no experience?

Why does the Builders’ Cliff Matter?

Briefly, homebuilders’ business and viability — like any other business — hinges on their being able to have more money coming in for what they produce and sell than they have going out for expenses.

Now, let’s look at a median-priced home in today’s market as a back-of-the-envelope exercise to understand how today’s labor constraint not only represents a challenge for today’s homebuilding value chain, but leads head-on to a builders’ cliff:

• Median Home Price: $335k

• Builder Margin: $33.5k or 10%

• Finished Lot: $66.25k or 20%

• Building Materials: $110k or 33%

• Labor: $110k or 33%

• Permits & Fees $15,250

Builders’ net margin of 10% is at risk when activities and costs that separate their pre-investment of $66K on a home site go awry — cost more than expected – creating a margin squeeze.

Now, if we zero in on the third of this process attributable to “labor” input costs, we see where a great deal of risk in the workstream lives. The net productivity —measured by how much value and revenue each laborer generates varies wildly, based on schedule tempo, proficiency and quality, and expense, all highly fungible numeric values. Some geographies have more stresses and shocks to their accessible skilled labor pool than others.

Risks to builders’ business plans pile higher with each increment of change of variability. Shrinking pool of workers means more available work per worker, higher prices, diminishing quality, greater number of mistakes, and increased call-backs and warranty costs.

This impact at the firm level multiplies logarithmically, and ultimately, embraces an entire multi-industry ecosystem of directly and indirectly affected stakeholders.

Our plan at The Builder's Daily is to thoroughly map this ecosystem, discover its true economic reach, and clarify construction’s capability challenge in a way that meaningfully awakens and empowers a full-circle of stakeholders.

We're here. There's a job to do. We'll look to our Dreamers' collective vision and courage, and to our budding community for direct, inclusive, and effective paths from words into action.

MORE IN Technology

AI Isn’t Optional: Marc Minor’s Call To Homebuilding Leaders

At The Builder’s Daily Focus on Excellence Summit, Higharc CEO Marc Minor urged homebuilding executives to do two hard things at once: run lean—and build the muscles for continuous innovation through AI.

HistoryMaker Homes Reinvents Itself From The Data Up

Chief Digital Officer Ty Brewer’s digital transformation playbook aims to drive operational unity, accountability, and agility in a turbulent market environment. The Builder's Daily unpacks the process.

Andrin Homes Turns Customer Pain Into Business Culture Shift

Facing the toughest Toronto market in decades, Andrin operationalized a proactive homeowner experience strategy. What started as a service platform became a catalyst for team alignment, trust, and performance.