Leadership

The Big 'Ifs' Homebuilders Face And The 'Thens' They Can Act On

Notes of caution and uncertainty as to which way momentum may turn leaves no doubt as to where residential construction and real estate's leaders should redouble focus: on people — team members and customers.

The English language has 43 words more common than the word "if." Still, let's focus on that one – the 5th most often used conjunction – for its value at a moment throes of uncertainty squeeze so tightly on homebuilders, developers, and their partners as the calendar second quarter kicks off.

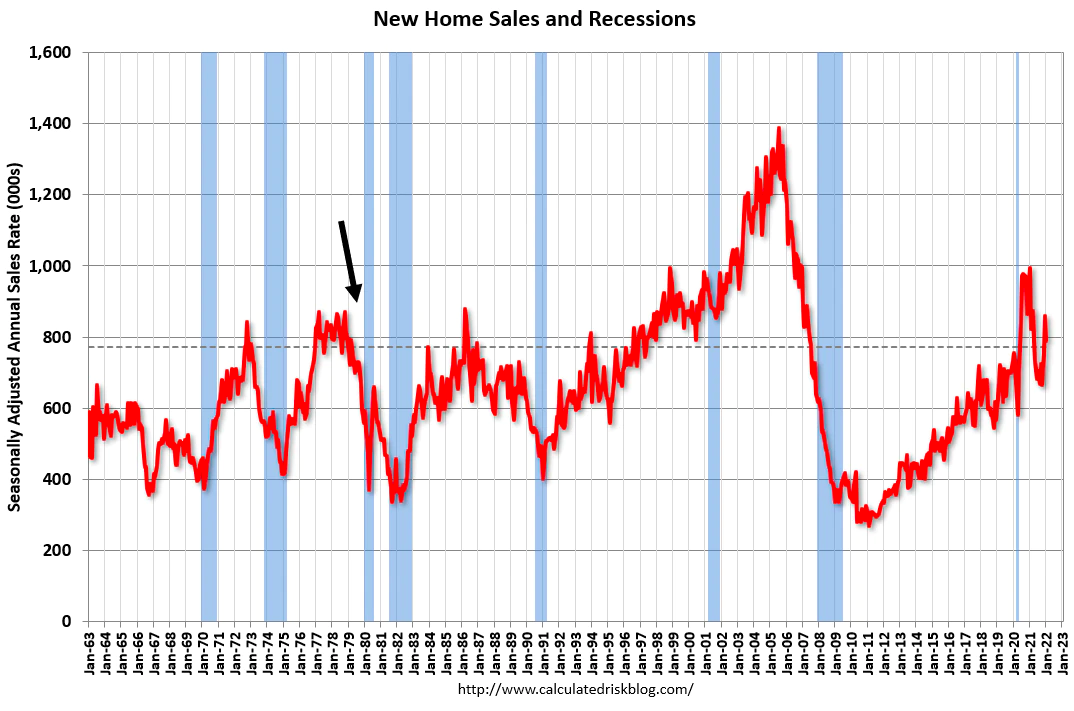

For housing, that squeeze of uncertainty sounds like two big opposing "ifs," so well characterized here by Calculated Risk housing analyst Bill McBride, in a piece he calls "Don't Compare The Current Housing Boom To The Bubble And Bust." Instead, McBride observes, a more appropriate housing and economic trends kinship can be observed during the Paul Volcker Federal Reserve days of the late 1970s and early '80s – when some of us bought our first homes.

McBride concludes his crunch of the charts and graphs this way:

We should expect something similar to the what happened in the late ‘70s - a decline in real house prices seems likely, and I also expect some decline in housing starts and new home sales. With solid lending, nominal prices should be sticky downwards, and I don’t expect national declines in nominal prices.

The size of the declines in new home sales and housing starts will depend on how much inflation is embedded, and therefore how much the Fed will have to raise rates (and reduce their balance sheet) to control inflation. If a large portion of inflation is transitory, the impact on housing will be minimal. However, if the Fed has to raise rates significantly, then we would expect a larger impact.

Did you catch the two "ifs?" [I bolded them to lead the witness]. Broadly, McBride suspects that softening in the market – offset by strong demographics, low unemployment, and strong household balance sheets and loan criteria – could stall new home production and sales for a stretch and cause some pullback on prices.

There are three big "ifs" in this column by Nobel Prize winning economist Paul Krugman, who's wondering aloud "Will Putin Kill the Global Economy?" Two of those "ifs" are here:

If you’re a business leader right now, surely you’re wondering whether it’s smart to stake your company’s future on the assumption that you’ll keep being able to buy what you need from authoritarian regimes. Bringing production back to nations that believe in the rule of law may raise your costs by a few percent, but the price may be worth it for the stability it buys.

If we are about to see a partial retreat from globalization, will that be a bad thing? Wealthy, advanced economies will end up only slightly poorer than they would have been otherwise; Britain managed to keep growing despite the decline in world trade after 1913.

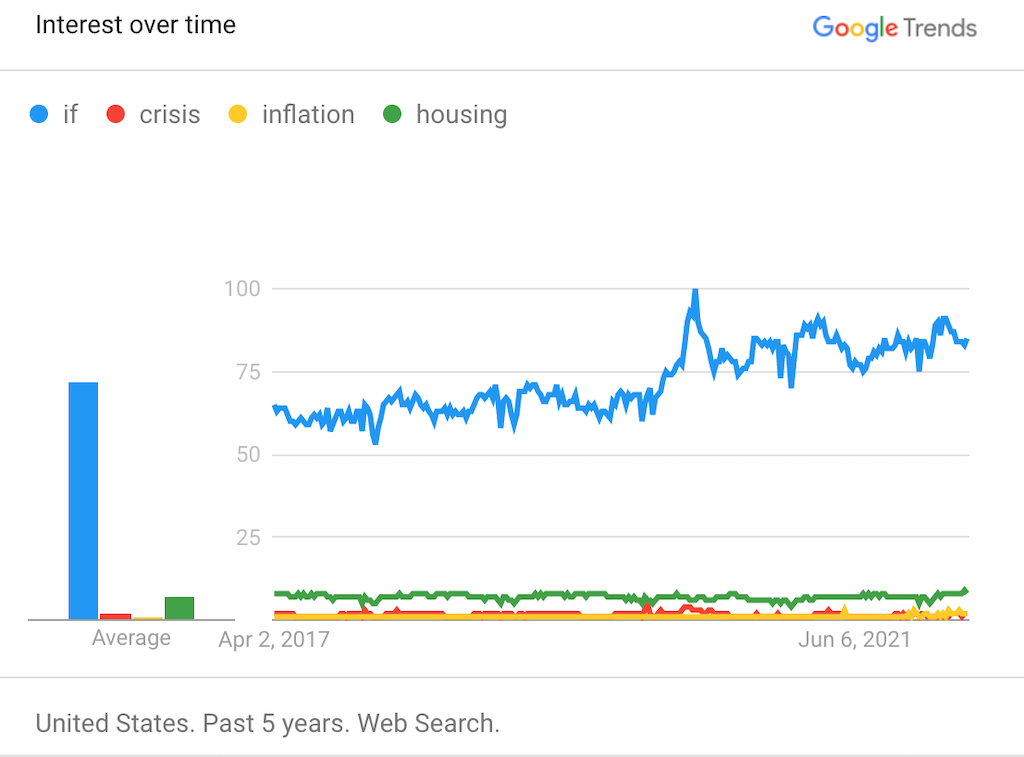

It's fascinating to observe, in Google Trends, how the use of the term "if" has trended upward in searchable content over the past five years. My guess, however, is that just as use of the term appears to crescendo in times of crisis , when doors to possibility both positive and negative seem to be open widest, it will index upward as a three-headed monster – geopolitical turbulence, inflation, interest rates -- rattles people, households, neighborhoods, communities, businesses, governments, and cultures in the months ahead.

Throttled since the imbalances between produce-able supply of new homes and the swelling demand for them kicked up a notch early on in the pandemic in 2020, most homebuilders single-minded focus has been on trying to catch up to and keep pace with buyer demand.

More demand than builders can keep up with eclipses any doubts that there would and will be buyers for anything they can build. Homebuilders see themselves not so differently than manufacturers in the new car industry, similarly stymied two years into the pandemic. One analyst described carmakers' challenge:

Make no mistake, this market is stuck in low gear,” Cox Automotive senior economist Charlie Chesbrough said. Auto makers are dealing with supply-chain disruptions that have pinched inventories, a dynamic that could worsen with the Ukraine war and Covid-19-related shutdowns in China, analysts say.

Catching up to demand – should that be the fervent wish – can happen in more ways than one.

As the chief executive of one of the stronger regional homebuilding operators tells us:

Supply side still filling the concerns bucket to the top."

Where Bill McBride's "ifs" and those of economist Paul Krugman – who'd rather liken the macro economy's current "rhyme scheme" to that of a post World War I period of inflation and deglobalization – come together matters for homebuilders whose greatest aim right now is to produce as many new homes as there are people who want them, and can buy them, and will pay the price builders want for them.

If the 2022 "pool" of qualified and motivated buyers remains undeterred by the disturbances on the inflation, interest rate, and global political risk front, then the challenges focus on how to nurture customers through another stretch of indefinite delays and elongated "buyers' journeys."

However, if shocks and stresses dry that pool up to any degree, the challenges still focus primarily on customers, but more on detecting who they are, where they are, and what it will take to get them to enter that journey with you rather than any other of the many competitors who'll be focused on exactly that.

Big "ifs," and they both come down to learning how your role is markedly more in the vein of a relationship now – versus a purveyor of a consumer durable in a single-point in time – than ever.

Either way, you're in the "delight business." Joseph Michelli's insight is – no ands, ifs, or buts – this means doubling down on people, both your team member and your customers' experience.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.