Capital

The 5th Cycle: Frank Anton On Housing's Law Of Gravity

What-if? The question few housing business stakeholders care to factor into their forecasts right now is what happens when -- not if -- interest rates spike?

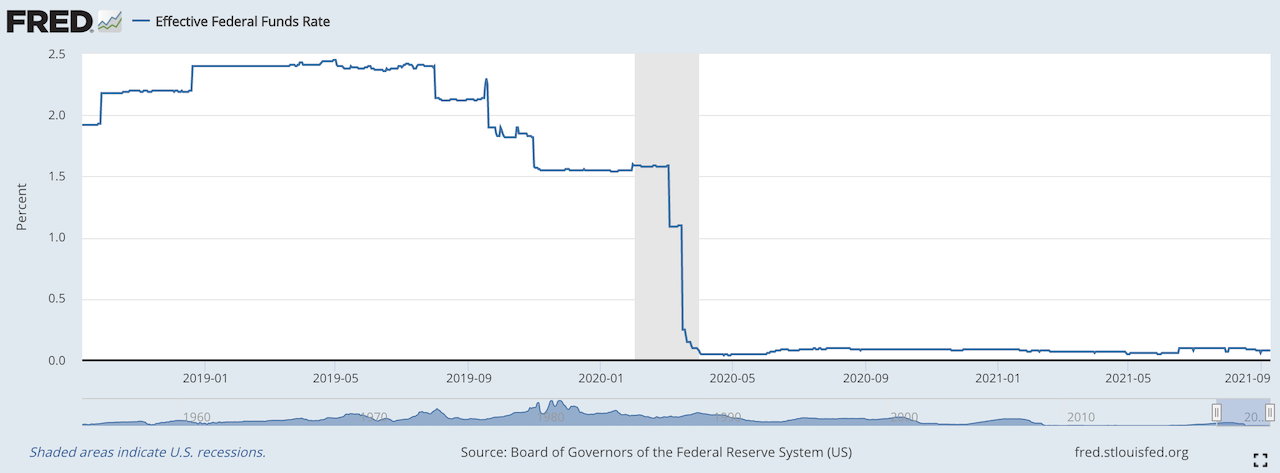

3% (or so)

That’s a number that makes me nervous, because, if it increases, and it seems likely that it will, housing activity could slow from almost frantic to sluggish. Of course that 3% (or so) number represents the current interest rate for a 30-year fixed rate mortgage. It’s never been lower in the last 50 years, and it’s less than half the 50-year average mortgage rate of about 7%.

(And it’s a far cry from the 16% mortgage I had on the

first-time move up house I bought in 1982. Hard to believe, isn’t it?)

There are other good reasons, besides low interest rates for housings’ largely unanticipated and incredible rebound from the near standstill in construction triggered by the first wave of the pandemic in spring of last year. Among the reasons are these:

- The threat of COVID prompted many households to seek safer ground (and a new house ) in either distant suburbs or in destination resort communities (the housing market in Nantucket, where I have a second home, is on fire, in spite of colossal housing price increases).

- American office workers found that working from home was really OK, particularly in a big, new home with comfortable office space. (Long live zoom calls and sweatpants.)

- The largest tranche of millennials, those born between 1989 and 1993, came of home buying age and behaved accordingly. (At long last.)

- The home buying frenzy fed on itself, convincing many potential first-time and move up buyers it was time to buy a house. (Now or never, they thought.)

- The Dow’s run up to one record high after another had many households feeling pretty flush. (So rather a new house than paper profits.)And, hey, mortgage rates were really, really low. Lower in fact than ever in memory. (Get off the sidelines and into the game.)

For all of those understandable reasons buyers adopted a buy-now mindset, and builders responded accordingly. In spite of labor shortages, a gummed distribution network and increased land costs, builders pushed the annual rate of housing starts from around 800,000 last spring units to around 1.6 million units this year. In turn residential investment, which includes residential remodeling as well as new housing construction, rose 27% year over year to a record $800 billion, a full 20% higher than the previous peak in 2006.

But it’s hard for me not to think that this joy ride could be over, particularly if mortgage rates increase. Maybe that’s because I’ve been around for the devastating housing downturns of 1974-1975, 1981-1982, 1991-1992 and, of course, the catastrophic collapse of the industry in 2007-2008, which followed on the heels of what had been the industry’s longest joy ride ever. It lasted for 10 years, not 12 months or so.

Already there are signs of a slowdown. Housing starts are slowing, albeit it modestly, but down is not up. Almost two-thirds of builders report getting pushback about high prices from potential buyers. And in real adjusted-for-inflation terms, housing has never been more expensive.

Low mortgage rates so far have kept buyers in the game. Imagine what could happen if that 3% (or so) mortgage rate was to spike. Roller coaster rides are fun …unless the car goes off the track on the way down.

Join the conversation

MORE IN Capital

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.

Private Capital Strikes Again: Oak Knoll’s $130M Kickstart

A historic Bay Area naval site is being transformed into a master-planned community amid the toughest credit market in years. With banks pumping the brakes, private capital is fueling a critical project in San Francisco's housing crisis.