Marketing & Sales

Take Demand From These Buyers For Granted At Your Peril

Focus these days zeroes in on the crush of capital flooding into residential real estate. However, it would be a mistake to lose track of an equally unpredictable business force-factor: Who will buy?

A wall of worry gets thicker and taller. Investors clamor and throng – to the tune of reported estimates of $30 billion, $40 billion, $60 billion -- into residential real estate's every nook and cranny, seeking yield here because options of finding it elsewhere range from bleak to none.

The spectre of disequilibrium – too much capital, too little capacity, and too many barriers to expanding the capacity, at least for the near future – swells an uneasiness, especially among people who've weathered residential real estate's storms past.

Of which there are enough – although, plenty of folks, especially in the hard-charging "No-Country-For-Old-Men" investment community that came of age in the post-Great Recession run-up era, are galvanizing the pell-mell crush of capital into the space as if the sky's the limit.

Lost in the balance of priorities, a more critical lifeline to future business fitness and resilience: customer focus.

Who will buy?

It's always and forever the more important strategic and operational and design and engineering and pricing and geographic model focal point, eclipsing the ephemeral where-the-capital-will-come-from question nine times out of 10.

It's also the factor most homebuilding firms take most for granted. "Everybody needs a home."

That may be true, but how clearly need it be expressed, that "everybody doesn't need" the $400,000 home you may be selling.

Who will buy?

That's where business fitness kicks in, especially as the Covid pandemic roots into our collective behavior's system of values, references, and ways of living.

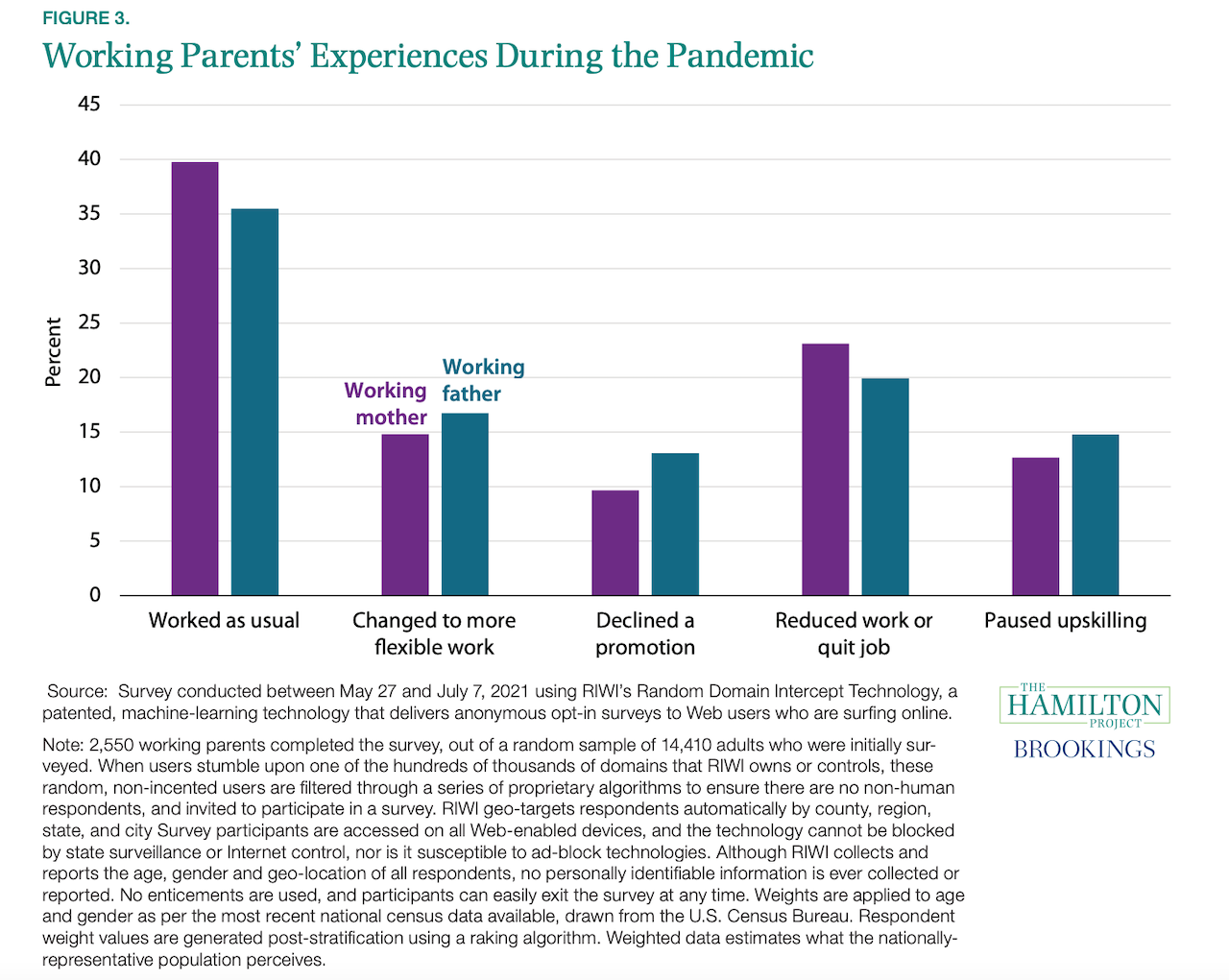

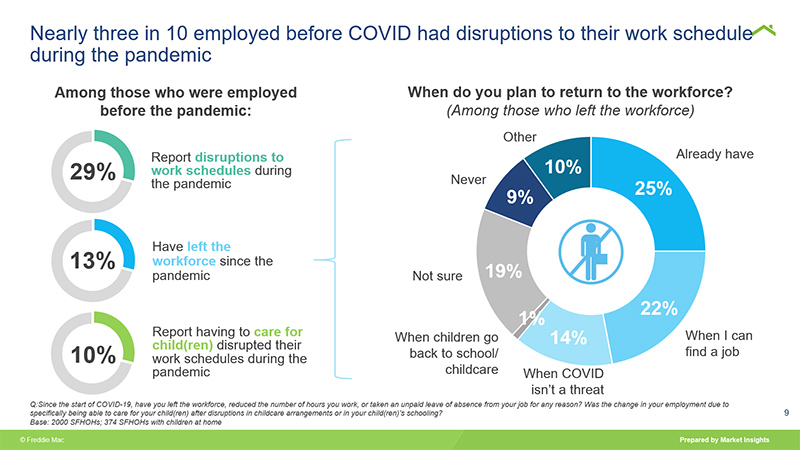

For instance, women – the past two-decade-or-so's wake-up call decision-maker in nine out of 10 home purchase or rental transactions – have entered an economic and societal inflection point, as disrupted household schedules, responsibilities, and finances have weighed more heavily on careers, time-spent, and household preferences.

As the crowding-in of global capital seizes the headlines, this critical reality is likely to be an underappreciated force-factor in the years ahead. A new or next-normal will work itself through transitory blips of reflex toward sustaining trends.

Who will buy?

Women have borne the brunt of job loss from the very first days of the pandemic (Stevenson 2020). That is because women, particularly minority women, are more likely to be in positions that require in-person work (Gould and Shierholz 2020). At the start of the pandemic, women held the majority of nonfarm payroll jobs, a milestone that they had reached in December 2019. Women’s labor force participation had risen both absolutely and relative to that of men in the years before the pandemic. Part of this growth was driven by mothers, whose employment reached a peak in 2019. Mothers in 2020 were older, with more work experience, and more education, potentially shaping their response to the pandemic-induced recession compared to previous recessions."

Who will buy?

Our [McKinsey] analysis shows that women’s jobs are 1.8 times more vulnerable to this crisis than men’s jobs: Women make up 39% of global employment but account for 54% of overall job losses as of May 2020. At the same time, the burden of unpaid care, which has risen in the pandemic, falls disproportionately on women.

McKinsey research suggests a veritable "lost-decade" ahead – a trade-off of $1 trillion in lost global GDP versus a potential opportunity to gain $13 trillion – if action is taken to address gender equality and rebalance some of the lost equilibrium in the wake of Covid.

Who will buy?

Many women had their work situation disrupted during the pandemic. Among those that dropped out of the workforce, a staggering 75% have not yet returned. Black and Hispanic women more frequently struggle to provide for their household and fear they will not recover financially in the next year — if ever. Generation X and younger respondents also struggle financially and feel stressed about the future."

Net, net, Freddie Mac research finds, three out of five single female heads of households conclude that homeownership has flitted from dream to non-reality.

Again, women drive nine out of 10 home purchase decisions. So, who will buy becomes the more important question. The specter for operators, strategic players in homebuilding, development, and residential investment may seem to be the glut of capital pouring willy-nilly into the space. The more profound challenge is not that supply of capital; it's the demand from residential investment's principle decision-maker.

Join the conversation

MORE IN Marketing & Sales

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.

Bad Data Bleeds Homebuilder Profits —Time to Stop the Loss

Hidden errors, fragmented systems, and outdated processes are eating into homebuilder margins. Industry experts reveal how better data can save time, cut costs, and boost profitability.