Capital

Starts, Permits Data Underline Strategic Crossroads For Builders

With housing starts and permits in flux, the stakes for homebuilding leaders are mounting fast. As we ramp up to Spring Selling, this analysis explores a critical question: How much spec is too much in any given market?

The U.S. Census Bureau’s December 2024 housing starts and permits release presented a mixed bag of signals for homebuilders navigating an increasingly complex economic and policy environment. Headline figures suggest resilience, yet deeper scrutiny reveals points of concern that underscore the precarious balancing act facing industry leaders. This analysis unpacks the data, interprets its implications, and explores strategic pathways for builders to sustain growth amidst uncertainty and risk.

Headline Insights from December Data

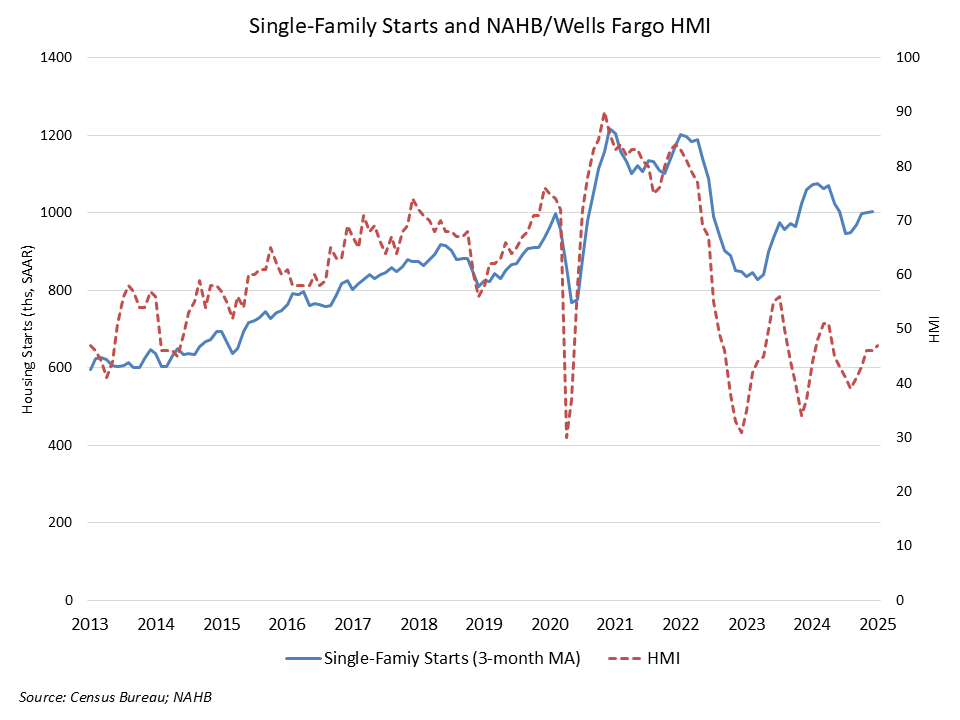

Housing starts surged 15.8% month-over-month to a seasonally adjusted annual rate (SAAR) of 1.499 million units in December 2024, driven primarily by a sharp 61.5% increase in multifamily starts. Single-family starts rose a modest 3.3% to a SAAR of 1.05 million units. This marked a positive close to a year characterized by fluctuations and persistent headwinds, including high mortgage rates and elevated financing costs.

Meanwhile, building permits, a forward-looking indicator, fell 0.7% month over month to a SAAR of 1.483 million units, with single-family permits up 1.6% and multifamily permits down 5.0%. For the year, total housing starts declined 3.9% compared to 2023, while single-family starts showed a promising 6.6% annual increase, highlighting the relative stability of the single-family sector amid multifamily softness.

The Signal Beneath the Noise

At first glance, the data reinforces industry optimism, particularly for single-family construction. However, a closer look at underlying metrics reveals critical challenges:

Elevated Speculative Inventory:

- According to Wolfe Research analyst Trevor Allinson, single-family starts have remained stubbornly above the 1 million unit threshold despite permits averaging below that level for nearly two years. This disconnect suggests builders may be “ahead of their skis” in certain markets, risking oversupply and potential price declines.

- The South and West regions, where speculative activity has been particularly robust, could see localized “air pockets” of stagnating sales. This could potentially trigger a cascading effect of price reductions as buyers grow wary of overpaying.

Pressure on Margins for Private Builders:

- Publicly traded builders, with diversified revenue streams and access to capital markets, are better positioned to weather potential downturns. In contrast, private builders—many reliant on personally guaranteed loans—face heightened vulnerability. Rising interest rates and shrinking profit margins could severely restrict their ability to secure future financing, threatening their operational sustainability.

Shifting Multifamily Dynamics:

- Although multifamily starts were buoyed by a temporary rebound, they remain in a broader decline, down 18.8% year over year in 2024. This sector’s challenges—including overbuilt markets and declining rent growth—could exacerbate financial strain as large numbers of units under construction reach completion in 2025.

Expert Perspectives

NAHB Chief Economist Robert Dietz

Dietz highlights ongoing demand-driven strength in single-family construction, citing persistent housing shortages and solid economic conditions as drivers. However, he acknowledges headwinds such as high mortgage rates and limited lot availability. Dietz’s forecast of modest growth in 2025 assumes continued resilience in the single-family sector but underscores the need for builders to manage supply carefully.

Bill McBride, Calculated Risk Blog

McBride’s analysis notes a gradual rebalancing in housing markets, with single-family completions now aligning more closely with starts. This dynamic signals reduced supply chain constraints but also necessitates cautious production planning to avoid oversupply. McBride writes:

Combined, there are 1.431 million units under construction, 280 thousand below the all-time record of 1.711 million set in October 2022 and the fewest since August 2021.

In the three years prior to the pandemic, there were about 1.1 to 1.2 million housing units under construction - so the current level is still historically high [emphasis added]."

Trevor Allinson, Wolfe Research

Allinson’s warning about speculative inventory levels resonates as a critical watchpoint. His emphasis on regional disparities—notably overactivity in Florida, Texas, Arizona, and Colorado—highlights the need for granular market analysis to identify and mitigate localized risks. Allinson

Unfortunately, SF Starts remain stubbornly above the 1M level, which is somewhat surprising appreciating SF Permits have been below 1M since February ’23 and we have been hoping Builders would slow production given elevated Completed Inventory levels. We expect SF Starts to eventually fall below the 1M as SF Permits have averaged 980K on a T3M and 968K on a T6M basis, respectively."

Strategic Implications for Builders

The December data provides a roadmap for strategic and tactical decision-making:

- Right-Sizing Production: Builders must fine-tune their intelligence on actual vs. hypothetical demand while taking the utmost care to avoid speculative overbuilding. Leveraging real-time data and predictive analytics can help align starts with actual market absorption rates, minimizing the risk of unsold inventory.

- Navigating Regional Variances: Regional markets exhibit stark contrasts in performance. For example, the South and West regions face potential oversupply pressures, while the Northeast shows relative strength in single-family starts and permits. Builders should tailor strategies to these regional nuances, focusing on markets with sustained demand and stable pricing.

- Strengthening Financial Resilience: Public builders’ access to capital markets provides a competitive edge, but private builders can enhance resilience by:

- Diversifying financing sources to reduce reliance on personally guaranteed loans.

- Partnering with institutional investors to share risk and gain access to capital.

- Leaning into the local and regional relationships in their business ecosystems, built on reputational regard and trust.

- Adapting to Multifamily Trends: With multifamily construction declining and completions outpacing starts, builders in this sector should prioritize lease-up strategies for near-completion projects and evaluate market conditions carefully before committing to new developments.

- Innovating for Affordability: Addressing affordability challenges remains critical. Builders can explore alternative construction methods, such as modular and prefabricated housing, to accelerate building lifecycle velocity, reduce costs and improve margins while expanding access to homeownership.

Survival Of The Fittest

A broader economic and policy backdrop — including Federal Reserve actions and fiscal policy — will shape the trajectory of housing markets in 2025 and beyond. Builders must prepare for a “higher-for-longer” interest rate environment while staying agile and adaptive to capitalize on potential tailwinds, such as improving consumer sentiment or easing financing conditions.

As the industry confronts a Darwinian period of “natural selection,” larger, well-capitalized enterprises hold a big, honking edge. Yet, with strategic foresight, nimble opportunism, and disciplined execution, private builders can carve out opportunities to thrive.

TBD Take-Away

The December 2024 housing starts data underscore the complexities of today’s housing market. For builders, the path forward requires a delicate balance of ambition and caution: investing in growth while mitigating risks tied to oversupply and financial constraints. By focusing on data- and technology-powered market-specific dynamics and obsessive customer experience commitment, financial resilience, and operational innovation, the industry can navigate these turbulent waters and build a foundation for sustainable success.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.