Leadership

Squeezed On Three Fronts, Private Builders Pare Back Staff

An operator's ability to achieve, improve, and sustain higher performance in today's market can mean more than reductions in force to harden and future-proof the business for uncertainty.

The asset-lighter, market-share-forward, tech-and-data-powered strategies of the nation’s big, national, public homebuilding enterprises are playing out now in real-time, with private, more locally-focused firms feeling the full destabilizing effects of their mega-rivals' game plans to force local capitulation.

Private companies increasingly report:

- Narrower and more costly access to capital to restock land and development pipelines for 2025 and beyond.

- A seasonal-plus slowdown in new orders, driven by more would-be buyers stepping to the sidelines to wait out either near-term future home price or interest rate declines or both.

- A sudden spread of talent reductions as uncertainty over the new-home market's direction grows on the eve of a seasonally slower period.

These three negative consequences are interconnected: choked-off capital, harder-to-sell new home inventory, and loss of talent. The unappreciated worst of these is the loss of good people, who are potentially the best source of solutions to the other two challenges, especially with a potential market turn by year-end.

Deteriorating Access To Capital

A recent conversation with the owner of a regional homebuilding operation in the Southeastern U.S. highlighted a significant issue: declining access to bank lending for land acquisition and development capital. He says this is due to U.S. government regulators pressuring local and regional banks to reduce loan portfolios, particularly because of the growing menace of risky commercial real estate loans. This squeeze on lending impacts private builders' ability to secure capital for future land acquisitions, stunting growth prospects for 2025 and beyond.

Even one of the lenders we've dealt with for years let us know we should expect a lower cap on what we can access, and that's going to be more expensive as well," this executive told us. "This is going to effect private builders everywhere, and ultimately, what the Federal government is doing is making the nation's affordability problems worse by making it harder for us to get access to financing that would enable us to grow and produce more homes."

Robert Dietz, chief economist of the National Association of Home Builders, acknowledges that regulatory policies have existed for some time but allows that they may now be more acutely felt in the current whiplash market. Dietz points out that the NAHB's AD&C survey has shown tightening lending conditions for nine straight quarters.

He notes specific data points from the most recent AD&C survey:

- 62% of respondents noted that “lenders are reducing the amount available to lend” as a recent change

- 48% are requiring personal guarantees

- 48% are increasing interest rates

- 43% are not making new loans

- 43% are lowering allowable LTV ratios

Dietz observes that the Fed's monetary policy, aimed at reducing inflation, inadvertently tightens lending for development loans, impacting housing supply and keeping shelter costs high. This paradoxically prolongs the fight against inflation.

The irony here is that the last leg of the fight against inflation is shelter cost inflation, which is still rising at a 5.5% year over year rate," Dietz tells us. "The only way to bring shelter costs lower is additional housing supply via single-family and multifamily construction. And yet, today’s tight monetary policy and higher interest rates — intended to cool the market through the demand-side of the market — are keeping supply tight and costs higher, contributing to more inflation in shelter and prolonging the fight against inflation. The economics with respect to inflation and housing are upside down."

Declining New Orders

Wolfe Research’s Truman Patterson reports a concerning trend: private builders’ May orders declined by 14.1% month-over-month, significantly underperforming historical averages. Public builders are faring slightly better, gaining market share from smaller privates. That advantage may be short-lived, however, as higher mortgage rates weigh on homebuyer demand. The expectation is that incentives will increase in the second half of 2024 if mortgage rates remain high, with potential Fed rate cuts in the latter half of the year being a critical factor.

Patterson writes:

We continue expecting incentives to increase in the 2H of ’24 should mortgage rates continue hovering in the 7.0%+ range. Moreover, we would not be surprised hearing of an uptick in rate buydowns, especially at EL communities. We highlight that 60% of survey respondents believe the potential for a Fed rate reduction in 2H24 is an impediment to current homebuyer demand and that an average 38 bps rate reduction is required to drive a 5% demand improvement from current levels."

Prioritizing Talent Amidst Challenges

A regional Mountain States-based operator tells us:

Every private builder we know (and even some publics operating in this region) is in the midst of layoffs."

In light of the challenges of slower sales pace and the follow-on negative effects of having less capital to replenish land and development pipelines, homebuilders are reducing force and cutting costs in other discretionary areas such as staffing and marketing. This is a valid and often necessary response to growing uncertainty. Reducing expenses can help firms navigate short-term financial pressures and remain viable. However, the long-term consequences of such measures need careful consideration.

Prior analysis underscores the necessity for homebuilding enterprises to prioritize attracting and retaining talent despite the higher expenses. This investment is crucial for survival and thriving in a challenging market. The integration of key information and technology talents, who can align customer wants with the entire building lifecycle – from land acquisition to customer care – is essential.

We've noted here:

A recently retired regional president of one of the nation's top 10-ranked homebuilders helped frame this ordering of focus this way.

We've seen a dearth of talented people coming into the business starting with the GFC," he tells us. "At the same time, the ones who were young – in their 20s and early 30s in 2009-2012 are all the more valuable now. They’ve worked through a whole new and different era of asset-lighter, leaner, more-integrated accountability management. And they've learned to navigate and thrive with far fewer layers of staff than in the 2000-to-2008 period. So, it’s meaningful to focus on retention of these 35- to 45-year-olds who’ve been rising in the ranks. They're a lynchpin to surviving and prospering through the next stretch."

They're also an organization's best bet for finally attracting the next generation of young incoming, curious, hungry, digitally—and A.I.-savvy team members up and down homebuilding's value chain.

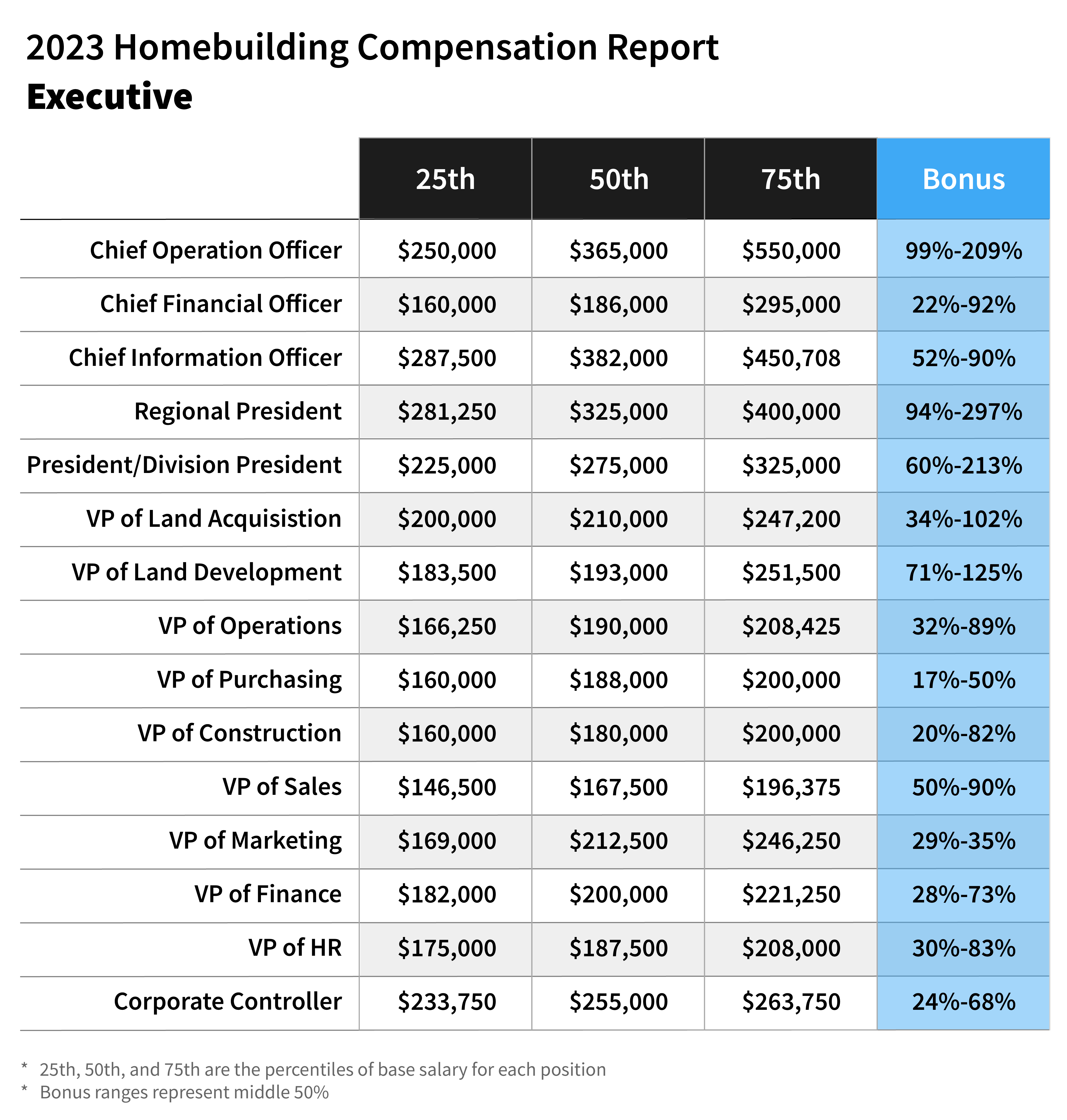

In this context, one of the residential construction and development sector's leading executive recruiting, staffing, and strategic advisory services, FTS – a supporting partner of The Builder's Daily – has introduced a National Homebuilding Compensation Report, including 73 titles across six key functional departments, with a geographical cost of living index filter for each major MSA.

One thing is clear: in practice, we find our builder clients that typically pay closer to the 75th percentile of the ranges within our report obviously attract more talent," says Thomas Carpitella, CEO of FTS. "Beyond that – the retention rates are significantly higher than those that tend to pay lower than the 50th percentile. The builders that take competitive compensation trends seriously and regularly review these trends are the ones capturing the top talent within the industry and offering long-term homes, which result in the ultimate competitive edge."

Call to Action

For private homebuilders, the strategic focus must be on retaining key talent. Laying off valued team members too soon could lead to graver problems in maintaining resilience and operational performance. Investing in the best talent, particularly in land strategy, construction operations, and technology integration, will enable firms to navigate current challenges and emerge stronger.

Attracting and retaining talent is multifactorial in that compensation is typically not the only thing most candidates care about, says FTS's Carpitella. "However, we do believe these numbers will continue to rise. For firms' interested in engaging with top talent within the industry, competitive compensation will be table stakes to even connect with these types of candidates."

Achieving, improving on, and sustaining higher performance requires fundamental recrafting of homebuilding enterprises' business models into an asset-light "demand machine." This model pulls construction operations and its ecosystem of related design, land purchase and development, community-making, and marketing, sales, and customer care disciplines through a highly integrated set of systems dependent on feedback loops.

A prime example of this approach is Lennar’s hiring of CTO Scott Spradley. Lennar's executive chairman Stuart Miller emphasized the importance of data-driven processes, stating:

It's a very integrated set of systems that is dependent on feedback loops. And any time that you find a process that becomes data-driven and the data improves to the point that it's actually relevant, at some point, there are large learning models that can be helpful in enhancing productivity. These are the areas where we are leaning in. I mentioned that we brought on a strategic Chief Technology Officer in Scott Spradley. And all of this is a coordinated program of taking steps at a time to improve the ingestion of data, to use the data more constructively and then to bring it to its next level where we're actually driving productivity gains within our business."

By fostering a technologically skilled, synched-up, and committed workforce, private homebuilders can ensure they can adapt to market changes, meet customer needs precisely, and optimize resource allocation. This approach will ultimately support sustainable growth and competitive advantage, even in an uncertain housing market landscape.

Staffing and recruiting done right. Fast Tracking Solutions specializes in delivering top talent in accounting/finance, construction, and technology operations.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.