Capital

Squeeze On Privately-Capitalized Builders Tightens As Market Slows

As property valuations take a hit, a sudden glut of specs due to cancellations can trip a covenant, which can domino into a cash-flow crisis for builders without a back-up stash of ready money.

It's all about the debt markets."

This was the topic heading for this morning's episode in a regular conversation series I have with a senior-level strategist in the homebuilding, build-to-rent, and residential development space. As worries grow about an economic contraction, and money gets tighter and more costly all around, the property valuation daisy chain hits differently capitalized homebuilders different ways.

The economic and business backdrop, of course, is a housing correction, deliberately induced as a Federal Reserve shock-treatment mechanism to stop and reel in a generational surge in inflation. In a few short months, home mortgage loan rates have doubled, monthly payments on new-home mortgages have shot up 30% or 40%, new home buyer interest in many cities has either slowed or stalled, and an increasing number of folks who'd put down deposits to buy homes before the end of the year or early next year are getting cold feet.

Most of the headline attention – deservedly – has been on the drop-off in sales activity and transactions as Fed interest rate increases jacked-up monthly payments beyond many would-be buyer households' payment power, and intentionally cooled demand.

Less attention is to the other side of the rapid-cool effect of the Fed fiscal and monetary about-face from profligate to miserly: The impact on builders' – particularly privately capitalized and financed homebuilders' – balance sheets, cash flows, and access to capital as capitulation spreads from specific markets to a more sweeping scale, and from households into the businesses that market to them.

Everybody's now sitting on valuations that have shrunk," says our trusted executive confidante. "Private builders – especially in the rapidly reversing markets like Austin, Boise, Denver, Phoenix, Salt Lake City, and Las Vegas – are now dealing head-on with a cash-flow crisis that can lead to a vicious-circle of unsavory financial alternatives. The way the debt markets swung, 300 or 400 basis-points to the negative, hits the equity value, the cost of their finance, as well as their reliable ability to service their debt, not trip their bank covenants, and continue to run their business with the kind of front-loaded capital they need to keep feeding the machine."

Our executive source gives us an example of many a privately-capitalized homebuilding principal/owner's painful predicament through the balance of 2022 and into Q1 2023 – which this person describes as already squeezing a number of firms.

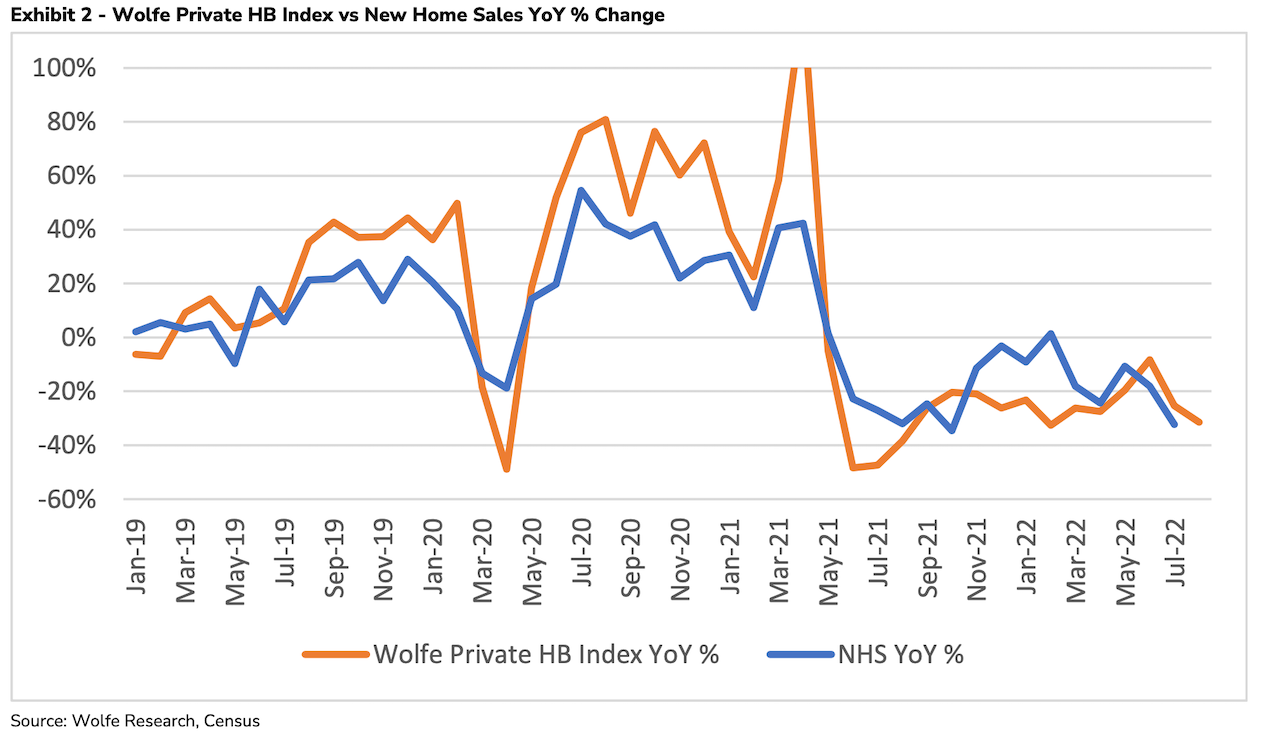

Here's a passage from Wolfe Research homebuilding and building products analyst Truman Patterson's August 2022 private homebuilding survey:

Aug Orders for surveyed builders declined -31.5% YoY, deteriorating from July’s -25% YoY, 2Q22’s -20% YoY and 1Q22’s -27.5% declines. For reference, this compares to our public homebuilder universe’s 2Q22 -16% Order decline and 1Q22’s -15%, on a weighted average basis.

Acquisition, development, and construction lenders – all actively pursuing new business with builders while demand predictably eclipsed supply, i.e. prior to Fed rate hikes this past Winter – have grown understandably cautious as absorption pace in many formerly high-activity markets and sub-markets has sputtered, order cancellations have spiked. Crucially, the big yet-unsolved mystery is what level of incentives and price cuts will it take to reset a "normalized" rate of sales per community each month.

The mechanics of serving your debt have changed," say our executive source. "Let's say the bank loan permits five specs at any one time. Then, mortgage rates suddenly hit 6.25% and you're in a position of not being able to close on five homes you had in you backlog, which means – on your monthly sworn affidavit to keep in compliance with your bank covenants – you now have 10 specs, not five. In that case, the bank requires a curtailment payment on your principal, so it'll sweep 100% of your cash on the homes you close. They're not going to let you go out and get more debt for your operations, and you need that revenue from closings to feed operations, so the cash flow crisis then kicks in."

For builders of all stripes, locations, and capital structures, the tough dilemma and highly delicate balance to strike is in having enough specs progressing to meet homebuyers' more sensitive timing needs in a trickier economic and mortgage rate environment, but not get stuck with so many that it will risk tripping the covenant. In that case, our source tells us, the choices narrow down to just two, and neither is pleasant.

Either your investors have to kick in more to support your operations – which means you're shrinking your equity in the company, or you're going into your own pocket to fund operations. This is the moment-of-truth moment, and it's going on now in some markets. Public builders obviously don't have this issue right now, but even though private builders did all they could to de-risk their balance sheets and stay as land-light as they could, it's the capital nature of the business that you're mostly using short-term capital finance to fund long-term returns on that invested capital. The stress on privates is enormous in some markets, and it's only starting."

The next three months to two years will go far to proving which homebuilding firms are fit enough to weather a punishing level of challenge in the near and mid-term, or not. As our strategic executive source tells us.

This is the existential crisis moment for some of the private companies."

Join the conversation

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.