Capital

Spring Thaw Beats Expectations But Are Sales Gains For Keeps?

Accounting for at least some of the lift, builders' now widely-practiced monthly payment value proposition has served as a reliable workhorse, especially since those who have very good reasons to buy a home have so little else to consider.

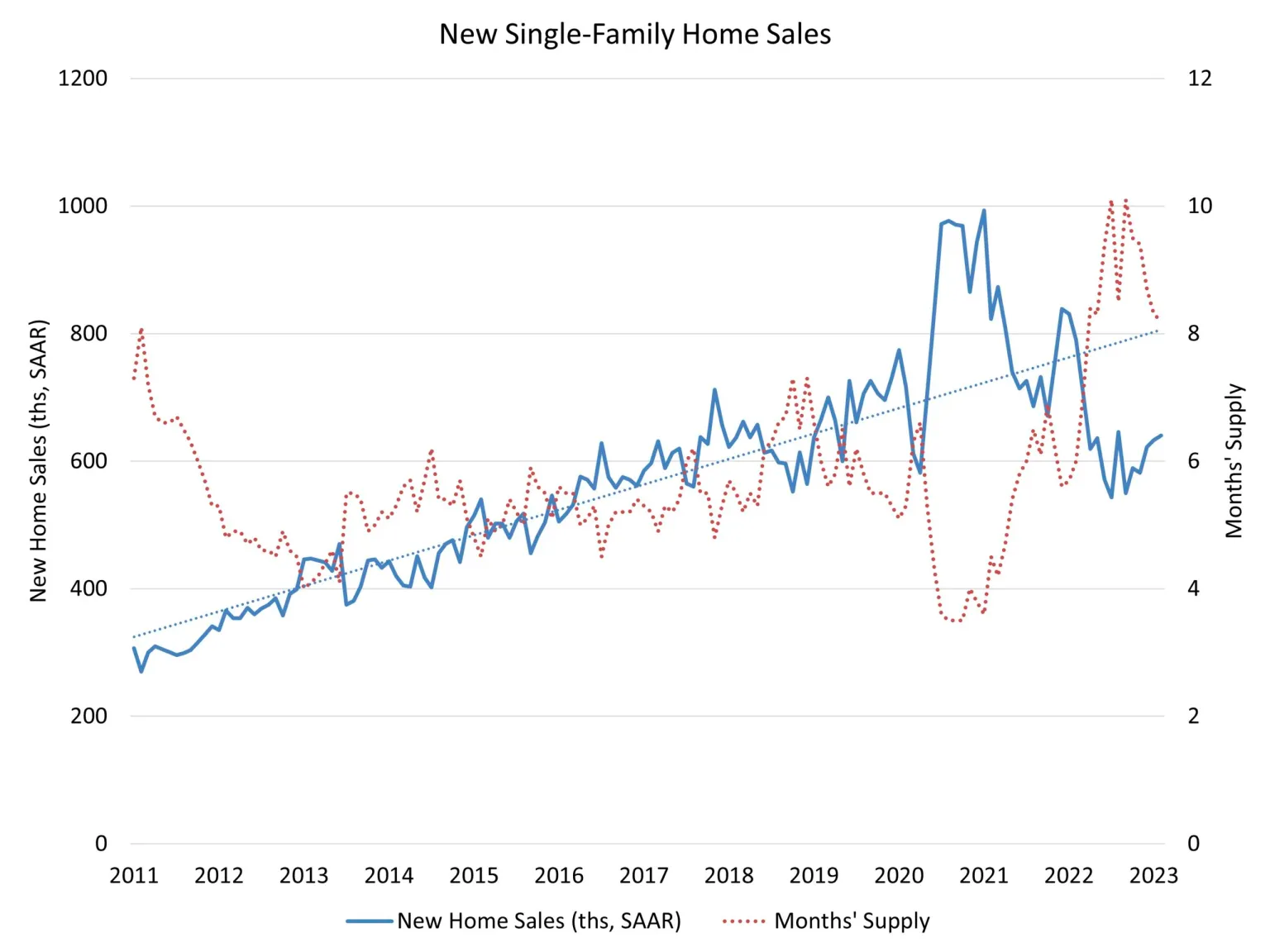

New home sales eked out a 1.1% gain in February over the prior month's lowered totals, a positive "compared with expectations."

Will there be a 2023 Spring Selling worth remembering? Or one we'll want to forget?

Robert Dietz, chief economist for the National Association of Home Builders, played down the positives in his commentary here, citing continued challenges on the affordability, mortgage access, and AC&D finance front:

Sales of newly built, single-family homes in February increased 1.1% to a 640,000 seasonally adjusted annual rate from a downwardly revised reading in January, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. However, new home sales are down 19% compared to a year ago."

Accounting for at least some of the lift, builders' now widely-practiced monthly payment value proposition has served as a reliable workhorse, especially since those who have very good reasons to buy a home have so little else to consider.

Bend the cost curve down; arc the household's payment power up. Parse it all out to a monthly kitchen table budget, and a homebuilder can close what had been a yawning gap of an initially daunting first-cost sticker price at a decade-high mortgage rate amid a housing market that's still drifting down.

The trade-offs for builders mean squeezing margins down from record highs to fund discounts and buy-downs and the like, but would still leave room to maneuver, buy time, and keep feeding the cash creation machine.

What's more, given a lift from two helping tailwinds – a palpable downswing in 30-year mortgage rates running from late November to early February, plus a gradually widening sphere of acceptance of higher interest rates as a new normal – homebuilders gave themselves a good shot at doing a lot better the past couple of months than they'd thought they'd do.

Welcome to the beginning, middle, and possibly the end of the "compared-with-expectations" lift homebuilders have experienced, starting in December or so, and running through the wake of the Silicon Valley Bank failure and its aftermath of disruptions to local and regional banking as we've known it.

The question -- despite signs pricing and pace have begun to stabilize as a response to buyer psychology and homebuilder and lender mathematical acrobatics -- is whether structural conditions supporting that stabilization are sustainable.

Three of which are wobbly right now, and getting more so daily.

- Household incomes

- [loss of] Wealth effect

- Borrowing power

Consumer households – and what they spend – shoulder seven-of-every-ten dollars of U.S. economic output. They're also having a moment.

- A cost of living crisis continues.

- Borrowing costs are going up, at least in the foreseeable future.

- Now, banks – many of them, anyway – are under pressure to cut back on lending as follow-on effects of depositors' uncertainties.

A Wall Street Journal article by Gabriel T. Rubin notes:

To the extent banks are “having difficulty getting deposits, they’re going to have to cut back on lending, which they’ve already started to do,” said Jack Ablin, a founding partner of wealth-management company Cresset Wealth Advisors LLC. “Someone who wants to refinance a mortgage, or buy a boat, or fund a kitchen remodel—they’re going to have a more difficult time.” – Banking Turmoil Tests the American Consumer, Wall Street Journal

And now, already bound to an explicit dual mandate of low inflation and low unemployment in its fiscal and monetary policy strategy, the Fed's now looking down the barrel of a third imperative to add to the mix of consequences its policy tools cause: Stabilize U.S. banks. So, while today's Fed meeting resulted in an expected 25 basis point hike in the Fed Funds Rate, to a 5% range, accompanying messaging about what's still ahead suggests one more hike this year may be this cycle's limit.

This note from a Financial Times piece by Colby Smith:

As Jay Powell fielded questions from journalists on Wednesday following the US Federal Reserve’s decision to plough forward with another interest rate rise, he quipped that it had been “quite an interesting seven weeks”.

The Fed chair was speaking after the bank raised rates by a quarter-point and signalled it might be close to concluding its campaign to stamp out inflation following the most aggressive monetary-tightening campaign in decades.

The end of painful rate rises would normally be a cause for relief, even celebration, but for one inconvenient fact: the reason the Fed thinks it can afford to let up is the worst bout of banking turmoil since the great financial crisis of 2008 — and one that critics of the US central bank argue it should have seen coming.

Where all this leaves consumers lies somewhere between juggling and struggling. Their relatively strong balance sheets, a still-tight job market driving pay increases, and pent up savings of a reported $800 billion – padded by Covid relief and stimulus funds – started them out from a strong place.

It isn’t only the credit crunch that could cause consumers to delay big purchases, said Steven Blitz, chief U.S. economist at TS Lombard. It is also a loss of confidence and a reluctance to take a financial leap when the landing spot is a moving target.

Consumers uncertain about their personal finances or the broader state of the economy might reconsider whether waiting on a major financial decision might be the more prudent move at the moment, he said. Mr. Blitz said many consumers are asking, “Am I going to go now and take out a first mortgage and buy a house?” – Wall Street Journal

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.