Marketing & Sales

Sonic Boom: MultiGen's Trajectory Got A Covid Lift

The same people that brought the world the very first 'Me Generation,' are now spurring a We Generation surge to multiple generations living under a single roof.

The demographic cohort whose coming-of-age devil-may-care self-preoccupation earned it the 1960s sobriquet the Me Generation is wheeling and dealing its way into a full tipping-point 180 as a next generational chapter.

They personified the generation gap. Now, they're all about bridging those grand-parent, parent, grandchildren gaps, turning to family-connection tactics their own parents – of the Silent or Greatest Generation – and their grandparents who endured raising families during The Great Depression – employed during simpler times.

Financial, health, cultural, and a more-fuzzy array of motivators – emotional balance, well-being, legacy, etc. – figure into a litany of reasons Baby Boom generation members have emerged as a swelling stream into an already trending trajectory of multigenerational household formations in a dynamic, pandemic era reset of household compositions, geographies, and community development strategies and tactics.

New York Times staffer Stefanos Chen picks up on the trend here in "The Family That Buys Together Stays Together," a piece that explores a surge in baby boom households with multiple generations.

Chen's story zeroes in on anecdotes, but the underlying data bear out an alignment of stars that suggest larger, flexibly-floor-planned, multi-use, work-live-play-nurture-care-give homes that provide for multi-aged family members to enjoy both connection and solitude will be a durable market opportunity, both at the home level and as parts of communities-in-the-making.

Chen writes:

The pandemic hasn’t just reshaped the housing market — for a growing number of homeowners, it’s remaking the household. After years of slow growth, multigenerational living is on the rise. As members of the baby boom generation move into their 60s and 70s, many are being called upon by their adult children for help raising their young children, while others are looking for ways to care for their aging parents.

With prices for single-family homes soaring in much of the country, consolidating generations under one roof can mean more buying power, which in turn can provide access to less competitive segments of the housing market — namely the higher end where the larger homes are. (Buyer beware: It can also mean reliving family get-togethers every day of the year.)

“I think this could be a trend that’s here to stay,” said Jessica Lautz, the vice president of demographics and behavioral insights at the National Association of Realtors, a large trade group.

Multigenerational buying has been expected to grow for years, she said, as families of Asian and Latino descent, who are more likely to live with aging parents, become a larger share of home buyers nationwide. But it took the pandemic to spur the market.

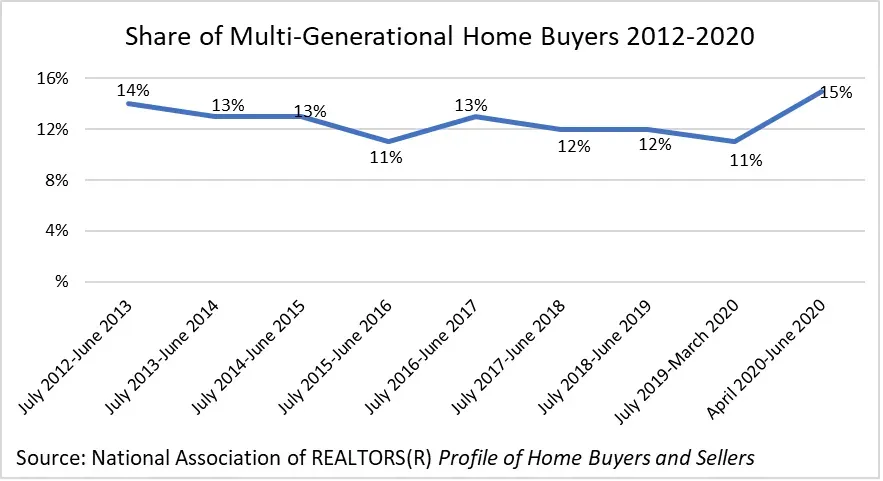

The National Association of Realtors in February noted that – even in a highly-constrained inventory of for-sale homes in 2020 – multigen buyers represented one in six purchases among existing homes buyers, a high-water mark for its measure of multigen buyers since 2012. Prior to Covid-19, 11% of purchases were for multigenerational buyers.

The NAR cites caregiving – to an aging parent or an adult-child who's experienced job dislocation – and cost savings as primary motivators for multigenerational household formation and purchase.

Pre-pandemic there was an even split between buyers who purchased a multi-generational home for aging parents and for adult children boomeranging back or never leaving. Now the top reason to purchase a multi-generational home is for aging parents to move into the home. The data does not indicate where they are coming from, but a mix of assisted living, nursing homes, and living independently is probably the case. This is likely for caregiving for the older relative, but also caregiving for children who are now at home, with closed childcare facilities and limited in-person schooling. There is some data from consumers to support the fact that this living situation is a permanent change. While the concern of COVID-19, loneliness, or childcare needs may have driven the change, the new paradigm may be here to stay. According to the American Health Care Association and the National Center for Assisted Living, 55% of nursing homes are losing money and 72% may not be able to stay open in the coming year.

So, 60 years or so ago, it was all about me. Now, well after a touch of grey and a spasm of arthritis, it's becoming more about we. And, you heard it here first, we have no plans of going anywhere soon if we have anything to say about it.