Marketing & Sales

Sneak Peak: As Sales Top Out, Signs Of Softening Multiply

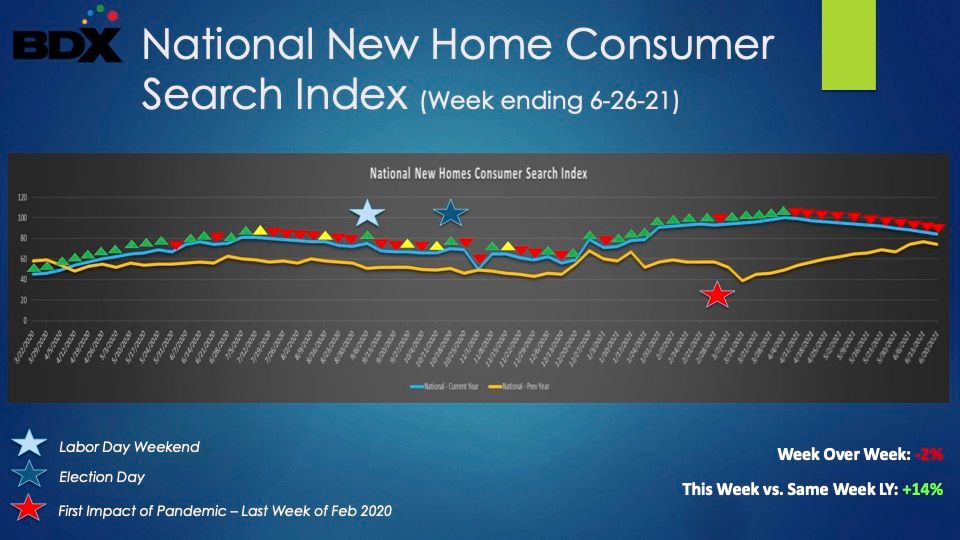

Keeping an eye on new-home "search" behavior offers a smart way to take stock on signals versus noise in the next several months.

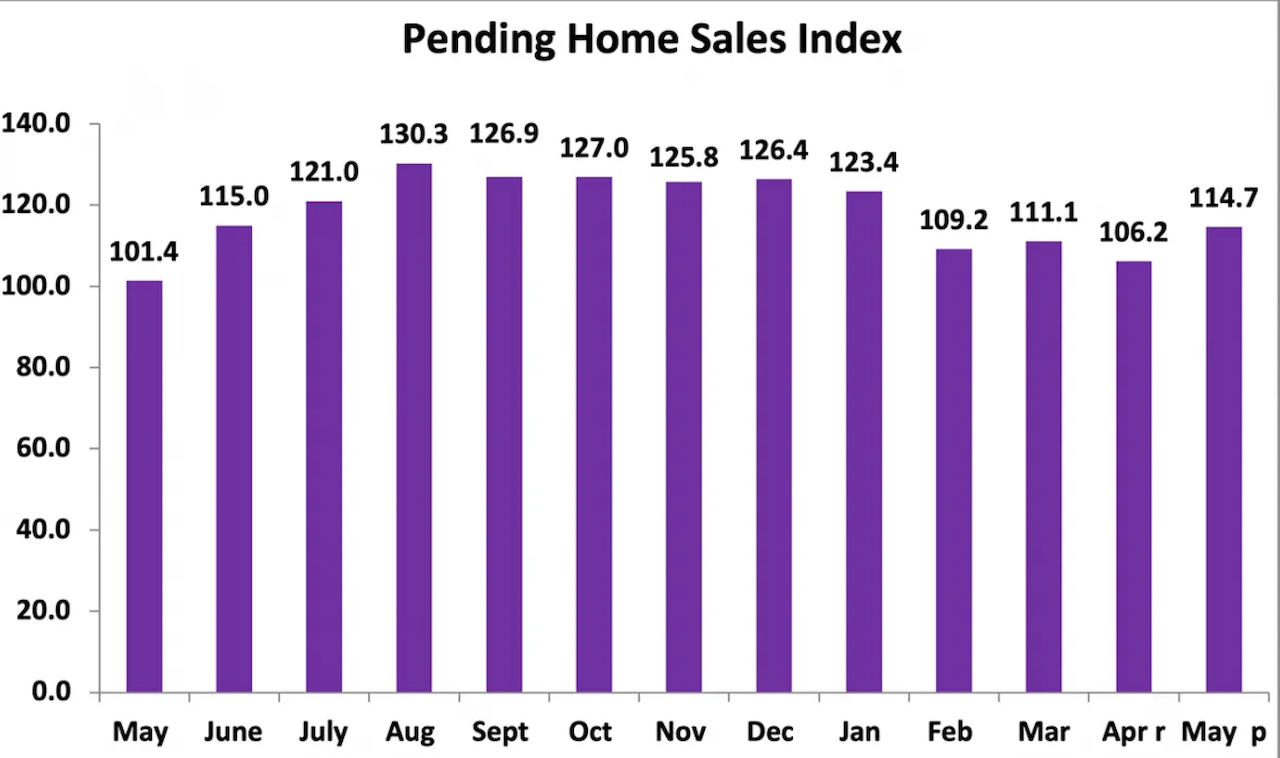

- Pending sales for May broke a 16-year record for signed contracts to purchase homes in a single month

- Mortgage applications, however, have shown signs of weakening

- Another meaningful leading indicator of future housing activity – online search – this week recorded its 11th consecutive week-on-week decline

What goes up ... A blood, sweat, and tears housing market – for all its demographically-endowed structural strength, further powered by not-to-miss interest rates and a suddenly-realized collective appreciation for the phenomenon of a backyard – may, like everything else, have to obey laws of gravity.

Wall Street has its yield curve – the relationship between yields on short-term and long-term debt – as a harbinger of market turbulence. Residential real estate lacks such a singularly important beacon of inflection, and rather, oozes data that suffice, more often than not, only to confirm the preferred biases of the beholder.

The structural muscle underlying housing expectations – all things being equal – is that Millennial generation and Generation Z adult leading-edgers comprise a decade or more of expected home-purchase activity as they form households, build incomes, and start families.

It's the "all-things-being-equal" part that may be susceptible to new discovery rather than sheer affirmation of what we know.

Quickly, here's a recap of the "where we're at" milestone in what has been an epochal chapter in housing dynamics to start the 2020s decade.

The May Pending Sales release from the National Association of Realtors – looked at as a "leading indicator" of mostly June and July settlement activity going on now – blew through consensus expectations, fueled at least somewhat by more owners deciding to sell now.

At the same time, evidence for those who're leaning toward a housing market downturn in their forecast, mortgage application activity has tracked to the negative of late.

Looking through the bearish lens – and framing just a few weeks' activity as bellwether – the conclusion sounds roughly like this one, reported by Marketwatch real estate writer Jacob Passy.

“Sales lag mortgage applications, and the 26% plunge in the latter between December and April is now working its way through the sales numbers,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote in a research note. He went on to argue that “sales will soon hit bottom, given the flattening in mortgage demand over the past couple months.”

The latest mortgage-applications data from the Mortgage Bankers Association would back up that prediction. The trade group’s index that measures the volume of applications for loans used to purchase homes was down 17% from a year ago as of the week ending June 25, and had declined 6% from the previous week.

As to what is causing the past several weeks' check-up in leading-indicator momentum can only be regarded as hunch, and the time-frames in the dot-plot trends are too brief to say that the jury's in.

CNBC correspondent Diana Olick tends to like to scoop a real estate boom or bust, and she's writing:

Demand is now slumping due to weakening affordability, especially at the lower end of the market where demand is strongest. Home prices rose more than 14% in April year over year, according to the latest S&P CoreLogic Case-Shiller national price index released Tuesday. Craig Lazzara of S&P Dow Jones Indices called the unprecedented jump, “Truly extraordinary.”

- So, are inelastically high prices – vis a vis buyers' pocketbooks -- starting to be the cure for high prices?

- Have pandemic-caused pent-up and pulled-forward demand pools fully played out in the past 12-to-16 months?

- Is something more structural going on regarding a rotation for homeownership versus rent-by-choice?

Too early to say.

A measure to keep an eye on, however, is yet another leading indicator of future housing activity, albeit less appreciated for its correlation to home sales volume and trends is the 15-year old BDX National New Home Search Index. This one might be particularly helpful for investors, land acquisition types, and developers whose judgment, big money bets, hurdle rate modeling, etc. are so critical at a moment where – "all things being equal – supply is short and signs of demand strength are so strong.

Extreme swings of the pendulum correct back toward the mean," says Jay McKenzie, senior director, Builders Digital Experience (BDX). "The BDX National New Home Search Index clearly shows a transition to a more balanced market: 11 weeks of decline W-o-W in the volume of consumer search online for newly built homes and the Y-o-Y gap continuing to shrink.

Now, back to our thought about "all things being equal."

They never are, but almost always appear to be.

Housing's cycles are nothing so much as apparent confirmation that "all things being equal" make the rules of housing's behavior. Fundamental demographics has been a constant driver of the need, the desire, and ultimately, the buying behavior.

As a matter of fact, one business leader we spoke with this week feels a sense of deja vu in the market dynamics of the moment – rumblings of inflation, rising interest rates, market uncertainty, etc. It takes him back to the late-1980s-early 1990s.

"The Millennials are right where we were then," he says. "I bought my first condo with 3% down 30 years ago or so – high interest rates, spiralling inflation and all the rest. That was the Baby Boom, and we have barely scratched the surface of the Millennial generation's impact."

So, "all things being equal," the structural drivers look better than good for a decade or more. But what if, as generational experts are beginning to reckon with," Millennials become a first.

A first generation ever that doesn't "do better" than the one that came before it could signal a tipping point in "all things being equal." That could change the outlook, profoundly. Keeping an eye on "search" behavior would be a wise way to take stock on signals versus noise in the next several months.