Capital

Smith Douglas' $162 Million IPO Signals A Homebuilding Tipping Point

After 15 years of striving, and an existential close call or two, Smith Douglas' founder-led arc of operational excellence, durability as a brand, and big-time impact as a business synced up in a bid to go public with impeccable timing.

Robert Crowley, who's advised public and private homebuilding organizations for a quarter of a century as managing director at Moelis & Company, had a nugget of wisdom from the 2012 way-back machine that I'll always remember.

It's not so much a question of whether a firm can go public," Crowley told me, as a fashion runway of five or six privately-held homebuilding companies readied their IPOs – Tri Pointe Homes, LGI, Century Communities, and the New Home Company among them – and took their offerings out for whirlwind global investment road shows. "It's whether you should."

The macro context of Crowley's insight at that moment – the onset of economic reawakening and long-running recovery following the Global Financial Crisis and housing market collapse – may prove to rhyme with current expectations for a broad, structurally sound economic uplift through the mid-2020s and beyond.

So, what would Bob Crowley say today, particularly on the heels of Wednesday evening's news that Woodstock, GA-based Smith Douglas Homes hit a timing and valuation jackpot in its IPO pricing?

Per Seeking Alpha news editor Manshi Mamtora, CFA:

Smith Douglas Homes (NYSE: SDHC) prices initial public offering of 7.69M shares at a price to the public of $21.00 per share.Underwriters have a 30-day option to purchase up to an additional 1,153,846 shares.Shares are expected to begin trading on NYSE on January 11, 2024, under the ticker symbol "SDHC".The offering is expected to close on January 16, 2024.

Wonder no longer. Here's exactly what Moelis' Crowley would and did say in the wake of Smith Douglas' raise of about $162 million in freshly minted equity.

I'm excited for the Smith Douglas guys," Crowley tells The Builder's Daily. "Anytime a homebuilder goes public, it's kind of an event. It's one of those cool milestones in the industry where founder-led companies since the beginning of time can and have gone public, starting their life as small caps. Then they can become the next D.R. Horton or Lennar. They can have that dream, and work for it because that's how those leading companies started."

Even in today's context – given the complexities, regulatory and tax encumbrances, and the constant pressure of quarterly fiduciary duties to yield thirsty institutional investment shareholders – Crowley says the path's not one to pursue merely as a way to access smoother, deeper streams of financial capital, nor does the route fit every strong privately-held operator's DNA.

That bar of what it takes to be a successful public company is still pretty high," Crowley says. "A Tri Pointe, an LGI, a Smith Douglas, ... they take a significant amount of conditions going for them. What they share in common is entrepreneurial, ambitious founders who really want to grow the company. Plus, whatever the industry, to be a successful public company, you have to have growth. Some builders are happy being who they are, and where they are, and don't want to go out necessarily and sort of jump into the rat race and get on that quarterly earnings treadmill. Some appear to be wired that way and they're up for it, and they can be quite successful."

As we've noted, Smith Douglas's move to "go big" – the first traditional private builder IPO since Dream Finders filed in January 2021 – comes as national, regional, and local homebuilding operators jockey for a competitive edge in a market-by-market pecking order for access to customers, developed and undeveloped lots, trade crews, materials supplies, etc. Where each operator comes in that pecking order may well determine the degree and extent of each of their opportunities or threats for the coming three to seven years.

An additional catalyst for the IPO – a tighter-for-longer credit backdrop and higher-for-longer baseline bank borrowing costs are stressing traditional bank-line dependent builders and land developers – makes it an opportune time for bigger players with access to deep and/or patient capital to strike while weakened homebuilders are back on their heels.

This is a fast-growing, high margin, high return on capital business focused in the right markets and the right price segment of entry-level," Builder Advisor Group CEO Tony Avila says. "Smith Douglas has a lot of momentum internally at the same time that the markets are pricing in five to six rate cuts in 2024."

Smith Douglas and its leadership team have earned high regard and respect among peers, trade colleagues, customers, and suppliers as an exceptionally led, superbly competent, and fiercely driven team that struck out on an accelerated growth path in its Southeastern market footprint six or seven years ago, and never looked back.

While founder Tom Bradbury has up until recently leaned toward a "closely-held" family-style organization, he simultaneously strove for a bold and enduring legacy for the Smith Douglas name. It was only a matter of time before a pivot from private operator to public enterprise would ensure he and his brain trust of the kind of enduring organizational impact they were inclined to put on their business roadmap.

Reflecting Bob Crowley's view that an entrepreneurial founder needs to be "wired" for life as a public, one of Bradbury's business ambitions illustrates that ambition to a tee. Getting to 4,000 homes and $1 billion in revenue by Bradbury's 80th birthday on July 15, 2024, has been the goal in the last five-year plan.

Now there's cash – and a lot of it – to operationalize and accelerate the pathways to that goal.

A note from Builder Advisor Group CEO Tony Avila notes:

Smith Douglas Homes priced at $21/share, coming in at the top of the estimated range. The company’s land-light business model, conservative leverage levels, and impressive growth trajectory commanded a strong premium for the stock. SDHC issued 7.7 million shares at a $1.08 billion valuation, with a $981m pre-money valuation. The pre-money valuation represents a 7x multiple on TTM EBITDA of $139 million, an 8x P/E multiple, and a 6.3x multiple on tangible book value (TBV)."

Strategically, SDHC spotlights six pillars toward reaching – and soon eclipsing founder Tom Bradbury's 4,000-home, $1 billion in revenue annual goals, in its SEC prospectus filings:

Capitalize on our land-light capital strategy to efficiently build new communities and drive superior risk-adjusted returns Increase presence and market share within our existing markets Opportunistically expand to new markets Continue to target our key entry-level and empty-nest homebuyer demographics Focus on delivering a personalized build-to-order experience at attractive price points Continue to utilize strong cash flow generation to grow platform and drive high return on equity

Two contextual notes come to mind with Smith Douglas' entry into homebuilding's public builder pantheon, and they relate.

Will other fast-tracking private firms be likely to position themselves for an IPO run, motivated by both similar constraints on the bank capital front and the runway for explosive growth on the operational side? andThe SDHC strategic vision in more ways than one models not just an NVR-style asset-light operational, land, and financial even flow system, but does so within a "super-regional" rather than a coast-to-coast national footprint.

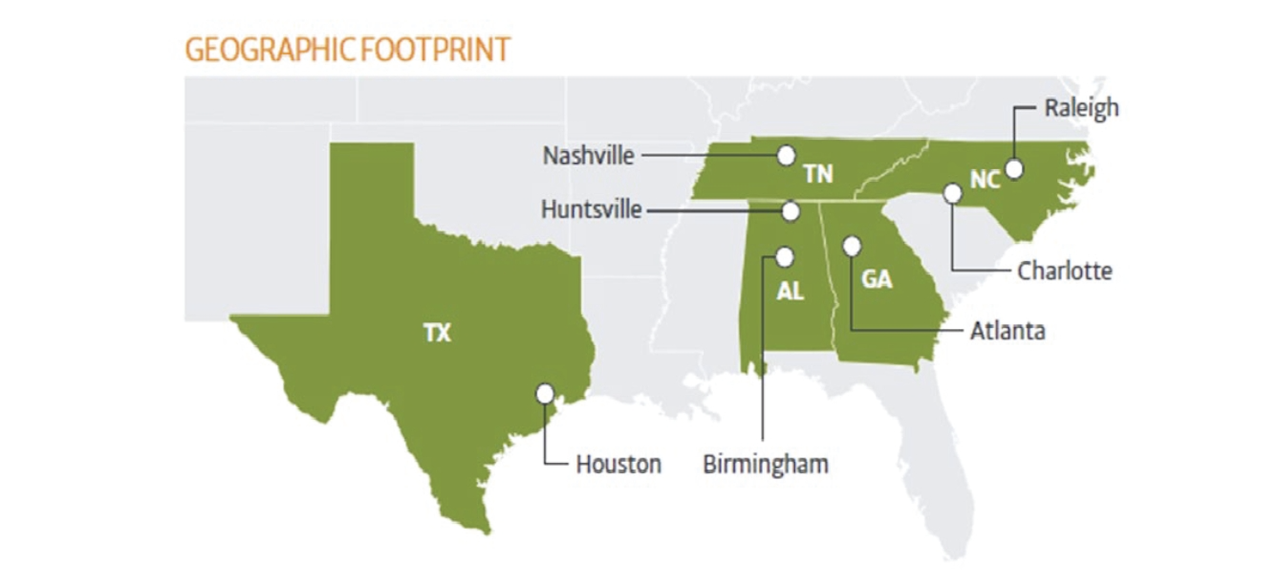

Smith Douglas, somewhat similar to another recent comer to homebuilding's public company cohort – United Homes Group, has mapped its present and near-future geographic ambitions to the fast-growing Southeastern states.

Here's SDHC's overview of its immediate plans to operate in "attractive, high-growth markets."

Our markets exhibit attractive demographic trends, including high employment growth, strong supply and demand fundamentals, positive net migration, home price appreciation, favorable land pricing, and low costs of living, which we believe will support the long-term growth of new home orders. According to JBREC, the majority of our markets rank among the top ten in the Southeast for positive net migration over the last year. We believe the combination of these compelling trends and our strong presence within these markets will help facilitate the execution of our growth strategy.

This super-regional public model is by no means a new template in homebuilding. However, from both a post-pandemic domestic economic growth standpoint and an opportunity to avail of greater operational synergies by concentrating them in a tighter geographical sphere, the super-regional public vision makes sense enough to imagine that UHG and SDHC may not even be the last of fast-tracking private operators to choose that as the public model.

People in homebuilding and investors have learned and appreciate that local market scale is critical, and that you don't have to be everywhere," says Moelis managing director Bob Crowley. "In fact, if by being everywhere, you spread yourself too thin, that's not a recipe for success. Conversely, if you can be regional and focused, you can probably generate attractive returns and financial performance. NVR is the poster child for that."

MORE IN Capital

United Homes Group’s Board Crisis In Compliance Countdown

United Homes Group is running out of time to rebuild a functioning board and avoid a Nasdaq compliance breach. CEO Jack Micenko says day-to-day operations continue, but governance uncertainty and market headwinds now threaten the company’s stability.

As Builders Face Bank Fatigue, New Financing Paths Emerge

Lending conditions have tightened for 14 straight quarters. A new era of private construction finance is taking shape — faster, leaner, more relationship-driven.

Hunt Companies Buys View Homes Amid M&A Wave

The early-October deal signals a growing M&A presence of patient capital platforms -- some of them global asset managers --backing operators as capital pressure mounts on private builders in a long-term bright-future backdrop for U.S. residential development.