Leadership

Sideways: NAHB HMI Signals No Relief Soon For Private Builders

Public builders can withstand price pressures and speculative inventory risks, but smaller private firms face mounting financial strain as affordability and demand remain precarious.

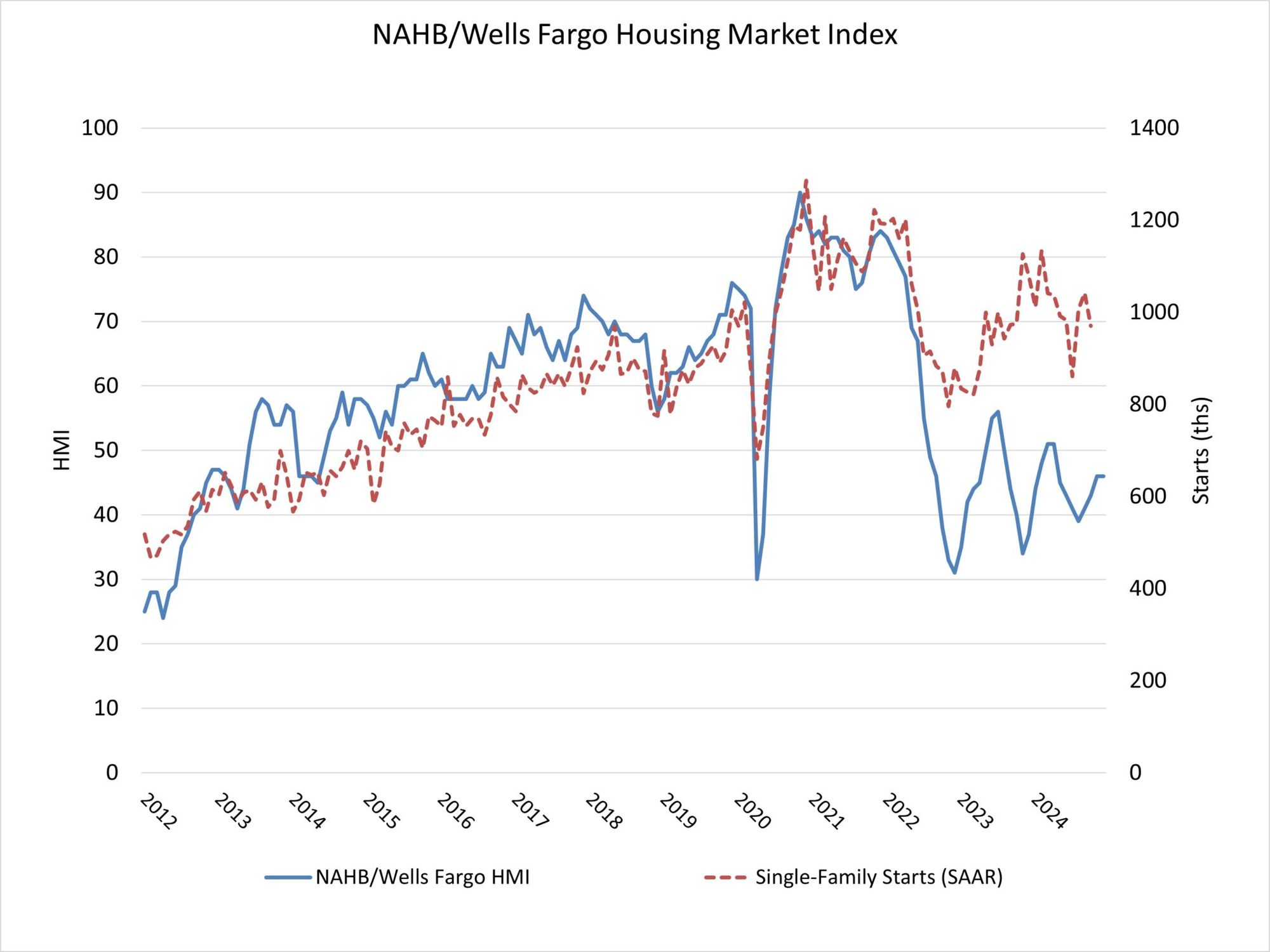

Homebuilder sentiment, as measured by the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), ended 2024 on a sideways note.

December’s reading steadied at 46, the same level as November. While builders remain cautiously optimistic about 2025, the plateau masks growing cracks, particularly for smaller, privately financed builders struggling with higher costs, slowing sales, and growing speculative inventory.

The HMI’s December components show the challenges beneath the surface:

- The current sales conditions index stayed flat at 48, still short of the positive 50 threshold.

- The traffic of prospective buyers fell one point to 31, underscoring soft buyer demand.

- In contrast, future sales expectations rose three points to 66, reaching its highest level since April 2022.

The numbers, however, reflect a divide in the outlook. For public and well-capitalized super-regional builders, like Lennar, D.R. Horton, and Japan-backed private firms such as Sekisui House and Sumitomo Forestry Group, the path to 2025 is one of cautious opportunity. For smaller, localized private builders, it’s a growing squeeze that shows few signs of easing.

The Strain on Private Homebuilders

NAHB Chief Economist Robert Dietz summarizes the challenges clearly:

Builders are expressing concerns that high interest rates, elevated construction costs and a lack of buildable lots continue to act as headwinds, [but] they are also anticipating future regulatory relief in the aftermath of the election.”

For large, public builders, optimism about a business-friendly regulatory shift and possible interest rate cuts fuels confidence. But for private homebuilders—many of whom operate with shorter financial lifelines—the sentiment has a more ominous undertone.

The Federal Reserve’s strategy of holding interest rates high through much of 2023 and 2024 has squeezed the industry’s smaller players hardest. Local private builders, who rely on bank loans and private capital for land acquisition and development (A&D), now face steep borrowing costs that eat into already razor-thin margins.

Worse yet, these firms lack the scale and financial flexibility to respond as quickly as public giants when demand slows. Trevor Allinson, a Wolfe Research analyst, cautions that the current HMI signals no immediate turnaround:

The absence of even a marginal post-election demand bump is somewhat disappointing. Optimism hinges on macro trends — rate cuts and deregulation — that are promising but still uncertain.”

The Speculative Inventory Trap

The speculative inventory buildup is one of the most visible risks looming over the 2025 housing market. To meet post-COVID buyer preferences for ready-to-own homes, builders—both public and private—pivoted heavily toward producing inventory homes rather than building to order.

That strategy made sense at the time. Buyers burned by pandemic-era delays and highly volatile – spiking – interest rates wanted certainty and immediacy. However, the combination of higher mortgage rates, persistent affordability issues, and unpredictable demand has turned that speculative inventory into a significant liability.

According to Lance Lambert of ResiClub Analytics:

Homebuilders now have the most completed unsold inventory since 2009—a worrisome dynamic if affordability doesn’t ease in the first half of 2025.”

Nowhere is this problem clearer than in Florida. During their recent earnings call, Toll Brothers CEO Douglas Yearley offered a blunt assessment:

The good news in Florida is Jacksonville has been very strong, but the other markets in Florida have seen some elevated inventory levels. That’s probably our most cautionary market in the country.”

Yearley’s comment reveals a troubling trend: once-hot markets like Tampa, Orlando, and South Florida are seeing inventories rise and buyer leverage grow. When buyers gain leverage, price negotiations get sharper — forcing builders to offer deeper discounts or incentives to close deals.

For large public builders, like D.R. Horton and Lennar, price cuts are manageable. They can reduce margins temporarily to keep sales pace steady and move unsold inventory off their books. For smaller private builders, though, price wars are untenable.

As one industry analyst puts it:

When the big public builders decide to drop prices, private builders have no choice but to follow, even if it means cutting into bone. If they don’t, they lose buyers to cheaper competition. Either way, it’s a hit to their bottom line—and their ability to survive.”

Affordability: The Persistent Choke Point

At the core of the issue is affordability—a challenge that remains as stubborn as ever for first-time buyers and entry-level markets.

A November analysis by Freddie Mac sheds light on the scale of the problem. On average, a renter moving from a single-family rental to a mortgage would see monthly housing costs jump by 29%. In some metros, the gap is even wider.

Sam Khater, Chief Economist at Freddie Mac, highlights the trends behind the pressure:

The Southern metros are experiencing the largest affordability declines, likely due to accelerated migration and the long-standing housing shortage.”

The result? Buyers are scaling back their expectations — settling for smaller homes, lower-priced neighborhoods, or delaying purchases altogether. Freddie Mac’s analysis shows that the percentage of buyers upgrading to a larger home has dropped from 71% in 2013 to just 64% in 2024.

This buyer behavior creates a ripple effect: builders who banked on consistent move-up demand must now recalibrate their strategies. Smaller homes may help attract buyers, but the shift adds yet another layer of pressure to already stressed margins.

Hopes for 2025: Real, but Fragile

Despite the headwinds, many builders are looking to 2025 with cautious optimism.

NAHB expects the Federal Reserve to cut rates by 75 basis points in 2025, which would ease borrowing costs for both builders and buyers. Builders are also betting on a more favorable regulatory environment under the incoming administration, with promises of reduced zoning barriers, lower corporate taxes, and a rollback of stricter environmental regulations.

Selma Hepp, CoreLogic’s Chief Economist, captures the mood:

Homebuilders continue to gain cautious optimism that 2025 will be a better year for housing, although a lot remains uncertain on what the new administration will do. And while higher construction costs are a worry due to potential deportations and tariffs, deregulation and lower corporate taxes could also offset some of the concerns. The anticipated Fed rate cut later this week will continue to bolster homebuilder confidence going into the New Year as the cost of construction lending ticks downward.”

But optimism alone won’t solve the affordability gap, reduce unsold inventory, or erase the growing divide between public and private builders. As Trevor Allinson warns:

Optimism hinges on macro trends—rate cuts and deregulation—that are promising but still uncertain.”

The Path Forward: Private Builders at a Crossroads

For smaller private builders, the coming year will demand a new level of discipline, resilience, and agility. The risks they face are clear:

- Speculative inventory pressure: If unsold homes linger, the carrying costs alone could sink undercapitalized firms.

- Pricing vulnerability: Public builders will cut prices to keep sales moving, forcing private builders into impossible decisions.

- Affordability barriers: Without a significant drop in borrowing costs or home prices, entry-level buyer demand will remain fragile.

The December HMI reading signals that no immediate relief is coming. Public builders, with their deeper financial cushions and scalable operations, are built to weather these challenges. Private builders, not so much, save for outliers.

As one builder puts it bluntly:

Public builders can afford to take a hit for a quarter or two. Private builders can’t.”

2025: A Survival Course

The December HMI serves as both a cautionary tale and a stark reminder: the housing market’s challenges are not easing. Builders are navigating a narrow path between optimism about rate relief and deregulation on one hand, and the realities of affordability constraints and inventory risk on the other.

For private builders, 2025 could mark a turning point. Those with strong financial discipline and operational flexibility may survive. Those without may find themselves on the wrong end of an unforgiving market.

As Robert Dietz noted, the industry is waiting for the “better days” many expect in 2025. But for many private builders, time may be running short.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.