Land

Rosewood Communities Buy Nets UHG A Move-Up Platform

25-year old Rosewood's Upstate South Carolina products and land positions diversify Great Southern's affordable core legacy offerings, and give it positions more shielded from near-term price- and interest-rate-sensitive turbulence.

With its second mergers-and-acquisitions deal announcement in the past 60 days, United Homes Group has purchased Rosewood Communities, a 25-year-old operator whose product platforms and land strategy give UHG a diversification launch-pad it hopes to port across its growing geographical footprint.

As part of the deal, Mark Nyblom, founder and former owner of Rosewood Communities, will stay on as Division Manager - Rosewood. UHG president Jack Micenko also said that the Rosewood team would become part of the UHG business family.

The combination follows UHG's August 30 entry into the Raleigh, N.C. market through its deal to acquire Herring Homes, in what its chief strategists expect will be a relatively swift series of both entity-level and land-asset acquisitions on a path to mega-regional heft across the seven-state Southeastern U.S., with an "implied revenue growth" opportunity of about $1 billion.

The game plan – spelled out in an earlier The Builder's Daily story – draws on UHG's sense that it can stand apart from other potential strategic and financial acquirers as the "acquirer of choice," owing largely to UHG chairman Michael Nieri's salt-of-the-earth, self-starter reputation in the region, along with a deep and motivated trove of ready capital.

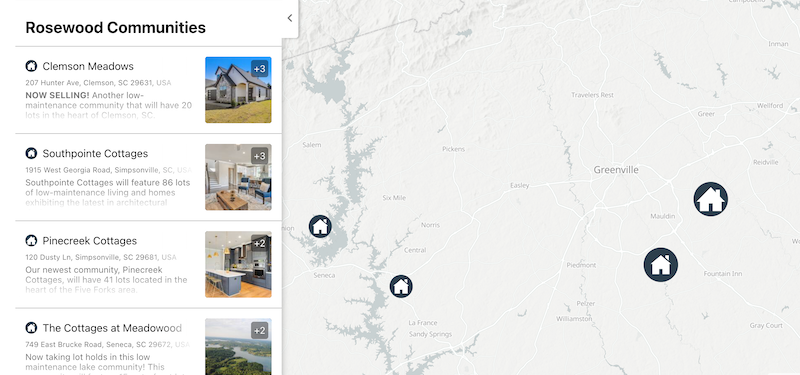

The Rosewood Communities acquisition – while geographically focused in the "upstate South Carolina" markets of Greenville and Clemson, where UHG's Great Southern Homes competes as a top-five homebuilder by volume in marketshare – adds a clearly complementary higher-end product competency that is new to UHG.

A press statement regarding the Rosewood purchase references this alignment with UHG Great Southern's established strength in the more affordable first-time buyer and first-move up product and price positions:

Acquiring Rosewood Communities is a great opportunity to expand our existing footprint in the Upstate area,” said UHG Chief Executive Officer Michael Nieri. “With a world-class university in Clemson and a booming industrial base in Greenville with employers like BMW, Upstate South Carolina is a fast growing, attractive new home market. Rosewood’s innovative home designs will also allow us to diversify our product offering in the Upstate, and we plan on using their designs in our other markets.”

Further emphasizing Rosewood's price, product, and customer segment distinctions, the press statement notes:

Inclusive of the Rosewood communities, UHG will operate 19 communities in the Upstate South Carolina market with plans to expand further. Prices on Rosewood Communities’ unique cottage-style homes range from $450,000 to over $1,000,000. Targeted to empty nesters and move-up buyers, the homes offer master-on-main and loft designs with appealing architecture and custom finishes."

Originally from Finland, Nyblom came to the United States in 1994 and formed Rosewood Communities in 1998. Rosewood Communities primarily operated as a developer until 2008, when the company initiated its concept of low-maintenance cottage-style communities. While adding compelling move-up and second-time-move-up product and land-positioning platform to UHG's portfolio has been since early-on a core strategic plan, and while direct conversations with Rosewood Communities founder Mark Nyblom date back more than a year, Micenko noted that fortifying the product offering at the higher-end makes sense right now:

Someone who's buying a $700,000 or $800,000 home is going to be less interest-rate-sensitive than somebody buying a $300,000 home," Micenko tells The Builder's Daily. "That's just the reality of it. So, our acquisition was more product-driven and strategic, but it does feel like a good place to be where rates of have moved."

Another piece of it applies to our legacy core product, our first-move-up, and second move-up. What did we print, 3.96 million annualized existing home sales last last month? There's no inventory for that trade-up buyer either, so it's clear that new homes are going to fill a greater void – whether it's entry-level or second-move-up – for the foreseeable future, given the lock-in effect."

Micenko also points up the fact that while adding this higher-price tier product and community position goes far to rounding out UHG's offerings in a category less prone to the biggest shocks and stresses of a high-rate-high-price environment, advantages also pour back to the Rosewood team and their efforts, especially given UHG's captive mortgage firm.

When you're relatively small, your ability to sort of compete on the mortgage, incentive side in the current environment is limited, so factoring in our robust mortgage joint venture means the Rosewood team can open more communities in more markets, and hopefully sell homes faster for more money," Micenko says. "That mortgage piece will be added to their ability to sell and close home and convert traffic."

Yet another strategic and tactical "higher-for-longer" era advantage of bolstering the UHG product and customer segmentation diversity play to include higher-price tier homes ties to a UHG plan to make larger land parcel acquisitions part of its growth and profitability playbook, says Micenko.

One of the things we're pushing our folks to do is look at bigger land deals," Micenko says. "It's the same amount of work to do 40 lots as it is 250. But if you've got three or four product types, instead of one or two, there's less risk to taking on those larger positions. You can break them down into different into different neighborhoods with different price points. So, there's there's the very near term goal of diversifying the product set to attract a different buyer base. But longer term, our organic growth needs to be supported by larger lot positions. And one of the best ways to de-risk that is to have several different products in the same deal."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.