Land

Remote Control: Here's CoreLogic's 15 Hottest Cities

Will the drivers that set the tone for 2020 migration patterns continue to reshape real estate strategy beyond the near-term? Or are we in limbo?

2021 begins what may one-day become known among economists, real estate experts, builders, developers, investors, and the like, as the limbo era.

Expectations pre-2020 and expectations post-2021 – for work, living, play, school, healthcare – look like two siblings that don't quite resemble mom, dad, nor each other.

Speculation, trendspotting, predictions, conjecture, scenario modeling, whatever you want to call it, it's a free-for-all in this state of limbo. Those who claim to know for certain what will become the nature and role of offices, of work-from-home, of hybrids, of reversion to prior norms, are lying. That's what wise people who check their own instincts to forecast, to detect, to scoop the rest on what's going on and what comes next.

Still, it's good to take stock – from the context of observable, evidence-based, action-oriented data – of what's just happened as a way of picking up a thread of what may continue to do so.

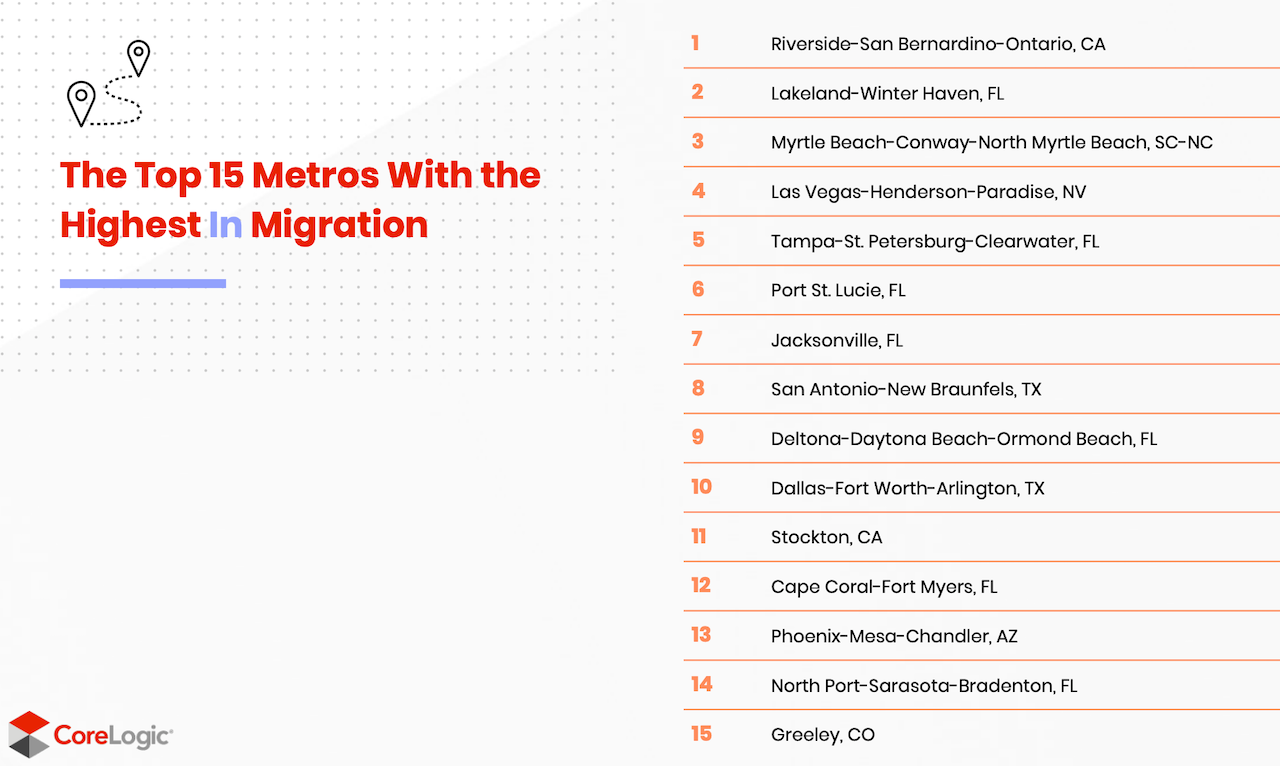

CoreLogic's "Hottest Cities for Homebuyers," just-released analysis on the in-and-out-migration patterns that sharpened with the onset of the COVID-19 pandemic in 2020 doesn't disappoint as a field-guide for understanding what happens when an economy and its people undergo a shattering shock.

Whether CoreLogic's biggest "here-to-stay" trend claim turns out to be true or not – namely that "Major metros are out, and affordable ones are in" – is about as arguable as guessing exactly how long one's stay in limbo might be.

Key points of the CoreLogic analysis, nicely reverse-engineered into digestible trend nuggets are:

- secondary cities met homebuyers needs in 2020

- space, the common-denominator X-factor as Covid gave real-time meaning to a need to "distance."

- natural amenity, air, light, water, comfortable temperature, hit home as well-being

- pocketbooks, employment continuity and a household-income-house-price balance meant mobility

- outdoor living, and one's ability to flaunt it as a statement of achievement, has become synonymous with status

- friction-free, tech-enabled, seamless, touchless, bother-proof purchase process and settlement serves as a magnet

Whether or not you agree that current market dynamics will one-day reveal an overall environment similar to limbo, CoreLogic does have a data kicker as a reference for investments and development commitments for at least a near-term stretch ahead:

The April 2021 CoreLogic consumer homebuyer study showed an increase in confidence in purchasing power. Ninety percent of respondents feel they are somewhat or extremely likely to qualify for a mortgage. Bank loans (38%) and savings (81%) are the primary sources respondents noted they will use to purchase a home. A strong 84% of consumers note they have been able to save more income to purchase a home due to the pandemic and stay-at-home orders, with nearly half saving 11% or more of their income.

Although it's generally regarded as a sellers' market, lots of potential buyers' feel it's their time as well.