Land

Purchase Of Biscayne Lands Sumitomo A Florida For-Sale Beachhead

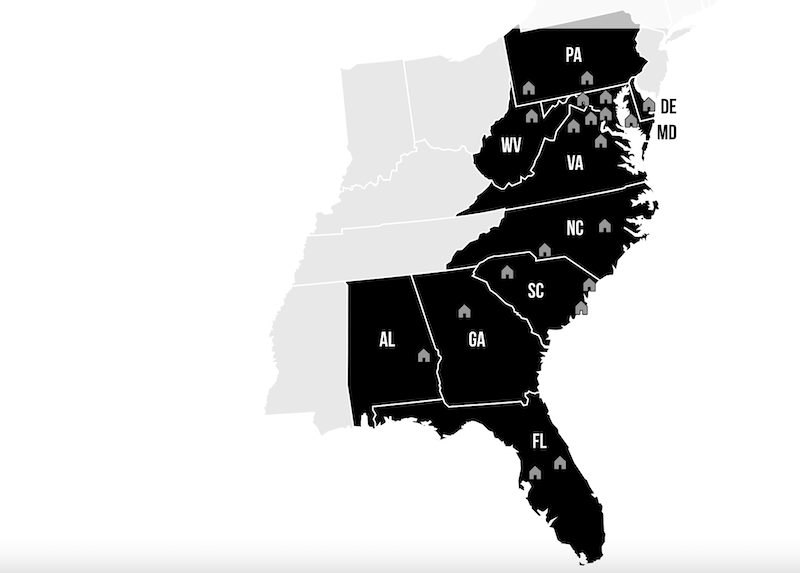

A deal completed this week will add Tampa Bay, FL-based Biscayne Homes, extending DRB Group's multi-regional footprint from the Mid-Atlantic through the Southeast coast.

Sumitomo Forestry America, Inc., through its U.S. Eastern Seaboard stronghold DRB Group, clinched a Central Florida strategic springboard with the purchase of fast-growing Tampa Bay, FL-based Biscayne Homes.

Biscayne Homes – co-founded in 2019 by Landstar Development Group and Avenir Holdings Group principal Eduardo Stern, along with his son Emmanual and highly-regarded Central Florida luxury home builder and developer David Adler – represents a coveted extension of DRB's powerful regional footprint and Sumitomo's first for-sale beachhead in Florida.

We took the Biscayne ownership team to Japan in January, which was a tremendous success," says Tony Avila, CEO of Builder Advisor Group, which served as the sellers' exclusive financial advisor. "This is an incredible partnership with ideal timing for both organizations."

Sumitomo Forestry America's seventh U.S. affiliate homebuilding acquisition, the addition of Biscayne Homes, activates a strategic door-opener to the critical Florida single-family for-sale market.

DRB Group, a press statement notes, had put a stake in the ground in Florida in 2023, with an organic start-up in the Orlando market. Per the release:

In 2023, DRB Group started its central Florida operations organically with an Orlando-based leadership team and is actively building in the Orlando MSA.

At the direction of CEO Ronny Salameh, the DRB Group team has continued to expand market share growing organically into several new markets in the Southeast in 2023 to include Myrtle Beach, SC, the Triad of North Carolina, and recently into Central Florida. Mr. Salameh stated, 'The acquisition of such a reputable and outstanding company as Biscayne Homes not only accelerates our strategic growth plan in the Florida markets, but it enhances the DRB Homes’ portfolio adding a luxury brand. I look forward to continuing the strong relationship formed with the owners of Biscayne Homes and all their employees.'”

A practical odds-on favorite to catalyze and sustain growth, the deal's secret sauce is a deep-rooted, four-plus decade-proven land acquisition, development, and "lifestyle" place-making prowess. This capability comes from Biscayne Homes' leadership team, co-founders Eduardo Stern, his son Emmanual, and Adler, who steered the team to its higher-end product and customer segmentation strategy. As a further boost out of the gate, Biscayne Homes' established actively-selling community positions include lagoon master plans developed by one of Florida’s largest developers, Metro Development Group.

We are very excited to join the DRB family," Adler, Managing member of Biscayne Homes said in a press statement. "We know that the acquisition of Biscayne by DRB will help foster tremendous growth for our company, its brand, and especially for our employees”

Similarly, Sumitomo's DRB Group acquired Atlanta-based Builders Professional Group (Knight Homes), carrying the company into the Georgia market in 2020.

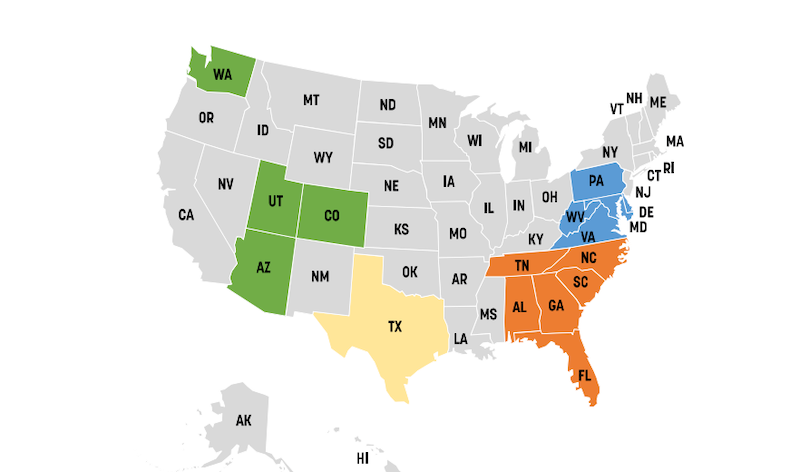

In early 2023, Sumitomo's Texas-based Brightland Homes purchased an 80% stake in Jacksonville, Fla-headquartered Southern Impression Homes, a fast-growing southeastern market build-to-rent development and construction platform for investors. What's more, Sumitomo's Crescent Communities U.S. development platform operates four central and Southeast Florida communities.

The Biscayne Homes acquisition – expected to deliver more than 200 homes in 2024, according to Eduardo Stern – now gives the DRB Group firepower on the for-sale real estate front, with an operator that in very few years has established a sterling reputation for higher-end "design-focused" home offerings, including five actively-selling communities – two of them, Epperson and Mirada, Crystal Lagoon communities in the Tampa Bay area.

Incidentally, Mirada – which began sales in 2020 and will ultimately include 4,500 homes when complete from builders including Biscayne, Lennar, D.R. Horton, LGI Homes, Maronda Homes, and Homes by WestBay – was co-developed by Metro Development Group's John Ryan and Tony Avila's Encore Group. Ryan and Eduardo Stern also collaborated early on on the lagoon community developments that have become Biscayne Homes' Tampa-area launchpad.

We did 27 homes the first year, and the delivery pace has been doubling each year since," says Stern. "As we planned the homebuilding operation, we felt the best opportunity was to position ourselves in a higher-end niche of semi-custom homes. This way, we were not going head-to-head with Lennar, D.R. Horton, Pulte, and the others who serve entry-level and first-move up so well. We feel this will also give DRB Group a strong, differentiated position to expand on in Florida, along with their current portfolio of plans."

The Florida puzzle-piece gives Sumitomo Forestry Group's Sun Belt states operational presence and game-plan potent growth opportunity at a time the company's North America strategy calls for aggressive growth. Five Sumitomo affiliate operators – Bloomfield Homes, Brightland Homes, DRB Group, Edge Homes, and MainVue Homes – together delivered 10,221 homes in 2023, which would have made Sumitomo one of the nation's top 15 single-family builders.

Company projections call for 15.3% growth in full-year 2024, to a total of 11,785 homes, and adding Florida to its 11 other states gives the enterprise a boost to reach that goal. As we have reported – although Sumitomo has proven it is nothing if not an astonishing case-study in long-term planning and strategy – the Osaka-based company's stated ambition for a decade or more has been to rise to a leadership level among U.S. homebuilding and development enterprises, setting 23,000 annual deliveries as a medium-term goal.

Together, Sumitomo, Sekisui House – which in January unveiled its blockbuster $4.9 billion deal to acquire MDC Holdings – and Daiwa House, have already altered the balance of power in the U.S. enterprise homebuilding business. Along with Knoxville, TN-based Clayton Homes, and a few Canada-based real estate players, Sumitomo, Sekisui House, and Daiwa House are on the short-list of any strong private homebuilding operator in the U.S. with a mind to sell now.

In many respects, 300-plus-year-old Sumitomo's road-map to 2030 reflects the most vertically-woven strategic game-plan – ranging from forestry and forest products, to mass timber construction, to cabinet manufacturing and supply chain solutions, to truss and wall panel manufacturing facilities, to horizontal land engineering and development, to multifamily apartment development and construction, as well as its single-family portfolio of companies.

The grand plan, per Sumitomo Forestry Group's press statement, paints a picture of blue sky business ambition, purpose, and customer focus:

The Sumitomo Forestry Group is engaged in a broad range of businesses revolving around wood, including forest management, timber and building material procurement and manufacturing, wooden construction including single-family home and real estate development, and wood biomass power generation. Through the Sumitomo Forestry Wood Cycle, an element of our long-term vision for 2030 “Mission TREEING 2030”, we are striving to increase the CO2 absorption of forests and store carbon for long periods of time with the popularization of mass timber buildings to contribute to decarbonization for the company, customers, business partners, and society. With the advancement of globalization being one of its long-term vision business policies, Sumitomo Forestry is also working to accelerate decarbonization initiatives in USA as well."

It's exactly this level of ambition – and the fact that, typically, Japan-based acquirers regard the local leadership of their U.S. operating affiliates as true strategic partners – that appealed most to Stern and his co-managing members, including David Adler, a long-time Florida homebuilder.

We've made it our business over the years to develop places and build homes that stand out among our buyer and resident customers as homes they love to come home to, and feel a sense of sanctuary and comfort," Eduardo Stern tells us. "This is the biggest investment most of them ever make in their lives, and we feel personally accountable to make them feel they've invested well and continue to gain value in our homes. The Sumitomo team gave us the sense and showed us evidence that they mean it when they say they believe 100% in the same thing."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.