Leadership

Public Homebuilders: '21 Median Total Compensation Rankings

The Builder's Daily offers an exclusive scorecard on public homebuilding company pay levels, and celebrates 2021 as a year when the pain 'hurt so good.'

A tag-team of interest rate run-ups and asking price-point inelasticity has made quick work of many a homebuilding strategists' firm belief that 2021's devilishly hard work to meet market demand would reap almost certain rewards in full-year 2022.

Among 18 of 19 publicly-traded homebuilding enterprises' corporate organizations, exceeding 60,000 associates with median total compensation of $101,330, the back-half of 2022 and beyond promises to be harder than ever.

Those 60,000-plus public company team members – among them – delivered up 311,346 completed new homes with total revenues that exceeded $132.1 billion.

All told, public homebuilding enterprise associate productivity measures roll up to an average of $2.26 million in revenue for each full-time corporate employee.

For comparison's sake, here's an excerpt on median total compensation trends across a wider range of publicly-traded firms and industry sectors, from reporting in the Wall Street Journal by John Stensholt and Nate Rattner.

Twelve of the top 25 best-paid median workers in 2021 were at tech companies or tech-driven media platforms, including Facebook parent Meta Platforms Inc. FB 0.65%▲ and Netflix.

Atop the Journal’s analysis was Google’s parent company, Alphabet Inc., GOOG 0.65%▲ where the median employee received $295,884, up 14% from 2019 and an 8% increase from 2020.

Cybersecurity firm Fortinet Inc. FTNT -0.66%▼ shows the quick-rising salaries in the technology sector. Fortinet’s median worker, the same person for the past three years, had pay of $202,875 last year, up from $122,329 in 2019.

Buoyed by pandemic profits, most Wall Street banks and financial institutions are paying their staff more than they were three years ago. The only financial firm in the top 25, however, was Atlanta-based investment management firm Invesco Ltd., IVZ -2.84%▼ where the median worker’s pay rose 50% from $125,282 in 2019 to $187,854 last year.

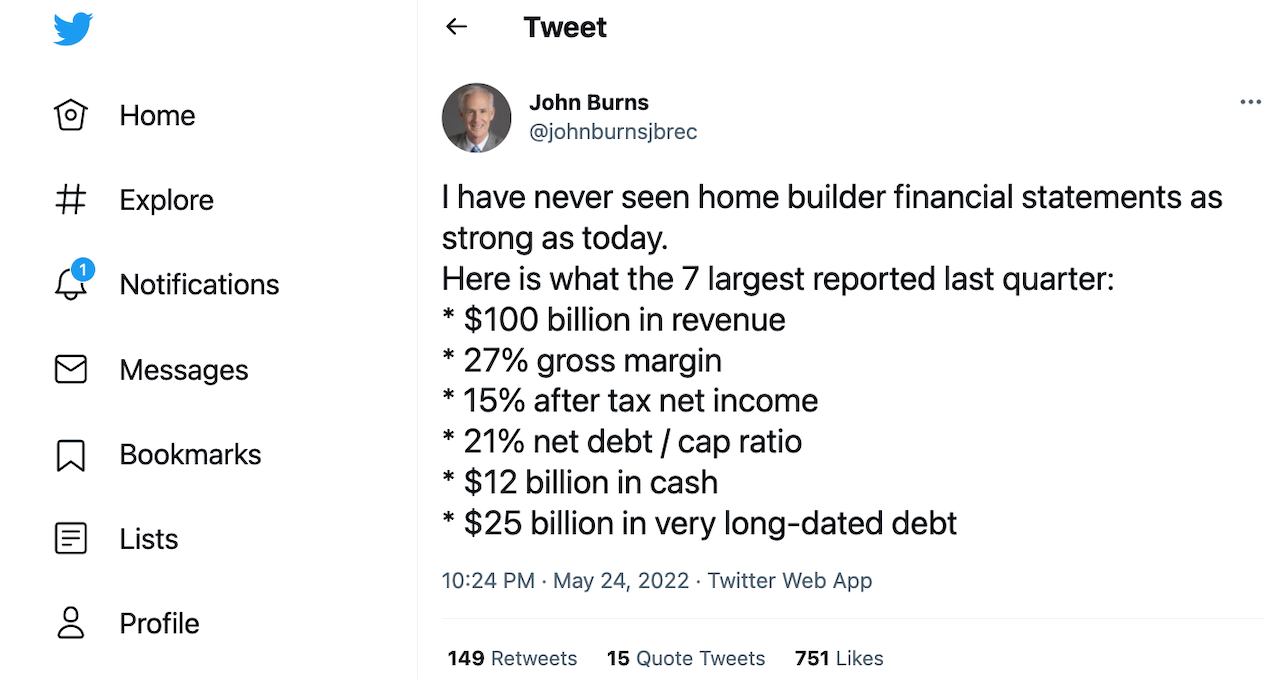

For context on homebuilders' business performance, here was one expression of both the level of accomplishment in the year just past, and a validation of the solidly exuberant talk-track of homebuilding's public company leaders' expectations, from John Burns, ceo of John Burns Real Estate Consulting.

I have never seen home builder financial statements as strong as today.

Here is what the 7 largest reported last quarter:

$100 billion in revenue

27% gross margin

15% after tax net income

21% net debt / cap ratio

$12 billion in cash

$25 billion in very long-dated debt

That was then, speaking of a year that will go down as one for the books.

The, what started in February as second-derivative "ankle-biters," not expected to sway expectations that – come what may – buyer demand would exceed any and every homebuilding enterprise's ability to meet it, evolved rapidly into big, honking, challenges in April and May.

Suddenly, the sense that all that heavy-lifting among team members dealing with an onslaught of crushing realities to deliver homes for buyers would make this year a virtual slam-dunk has become another sense altogether – one far more focused on all that front-loaded time-sensitive investment in place that now needs to match up with far fewer buyers with means to close.

The real hard work, the canny capability – to sell, to compete, to close – lies ahead. As each once-blistering hot market sees its run of existing home price increases plateau and then yield to gravity, capability and culture will set outlier enterprises apart from their peers as those that can thrive as conditions turn.

To memorialize – not forget – and celebrate the accomplishments of homebuilding company associates in a 2021 where demand felt infinitely deep and undeterrable and supply was a tiger by the tail, The Builder's Daily combed through company Securities & Exchange Commission filings to produce analysis of their reported team member headcounts, their median total compensation, and their company's home delivery and homebuilding revenues for 2021.

Join the conversation

MORE IN Leadership

Buffett's 2025 Shareholder Letter: Leadership Lessons for Builders

Warren Buffett's 2025 shareholder letter delivers wisdom on trust, adaptability, empathy, and long-term thinking—essential for homebuilding leaders facing today’s volatility. His words challenge executives to distinguish between controllable factors and those beyond their grasp.

Rick Lawson Joins TBD: Stories That Shape Housing’s Future

Rick Lawson brings deep historical insight and a solutions-driven approach to housing’s toughest challenges. His work connects past policies to today’s affordability, zoning, and development realities, offering strategic leaders invaluable perspective.

An Outlier In Affordable Market-Rate Ground-Up Homebuilding

Rising costs and falling affordability haven't stopped McGuinn Homes from serving homebuyers others overlook or fail to price in. Filling that unmet need means a steep growth trajectory.