Policy

Silver Linings And Teachable Moments In The Prices Crisis

This week's inflation red flags, temporary or structural, serve as potential catalysts for housing's leaders to think, act, and solve challenges differently than ever before.

It didn't take this week's release of the Bureau of Labor Statistics' Producer Price Index for anybody in construction to learn their input costs are going haywire.

Eating, sleeping, breathing the soaring costs, the rationed access, and the uncertain near-future of building materials, microprocessor-enabled systems, and other products has become table-stakes intestinal fortitude among sourcing, procurement, and purchasing folks and their partners in the building lifecycle.

Yesterday's slew of data points only serve to punctuate the challenge.

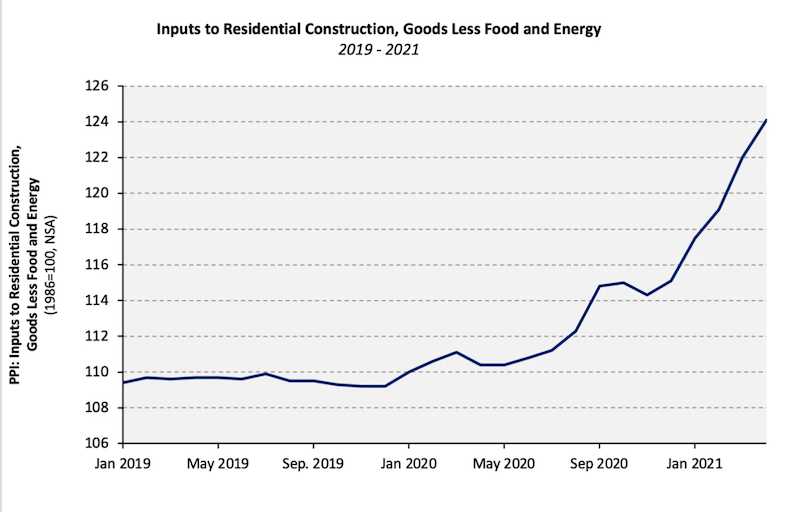

National Association of Home Builders director of Tax Policy and Analysis David Logan illuminated the loathed hockey-stick shape of seven-deadly-charts showing input prices near-past and present in his analysis of PPI trends' direct hit on goods used in residential construction.

His first-blush take on the price crisis sums up with a rate-of-change observation that leaves open the possibility that matters may not improve anytime soon:

Over the past three months, prices have climbed 22.0%. Perhaps more concerning than rising prices is that the pace of price changes has quickened each of the past nine months.

Smarter people than us already are at-it over whether the much-greater-than-expected inflation spike in producer and consumer prices reflects the momentary criss-cross of pent-up and structural demand with the slow-going reboot of the channel of goods and services back into the arteries and veins of the global economy, or something else.

Officials at the Fed and U.S. Treasury level admit no great alarm as to the permanence of inflationary forces, and it's their views that'll matter most on fiscal and monetary policy that could impact builders' and developers' borrowing costs as well as mortgage interest rate baselines for the near term.

Former U.S. Treasury Secretary Lawrence Summers counters the Fed's "benign scenario" with a more cautionary outlook here:

“The better part of wisdom is that there are slippery slopes, and once you start a process of accelerating inflation there are precious few examples of where inflation has been brought back down without very substantial economic disruption and without enormous disruption to financial markets,” he said.

Summers' perspective gets at the truly tricky dimension of where economic data benchmarks, headline risk, and consumer sentiment converge. This is where investors, developers, homebuilders and their partners find themselves in a nexus point between uncertainty and doubt.

New York Times economics writer Neil Irwin frames out the delicate balances at work here between supply-demand dynamics and Animal Spirits expectations, not only at the producer cost level, but at the household consumer expense kitchen table level. Irwin writes:

What is unusual about this moment is that prices for so many things are rising at once, albeit for different reasons. Some, like airfares, are simply returning to prepandemic levels, which shows up in inflation data as a price increase. Others, like lumber prices, reflect high demand along with supply that is fixed in the short run.

And still others, like the spike in East Coast gasoline prices after a cyberattack shut down a major pipeline, are truly random events that tell us virtually nothing about underlying supply and demand or future inflation.

Some other sectors seem poised to experience price rises. Restaurants, for example, are complaining of severe labor shortages that are forcing them to curtail service or sharply raise pay for line cooks and dishwashers. If they try to reflect those higher costs in their prices, it will cause the price of food away from home to start rising faster than the (already fairly high) 3.8 percent figure over the last year.

Professional inflation-watchers are on close watch for signs that these forces might be unleashing a form of thinking about price dynamics unseen since the early 1980s, when prices rose in part because everyone expected them to.

Bottom line for those whose leadership and livelihoods orbit the residential building and community development sphere:

- Double- and triple-down focus on consumers – not just writ-large consumers, but people you know, listen to, talk with, and learn from – and what job their homes perform for them as society navigates a desired but cautious transition across the line from abnormal to new normal.

- Corporate self-preservation tactics – when it comes to competing to access products, materials, and services in a supply-constrained – can work counter-productively. Although they may appear to solve for immediate needs, they can actually fuel contagion on the pricing and scarcity front.

- Imagine and behave now as you will want to have done looking back from, say 2025, as leaders, as builders of trust as well as developers of homes and communities, and as competitors for housing as a solution to economic and societal challenges.