Capital

Prices, And Risk To Historically Low Interest Rates, Spool Upward

As inflation pressure builds, real estate and construction stakes as a 'safe haven' investment mount.

Prices are a messy, noisy, headline-hogging matter of the moment, no?

At every turn, supply disruptions running the gamut of commodities – raw, refined, human, and inanimate – have cropped up, complicating the collision of pent-up demand with a world economy's attempt to re-launch.

Residential real estate and construction – a virtual catch-all for nearly every resource, product-category, and process through the building value-chain – is not immune from intensifying speculation over how and when its current rule of dirt-cheap borrowing costs give way to higher interest rates.

Bloomberg staffer Cecile Gustscher writes this morning:

Debate rages over whether the expected jump in price pressures will be enduring enough to force the Federal Reserve into tightening policy sooner than current guidance suggests. A measure of U.S. inflation expectations reached the highest level since 2006.

The eve of the consumer price index and other inflation reports (tomorrow) has also got Wall Street Journal staffer James MacIntosh working through scenarios and hedges for what investors may resort to if price inflation suddenly takes on a life of its own.

The biggest problem investors face is to create a portfolio that will be able to cope with inflation but not lose horribly if the Fed surprises everyone and jacks up interest rates to kill inflation. The Fed’s change in approach makes this less likely than in the past, but it remains entirely plausible, and would hurt almost any bet on inflation returning.

Interest rates, and what happens to them, are of course homebuilders' biggest area of concern of the moment. Removing the strong tailwinds of historically-low, fear-of-missing-out, monthly-payment impact that today's rates reflect would expose a world of pain new home and community producers are experiencing on their own input costs.

What's more, increases to borrowing costs would come as a direct hit to builders who rely on project finance for land, development and construction.

Dialing in, then, on the fundamental value of what people derive from their homes, may give stakeholders a worthwhile focus point as they await the markets' ultimate verdict on whether concerns about inflation are warranted now or not.

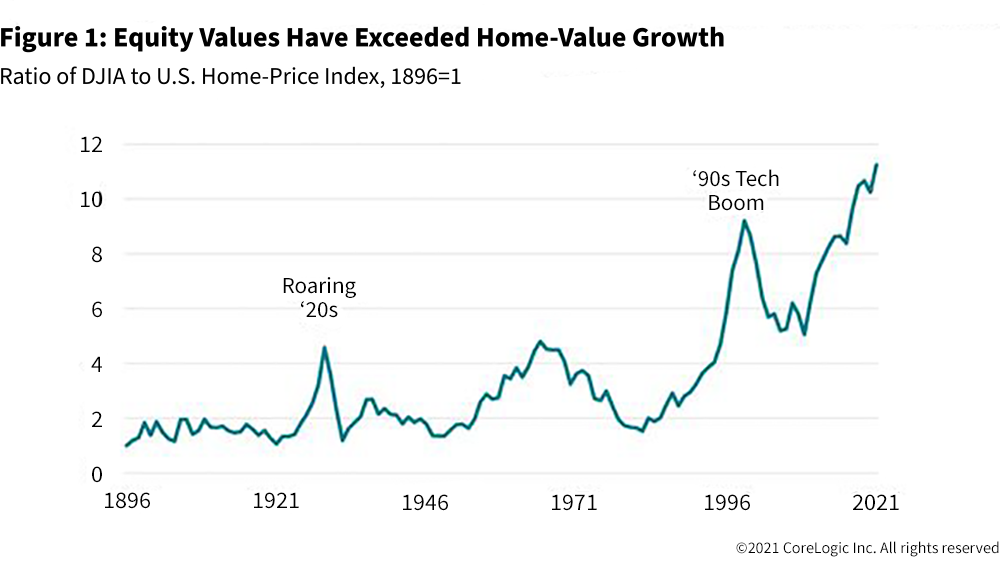

CoreLogic chief economist Frank Nothaft here takes a long view at value people get from either their home's exit value or investment in the 125-year-old Dow Jones Industrials basket of stocks.

Nothaft notes:

Greater volatility is reflected in larger swings up and down in the Dow compared with average U.S. home prices. The upside potential is reflected in the faster overall growth in the Dow. We can calculate value change over, say, successive 10-year time frames since 1946 to illustrate the downside risk. Ten years happens to be the median tenure of homeowners during the last generation.[1] If you owned stock for 10 consecutive years in the 30 companies that made up the Dow, based on the Dow’s experience since 1946 you have a 10.6% chance of experiencing a loss. In contrast, the odds that a U.S. home-price index would have fallen after 10 years is 1.5%.

For those who lose sleep at night as the engines of inflation – and the accompanying volatility in asset values – stir noisily, Nothaft lists the following as a source of potential comfort and calm.

Housing has generally been a good inflation hedge over long periods of time, with home prices generally rising slightly faster than inflation.

And then, don't forget, there are the millennials who are still in rapid household and family formation mode, and still building their income power in a recovering economy.

Join the conversation