Technology

Price-Vs.-Cost Neutrality Pursuit Drives Builders To Build Smarter

The power to build smarter, and the risks of of not doing so have never meant more to homebuilders' business outlook than they do in late-Spring 2022.

It's what keeps people up at night these days. A non-dream voice repeats:

Your mission – should you decide to accept it – is to execute on-plan for completions and settlements by year-end, and do it price-vs.-cost neutral."

In today's business and operations environment, that means fight like hell at every turn to hold costs down. It means push like the dickens at every opportunity to keep raising prices. It also means – given a general state of demand where there's at least one bidder more who'd happily take the place of every buyer out there – no let-up is in sight on either front.

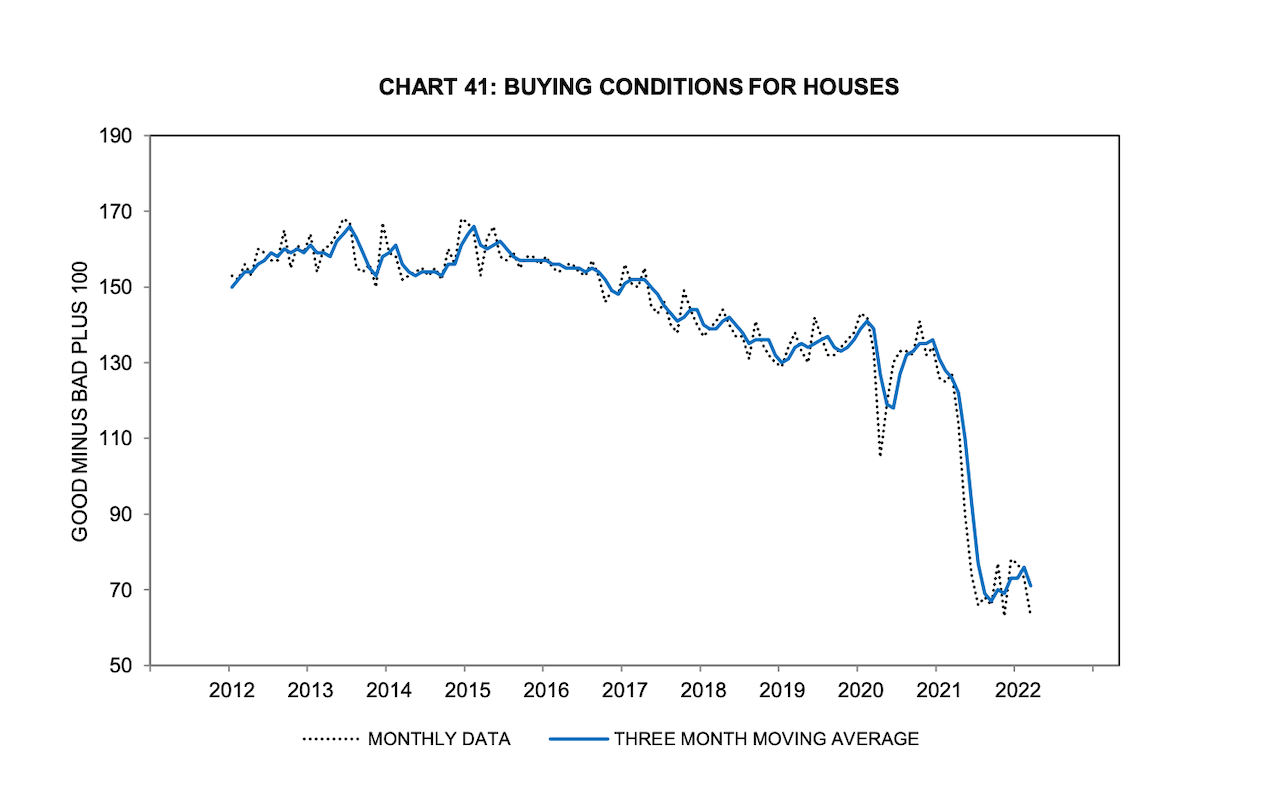

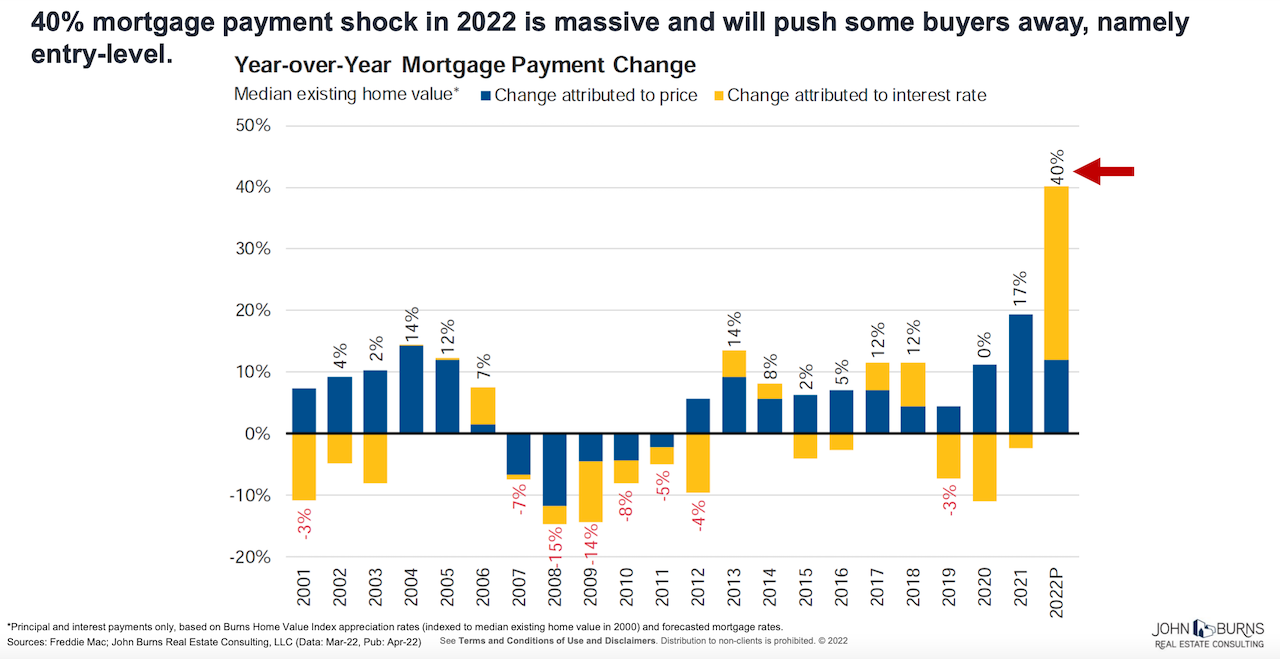

Two sources of price shock for consumer households – inflationary price pressures, and, now fast-rising interest rates on home finance – are shape-shifting the housing cycle backdrop, literally siphoning off demand by either disqualifying borrowers outright, or eroding their confidence that now is the time to buy, causing them to give up their search.

Adding to those sources of friction, consider, as a macro view of the moment for residential construction, with sharp implications for every business building homes in the U.S. right now:

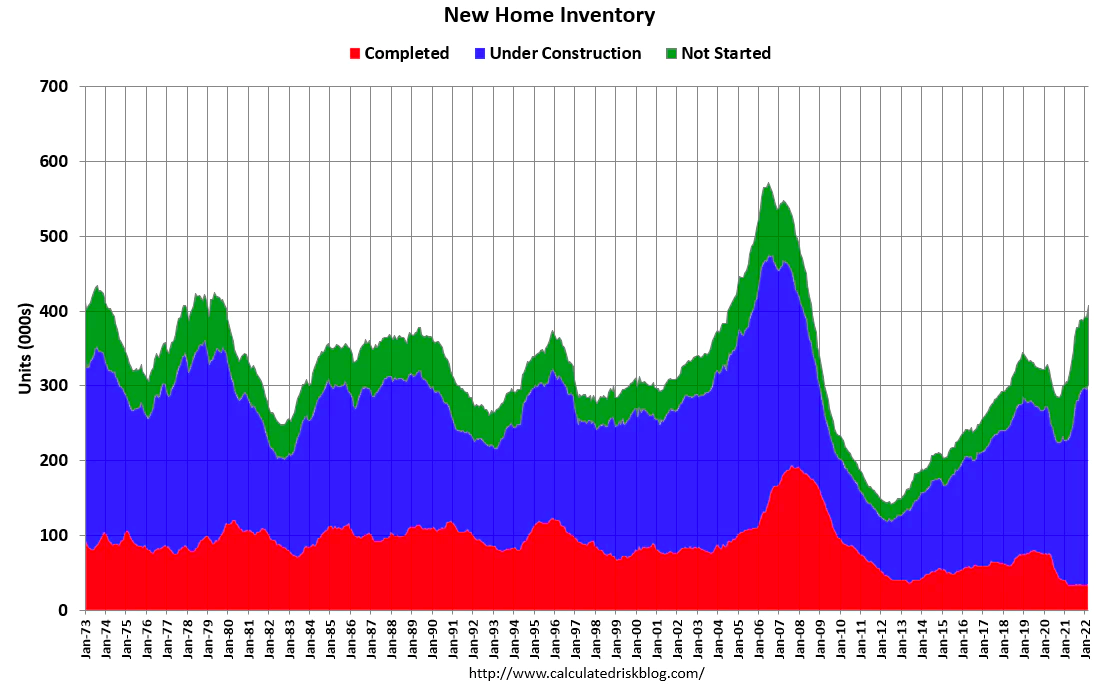

The inventory of completed homes for sale - at 35 thousand - is up from the record low of 33 thousand in 2021 and early 2022. This is about half the normal level of completed homes for sale.

The inventory of homes under construction at 267 thousand is the highest since 2007. The inventory of homes not started is at a record 105 thousand.

Together, the blue and the green segments in the chart above – under construction and not-started new homes – add up to 372,000 homes. Each of them – for even the homebuilders with the biggest clout, the most GS&A discipline, and operational excellence – it's taking 30-, 60-, or 90-days longer than typical buildtimes in their start-to-completion cycles.

When 30-, 60-, or 90-days can lead to a mortgage disqualification, a job switch to a new location, a host of other unforeseen shifts and adjustments, that adds up to 372,000 reasons for homebuilders to crack the price-vs.-cost neutral code in one way alone: Build smarter.

Fast-evolving end-to-end build cycles – including constantly in flux inflationary pressures on your per square foot costs -- alter what it means to build smarter. It's precisely that difference – and the fact that to remain price-vs.-cost neutral, builders need to respond in real-time to real-time challenges, opportunities, and threats.

What builders and partners need to know to improve their process, work-around impediments, and drive value to a homebuyer through their entire 'buyer’s journey,' has never been more crucial," says Chris Graham, President of Constellation HomeBuilder Systems. “Access to critical business data in real-time can make all the difference in the multi-project build cycles production builders manage, especially as they continue to leverage value to raise prices even as they push back against higher costs."

Graham says the Constellation team and its data empower builders to continually review their pricing, look for comparable benchmarks, and work with their trades and suppliers for improvement. He spotlights the importance of the power of timely insight and real-time business data to mitigate risks, not only to additional cost exposures, but potentially to losing traction with customers in several key building materials and their roll-up impact on per-square building costs.

- For lumber and framing in 2021, inclusive of labor and materials, the cost per square foot increased by 58% over the course of the year. YTD, that is up about 8% inclusive of April closings and expected to be slightly higher still for future closings. Comparing this increase to the lumber indexes, they ended the year roughly flat, despite significant volatility throughout the year.

- For drywall, 2021 saw an increase in cost per square foot of 19% over the course of the year. YTD, it is up about 5% inclusive of April closings and expected to increase slightly in the later months of this quarter.

- For cabinets, 2021 saw a 23% increase in cost per square foot over the course of the year. YTD, that is up an additional 16% inclusive of April closings, and expected to increase further in the later months of this quarter.

- For windows and doors, 2021 saw a 24% increase in cost per square foot over the course of the year. YTD, that is up an additional 42% inclusive of April closings, and expected to increase further in the later months of this quarter.

If data gets captured in a snapshot, as if time stood still, the risks to builders are that they're pushing for comparables that are out of sync with the market, which exposes them to even more costly outcomes. If the data is refreshing and repopulating on an ongoing basis, work with vendors across the build cycle becomes an efficiency win-win for all partners.

As the market and economic situation changes, it is critical to be able to react quickly, says Graham. "Waiting for a month or longer for the latest information will not be sufficient. Everyone wants to be able to forecast and plan within their business, and data is critical for that purpose. To achieve efficiency improvements and cost reductions, you’ll need to share data with your trades and suppliers. The cost data mentioned above is one factor, but the delivery times are also a huge factor in being able to close a home on time."

The bottom line connects directly with consumers. Building smarter’s superpower today is that homebuyer customers experience it first-hand as a benefit they value, putting the consumer homebuyer – not the process – at the top of the pyramid of priorities, exactly when they value it most. A smarter build cycle removes what consumers don’t value in a home, and adds meaning to what they do value. Building smarter both transforms the home they purchase, and how that home lives, therefore leading to greater value.

At Constellation, we have been working closely with builders to improve the visibility and usefulness of their data," says Constellation's Chris Graham. "Whether it is through data security and data hygiene, or proactive sharing of information with employees, departments, partners, and customers, the principle is the same. Data helps drive good decision making and helps to set expectations of what is possible and acceptable."

And, in an operational environment that's all in flux, it's probably builders' best shot at price-vs.-cost neutrality.

Join the conversation

Constellation provides fully-integrated or standalone software solutions expertly engineered to manage the complete ecosystem of a homebuilder’s business functions and growth.

MORE IN Technology

Andrin Homes Turns Customer Pain Into Business Culture Shift

Facing the toughest Toronto market in decades, Andrin operationalized a proactive homeowner experience strategy. What started as a service platform became a catalyst for team alignment, trust, and performance.

Homebuilding’s Hardest Test: Change As Core Competency

Residential development leaders are being forced to lead across timelines. Resilience means solving today’s air pockets with tomorrow’s customers in mind.

Pre-Development Is Where Velocity Happens: Here's How

In a high-cost, high-risk market, developers and builders must find every dollar and day they can save. Integrated digital pre-construction tools are quietly delivering outsized impact — if you know where to look.